With the broader equity market climbing across August, the miners showed some renewed strength. The ETF of GDX saw a net monthly gain of 2.8% @ $26.65. Despite the gains, the miners - along with precious metals, remain within a broader down trend.

GDX, daily

GDX, monthly

Summary

So.. a net monthly gain of almost 3%, yet the gold bugs still can't get overly excited about their mining stocks... or their physical gold/silver holdings. Both remain within starkly broad down trends from the highs in 2011.

Most notable (at least to me), the monthly MACD (blue bar histogram) cycle. It floored in June 2013, and has been ticking higher for 14 months - a very significant up wave.

Yet.. in price terms.. GDX is barely any higher than it was in summer 2013.

The miner (and precious metal) bulls have had a good up cycle, and all they've managed to do is flat line prices.

The bears are going to get another chance for a multi-month down wave soon, and we'll surely see the 2013 lows for both the miners.. and metals broken under.

--

*holding to broader downside for Gold $1000/900s, which would almost certainly equate to GDX under $20..perhaps the mid teens.

Friday 29 August 2014

Thursday 28 August 2014

CHK - renewed strength

Whilst the main market saw minor weak chop, there was notable strength in Chesapeake Energy (CHK), which settled up a rather significant 2.1% @ $26.99. A new multi-week up cycle appears underway, primary target zone is 30/32.

CHK, daily

CHK, weekly

Summary

Suffice to say, CHK remains one of my favourite Nat' gas companies. It has seen some noticeable chop this year, but with underlying upside throughout.

Today's candle was a bullish engulfing candle, and bodes for further gains into September.

The $32 high from summer 2011 remains a very valid target.

CHK, daily

CHK, weekly

Summary

Suffice to say, CHK remains one of my favourite Nat' gas companies. It has seen some noticeable chop this year, but with underlying upside throughout.

Today's candle was a bullish engulfing candle, and bodes for further gains into September.

The $32 high from summer 2011 remains a very valid target.

Wednesday 27 August 2014

SDRL - knocked lower on earnings

Seadrill (SDRL) saw a slight miss on earnings, and the stock was duly knocked lower by -4% in early morning. There was something of a latter day recovery (intra high $36.94), but failed at the Tuesday price gap zone, settling -2.8% @ $36.63

SDRL, 60min

SDRL, daily

Summary

*daily candle was a hollow red 'reversal', it does suggest a possible 'earnings low' is in, but bulls need a break into the $38s to really confirm it.

--

Suffice to say, SDRL earnings missed by around 3%, and the market decided that was enough to merit an opening gap down of around 4%.

The oil/gas drilling sector as a whole is on the rise though, and that should help SDRL recover next week. Right now, a break above the 50 day MA - in the upper $37s should be first target for equity bulls.

Any daily close >38, will likely lead to 40/41, and that target zone might equate to sp'2040/60s by late September.

-

*I remain long SDRL from the $37.50s, seeking an exit in the 39/41 zone.

SDRL, 60min

SDRL, daily

Summary

*daily candle was a hollow red 'reversal', it does suggest a possible 'earnings low' is in, but bulls need a break into the $38s to really confirm it.

--

Suffice to say, SDRL earnings missed by around 3%, and the market decided that was enough to merit an opening gap down of around 4%.

The oil/gas drilling sector as a whole is on the rise though, and that should help SDRL recover next week. Right now, a break above the 50 day MA - in the upper $37s should be first target for equity bulls.

Any daily close >38, will likely lead to 40/41, and that target zone might equate to sp'2040/60s by late September.

-

*I remain long SDRL from the $37.50s, seeking an exit in the 39/41 zone.

Tuesday 26 August 2014

RIG, SDRL - drillers resuming higher

Having been knocked lower since mid June, the oil/gas drillers have apparently floored, and have begun a new multi-week up cycle. Transocean (RIG) and Seadrill (SDRL) settled higher by a significant 2.8% and 1.9% respectively.

RIG, daily

SDRL, daily

Summary

RIG was gaining some particular attention today, and the daily cycle is offering a rather clear reversal, from what is a likely double floor in the $37s.

SDRL is somewhat stronger than RIG, and is offering a large bull flag on the weekly cycle...

So long as the main market can continue to claw higher into September, there looks to be reasonable upside for all the drillers, including DO (Diamond offshore).

--

*I am long SDRL from $37.50s this afternoon. seeking an initial exit in the 39.50/40.25 zone..which seems very viable within the very near term.

RIG, daily

SDRL, daily

Summary

RIG was gaining some particular attention today, and the daily cycle is offering a rather clear reversal, from what is a likely double floor in the $37s.

SDRL is somewhat stronger than RIG, and is offering a large bull flag on the weekly cycle...

So long as the main market can continue to claw higher into September, there looks to be reasonable upside for all the drillers, including DO (Diamond offshore).

--

*I am long SDRL from $37.50s this afternoon. seeking an initial exit in the 39.50/40.25 zone..which seems very viable within the very near term.

Monday 25 August 2014

GDX - miners pressured by weak metals

With the precious metals under pressure from a rising US dollar, the miners were naturally lower from the weak metals. The miner ETF of GDX settled lower by a significant -1.8% @ $25.62. Near term outlook is for further weakness.

GDX, daily

Summary

*from a pure price perspective, the 200 day MA in the $24s remains critical resistance. If GDX slips into the $23s.. whether this week..or next month, it will be a major warning of trouble for the remainder of the year.

--

The strength in the USD - which could be in the very early phase of a major multi-month climb, is going to be a major downward pressure to the metals..and thus..indirectly, the mining stocks.

--

*my grander outlook is for Gold $1000/900s. If correct, the miners will remain weak, if not breaking below the 2013 lows.

GDX, daily

Summary

*from a pure price perspective, the 200 day MA in the $24s remains critical resistance. If GDX slips into the $23s.. whether this week..or next month, it will be a major warning of trouble for the remainder of the year.

--

The strength in the USD - which could be in the very early phase of a major multi-month climb, is going to be a major downward pressure to the metals..and thus..indirectly, the mining stocks.

--

*my grander outlook is for Gold $1000/900s. If correct, the miners will remain weak, if not breaking below the 2013 lows.

Friday 22 August 2014

TVIX, UVXY - just another lousy week

With the VIX falling -12.8% across the week, the 2x lev' bullish instruments of TVIX and UVXY saw net weekly declines of -6.6% and -7.5% respectively. Near term outlook is for the VIX to remain subdued as sp' climbs into the 2000s

TVIX, daily

UVXY, daily

Summary

First, an update on the VIX, weekly...

--

As for the 2x instruments.. it was the second consecutive weekly decline. TVIX and UVXY have now erased all the gains from the lows in late June.

Outlook into late summer

Best guess remains.. sp'2030/50 in September, before the next opportunity for a multi-week down wave. VIX will likely jump into the high teens in October, but the 20s look difficult.. even if we see a down wave to the low sp'1900s.

On any near term outlook, I have zero interest in being long the VIX until at least late Sept/early October.

TVIX, daily

UVXY, daily

Summary

First, an update on the VIX, weekly...

--

As for the 2x instruments.. it was the second consecutive weekly decline. TVIX and UVXY have now erased all the gains from the lows in late June.

Outlook into late summer

Best guess remains.. sp'2030/50 in September, before the next opportunity for a multi-week down wave. VIX will likely jump into the high teens in October, but the 20s look difficult.. even if we see a down wave to the low sp'1900s.

On any near term outlook, I have zero interest in being long the VIX until at least late Sept/early October.

Thursday 21 August 2014

DRYS - continuing to climb

With the broader US equity market still rising, transports were similarly on the climb. Dry Ships (DRYS) settled higher by a significant 3.7% @ $3.35. The big $4.00 threshold looks viable in September.

DRYS, daily

Summary

Little to add from previous posts.

-

Today was the first daily close above the 200 day MA since June. Certainly bodes for further upside for the rest of August, and into September.

If main market can climb into the sp'2030/50 zone in Sept', DRYS could easily see a major surge to the $4 level.

*BDI continues to rise.. and that is certainly helping.

DRYS, daily

Summary

Little to add from previous posts.

-

Today was the first daily close above the 200 day MA since June. Certainly bodes for further upside for the rest of August, and into September.

If main market can climb into the sp'2030/50 zone in Sept', DRYS could easily see a major surge to the $4 level.

*BDI continues to rise.. and that is certainly helping.

Wednesday 20 August 2014

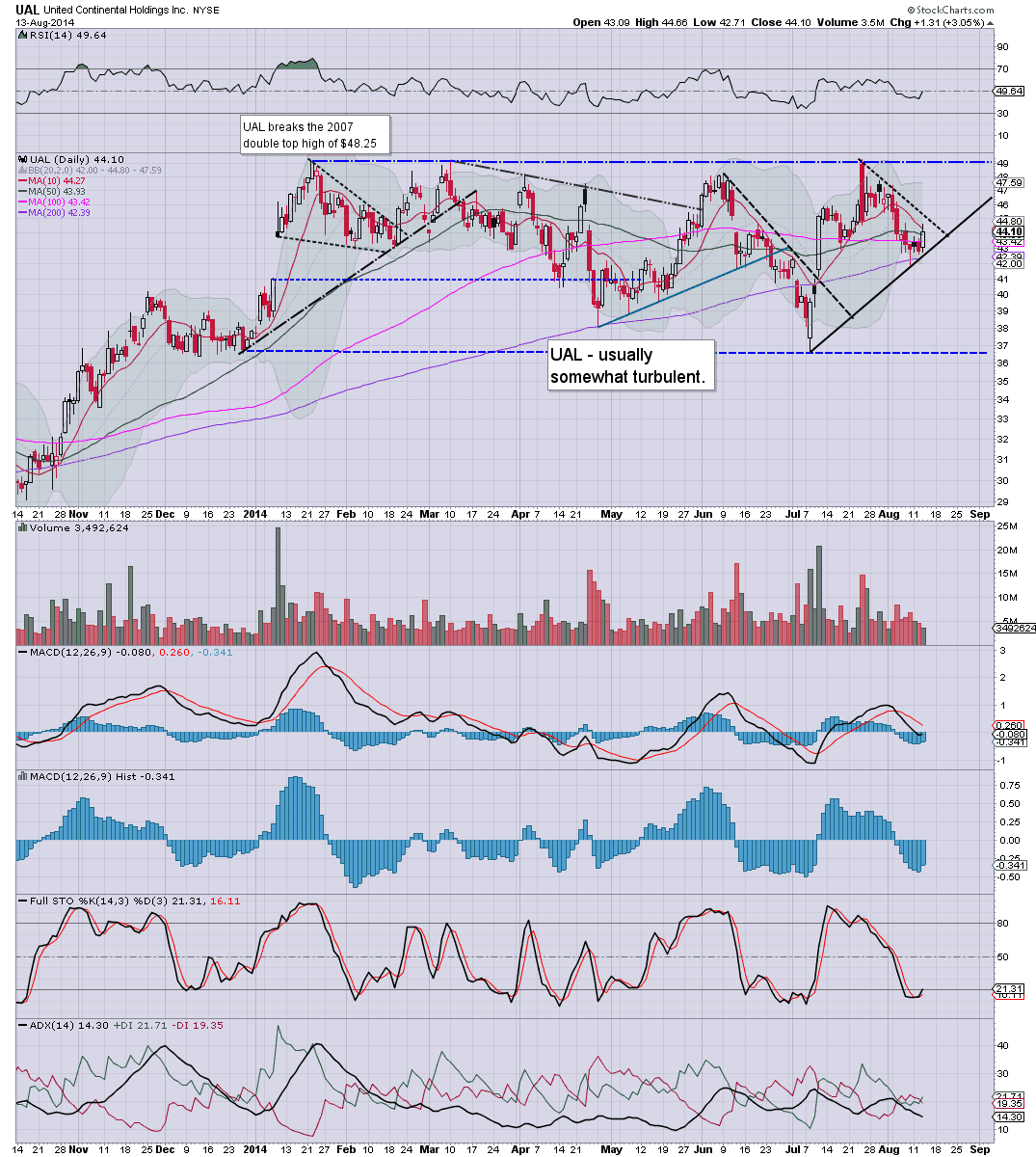

DAL, UAL - airlines continue to climb

With the broader market continuing to rise, the airline stocks were especially strong. Delta (DAL) and United (UAL) settled significantly higher, by 2.5% and 3.3% respectively. The outlook remains bullish into September.

DAL, daily

UAL, daily

Summary

Little to add from recent posts.

Both look set to climb higher...with Delta being the more financially sound and stable stock.

--

DAL, daily

UAL, daily

Summary

Little to add from recent posts.

Both look set to climb higher...with Delta being the more financially sound and stable stock.

--

Tuesday 19 August 2014

AAPL - breaks into the $100s

With US equity indexes continuing to climb, Apple (AAPL) was notably strong, settling +1.4% @ $100.55. Outlook is broadly bullish into September, with viable upside to the $105/110 zone.

AAPL, daily

Summary

Little to add.

AAPL is on the edge of breaking new historic highs... and looks set to climb with the broader market into September.

AAPL, daily

Summary

Little to add.

AAPL is on the edge of breaking new historic highs... and looks set to climb with the broader market into September.

Monday 18 August 2014

DAL, UAL - lower oil prices helping the airlines

With the main market seeing significant gains, the airlines were also on the rise. Delta (DAL) and United Continental (UAL), settled higher by 2.5% and 4.0% respectively. Near term outlook is bullish into September.

DAL, daily

UAL, daily

Summary

Suffice to say, airlines are rising with the main market..and with lower oil prices - consistently under the big $100 threshold, there is increasing media (bullish) attention on the sector.

-

*Delta (DAL) remains more stable in terms of stock price, and is unquestionably financially superior to United.

DAL, daily

UAL, daily

Summary

Suffice to say, airlines are rising with the main market..and with lower oil prices - consistently under the big $100 threshold, there is increasing media (bullish) attention on the sector.

-

*Delta (DAL) remains more stable in terms of stock price, and is unquestionably financially superior to United.

Friday 15 August 2014

TVIX, UVXY - huge weekly declines

Despite the VIX seeing Friday gains, the VIX was still net lower on the week by -16.6%. The 2x lev' bullish instruments of TVIX and UVXY saw sig' net weekly declines of -25.4% and -25.6% respectively. Near term outlook is for further declines into September.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX weekly..

A second consecutive net weekly decline of a very significant -16.6%. VIX might jump to the 15s on Monday, but looks set to slip back to the 11/10s. 9s are even possible if sp'2000s in September.

--

As for the 2x instruments...

It was a pretty horrific weekly decline of -25% for TVIX/UVXY. Anyone still holding long is going to face a real battle just to regain half of those declines next week.

All things considered, if sp'2000s in September, then there is little point in being long volatility in the immediate term.

As ever... such leveraged instruments are for short term holds only...not least due to the statistical decay issue.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX weekly..

A second consecutive net weekly decline of a very significant -16.6%. VIX might jump to the 15s on Monday, but looks set to slip back to the 11/10s. 9s are even possible if sp'2000s in September.

--

As for the 2x instruments...

It was a pretty horrific weekly decline of -25% for TVIX/UVXY. Anyone still holding long is going to face a real battle just to regain half of those declines next week.

All things considered, if sp'2000s in September, then there is little point in being long volatility in the immediate term.

As ever... such leveraged instruments are for short term holds only...not least due to the statistical decay issue.

Thursday 14 August 2014

DRYS - breaks out to the upside

With the main market continuing to claw higher, the Transports gained. There was notable strength in Dry Ships (DRYS), settling +3.1% @ $3.18. A marginal breakout, with the weekly cycles offering the $4 threshold in September.. some 25% higher.

DRYS, daily

DRYS, weekly

Summary

Little to add from a few days ago.

DRYS - along with the main market, is headed higher.

We have an important break into the $3.20s..and the big $4 threshold look very viable next month.

DRYS, daily

DRYS, weekly

Summary

Little to add from a few days ago.

DRYS - along with the main market, is headed higher.

We have an important break into the $3.20s..and the big $4 threshold look very viable next month.

Wednesday 13 August 2014

DAL, UAL - airlines back on the climb

With the broader market having some moderate gains, there was notable strength in the Transports. Delta (DAL) and United (UAL) settled with significant gains of 2.1% and 3.0% respectively. Near term outlook is bullish.

DAL, daily

UAL, daily

Summary

Suffice to say... Delta remains the better company of the two, but UAL will usually offer far more price volatility... on both sides.

If the sp' can break into the 2000s in late Aug/early Sept, the airlines should continue their broad climbs, and should indeed break new highs for the year.

DAL, daily

UAL, daily

Summary

Suffice to say... Delta remains the better company of the two, but UAL will usually offer far more price volatility... on both sides.

If the sp' can break into the 2000s in late Aug/early Sept, the airlines should continue their broad climbs, and should indeed break new highs for the year.

Tuesday 12 August 2014

F - minor gains on a down day

Whilst the broader market was moderately weak across the day, there was notable resilience in Ford (F), settling higher by 0.2% @ $17.20. Near term outlook is bullish, with a reasonable opportunity to challenge the recent high of $17.99

F, daily

Summary

Price structure since the mid July high is a large bull flag.. and today was a pretty clear breakout.

Yes, the daily candle was a touch bearish with the spiky top, but considering the main market weakness...it looks okay.

If the main market can break into the sp'2000s by mid/late September, Ford should be somewhat higher. A break into the 18s will open up the next big psy' level of $20.

F, daily

Summary

Price structure since the mid July high is a large bull flag.. and today was a pretty clear breakout.

Yes, the daily candle was a touch bearish with the spiky top, but considering the main market weakness...it looks okay.

If the main market can break into the sp'2000s by mid/late September, Ford should be somewhat higher. A break into the 18s will open up the next big psy' level of $20.

Monday 11 August 2014

DRYS - clawing higher

With the main market higher for a second day, Dry Ships (DRYS) managed a gain of 3.3% @ $2.95. There remains strong resistance in the low $3.00s. A break >3.20 would be pretty decisive, and offer the $4 threshold in September.

DRYS, daily

Summary

Suffice to say, most transport stocks did particularly well today, and not surprisingly.. DRYS did pretty well.

Just another 4-5% higher, and DRYS will be on the edge of a breakout.

If we see the $3.20s... there will be a very big surge in media/trader attention on the stock... at which point we could see some rather significant multi-week gains.

--

*I've no position, and I've little interest in DRYS, unless sp'1700/1600 within the next 3-6 months. At that point, I'd consider picking up a long term block... but without question, it'd be purely speculative.

DRYS, daily

Summary

Suffice to say, most transport stocks did particularly well today, and not surprisingly.. DRYS did pretty well.

Just another 4-5% higher, and DRYS will be on the edge of a breakout.

If we see the $3.20s... there will be a very big surge in media/trader attention on the stock... at which point we could see some rather significant multi-week gains.

--

*I've no position, and I've little interest in DRYS, unless sp'1700/1600 within the next 3-6 months. At that point, I'd consider picking up a long term block... but without question, it'd be purely speculative.

Friday 8 August 2014

TVIX, UVXY - net weekly gains

Despite the VIX seeing a net weekly decline of -7.4%, the 2x lev' bullish instruments of TVIX and UVXY climbed for the third consecutive week, both with gains of around 2%. Near term outlook is for VIX to slip back to the low teens, as equities bounce to the sp'1960s.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, weekly

Despite all the geo-pol concerns, it is very notable that the VIX again failed to get a weekly close above the 200 MA., something the VIX has not been able to manage since late 2011.

--

As for TVIX/UVXY

We've not seen 3 consecutive net weekly gains since January. Indeed, price action is somewhat similar in the broader market to late Jan/early Feb.

Best guess? I'd expect VIX will slide next week as equities battle at least somewhat higher. The big issue is whether the bulls can break back above broken support.. into the 1970s.

If they can't...then VIX is going to resume the climb.

-

As ever, such derivatives are for short term holds only. It is VERY rare to see these things manage gains across multiple months.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, weekly

Despite all the geo-pol concerns, it is very notable that the VIX again failed to get a weekly close above the 200 MA., something the VIX has not been able to manage since late 2011.

--

As for TVIX/UVXY

We've not seen 3 consecutive net weekly gains since January. Indeed, price action is somewhat similar in the broader market to late Jan/early Feb.

Best guess? I'd expect VIX will slide next week as equities battle at least somewhat higher. The big issue is whether the bulls can break back above broken support.. into the 1970s.

If they can't...then VIX is going to resume the climb.

-

As ever, such derivatives are for short term holds only. It is VERY rare to see these things manage gains across multiple months.

Thursday 7 August 2014

FCX - still on the slide

With the broader market seeing further moderate weakness, Freeport McMoran (FCX) was also weak, settling lower by -1.5% @ $36.14. Near term outlook is for renewed upside.. along with the broader market.

FCX,daily

Summary

Suffice to say... its been a bit of a rough few weeks for FCX, having slipped from $39.05 to the low 36s... a drop of around 8% - around twice the main market fall since sp'1991.

Overall though, FCX should hold the broader rising support...in the mid $35s.

FCX,daily

Summary

Suffice to say... its been a bit of a rough few weeks for FCX, having slipped from $39.05 to the low 36s... a drop of around 8% - around twice the main market fall since sp'1991.

Overall though, FCX should hold the broader rising support...in the mid $35s.

Wednesday 6 August 2014

DRYS - trying to turn around

Whilst the main market opened lower, Dry Ships (DRYS) opened significantly higher, on better than expected earnings, settling +5.7% @ $2.86. There is near term resistance around $3.05/10.

DRYS, daily

Summary

DRYS remains one of those stocks I still keep an eye on. It used to be one of the hugely popular stocks to trade, especially in the first year of the post 2009 rally.

Earnings (or rather.. lack of).. were a loss of 1 cent a share.

So.. its still a loss maker, but browsing some of the individual aspects of the earnings report, there are some good signs for the longer term.

-

see key stats @ Yahoo Finance

-

In terms of price, DRYS remains stuck under declining resistance that stretches all the way back to last December, when DRYS peaked at $5.00

A break >$3.20 would be decisive, and open up the next key level of $4.

As things are, even sp'2000s won't likely be enough to kick DRYS to the big $5 threshold.. that seems unlikely for some considerable time to come, not least if the broader market does eventually see a multi-month decline late 2014/early 2015.

DRYS, daily

Summary

DRYS remains one of those stocks I still keep an eye on. It used to be one of the hugely popular stocks to trade, especially in the first year of the post 2009 rally.

Earnings (or rather.. lack of).. were a loss of 1 cent a share.

So.. its still a loss maker, but browsing some of the individual aspects of the earnings report, there are some good signs for the longer term.

-

see key stats @ Yahoo Finance

-

In terms of price, DRYS remains stuck under declining resistance that stretches all the way back to last December, when DRYS peaked at $5.00

A break >$3.20 would be decisive, and open up the next key level of $4.

As things are, even sp'2000s won't likely be enough to kick DRYS to the big $5 threshold.. that seems unlikely for some considerable time to come, not least if the broader market does eventually see a multi-month decline late 2014/early 2015.

Tuesday 5 August 2014

DAL, UAL - turbulant airlines

With the main market seeing somewhat significant declines, the airline stocks were especially weak. Delta (DAL) and United Continental (UAL) settled -2.8% and -3.4% respectively. Outlook is for a little lower...then climbing into September.

DAL, daily

UAL , daily

Summary

Suffice to say... airlines are seeing some real chop lately, although they are still holding massive multi-year gains.

Another day or two lower...and then... UP - along with the broader market.

If sp'500 can break the 2000s in September, then DAL has a fair chance at the mid/upper 40s.

Both are great companies.. Delta being more stable - especially in terms of the stock price.. than UAL.

DAL, daily

UAL , daily

Summary

Suffice to say... airlines are seeing some real chop lately, although they are still holding massive multi-year gains.

Another day or two lower...and then... UP - along with the broader market.

If sp'500 can break the 2000s in September, then DAL has a fair chance at the mid/upper 40s.

Both are great companies.. Delta being more stable - especially in terms of the stock price.. than UAL.

Monday 4 August 2014

GDX - just another day for the miners

With the broader equity market seeing moderate upside, and the precious metals a little weak, the miners saw some significant weakness. The ETF of GDX settled -1.2% @ $25.88. Near term outlook is bearish.

GDX, daily

Summary

Suffice to say, the miners are having issues... not least with the precious metals having declined for the past 3 weeks.

*my mid term target is for Gold to test the giant $1000 threshold, and if that is the case, then the miners will be held back.

GDX, daily

Summary

Suffice to say, the miners are having issues... not least with the precious metals having declined for the past 3 weeks.

*my mid term target is for Gold to test the giant $1000 threshold, and if that is the case, then the miners will be held back.

Friday 1 August 2014

TVIX, UVXY - powerful weekly gains

With the sp' breaking <1960, the VIX built strong gains this week. The 2x lev' bullish VIX instruments of TVIX and UVXY saw the first major weekly gains in some months, higher by 29.2% and 30.3% respectively.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which gained 34.2% across the week.

Most notably, the VIX is making a play for the weekly 200 MA. This week was a marginal miss.. but there now looks to be a very real chance of an August weekly VIX close in the 18s...or higher

If that is achieved.. it will be the first real sign that a broader trend change is underway in the broader equity market.

-

As for TVIX and UVXY, it was indeed the first significant net weekly gains since early April. As ever, both will be highly susceptible to a few days of 'cool down' in the VIX.

What now for the VIX?

I'm seeking a back test of sp'1955/65 next week.. which should equate to VIX cooling to the 14/13s.

From there...so long as SP' does not break 1970.... VIX long will be a valid trade in August.

First major upside target would be VIX 22 - which would surpass the 2013 high of the 21.90s.

--

Personally, I have no intention to trade long VIX in the current equity down cycle. I would only consider picking up some VIX calls in September. Certainly though, the past two days have changed things, and I will strongly consider shorting the equity indexes on the next 2-3 day bounce.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which gained 34.2% across the week.

Most notably, the VIX is making a play for the weekly 200 MA. This week was a marginal miss.. but there now looks to be a very real chance of an August weekly VIX close in the 18s...or higher

If that is achieved.. it will be the first real sign that a broader trend change is underway in the broader equity market.

-

As for TVIX and UVXY, it was indeed the first significant net weekly gains since early April. As ever, both will be highly susceptible to a few days of 'cool down' in the VIX.

What now for the VIX?

I'm seeking a back test of sp'1955/65 next week.. which should equate to VIX cooling to the 14/13s.

From there...so long as SP' does not break 1970.... VIX long will be a valid trade in August.

First major upside target would be VIX 22 - which would surpass the 2013 high of the 21.90s.

--

Personally, I have no intention to trade long VIX in the current equity down cycle. I would only consider picking up some VIX calls in September. Certainly though, the past two days have changed things, and I will strongly consider shorting the equity indexes on the next 2-3 day bounce.

Subscribe to:

Posts (Atom)