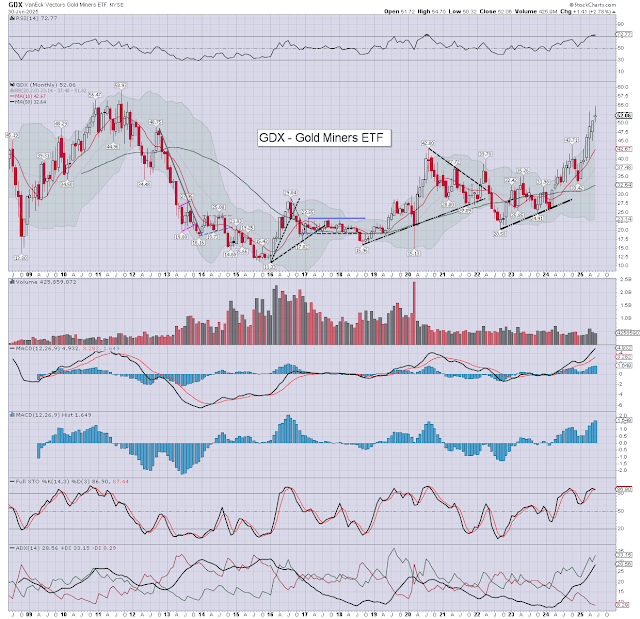

The gold miner ETF of GDX saw a net June gain of +$1.41 (2.8%) to

$52.06

GDX, monthly

Summary

The collective of miners climbed for a sixth consecutive month. GDX printing $54.70 - the highest since Nov'2011, if cooling to settle at $52.06. I

would note the 10MA at $42.67, which was settled above, as the m/t

trend remains bullish.

-

Four of the key miners...

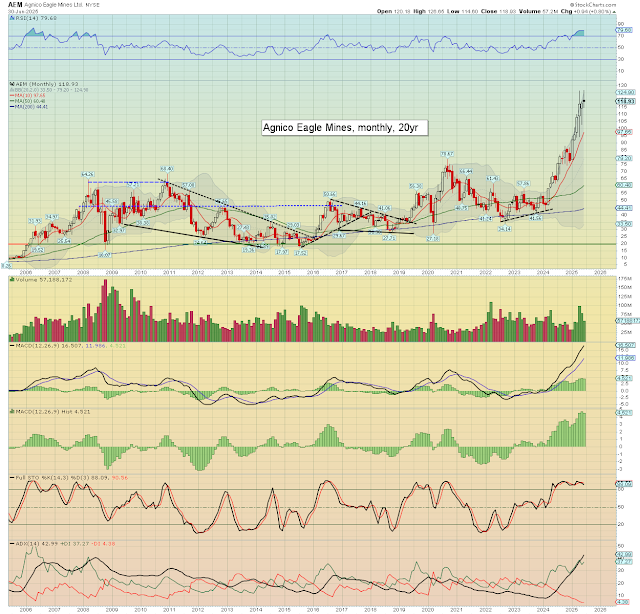

Agnico Eagle Mines (AEM)

Agnico printed a new hist' high of $126.65, with a June gain of +$0.94 (0.8%) to $118.93. Monthly momentum ticked back lower, but remains on the very high side. Vol' was lower at 57M.

--

Newmont (NEM)

Newmont saw a June gain of +$5.54 (10.5%) to $58.26. I

would note the monthly 10MA at $47.17, which was settled above. Monthly

momentum ticked upward for a fourth month. Vol' remained elevated at 254M.

--

Barrick Mining (B)

Barrick saw a net June gain of +$1.66 (8.7%) to $20.82, the highest monthly settlement since March 2022. Momentum

ticked a little higher, and is moderately positive. Vol' was a little lighter at 337M

--

Pan American Silver (PAAS)

Pan American Silver saw a net June gain of +$4.01 (16.4%) to

$28.40, on sustained high vol' of 124M. Momentum ticked back upward, if remaining on the

moderately high

side.

--

Of

the four, yours truly favours Agnico Eagle Mines, which has been the sector leader over a year. The primary concern should be if the broader equity market is net lower into October, the miners will

struggle... even if gold and/or silver continue to climb.

For more of the same...

Subscription details >>> https://www.tradingsunset.com