The gold miner ETF of GDX saw a

net December gain of +$0.20 (0.6%) to $31.01, which made for a net 2023 gain of +$2.81 (10.0%).

GDX, monthly

Summary

The collective of miners climbed for a third consecutive month. I would note the 10MA at $30.04, which was settled above.

Mining bulls should be seeking to take out the 2023 high of $35.67, which will arguably require Gold sustainably >$2100, Silver >$25.00, and Copper >$4.00.

As ever, any main market downside would be a problem to the mining stocks. Right now though, the broader US market is unquestionably m/t bullish.

--

Three of the key miners...

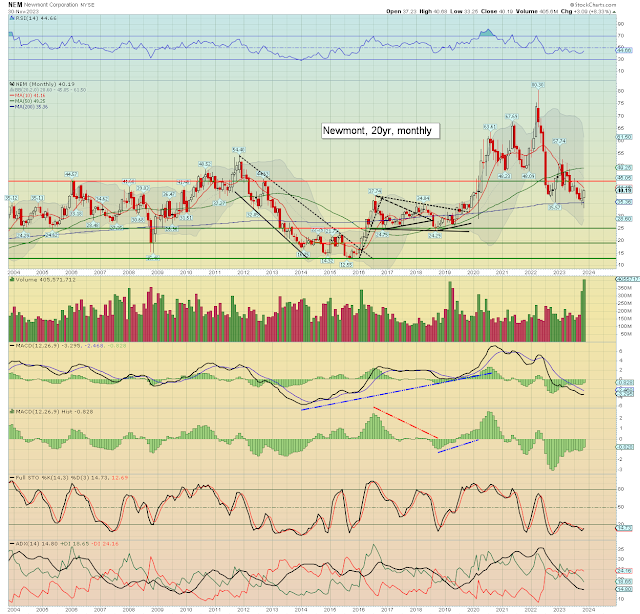

Newmont (NEM), monthly

Newmont saw a net December gain of +$1.20 (3.0%) to $41.39. I

would note the monthly 10MA at $41.10, which was marginally settled above. Net yearly decline of -$3.97 (8.8%).

Monthly

momentum is ticking upward, and prone to turning positive within Jan/Feb'. Price could be expected to spike, with a break above key price threshold of the $44s.

--

Barrick Gold (GOLD), monthly

A net December gain of +$0.50 (2.8%) to $18.09. A net yearly gain of +$1.32 (7.9%). The December candle leans at least s/t bullish, with momentum having turned positive.

--

First Majestic Silver (AG), monthly

A net December gain of +$0.18 (3.0%) to $6.15. I would note the December settlement is back above the 10MA, with monthly momentum due to turn positive in January. A net yearly decline of -$2.16 (26.0%), as the silver miners are (as is usually the case) fairing worse than the gold miners.

--

Of the three, yours truly favours NEM.

As of end 2023... I hold a stock position in NEM

-

Something I just recently noticed.

Highly recommended for those with an interest in gold and the related miners.

--

For more of the same...

For details and the latest offers > https://www.tradingsunset.com