Apple (AAPL) closed the day -0.7% @ $441. Across the month of February, AAPL lost 2.5%, and this was the fifth consecutive monthly decline for AAPL - something we've not seen in over twenty years! Near term trend looks weak, with a potential bearish H/S formation, suggesting sub 400s this spring.

AAPL, daily

AAPL, monthly

Summary

A fifth month lower for AAPL, and it really is historic. I don't have access to data prior to 1993, but I can definitively say, AAPL has not seen five months of declines in the past twenty years. That is pretty incredible, and even more so, when you consider the broader equity market which is still trending higher.

With a cash pile of around $150 per share, AAPL remains a bizarre company.

Theoretically, it seems impossible to consider the stock much lower, but the price action is still suggesting a break under $400 seems likely.

Under-valued?

Forward PE is in the 8s. Even if profits dropped 50%, you'd still only be looking at a PE of 12, which is under the current market average of 15 (or 20)..depending on how you calculate it.

see key stats @ yahoo! finance

Baring a collapse in its loyal consumer following, AAPL is significantly undervalued relative to the main market, but as noted..near term price action says further declines coming.

Thursday 28 February 2013

Wednesday 27 February 2013

F - about to confirm the bull flag

Ford (F) closed significantly higher - in tandem with the main indexes, +3.5% @ $12.77. Ford is now very close to breaking what is a large bull flag, that stretches from mid January

Ford, daily

Summary

First target is a daily close over the 50 day @ $13.00, which itself is just above the upper channel line.

Underlying MACD (blue bar histogram) cycle is turning upward, and should be positive cycle in about 3-4 days.

--

Key support remains @ $11.75

Ford, daily

Summary

First target is a daily close over the 50 day @ $13.00, which itself is just above the upper channel line.

Underlying MACD (blue bar histogram) cycle is turning upward, and should be positive cycle in about 3-4 days.

--

Key support remains @ $11.75

Tuesday 26 February 2013

PWE - someone was buying

Penn West Energy (PWE) closed +0.5% @ $9.71, a moderate gain. The interesting aspect of today was the trading volume. A huge 6 million shares were traded, and this was the biggest up vol' day since Sept'2010. Near term price trend though, remains lower.

PWE, daily

Summary

The recent break of what seemed to be key support @ $10.00 was something of a surprise. Today was the fourth daily close under the $10 level, and its starting to be a real problem from a price/chart perspective.

*Arguably, if PWE can climb back over $10, a $10 stop-level would be a very reasonable strategy.

--

PWE remains marginally profitable, but its the very large dividend - currently 11% of the stock price that is attracting some serious interest from those seeking a good yield.

see key stats @ yahoo! finance

We remain in an oil based economy, and so long as Oil prices don't fall below $90..or certainly $80...the industry as a whole should do okay across 2013.

PWE, daily

Summary

The recent break of what seemed to be key support @ $10.00 was something of a surprise. Today was the fourth daily close under the $10 level, and its starting to be a real problem from a price/chart perspective.

*Arguably, if PWE can climb back over $10, a $10 stop-level would be a very reasonable strategy.

--

PWE remains marginally profitable, but its the very large dividend - currently 11% of the stock price that is attracting some serious interest from those seeking a good yield.

see key stats @ yahoo! finance

We remain in an oil based economy, and so long as Oil prices don't fall below $90..or certainly $80...the industry as a whole should do okay across 2013.

Monday 25 February 2013

TVIX, UVXY - surge...with the VIX

With the equity indexes seeing a major reversal..and the VIX exploding 34% higher, both the 2x bullish VIX instruments of TVIX and UVXY saw massive gains of 25.0 and 27.6% respectively. Volume was extremely high..and the closing action was very strong.

TVIX, daily

UVXY, daily

VIX, daily3

Summary

Suffice to say, the explosion in the VIX is the largest in a very long time, and it will be interesting to see just how far this ramp in volatility can continue.

I'm guessing though we'll get stuck around sp'1480.

--

However, ANY break into the low 1470s opens up a flash-crashy move down to a very well known gap from early January of sp'1425.

That would probably equate to VIX 30/35.

--

As ever..good short-shops are imperitive..if only to protect existing gains!

TVIX, daily

UVXY, daily

VIX, daily3

Summary

Suffice to say, the explosion in the VIX is the largest in a very long time, and it will be interesting to see just how far this ramp in volatility can continue.

I'm guessing though we'll get stuck around sp'1480.

--

However, ANY break into the low 1470s opens up a flash-crashy move down to a very well known gap from early January of sp'1425.

That would probably equate to VIX 30/35.

--

As ever..good short-shops are imperitive..if only to protect existing gains!

Friday 22 February 2013

TVIX, UVXY - disappointing end to the week

With the indexes melting higher across Friday, the VIX slipped lower. Naturally, both the leading 2x bullish VIX instruments of TVIX and UVXY closed lower. The bigger VIX weekly chart offers the small hope of further significant upside next week.

TVIX, daily

UVXY, daily

Summary

First, a reminder on the VIX weekly chart, where we saw a gain of almost 14% on the week, although this was far below the highs of Thursday morning , when the VIX was in the low 16s.

Massive trading volume

The most noticeable thing right now about ALL the VIX instruments is the trading volume. Since the index reversal on Wednesday, volume has surged. Even the Friday volume was still above average. Are the big players just hedging some of their long equity positions? I'd guess that is partly it.

Looking ahead

The weekly VIX chart is set to go positive cycle next week, and that does offer the small hope that we'll be back in the VIX 16s....and possibly 17/18s.

However, considering the continuing Fed POMO program, and the index charts, I find it implausible to consider the VIX will be in the 20s any time soon. Indeed, I think the doomer bears will be lucky to see VIX break 20 in early May.

If that is outlook is broadly correct, we'll see further consistant, and significant decline in the VIX instruments.

TVIX, daily

UVXY, daily

Summary

First, a reminder on the VIX weekly chart, where we saw a gain of almost 14% on the week, although this was far below the highs of Thursday morning , when the VIX was in the low 16s.

Massive trading volume

The most noticeable thing right now about ALL the VIX instruments is the trading volume. Since the index reversal on Wednesday, volume has surged. Even the Friday volume was still above average. Are the big players just hedging some of their long equity positions? I'd guess that is partly it.

Looking ahead

The weekly VIX chart is set to go positive cycle next week, and that does offer the small hope that we'll be back in the VIX 16s....and possibly 17/18s.

However, considering the continuing Fed POMO program, and the index charts, I find it implausible to consider the VIX will be in the 20s any time soon. Indeed, I think the doomer bears will be lucky to see VIX break 20 in early May.

If that is outlook is broadly correct, we'll see further consistant, and significant decline in the VIX instruments.

Thursday 21 February 2013

F - just a minor retracement?

Ford (F) closed lower for the fourth consecutive day, -1.9% @ $12.36. The close below the 50 day MA is kinda significant, next support is the old resistance high around 11.75.

Ford, daily

Summary

Ford is arguably a very reasonably representative of the wider market. Its seen a very strong run since the post election Nov' 2012 lows, rallying from around 10.50 to 14.25.

The current down cycle is very likely just a natural retracement.

Only if Ford breaks <11.75, should the long term bulls get concerned. It makes for a stop level after the six month rally.

--

Bulls should look for a less negative (rounded) tower on the MACD (blue bar histogram) within the next 2-4 days. If that's the case, it bodes well for Ford..and the broader equity market into March..and the spring.

Ford, daily

Summary

Ford is arguably a very reasonably representative of the wider market. Its seen a very strong run since the post election Nov' 2012 lows, rallying from around 10.50 to 14.25.

The current down cycle is very likely just a natural retracement.

Only if Ford breaks <11.75, should the long term bulls get concerned. It makes for a stop level after the six month rally.

--

Bulls should look for a less negative (rounded) tower on the MACD (blue bar histogram) within the next 2-4 days. If that's the case, it bodes well for Ford..and the broader equity market into March..and the spring.

Wednesday 20 February 2013

FCX, SCCO, GDX - miners..slaughtered

A disastrous day for the mining sector. Leading copper miners FCX and SCCO declined by 6.0 and 2.8% respectively. The sector as a whole lost around 5%, with GDX in the $37s. Near term trend looks weak. There is no sign of a floor yet.

FCX, daily

SCCO, daily

GDX, daily

Summary

As a whole, it was the worse day for the miners in a very long time. Even the high quality giants like Freeport McMoran (FCX) and Southern Copper (SCCO) saw very significant declines.

What is clear, there is absolutely no sign of a levelling/turn phase.

In terms of the main market, if the SP' retraces down to around sp'1490/80, we could probably expect another 2-4 days lower for the miners..before there is any chance of a bounce.

*major sell-side volume..as seen on all charts.

FCX, daily

SCCO, daily

GDX, daily

Summary

As a whole, it was the worse day for the miners in a very long time. Even the high quality giants like Freeport McMoran (FCX) and Southern Copper (SCCO) saw very significant declines.

What is clear, there is absolutely no sign of a levelling/turn phase.

In terms of the main market, if the SP' retraces down to around sp'1490/80, we could probably expect another 2-4 days lower for the miners..before there is any chance of a bounce.

*major sell-side volume..as seen on all charts.

Tuesday 19 February 2013

GDX - miners still digging deeper

Despite the main equity market closing moderately higher, the mining sector again saw significant declines. GDX closed 1.1% lower @ $39.46, and is 5% lower so far this month. Primary trend looks very weak, and a move to the $35/30 zone looks very likely within the next month or two.

GDX, daily

GDX, monthly

Summary

Just a brief update.

With the precious metals (and Copper too !) all seeing further declines it was not exactly surprising to see further weakness in the mining sector.

It does look like the secondary target zone of 35/30 will be hit within a month or two.

GDX, daily

GDX, monthly

Summary

Just a brief update.

With the precious metals (and Copper too !) all seeing further declines it was not exactly surprising to see further weakness in the mining sector.

It does look like the secondary target zone of 35/30 will be hit within a month or two.

Friday 15 February 2013

GDX - Miners..a fifth month lower

The miners (GDX) closed the day -3.5%, which was again a lousy performance relative to the broader equity market, Yet, with the precious metals getting hammered lower, its not entirely surprising. The miners are right back at the lows from last July, near term trend is very bearish.

GDX, daily

GDX, monthly.

Summary

GDX failed to hold the 40s, and this comes after hitting the 54s last September.

You can see how the miners - along with Gold and Silver, ramped hard in late summer 2012. With the announcement of QE3, the main market peaked the following day, and its been all down hill since then.

Aside from the fact that the main market actually floored in mid November, whilst the miners - and metals, have just kept falling.

On any basis, we're approaching grossly oversold levels, although its very dangerous meddling, whilst the trend is still clearly down..and there is NO sign of any turn/levelling phase yet.

It would seem my secondary target of GDX 35/30 looks set to be hit within the near term..and I would believe a new up cycle can then begin. At that point, the issue will be, can GDX break above the sept'2012 highs?

Right now, that remains the critical unknown.

Considering the post QE3 reaction in the miners/metals market, you'd have to believe we might merely put in another 'lower high'.

GDX, daily

GDX, monthly.

Summary

GDX failed to hold the 40s, and this comes after hitting the 54s last September.

You can see how the miners - along with Gold and Silver, ramped hard in late summer 2012. With the announcement of QE3, the main market peaked the following day, and its been all down hill since then.

Aside from the fact that the main market actually floored in mid November, whilst the miners - and metals, have just kept falling.

On any basis, we're approaching grossly oversold levels, although its very dangerous meddling, whilst the trend is still clearly down..and there is NO sign of any turn/levelling phase yet.

It would seem my secondary target of GDX 35/30 looks set to be hit within the near term..and I would believe a new up cycle can then begin. At that point, the issue will be, can GDX break above the sept'2012 highs?

Right now, that remains the critical unknown.

Considering the post QE3 reaction in the miners/metals market, you'd have to believe we might merely put in another 'lower high'.

Thursday 14 February 2013

RIG - a new push higher, headed for $100

Transocean (RIG) closed strongly higher, +3.9% @ $59.27. After the significant breakout that began the year, RIG looks set for much higher levels.

RIG, daily

Summary

There is very little to note, other than the break we saw at the start of the year, is absolutely seeing the follow through necessary for confirmation that a major new upward phase is underway.

If the main market cruises higher into the spring..and summer...then RIG is probably going to have a shot at hitting the big $100 threshold.

RIG is unquestionably a good company, arguably one of the best in the Oil/Gas service sector.

With the underlying MACD (blue bar histogram) cycle due to go positive cycle within the next few trading days, looks to be further significant upside yet to come in the immediate term.

RIG, daily

Summary

There is very little to note, other than the break we saw at the start of the year, is absolutely seeing the follow through necessary for confirmation that a major new upward phase is underway.

If the main market cruises higher into the spring..and summer...then RIG is probably going to have a shot at hitting the big $100 threshold.

RIG is unquestionably a good company, arguably one of the best in the Oil/Gas service sector.

With the underlying MACD (blue bar histogram) cycle due to go positive cycle within the next few trading days, looks to be further significant upside yet to come in the immediate term.

Wednesday 13 February 2013

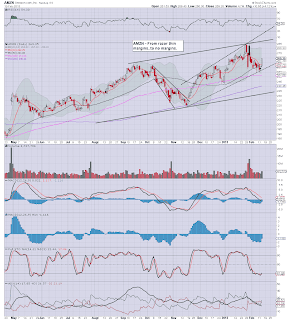

AMZN - no margins, but ramping upward

Amazon (AMZN) closed strongly higher for the first time in almost a month, +4% @ $269. The recent high of $284 is very much within range..and then its open air into the 300s. Today's action is all the more remarkable considering AMZN is a loss making company.

AMZN, daily

Summary

I do like to focus on price/earnings, but now that AMZN doesn't make ANY money, it no longer even has a P/E.

Is that some sort of ultra-buy signal? In this market, it seems that so long as you are 'big', it really doesn't matter whether you make money or not.

see key stats @ yahoo! finance

Forward PE is in the 70s, but hey, that's based on the notion that AMZN will start making money this year, and that is something I find somewhat suspect.

The underlying economy is still lousy, and AMZN management are showing virtually no attempt to improve margins. Ohh, the AMZN leadership are showing massive attempts to increase volume/sales, but...not the margins!

Until I see this company with stable 'minimum' margins of 5-7%, I can't take it seriously as a company.

Incredible times....and incredible valuations.

AMZN, daily

Summary

I do like to focus on price/earnings, but now that AMZN doesn't make ANY money, it no longer even has a P/E.

Is that some sort of ultra-buy signal? In this market, it seems that so long as you are 'big', it really doesn't matter whether you make money or not.

see key stats @ yahoo! finance

Forward PE is in the 70s, but hey, that's based on the notion that AMZN will start making money this year, and that is something I find somewhat suspect.

The underlying economy is still lousy, and AMZN management are showing virtually no attempt to improve margins. Ohh, the AMZN leadership are showing massive attempts to increase volume/sales, but...not the margins!

Until I see this company with stable 'minimum' margins of 5-7%, I can't take it seriously as a company.

Incredible times....and incredible valuations.

Tuesday 12 February 2013

TVIX, UVXY - the horror continues

Another day lower for the VIX, and so its not surprising to see the 2x bullish VIX instruments - TVIX and UVXY, both close a little lower, by 2.3 and 2.0% respectively. With the VIX back in the low 12s, there is simply no momentum to the upside...in this fearless market

TVIX, daily

UVXY, daily

Summary

The VIX itself hasn't quite broken the recent lows...but its real close.

VIX'daily3

As is the case with the leveraged instruments, the statistical decay is a real problem, and both TVIX and UVXY made fractional new lows today..even though the VIX has not.

--

For the moment, there is simply no fear in this market.

With the Fed throwing 45bn a month of POMO $ at the primary dealers, I increasingly find it difficult to even envision a minor VIX gap-fill in the 16-18 range. How many months might we have to wait until that level is hit again?

--

As always, all leveraged instruments are for short term trading only.

TVIX, daily

UVXY, daily

Summary

The VIX itself hasn't quite broken the recent lows...but its real close.

VIX'daily3

As is the case with the leveraged instruments, the statistical decay is a real problem, and both TVIX and UVXY made fractional new lows today..even though the VIX has not.

--

For the moment, there is simply no fear in this market.

With the Fed throwing 45bn a month of POMO $ at the primary dealers, I increasingly find it difficult to even envision a minor VIX gap-fill in the 16-18 range. How many months might we have to wait until that level is hit again?

--

As always, all leveraged instruments are for short term trading only.

Monday 11 February 2013

SCCO - an ABC lower?

Southern Copper (SCCO) closed around 1.2% lower @ $40.14 The recent Q4 results were arguably reasonable, and the long term trend looks set to continue, after what might easily be a standard ABC correction, levelling out somewhere between 39/38.

SCCO, daily

Summary

Just a brief update on SCCO.

The company remains one of the better miners out there. Long term trend is clearly higher, and so long as the main market holds together this spring, SCCO will probably be trading somewhere in the 50s by the early summer.

The immediate price action could easily be a simple ABC correction...with the B wave perhaps now complete. We're only talking about another dollar or so lower.

A decline <37 looks extremely unlikely. For the big money..it makes for a very straightforward stop-loss.

SCCO, daily

Summary

Just a brief update on SCCO.

The company remains one of the better miners out there. Long term trend is clearly higher, and so long as the main market holds together this spring, SCCO will probably be trading somewhere in the 50s by the early summer.

The immediate price action could easily be a simple ABC correction...with the B wave perhaps now complete. We're only talking about another dollar or so lower.

A decline <37 looks extremely unlikely. For the big money..it makes for a very straightforward stop-loss.

Thursday 7 February 2013

HPQ - post election stair step

Hewlett Packard (HPQ) closed lower by 1.5%, to settle @ $16.44. Despite the weak close, it has to be recognised that the stock has seen a massive stair step climb higher since the post election low in the 11s.

HPQ, daily

Summary

HPQ is now up around 40% since the mid November lows - when sp' was 1343. With the market up around 12%, HPQ sure is outpacing the broader market by a factor of 3.

Very impressive indeed,

Yet, there remain serious structural issues with the company. Does it really have the management and leadership necessary? I have to say, no way, but...maybe HPQ will be still okay despite incompetence at the helm.

--

From a price perspective, there is good channel support around $16, and the 50 day MA in the low 15s. Clearly, this stock broke the bearish trend - that stretches way back into early 2012, with the little snap higher at the start of this year.

HPQ will be one to watch. Q1 earnings in April will be particularly interesting to see for this technological behemoth.

HPQ, daily

Summary

HPQ is now up around 40% since the mid November lows - when sp' was 1343. With the market up around 12%, HPQ sure is outpacing the broader market by a factor of 3.

Very impressive indeed,

Yet, there remain serious structural issues with the company. Does it really have the management and leadership necessary? I have to say, no way, but...maybe HPQ will be still okay despite incompetence at the helm.

--

From a price perspective, there is good channel support around $16, and the 50 day MA in the low 15s. Clearly, this stock broke the bearish trend - that stretches way back into early 2012, with the little snap higher at the start of this year.

HPQ will be one to watch. Q1 earnings in April will be particularly interesting to see for this technological behemoth.

Wednesday 6 February 2013

STX - bear flag?

Seagate Technology Holdings (STX) closed up almost 2% @ $34.62. Its continuing to recover after the gap lower on recent disappointing results. Despite the minor recovery, the price action could easily be a bear flag, with a target of 32/31 within the next week or two.

STX, daily

Summary

*not much to add, its merely one to watch.

If the main indexes retrace to sp'1470/60 within the next few weeks, then STX @ 32/30 would look like a very reasonable entrry level.

STX, daily

Summary

*not much to add, its merely one to watch.

If the main indexes retrace to sp'1470/60 within the next few weeks, then STX @ 32/30 would look like a very reasonable entrry level.

Monday 4 February 2013

PWE - holding the big $10.00 level

Penn West Petroleum (PWE) managed moderate gains today, despite the main indexes having their biggest daily decline in 5 weeks. The fact PWE held the hugely important lows from early November is also a good sign the floor is indeed going to hold.

PWE, daily

Summary

Today's action in PWE was a great contrast to the weakness seen in the broader market. Whilst the indexes saw declines of around 1%, PWE actually managed to close 0.7% higher.

Lets be clear, PWE is still holding within a down channel, and it won't be until its above the $10.75/11.00 level, that we can be more secure that the huge drop that extends all the way from March 2011 (when PWE was $26)..is over.

Not the best...but certainly not the worst.

PWE is not without problems, but it seems reasonably stable..and the balance sheet appears acceptable at the current valuation.

see key stats @ yahoo! finance

If we see a few daily closes >$11, first target would be the declining 200 day MA @ $12.50.

The old head/shoulder high of $16 from September 2012 will be important to break by the early summer.

PWE, daily

Summary

Today's action in PWE was a great contrast to the weakness seen in the broader market. Whilst the indexes saw declines of around 1%, PWE actually managed to close 0.7% higher.

Lets be clear, PWE is still holding within a down channel, and it won't be until its above the $10.75/11.00 level, that we can be more secure that the huge drop that extends all the way from March 2011 (when PWE was $26)..is over.

Not the best...but certainly not the worst.

PWE is not without problems, but it seems reasonably stable..and the balance sheet appears acceptable at the current valuation.

see key stats @ yahoo! finance

If we see a few daily closes >$11, first target would be the declining 200 day MA @ $12.50.

The old head/shoulder high of $16 from September 2012 will be important to break by the early summer.

Friday 1 February 2013

TVIX, UVXY - ending the week on a downer

With the main indexes clawing to new post-2009 highs, the VIX was ground lower across much of the day. Both the 2x bullish VIX instruments of TVIX and UVXY saw appropriate severe drops of 8.0 and 9.9% respectively. The VIX itself closed around -10% for the day, but was flat for the week.

TVIX, daily

UVXY, daily

Summary

The long term trend is down, but then...such is the case with almost all of the leveraged instruments, even the ones where the trend it broadly in their favour.

I suppose the TVIX/UVXY holders who have been holding for the past week or two could claim that new lows are NOT yet being put in, but still..the daily charts - as ever, are a sight of abject horror.

--

VIX, weekly

It has to be said, the VIX does look floored on the bigger weekly chart. Yet it could be weeks, even months before we see a major multi-week up trend, and even then, it is probably going to be tough to break the important VIX 20 threshold.

-

*personally, rather than trade VIX via TVIX, UVXY, or even VXX, I prefer VIX options, but thats even more of an issue in terms of time-decay..

TVIX, daily

UVXY, daily

Summary

The long term trend is down, but then...such is the case with almost all of the leveraged instruments, even the ones where the trend it broadly in their favour.

I suppose the TVIX/UVXY holders who have been holding for the past week or two could claim that new lows are NOT yet being put in, but still..the daily charts - as ever, are a sight of abject horror.

--

VIX, weekly

It has to be said, the VIX does look floored on the bigger weekly chart. Yet it could be weeks, even months before we see a major multi-week up trend, and even then, it is probably going to be tough to break the important VIX 20 threshold.

-

*personally, rather than trade VIX via TVIX, UVXY, or even VXX, I prefer VIX options, but thats even more of an issue in terms of time-decay..

Subscribe to:

Posts (Atom)