The gold miner ETF of GDX saw a

net November gain of +$3.31 (11.8%) to $31.32, helped by upside in gold and silver.

GDX, monthly

Summary

An intra month low of $27.01, but swinging lower to

settle at $31.32. I

would note the 10MA at $30.14, which was settled above. Monthly

momentum ticked back upward, and settled fractionally positive.

The central concern should be any renewed broad/sustained downside in the main market. However, I'd accept that doesn't look due any earlier than mid January.

--

Three of the key miners...

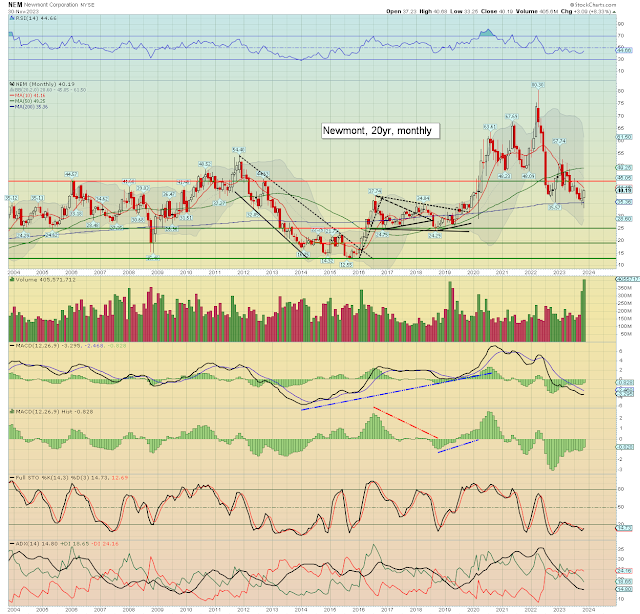

Newmont (NEM), monthly

Newmont saw a net November gain of +$3.09 (8.3%) to $37.47. I

would note the monthly 10MA at $41.16, which was settled beneath.

Monthly

momentum ticked upward, if remaining negative. The November candle is bullish engulfing, and leans s/t bullish.

--

Barrick Gold (GOLD), monthly

A net November gain of +$1.70 (10.7%) to $15.98. Momentum subtly ticked

upward, turning fractionally positive. Soft target is key price threshold of the $19.20s.

--

First Majestic Silver (AG), monthly

A net November gain of +$0.83 (16.0%) to $5.97. A twelfth consecutive settlement below the 10MA. The November candle is bullish engulfing, and leans s/t bullish.

--

Of

the three, yours truly favours Newmont, as it has less exposure to

copper than Barrick. The bold will lean to the silver miners, but they

would be especially vulnerable if the main market continues lower.

--

For more of the same...

For the latest subscription offers > https://www.tradingsunset.com