With precious metals climbing across the month, the related mining stocks were similarly on the rise. The ETF of GDX saw a very powerful net monthly gain of $5.13 (36.1%) to $19.34 - the highest monthly close since May 2015. Near term outlook threatens some cooling, before much higher levels across the spring/early summer.

GDX, monthly

GDX, daily

Summary

The mining stocks are naturally following the precious metals.

The February gains were very powerful, and regardless of any cooling into mid March, the precious metals and related mining stocks look set for much higher levels into April/May.

The issue is whether a key multi-year low is in. The gold bugs are going to need to see a higher low generated on the bigger weekly/monthly cycles, but there won't likely be clarity of that for some months.

*I am seeking to be long Gold - via GLD, and the miners - via GDX, in mid March.

Monday, 29 February 2016

Friday, 26 February 2016

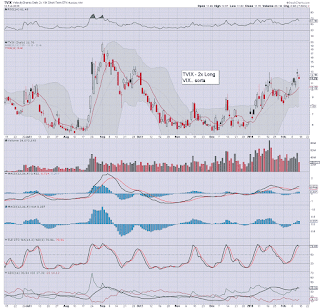

TVIX, UVXY - a second week of declines

With equities continuing to battle upward, the VIX remained in cooling mode. The 2x lev' bullish instruments of TVIX and UVXY settled lower by -7.7% and -8.0% respectively. Near term outlook offers subdued volatility into mid March, before viable hyper upside into April-May.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which saw a net weekly decline of -3.5%.

--

As for TVIX/UVXY, they look set to weaken for another 2-3 weeks. That will probably equate to another 15/20% lower, not least as they are also prone to the issue of statistical decay.

--

*I am seeking to be long VIX from mid March onward.. and all the way into May/June.

VIX 40/50s looks due in the next equity wave lower... and if so.. TVIX/UVXY will have risen by at least 4-5x.. from whatever level they are trading in mid March.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which saw a net weekly decline of -3.5%.

--

As for TVIX/UVXY, they look set to weaken for another 2-3 weeks. That will probably equate to another 15/20% lower, not least as they are also prone to the issue of statistical decay.

--

*I am seeking to be long VIX from mid March onward.. and all the way into May/June.

VIX 40/50s looks due in the next equity wave lower... and if so.. TVIX/UVXY will have risen by at least 4-5x.. from whatever level they are trading in mid March.

Thursday, 25 February 2016

TSLA - breaks above resistance

Whilst the broader market closed significantly higher, there was notable strength in Tesla Motors (TSLA), which despite early declines (intra low $175.20), swung powerfully higher, settling +4.8% @ $187.65. Near term outlook offers the $200 threshold. Broader downside to the 120/100 zone looks due later this year.

TSLA, daily

TSLA, monthly

Summary

Suffice to add, TSLA looks headed to around $200 by mid March.

From there, if my broader bearish outlook is correct - to the sp'1600s, then TSLA will likely take out the Feb'9th low of $141.09, and continue falling to the 120/100 zone.

Seen on the giant monthly chart, any sustained action <$100, will likely confirm a full retrace back to the original breakout level of $40.

-

*to be clear, I like the company, Tesla is an industry leader... highly innovative, but still... its a loss maker..with net cash out-flow.

No doubt, the CEO Musk will manage to raise more capital within the next year or two to keep the company fully financed, but for now... the valuation is simply ludicrous.

TSLA, daily

TSLA, monthly

Summary

Suffice to add, TSLA looks headed to around $200 by mid March.

From there, if my broader bearish outlook is correct - to the sp'1600s, then TSLA will likely take out the Feb'9th low of $141.09, and continue falling to the 120/100 zone.

Seen on the giant monthly chart, any sustained action <$100, will likely confirm a full retrace back to the original breakout level of $40.

-

*to be clear, I like the company, Tesla is an industry leader... highly innovative, but still... its a loss maker..with net cash out-flow.

No doubt, the CEO Musk will manage to raise more capital within the next year or two to keep the company fully financed, but for now... the valuation is simply ludicrous.

Wednesday, 24 February 2016

GDX - wild day for the miners

With Gold catching another fear bid in the morning, the related mining stocks surged, with GDX breaking a new multi-month high of $19.85. Yet.. with the market recovering, Gold rapidly cooled, with the miners seeing a rather powerful reversal, briefly turning negative, with GDX settling +1.0% @ $19.11.

GDX, daily

Summary

Suffice to add, Gold/Silver look set to cool into mid March.

If correct, the related mining stocks look vulnerable to a decline of at least 10/15%.

Worse case for GDX... the mid $15s.... but from there... primary upside to $25/26.

-

*I'll strongly consider picking up GDX in a few weeks... although long Gold - via GLD, would be a primary trade.

GDX, daily

Summary

Suffice to add, Gold/Silver look set to cool into mid March.

If correct, the related mining stocks look vulnerable to a decline of at least 10/15%.

Worse case for GDX... the mid $15s.... but from there... primary upside to $25/26.

-

*I'll strongly consider picking up GDX in a few weeks... although long Gold - via GLD, would be a primary trade.

Tuesday, 23 February 2016

CBRL - rising on good earnings

Whilst the broader market closed broadly weak, there was notable strength for Cracker Barrel Old Country Store (CBRL), which settled +4.4% at $147.49, the highest level since early October'2015. Near term outlook is bullish into mid March, but the stock will be vulnerable if the main market implodes this spring.

CBRL, daily

Summary

Earnings were unquestionably fine, with EPS of $2.01.

Operating margin was 9.2% vs 9.4%.

Rev' $764 million, +1.1%

--

CBRL is one of the better listed companies in the sector, but the restaurant trade remains fiercely competitive. For now.. CBRL is unquestionably doing fine.

In terms of price, next upside resistance will be the July 13th 2015 high of $155.59. That is within range - not least after today's net gain, but sustainable action in the 160s will not be easy, as the broader market looks set for much lower levels this spring/early summer.

If the sp'1600s, CBRL could be expected to be trading in the 110/100 zone.

CBRL, daily

Summary

Earnings were unquestionably fine, with EPS of $2.01.

Operating margin was 9.2% vs 9.4%.

Rev' $764 million, +1.1%

--

CBRL is one of the better listed companies in the sector, but the restaurant trade remains fiercely competitive. For now.. CBRL is unquestionably doing fine.

In terms of price, next upside resistance will be the July 13th 2015 high of $155.59. That is within range - not least after today's net gain, but sustainable action in the 160s will not be easy, as the broader market looks set for much lower levels this spring/early summer.

If the sp'1600s, CBRL could be expected to be trading in the 110/100 zone.

Monday, 22 February 2016

GDX - miners holding up relatively well

Considering the net daily declines in Gold and Silver, the related mining stocks held up very well today. The ETF of GDX swung from a morning low of $17.75, to settle +0.8% @ $18.53. Near term outlook still offers further cooling though, to the mid $15s.

GDX, daily

GDX,monthly

Summary

It was one of those rare days when despite the metals being significantly lower, the miners managed a net daily gain.

It is notable that in early trading the miners were lower by around -2%, but the buyers came in strongly.. and most mining stocks ended the day with gains.

--

I'm seeking Gold to see further cooling to $1180 or so... perhaps 1150/40 by mid March. In theory.. the latter would likely equate to GDX in the mid 15s.

Considering today's price action though... the 15s look overly difficult.

To be clear... whatever level GDX is trading - when Gold floors - which is likely to be no later than mid March... the mining stocks are likely to see explosive upside into end March and across April.

Targets?

First core upside for GDX is the $20 threshold.

Secondary.... 25/26... which is roughly 30% than current levels.

The more volatile junior miners would have around double the % gains.

GDX, daily

GDX,monthly

Summary

It was one of those rare days when despite the metals being significantly lower, the miners managed a net daily gain.

It is notable that in early trading the miners were lower by around -2%, but the buyers came in strongly.. and most mining stocks ended the day with gains.

--

I'm seeking Gold to see further cooling to $1180 or so... perhaps 1150/40 by mid March. In theory.. the latter would likely equate to GDX in the mid 15s.

Considering today's price action though... the 15s look overly difficult.

To be clear... whatever level GDX is trading - when Gold floors - which is likely to be no later than mid March... the mining stocks are likely to see explosive upside into end March and across April.

Targets?

First core upside for GDX is the $20 threshold.

Secondary.... 25/26... which is roughly 30% than current levels.

The more volatile junior miners would have around double the % gains.

Friday, 19 February 2016

TVIX, UVXY - significant net weekly declines

With US equities seeing very significant net weekly gains, the VIX was naturally in cooling mode. The 2x lev' bullish instruments of TVIX and UVXY, declined by -20.9% and -21.0% respectively. Near term outlook is for further VIX cooling, at least to the 19/18s.

TVIX, daily

UVXY, daily

Summary

*first an update on the VIX, which saw a net weekly decline of -19.2%.

--

As for TVIX/UVXY, we've now seen a very significant decline from the volatility high of Feb' 11th.

In the case of TVIX, we've seen it fall from $13.58 to the low 9s.. a clear 30%.

--

*my broader outlook remains unchanged.. seeking the sp'1600s.. with market shaking bankruptcies in the oil/gas/mining sector. That should see the VIX at least briefly explode to the 40/50s.

TVIX, daily

UVXY, daily

Summary

*first an update on the VIX, which saw a net weekly decline of -19.2%.

--

As for TVIX/UVXY, we've now seen a very significant decline from the volatility high of Feb' 11th.

In the case of TVIX, we've seen it fall from $13.58 to the low 9s.. a clear 30%.

--

*my broader outlook remains unchanged.. seeking the sp'1600s.. with market shaking bankruptcies in the oil/gas/mining sector. That should see the VIX at least briefly explode to the 40/50s.

Thursday, 18 February 2016

GDX - miners catching a bid

With precious metals back on the rise, the related gold/silver mining stocks were similarly climbing. The ETF of GDX settled higher by a rather powerful 6.6% @ $18.89, notably above last Friday's high. Near term outlook is for renewed cooling in the precious metals.. and by default... the miners.

GDX, daily

GDX, monthly

Summary

Suffice to add.. a new multi-month high for the gold/silver miners, with GDX back to levels last seen in June 2015.

Near term outlook is mixed, with high threat of renewed cooling in Gold to the $1180/70 zone... which would likely equate to GDX in the mid $15s.

Broadly though, precious metals look set to surge into the spring... at least to Gold $1300s, and that will equate to GDX 20/21s.

-

Seen on the giant monthly cycle, we have a clear break of the declining trend from 2011.. and that is VERY important to recognise.

GDX, daily

GDX, monthly

Summary

Suffice to add.. a new multi-month high for the gold/silver miners, with GDX back to levels last seen in June 2015.

Near term outlook is mixed, with high threat of renewed cooling in Gold to the $1180/70 zone... which would likely equate to GDX in the mid $15s.

Broadly though, precious metals look set to surge into the spring... at least to Gold $1300s, and that will equate to GDX 20/21s.

-

Seen on the giant monthly cycle, we have a clear break of the declining trend from 2011.. and that is VERY important to recognise.

Wednesday, 17 February 2016

CNX, FCX, SDRL - bear market gains

With the broader market closing significantly higher for a third consecutive day, many of the more severely beaten down stocks were seeing rather extreme daily gains. Consol Energy (CNX), Freeport McMoran (FCX) and Seadrill (SDRL), settled higher by 12.4%, 12.2%, and 6.9% respectively.

CNX, daily

FCX, daily

SDRL, daily

Summary

Suffice to add.. all three stocks remain absolutely destroyed since summer 2014.

This is arguably just a classic trio of hyper gains as part of a broader bear market rally.

--

CNX, FCX, and SDLR are all on the disappear list. All three companies are overly debt burdened, and considering commodities still look due full capitulation, I would be surprised if at least one of the trio doesn't file for bankruptcy by early summer.

*no position... I'd rather short the main indexes/long VIX this spring.

CNX, daily

FCX, daily

SDRL, daily

Summary

Suffice to add.. all three stocks remain absolutely destroyed since summer 2014.

This is arguably just a classic trio of hyper gains as part of a broader bear market rally.

--

CNX, FCX, and SDLR are all on the disappear list. All three companies are overly debt burdened, and considering commodities still look due full capitulation, I would be surprised if at least one of the trio doesn't file for bankruptcy by early summer.

*no position... I'd rather short the main indexes/long VIX this spring.

Tuesday, 16 February 2016

GDX - miners retracing as metals cool

With the precious metals cooling from last week's hyper gains, the related gold/silver mining stocks were seriously impacted - despite the broader market rising. The ETF of GDX settled -8.6% @ $17.21. Next support is the gap zone, where the 200dma is lurking, around the $15.50s.

GDX, daily

GDX, monthly

Summary

Suffice to add, having ramped from $12.40 (Jan'19th) to $18.85 (Feb 12'th), its not exactly surprising to see the mining stocks in cooling mode.

It would seem both the precious metals and the miners should be able to level out around their respective 200dmas.

It is notable that the 50dma is set for a golden cross in early March... and that should act as an extra layer of support.

-

*Having broken a fair few technical levels and the declining trend from 2011, I am bullish the miners/Gold into the spring.

I will probably go long Gold - via GLD within a few weeks, with an initial target of $1300. In theory, that should equate to GDX around 20/21.

GDX, daily

GDX, monthly

Summary

Suffice to add, having ramped from $12.40 (Jan'19th) to $18.85 (Feb 12'th), its not exactly surprising to see the mining stocks in cooling mode.

It would seem both the precious metals and the miners should be able to level out around their respective 200dmas.

It is notable that the 50dma is set for a golden cross in early March... and that should act as an extra layer of support.

-

*Having broken a fair few technical levels and the declining trend from 2011, I am bullish the miners/Gold into the spring.

I will probably go long Gold - via GLD within a few weeks, with an initial target of $1300. In theory, that should equate to GDX around 20/21.

Friday, 12 February 2016

TVIX, UVXY - a second week of gains

Despite cooling into the weekly close, the 2x lev' bullish VIX instruments of TVIX and UVXY climbed for a second consecutive week, both with net weekly gains of 17.2%. Near term outlook offers a continued equity bounce into the sp'1900s, with VIX cooling to the 22/18 zone.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which saw a net weekly gain of 8.6%

--

As for TVIX/UVXY, note the Thursday black-fail candle. Often indicative of a short term exhaustion top, which was arguably confirmed with Friday's significant net daily decline.

With the VIX set to cool for much of next week, TVIX/UVXY look liable to retrace at least 15/20%. Right now, TVIX in the 8s looks probable.

In any March/April 'major market upset' equity down wave, TVIX/UVXY should in theory increase by a multiple of 4-5x.

It is notable, in the 12 day equity collapse of July/August 2011, TVIX increased 7x.

As ever, holding longer for more than a few weeks is highly problematic, primarily due to underlying statistical decay factors. Indeed, the higher the volatility level, the worse the level of decay is.

--

I am seeking to be long VIX from the next cycle, as it would seem the VIX is set for far higher levels in March/April, the 40/50s look very viable if sp'1750/25 - which is a pretty basic target for this spring.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which saw a net weekly gain of 8.6%

--

As for TVIX/UVXY, note the Thursday black-fail candle. Often indicative of a short term exhaustion top, which was arguably confirmed with Friday's significant net daily decline.

With the VIX set to cool for much of next week, TVIX/UVXY look liable to retrace at least 15/20%. Right now, TVIX in the 8s looks probable.

In any March/April 'major market upset' equity down wave, TVIX/UVXY should in theory increase by a multiple of 4-5x.

It is notable, in the 12 day equity collapse of July/August 2011, TVIX increased 7x.

As ever, holding longer for more than a few weeks is highly problematic, primarily due to underlying statistical decay factors. Indeed, the higher the volatility level, the worse the level of decay is.

--

I am seeking to be long VIX from the next cycle, as it would seem the VIX is set for far higher levels in March/April, the 40/50s look very viable if sp'1750/25 - which is a pretty basic target for this spring.

Thursday, 11 February 2016

GDX - explosive miners following the metals

As a collective, the mining stocks are seeing a provisional break of the downward trend that stretches back to Sept' 2011. The ETF of GDX settled powerfully higher by 7.3% @ $18.39, the highest level since June 2015. The bigger monthly cycle is offering a hugely important multi-year upside break.

GDX, daily

GDX, monthly

Summary

*I'll likely post the bigger monthly charts tomorrow.

--

Suffice to say... the precious metals are showing very distinct multi-year upside breaks.. and the related mining stocks are similarly following.

All that is necessary to give full clarity now, is a Feb' or March close above the broken trend.

--

*By definition, with the monthly cycle break... any pull backs are now to be bought, and I will consider GDX-long before end month.

GDX, daily

GDX, monthly

Summary

*I'll likely post the bigger monthly charts tomorrow.

--

Suffice to say... the precious metals are showing very distinct multi-year upside breaks.. and the related mining stocks are similarly following.

All that is necessary to give full clarity now, is a Feb' or March close above the broken trend.

--

*By definition, with the monthly cycle break... any pull backs are now to be bought, and I will consider GDX-long before end month.

Wednesday, 10 February 2016

DIS - the selling continues

Despite unquestionably good earnings, Disney (DIS) continued to slide (intra low $86.25), settling -3.7% @ $88.86. Near term outlook still offers high threat of a short term bounce to the 95/97 zone, but the broader outlook is clear.. headed lower to at least 80/75.

DIS, daily

DIS, monthly

Summary

*closing daily candle is of the reversal type, but having broken a new multi-month low, it should not inspire the longer term bulls.

--

Q4 earnings for DIS were no doubt largely helped by huge box office receipts from Star Wars 7, yet that still wasn't enough to satisfy the market.

Clearly, EPS/rev' were fine, but in the current market, its still not seen as good enough.

Regardless of any near term bounce, DIS looks headed lower by another 10/15% - which would sync up with the broader market downside to the sp'1600s.

Special note..

A monthly close <$75 would bode for continued implosion to the old breakout level of $40. That would be suggestive of sp'1200/1000. For now... its something to keep in mind, if very unlikely.

DIS, daily

DIS, monthly

Summary

*closing daily candle is of the reversal type, but having broken a new multi-month low, it should not inspire the longer term bulls.

--

Q4 earnings for DIS were no doubt largely helped by huge box office receipts from Star Wars 7, yet that still wasn't enough to satisfy the market.

Clearly, EPS/rev' were fine, but in the current market, its still not seen as good enough.

Regardless of any near term bounce, DIS looks headed lower by another 10/15% - which would sync up with the broader market downside to the sp'1600s.

Special note..

A monthly close <$75 would bode for continued implosion to the old breakout level of $40. That would be suggestive of sp'1200/1000. For now... its something to keep in mind, if very unlikely.

Tuesday, 9 February 2016

GDX - daily reversal

With the precious metals reversing lower in the afternoon, the related mining stocks saw the first major net daily decline since mid January. The ETF of GDX swung from an intra high of $17.82, but settled lower by a very significant -4.0% to $16.77. Near term outlook is bearish as a retrace appears underway.

GDX, daily

GDX, monthly

Summary

Suffice to add, with gold/silver getting into seriously over bought territory - at levels not seen since Oct'2012, there was always threat of a reversal.. and we have seen that today.

Now it appears a case of GDX at least retracing to the 200dma - which is currently at $15.48.

--

Seen on the bigger monthly cycle, there is a clear attempt by the mining stocks to break out of the primary downward trend that stretches back to Sept'2011.

For me, I'd like to see at least a monthly close >$18 to give a provisional bullish signal.

To give strong clarity/confidence, I'd like to see GDX >$20. Until then... it could easily be just another tease, as the mining industry is yet to capitulate.

... and capitulation WILL happen, just as it must for the oil/gas sector.

--

*eyes on those gold/silver miners with large unsustainable debts.

GDX, daily

GDX, monthly

Summary

Suffice to add, with gold/silver getting into seriously over bought territory - at levels not seen since Oct'2012, there was always threat of a reversal.. and we have seen that today.

Now it appears a case of GDX at least retracing to the 200dma - which is currently at $15.48.

--

Seen on the bigger monthly cycle, there is a clear attempt by the mining stocks to break out of the primary downward trend that stretches back to Sept'2011.

For me, I'd like to see at least a monthly close >$18 to give a provisional bullish signal.

To give strong clarity/confidence, I'd like to see GDX >$20. Until then... it could easily be just another tease, as the mining industry is yet to capitulate.

... and capitulation WILL happen, just as it must for the oil/gas sector.

--

*eyes on those gold/silver miners with large unsustainable debts.

Monday, 8 February 2016

CHK - facing the end of times

Whilst the main market settled significantly lower, there was even more extreme weakness in Chesapeake Energy (CHK), which imploded by 50% in early morning to a new low of $1.50, but settling lower by a relatively moderate -33.0% @ $2.05. Mid term outlook is... bankruptcy.

CHK, daily

CHK, monthly

Summary

It was a pretty wild day for CHK, with the stock being suspended in the morning, only to see the company issue a press release stating it had no intention to file for bankruptcy.

In terms of price, CHK has been in collapse mode since summer 2014, falling from a high of $29.37 to today's new low of $1.50... a drop of -94.9%.

CHK has been on the 'disappear list' for many months, I don't expect it to be around beyond April/May.

--

The next obvious question is... after CHK disappears... who is next?

CHK, daily

CHK, monthly

Summary

It was a pretty wild day for CHK, with the stock being suspended in the morning, only to see the company issue a press release stating it had no intention to file for bankruptcy.

In terms of price, CHK has been in collapse mode since summer 2014, falling from a high of $29.37 to today's new low of $1.50... a drop of -94.9%.

CHK has been on the 'disappear list' for many months, I don't expect it to be around beyond April/May.

--

The next obvious question is... after CHK disappears... who is next?

Friday, 5 February 2016

TVIX, UVXY - significant net weekly gains

With US equity indexes seeing sig' net weekly declines, the VIX was naturally on the rise. The 2x lev' bullish instruments of TVIX and UVXY saw net weekly gains of 18.7% and 18.5% respectively. Near term outlook offers renewed cooling in volatility, before first opportunity of hyper upside in March.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX

--

As for TVIX/UVXY, a rather powerful net weekly gain, but still well below the high from January 20th, when VIX 32s, and VIX was borderline 13s.

As ever, such instruments are for short term holds only, not least due to the endless problem of statistical decay.

If equities see renewed upside next week, breaking above the Monday high of sp'1947, TVIX will probably be in the low 8s again, if not the 7s.

--

*I am seeking to go long TVIX from the sp'1960/80 zone, with VIX 18/17s.

I realise, considering this weeks equity declines, that seems difficult.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX

--

As for TVIX/UVXY, a rather powerful net weekly gain, but still well below the high from January 20th, when VIX 32s, and VIX was borderline 13s.

As ever, such instruments are for short term holds only, not least due to the endless problem of statistical decay.

If equities see renewed upside next week, breaking above the Monday high of sp'1947, TVIX will probably be in the low 8s again, if not the 7s.

--

*I am seeking to go long TVIX from the sp'1960/80 zone, with VIX 18/17s.

I realise, considering this weeks equity declines, that seems difficult.

Thursday, 4 February 2016

FCX - hyper upside within a massive down trend

Whilst the broader market saw a day of moderate swings, there was notable hyper upside in many of the resource stocks that have been destroyed since summer 2014. Freeport McMoran (FCX) settled higher by 17.8% at $5.72. Broadly though, the company looks extremely vulnerable to disappearing entirely.

FCX, daily

FCX, monthly

Summary

Seen on the giant monthly cycle, the true horror is even more clear.

FCX has already been largely obliterated since the July 2014 high of $37.52.

Having decisively broken below the 2008/09 collapse wave low, FCX looks on its death bed.

-

*the stock looks pointless to short from such low levels. No doubt, many retail amateurs are sporadically buying on the notion that one day it will again be trading back to the levels of summer 2011.. or even 2008.

I'm extremely doubtful it'll ever see >$10 again.

FCX, daily

FCX, monthly

Summary

Seen on the giant monthly cycle, the true horror is even more clear.

FCX has already been largely obliterated since the July 2014 high of $37.52.

Having decisively broken below the 2008/09 collapse wave low, FCX looks on its death bed.

-

*the stock looks pointless to short from such low levels. No doubt, many retail amateurs are sporadically buying on the notion that one day it will again be trading back to the levels of summer 2011.. or even 2008.

I'm extremely doubtful it'll ever see >$10 again.

Wednesday, 3 February 2016

GDX - miners breaking out

With precious metals continuing to climb from the mid December low of Gold $1045.40, the mining stocks achieved a rather notable break above declining trend. The ETF of GDX settled higher by +7.3% @ $15.35, the highest level since late October.

GDX, daily

GDX, monthly

Summary

We have a clear break of trend, one that stretches all the way back to mid May 2015 - when most US equity indexes were maxing out.

--

As things are, I'm still highly dismissive that Gold has seen a key multi-year floor @ $1045.

A trading problem...

If the broader market resumes lower to the sp'1700/1600s within the next few months, that sure won't help the mining stocks.

For now, I have ZERO interest in picking up any mining stocks whilst the broader equity market outlook is bearish for the mid term.

Then there is the underlying issue that some miners are still liable to implode. Industry capitulation is STILL due within the mining sector... not all of the currently listed stocks are going to be around by end 2016.

--

Seen on the giant monthly cycle, if could be argued we have a 6-8 month floor, but its notable the miners and precious metals broke new lows as recently as December.

To me, unless GDX >$20, I can't take the current gains seriously.

yours... still patiently watching

GDX, daily

GDX, monthly

Summary

We have a clear break of trend, one that stretches all the way back to mid May 2015 - when most US equity indexes were maxing out.

--

As things are, I'm still highly dismissive that Gold has seen a key multi-year floor @ $1045.

A trading problem...

If the broader market resumes lower to the sp'1700/1600s within the next few months, that sure won't help the mining stocks.

For now, I have ZERO interest in picking up any mining stocks whilst the broader equity market outlook is bearish for the mid term.

Then there is the underlying issue that some miners are still liable to implode. Industry capitulation is STILL due within the mining sector... not all of the currently listed stocks are going to be around by end 2016.

--

Seen on the giant monthly cycle, if could be argued we have a 6-8 month floor, but its notable the miners and precious metals broke new lows as recently as December.

To me, unless GDX >$20, I can't take the current gains seriously.

yours... still patiently watching

Tuesday, 2 February 2016

F, RACE, TSLA - car makers all wrecked

With the broader market closing significantly lower, the automotive industry was under particular pressure, Ford (F), Ferrari (RACE), and Tesla (TSLA), settled lower by -4.6%, -12.3%, and -7.3% respectively. Near term outlook offers a moderate bounce, but the broader trend remains fiercely bearish.

F, daily

RACE, daily

TSLA, daily

Summary

F: next support is the psy' level of $10, and then $8. If sp'1600s within 2-4 months, then the 8s look probable.

RACE: lousy earnings, with an outlook that upset the market. The IPO price of $52 is now a long way higher, and it would seem if sp'1700/1600s in the next few months, RACE will continue falling to the 25/20 zone.

Note the the opening black-fail candle from IPO day, as is often the case with over-priced new issues.

--

TSLA: once a beloved momo stock, TSLA is really struggling. Broader downside target is the $120/100 zone.

-

*of the three stocks, I favour Ford in the long term. I'd be very tempted in the 8s, with a multi-year upside target of $24. Clearly though, that will be a good 3-4 years away, and assumes renewed broad upside across world equity markets into 2019/20.

F, daily

RACE, daily

TSLA, daily

Summary

F: next support is the psy' level of $10, and then $8. If sp'1600s within 2-4 months, then the 8s look probable.

RACE: lousy earnings, with an outlook that upset the market. The IPO price of $52 is now a long way higher, and it would seem if sp'1700/1600s in the next few months, RACE will continue falling to the 25/20 zone.

Note the the opening black-fail candle from IPO day, as is often the case with over-priced new issues.

--

TSLA: once a beloved momo stock, TSLA is really struggling. Broader downside target is the $120/100 zone.

-

*of the three stocks, I favour Ford in the long term. I'd be very tempted in the 8s, with a multi-year upside target of $24. Clearly though, that will be a good 3-4 years away, and assumes renewed broad upside across world equity markets into 2019/20.

Monday, 1 February 2016

TVIX, UVXY - continuing to melt lower

With US equities opening moderately lower, it was notable that the VIX was barely able to muster any upside. With US equities turning positive in the afternoon, the VIX turned negative, with the 2x lev' bullish VIX instruments of TVIX and UVXY both settling -3.0%.

TVIX, daily

UVXy, daily

Summary

Suffice to add, the broader cooling from the Jan'20th volatility high continues.

--

I'm looking to pick up TVIX next week, when VIX 17/16s.. and sp'1970s. Why next week? I'm highly inclined to wait at least another week, as Yellen is due to appear.

That will offer a viable short term top.. from the rally/bounce from sp'1812 (when VIX 32s).

TVIX, daily

UVXy, daily

Summary

Suffice to add, the broader cooling from the Jan'20th volatility high continues.

--

I'm looking to pick up TVIX next week, when VIX 17/16s.. and sp'1970s. Why next week? I'm highly inclined to wait at least another week, as Yellen is due to appear.

That will offer a viable short term top.. from the rally/bounce from sp'1812 (when VIX 32s).

Subscribe to:

Posts (Atom)