With US equities settling July at/near historic highs, the VIX remained very subdued. The 2x lev' bullish VIX instruments were under strong downward pressure, seeing net weekly declines of -18.4% and -17.9% respectively. The VIX looks set to remain broadly low into mid/late September.

TVIX, daily

UVXY, daily

Summary

First, an update on the VIX, which saw a net weekly decline of -1.2%

--

As for TVIX and UVXY... it was a fifth consecutive net weekly decline, as equities remained broadly strong, with a VIX reflecting a confident capital market.

--

As ever... due to the inherent statistical decay problem, holding such leveraged instruments across multiple weeks rarely works out well.

*UVXY saw a reverse split this past Monday... TVIX will no doubt follow.. although I'm unaware of any scheduled date.

Friday, 29 July 2016

Thursday, 28 July 2016

F - car crash stock

Whilst the broader market saw yet another day of micro chop, there was severe weakness in Ford Motors (F), which settled -8.2% @ $12.71. Q2 earnings were a clear miss, and Mr Market is now concerned about increasing problems for the remainder of the year.

F, daily

F, monthly

Summary

I'm one of the first who will whine about grossly over-valued stocks, but despite today's earnings, I simply can't remotely tout Ford as anything other than grossly under-valued.

Even with the earnings miss, Ford is generating around $2 EPS a year... that works out to roughly a PE of just 6.

6.

Just reflect on that for a moment.. and then consider the following (trailing) PEs...

AMZN: 309

FB: 76

NFLX: 286

Even AAPL is 12

--

From a pure price perspective, next support is around $12, 10, and then $8.

I do not expect any price action <$10.

Typically, after a major earnings miss, a stock will trundle lower for some days, and take a few weeks to cement an initial floor.

So... even if the sp'2250/2300s by October, Ford could still be lurking in the 13/12 zone.

--

Not on the fence

My argument is that (at the very least) Ford should be valued at least equal to the market average.

Ford is arguably trading around a third of what it should be. Yours truly would seek Ford to at least double.. if not triple the current valuation to the 25-35 zone.. which is a monstrous increase since the Nov'2008 low of $0.85. The yield is around 4.5%... around 3x the US 10yr bond!

As I often say lately, or perhaps you'd prefer a negative yield bond from Japan, or the EU?

F, daily

F, monthly

Summary

I'm one of the first who will whine about grossly over-valued stocks, but despite today's earnings, I simply can't remotely tout Ford as anything other than grossly under-valued.

Even with the earnings miss, Ford is generating around $2 EPS a year... that works out to roughly a PE of just 6.

6.

Just reflect on that for a moment.. and then consider the following (trailing) PEs...

AMZN: 309

FB: 76

NFLX: 286

Even AAPL is 12

--

|

| The mainstream cheerleaders are spooked |

From a pure price perspective, next support is around $12, 10, and then $8.

I do not expect any price action <$10.

Typically, after a major earnings miss, a stock will trundle lower for some days, and take a few weeks to cement an initial floor.

So... even if the sp'2250/2300s by October, Ford could still be lurking in the 13/12 zone.

--

Not on the fence

My argument is that (at the very least) Ford should be valued at least equal to the market average.

Ford is arguably trading around a third of what it should be. Yours truly would seek Ford to at least double.. if not triple the current valuation to the 25-35 zone.. which is a monstrous increase since the Nov'2008 low of $0.85. The yield is around 4.5%... around 3x the US 10yr bond!

As I often say lately, or perhaps you'd prefer a negative yield bond from Japan, or the EU?

Wednesday, 27 July 2016

AAPL - earnings better than feared

Q2 earnings for Apple (AAPL) were a little better than many had feared, and it has resulted in a rather powerful rebound, settling +6.5% @ $102.99, the best close since late April. Any price action >105 should confirm the 120s by late 2016/early 2017... with eventual new historic highs (>131).

AAPL, daily

AAPL, monthly

Summary

Just consider that AAPL saw Q2 EPS of $1.42, on rev' of $42.4bn

That is roughly $6 a year... and on a stock price of $100, that makes for a PE in the 16s.

Unquestionably, AAPL is a superior company relative to the main market, and thus 'should' be trading considerably above the average market valuation.

--

Technically, the break back above the $100 threshold today was very important... along with a close above the 200dma (102s).

Next resistance is declining trend, currently in the $105s.

With a new historic high >sp'2134, AAPL looks set to follow in 2017

AAPL, daily

AAPL, monthly

Summary

Just consider that AAPL saw Q2 EPS of $1.42, on rev' of $42.4bn

That is roughly $6 a year... and on a stock price of $100, that makes for a PE in the 16s.

Unquestionably, AAPL is a superior company relative to the main market, and thus 'should' be trading considerably above the average market valuation.

--

Technically, the break back above the $100 threshold today was very important... along with a close above the 200dma (102s).

Next resistance is declining trend, currently in the $105s.

With a new historic high >sp'2134, AAPL looks set to follow in 2017

Tuesday, 26 July 2016

FCX - significant daily reversal

Freeport McMoran (FCX) posted lousy earnings for Q2, even failing to meet the lowered targets set by the mainstream analysts. Naturally, FCX opened lower by around -6% (intra low $11.25), but then swung strongly higher, settling +2.4% at $12.68. The $14 threshold remains key.

FCX, daily

FCX, monthly

Summary

Suffice to add, lousy earnings, as the miners struggle with commodity prices remaining very low - relative to just a few years ago.

However, after a combination of short-covering and some 'bullish chasers', FCX managed a very notable net daily gain.

First upside target is a daily break/hold of the $14 threshold. If that is achieved, then the door will open to $20 by year end.

FCX, daily

FCX, monthly

Summary

Suffice to add, lousy earnings, as the miners struggle with commodity prices remaining very low - relative to just a few years ago.

However, after a combination of short-covering and some 'bullish chasers', FCX managed a very notable net daily gain.

First upside target is a daily break/hold of the $14 threshold. If that is achieved, then the door will open to $20 by year end.

Monday, 25 July 2016

AAPL - pre-earnings cooling

Apple (AAPL) - which has earnings at the Tuesday close, settled lower for a third consecutive day, -1.3% @ $97.33. The downgrade by BGC sure didn't help, and AAPL is at another critical junction. There is clear resistance at the giant psy' level of $100, and AAPL needs to jump straight over to negate the renewed bearish chatter.

AAPL, daily

AAPL, monthly

Summary

story, see: BGS downgrade

--

So, not a great start to the last week of July for the tech behemoth that is AAPL.

Overall market mood isn't great, as many recognise that the stock has largely failed to participate in the broad market rally since the Jan/Feb' low.

Best guess: A break back above the $100 threshold, and onward to quickly test the 200dma in the $103s.

It is notable that declining trend will be $105 in early August. The bigger monthly MACD cycle remains on the very low end and is offering vastly higher levels - to new historic highs in 2017.

--

**Earnings due Tuesday afternoon (probably at 4.30pm EST)

AAPL, daily

AAPL, monthly

Summary

story, see: BGS downgrade

--

So, not a great start to the last week of July for the tech behemoth that is AAPL.

Overall market mood isn't great, as many recognise that the stock has largely failed to participate in the broad market rally since the Jan/Feb' low.

Best guess: A break back above the $100 threshold, and onward to quickly test the 200dma in the $103s.

It is notable that declining trend will be $105 in early August. The bigger monthly MACD cycle remains on the very low end and is offering vastly higher levels - to new historic highs in 2017.

--

**Earnings due Tuesday afternoon (probably at 4.30pm EST)

Friday, 22 July 2016

TVIX, UVXY - a fourth week lower

With equities breaking new historic highs, the VIX continued to break new multi-year lows. The 2x lev' bullish VIX instruments of TVIX and UVXY saw net weekly declines of -10.5% and -8.8% respectively. Mid term outlook into Aug/Sept', is for further equity upside and a subdued VIX, which will merely equate to further decay for TVIX/UVXY.

TVIX, daily

UVXY, daily

Summary

First, an update on the VIX, which saw a net weekly decline of -5.1%.

--

As for TVIX/UVXY, a fourth week of (not surprising) declines, as equities broke new highs, and the VIX was unable to manage a daily close in the low teens.

If equities continue to broadly climb across August and into September - as seems highly probable, then TVIX/UVXY are going to broadly decay by another 20-30%

*for me, the VIX-long trade is dead until at least mid/late September.

TVIX, daily

UVXY, daily

Summary

First, an update on the VIX, which saw a net weekly decline of -5.1%.

--

As for TVIX/UVXY, a fourth week of (not surprising) declines, as equities broke new highs, and the VIX was unable to manage a daily close in the low teens.

If equities continue to broadly climb across August and into September - as seems highly probable, then TVIX/UVXY are going to broadly decay by another 20-30%

*for me, the VIX-long trade is dead until at least mid/late September.

Thursday, 21 July 2016

INTC - post earnings depression

Whilst the main market closed moderately lower, there was very significant weakness in Intel (INTC), which settled -4.2% @ $32.20. The low $33s look due, with key support of the 50/200dma in the 32/31s. Any price action <30 looks out of range, as the broader market looks strong.

INTC, daily

INTC, monthly

Summary

Earnings weren't exactly inspiring, but neither were they disastrous.

From a pure price perspective, INTC could easily fall another 3-5% across the next 2-4 days, but the $30 threshold looks very secure.

Long term upside to the $40s and 50s look due, not least if sp'2400/2500s by late spring 2017.

INTC, daily

INTC, monthly

Summary

Earnings weren't exactly inspiring, but neither were they disastrous.

From a pure price perspective, INTC could easily fall another 3-5% across the next 2-4 days, but the $30 threshold looks very secure.

Long term upside to the $40s and 50s look due, not least if sp'2400/2500s by late spring 2017.

Wednesday, 20 July 2016

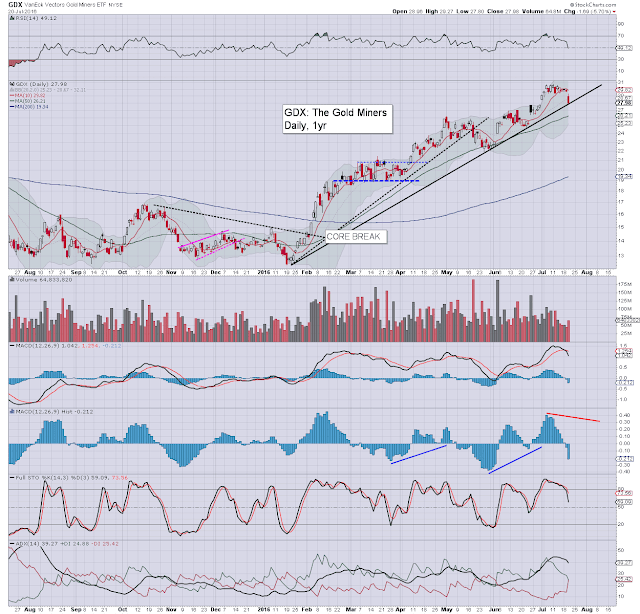

GDX - the miners are in big trouble

With precious metals under continued downward pressure from a rising dollar, the related mining stocks were naturally on the slide. The ETF of GDX settled lower by a very significant -5.7% @ $27.98. If rising trend is broken, there is open air to the 22/20 price cluster zone, where the 200dma will soon be lurking.

GDX, daily

GDX, monthly

Summary

The precious metals/miners have been trading broadly inverse to equities/capital market confidence, since the end of 2015.

If USD remains broadly strong, and if the metals continue to cool, then the miners are going to massively cool into the late summer.

GDX, daily

GDX, monthly

Summary

The precious metals/miners have been trading broadly inverse to equities/capital market confidence, since the end of 2015.

If USD remains broadly strong, and if the metals continue to cool, then the miners are going to massively cool into the late summer.

Tuesday, 19 July 2016

NFLX - great shows, crazy valuation

Whilst the main market closed moderately weak, there was very severe downside in Netflix (NFLX), which settled -13.2% @ $85.76. As Q2 earnings/outlook have upset the market, NFLX looks highly vulnerable to the $70 threshold within 2-3 months.

NFLX, daily

NFLX, monthly

Summary

NFLX is churning out some of the best scripted television shows ever made. Yet.... such original production is costly, and NFLX has become a seriously cash hungry company.

Recent increases in subscription prices are a good thing for the longer term, as viewers are going to need to fully pay for the costs of such original content, along with some degree of profit margin.

--

From a pure price perspective, NFLX looks headed for $70... where there is a lot of price cluster support.

It should be clear though, if profits/revenue miss again in Q3 or Q4, the stock will be vulnerable to next support in the $50/45 zone.

--

*no position, would consider long in the 72/68 zone, and most certainly around the $50 threshold.

NFLX, daily

NFLX, monthly

Summary

NFLX is churning out some of the best scripted television shows ever made. Yet.... such original production is costly, and NFLX has become a seriously cash hungry company.

Recent increases in subscription prices are a good thing for the longer term, as viewers are going to need to fully pay for the costs of such original content, along with some degree of profit margin.

--

From a pure price perspective, NFLX looks headed for $70... where there is a lot of price cluster support.

It should be clear though, if profits/revenue miss again in Q3 or Q4, the stock will be vulnerable to next support in the $50/45 zone.

--

*no position, would consider long in the 72/68 zone, and most certainly around the $50 threshold.

Monday, 18 July 2016

APC - battling broadly upward

Along with the main market, Anadarko Petroleum (APC) has been battling broadly higher since a low of $28.10 in January, settling Monday +0.2% @ $55.10. The breakout 'up and away' threshold remains $58. If broken/held above, next level is $75 which seems viable before year end.

APC, daily

APC, monthly

Summary

Suffice to add, APC, like most other energy stocks has seen a massive rebound since opening low this year. Many - including APC, have already doubled up.

However, APC is still less than half of the summer 2014 peak ($110.92).

**Next earnings are due at the close of Tuesday July 26th.

--

*yours truly is long APC, seeking broad upside, at least into mid September.

APC, daily

APC, monthly

Summary

Suffice to add, APC, like most other energy stocks has seen a massive rebound since opening low this year. Many - including APC, have already doubled up.

However, APC is still less than half of the summer 2014 peak ($110.92).

**Next earnings are due at the close of Tuesday July 26th.

--

*yours truly is long APC, seeking broad upside, at least into mid September.

Friday, 15 July 2016

TVIX, UVXY - a third week lower

With the sp'500 and Dow breaking new historic highs, the VIX remained broadly subdued. The 2x lev' bullish instruments of TVIX and UVXY saw a third week of declines, -8.4% and -8.6% respectively. VIX outlook into Aug/early September offers no realistic opportunity for sustained increased volatility.

TVIX, daily

UVXY, daily

Summary

First, an update on the VIX, which saw a net weekly decline of -4.0%.

--

As for TVIX/UVXY, with equities breaking new highs, it was no surprise to see further declines in the VIX instruments.

Considering the very significant equity break 'up and away', I see VIX-long as a broadly dead trade until at least mid/late September.

--

It is notable that UVXY is set for a 1 for 5 reverse split on July 25th.

TVIX, daily

UVXY, daily

Summary

First, an update on the VIX, which saw a net weekly decline of -4.0%.

--

As for TVIX/UVXY, with equities breaking new highs, it was no surprise to see further declines in the VIX instruments.

Considering the very significant equity break 'up and away', I see VIX-long as a broadly dead trade until at least mid/late September.

--

It is notable that UVXY is set for a 1 for 5 reverse split on July 25th.

Thursday, 14 July 2016

INTC - a sixth day higher

With the broader market closing moderately higher, there was similar continued strength in Intel (INTC), which settled +0.5% @ $35.20. With this week's break into the $35s, the door is open to challenge the Dec'2014 high of $36.14, after that... the $40 threshold.

INTC, daily

INTC, monthly

Summary

One of the most important hardware companies in the world, INTC is breaking up and away... along with the rest of the market.

The Dec' 2014 high in the low $36s is very viable this month, with $40 by mid September. From there, it would then require another 34% to test the Aug'2000 bubble high of $53.67.

Unquestionably, a superb company.

yours... processed via an intel i7 CPU.

INTC, daily

INTC, monthly

Summary

One of the most important hardware companies in the world, INTC is breaking up and away... along with the rest of the market.

The Dec' 2014 high in the low $36s is very viable this month, with $40 by mid September. From there, it would then require another 34% to test the Aug'2000 bubble high of $53.67.

Unquestionably, a superb company.

yours... processed via an intel i7 CPU.

Wednesday, 13 July 2016

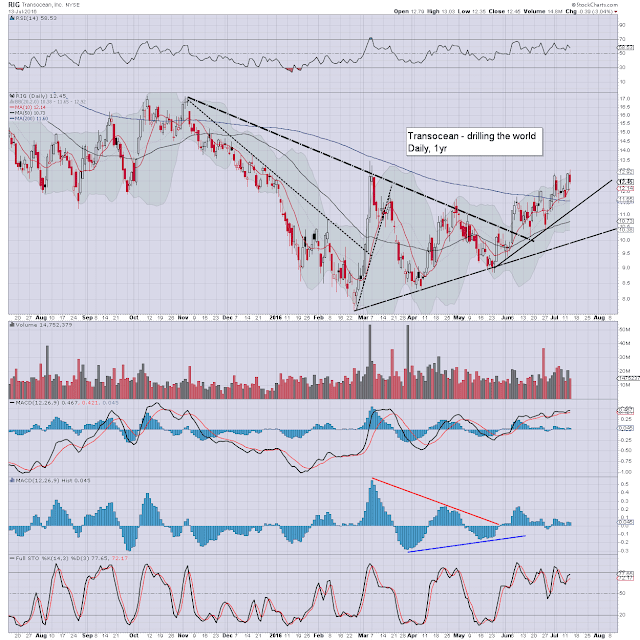

RIG, SDRL - drillers under pressure

With Oil negating much of the powerful Tuesday gains, the oil/gas drillers were under considerable downward pressure. Transocean (RIG), and Seadrill (SDRL) settled lower by -3.0% and -3.2% respectively. Near term outlook is weak, but mid term is now bullish.

RIG, daily

SDLR, daily

Summary

Suffice to add, not a great day for most energy stocks (as oil was lower by around -3.8%), but then, all have massively rallied since the BREXIT low, and more so.. the Jan/Feb' lows.

In terms of 'survival', RIG looks secure. However, SDRL still looks somewhat vulnerable, and remains lower by a monstrous -92% since the June 2014 high of $39.35.

The bigger monthly charts for some perspective...

RIG

SDRL

--

RIG looks an interesting long, once oil stabilises somewhere above $40.

RIG, daily

SDLR, daily

Summary

Suffice to add, not a great day for most energy stocks (as oil was lower by around -3.8%), but then, all have massively rallied since the BREXIT low, and more so.. the Jan/Feb' lows.

In terms of 'survival', RIG looks secure. However, SDRL still looks somewhat vulnerable, and remains lower by a monstrous -92% since the June 2014 high of $39.35.

The bigger monthly charts for some perspective...

RIG

SDRL

--

RIG looks an interesting long, once oil stabilises somewhere above $40.

Tuesday, 12 July 2016

FCX - pushing for the teens

Whilst the Dow/sp'500 continued to break new historic highs, there was far more notable strength in Freeport McMoran (FCX), which settled higher by a very powerful 10.8% @ $12.91, the best level since early May. Next upside target is $14, and then the psy' level of $20.

FCX, daily

FCX, monthly

Summary

Suffice to add, after being stuck since early May, FCX looks headed back into the teens... and eventually, to the psy' level of $20 - along with sp'2200s.

--

FCX is being removed from my 'disappear list', as if commodities have floored, and further QE money is being injected across the world, then the miners are going to continue to recover.

FCX, daily

FCX, monthly

Summary

Suffice to add, after being stuck since early May, FCX looks headed back into the teens... and eventually, to the psy' level of $20 - along with sp'2200s.

--

FCX is being removed from my 'disappear list', as if commodities have floored, and further QE money is being injected across the world, then the miners are going to continue to recover.

Monday, 11 July 2016

KMI - breaking up and away

With the sp'500 breaking a new historic high, there was also notable price action in Kinder Morgan (KMI), which settled +3.5% @ $19.19. Mid term target is $22, with $26 no later than spring 2017.

KMI, daily

KMI, monthly

Summary

Suffice to add... after being stuck for some months.. we have a bullish breakout.

See key stats @ http://finance.yahoo.com/quote/KMI/key-statistics

*Yahoo finance are reworking their pages, but still... its a good first place to look.

--

From a pure price momentum perspetive, at the current rate of incline, the monthly MACD (green bar histogram) cycle will turn positive in Sept/Oct... certainly before year end.

KMI, daily

KMI, monthly

Summary

Suffice to add... after being stuck for some months.. we have a bullish breakout.

See key stats @ http://finance.yahoo.com/quote/KMI/key-statistics

*Yahoo finance are reworking their pages, but still... its a good first place to look.

--

From a pure price momentum perspetive, at the current rate of incline, the monthly MACD (green bar histogram) cycle will turn positive in Sept/Oct... certainly before year end.

Friday, 8 July 2016

TVIX, UVXY - a second week of horror

With equities climbing for a second week, the VIX continued to cool, with the 2x lev' bullish instruments of TVIX and UVXY seeing net weekly declines of -23.8% and -22.4% respectively. Considering that the sp'500 looks set to break up and away, the VIX could remain broadly subdued for the mid term.

TVIX, daily

UVXY, daily

Summary

First, an update on the VIX, which saw a net weekly decline of -10.4%.

--

As for TVIX/UVXY, a second consecutive net weekly decline, as the VIX has cooled from a BREXIT spike high of the 26s to the 13s.. literally cut in half.

Clearly, the VIX is now on the very low side, yet if equities are in the early process of breaking 'up and away', then the VIX can remain broadly subdued for many weeks... and indeed, many months.

--

UVXY is set for a reverse split of 1 for 5 at the July 25th open.

As far as I can tell, TVIX is not scheduled for a RS, but one is clearly due... and it will likely be on the order of 1 for 10.

TVIX, daily

UVXY, daily

Summary

First, an update on the VIX, which saw a net weekly decline of -10.4%.

--

As for TVIX/UVXY, a second consecutive net weekly decline, as the VIX has cooled from a BREXIT spike high of the 26s to the 13s.. literally cut in half.

Clearly, the VIX is now on the very low side, yet if equities are in the early process of breaking 'up and away', then the VIX can remain broadly subdued for many weeks... and indeed, many months.

--

UVXY is set for a reverse split of 1 for 5 at the July 25th open.

As far as I can tell, TVIX is not scheduled for a RS, but one is clearly due... and it will likely be on the order of 1 for 10.

Thursday, 7 July 2016

GDX - relatively minor cooling

Whilst US equities closed moderately mixed, there was notable weakness in the gold/silver miners. The ETF of GDX settled -3.1% @ $29.62. Despite a sig' net daily decline, the mid term outlook remains powerfully bullish.

GDX, daily

Summary

Suffice to add, it was not surprising to see the gold/silver miners cool, as the precious metals were significantly lower in early trading, as US capital market confidence saw a morning spike.

Broadly, the precious metals look to set to resume powerfully higher. Gold in the $1450/1550 zone looks a realistic target within 1-3 months, and would likely equate to GDX $35/40.

GDX, daily

Summary

Suffice to add, it was not surprising to see the gold/silver miners cool, as the precious metals were significantly lower in early trading, as US capital market confidence saw a morning spike.

Broadly, the precious metals look to set to resume powerfully higher. Gold in the $1450/1550 zone looks a realistic target within 1-3 months, and would likely equate to GDX $35/40.

Wednesday, 6 July 2016

NFLX - headed broadly lower

Whilst the main market closed moderately mixed, there was notable weakness in Netflix (NFLX), which settled lower by -3.4% @ $94.59. Near term outlook offers weakness to the Feb' low of $79.95, with a broader bearish target of $70.

NFLX, daily

NFLX, monthly

Summary

Suffice to add, mainstream sentiment is increasingly frustrated with NFLX.

With the BREXIT, and related EU weakness, there is serious concern that the European market will mean rev/profits will be impacted into 2017.

--

From a pure price perspective, NFLX looks headed for $70. If the main market implodes to the sp'1600s or lower, than $50/45.

To be clear, NFLX is producing some of the finest TV shows ever made, but from a valuation perspective, its simply over-priced, with a forward PE pretty close to 100.

NFLX, daily

NFLX, monthly

Summary

Suffice to add, mainstream sentiment is increasingly frustrated with NFLX.

With the BREXIT, and related EU weakness, there is serious concern that the European market will mean rev/profits will be impacted into 2017.

--

From a pure price perspective, NFLX looks headed for $70. If the main market implodes to the sp'1600s or lower, than $50/45.

To be clear, NFLX is producing some of the finest TV shows ever made, but from a valuation perspective, its simply over-priced, with a forward PE pretty close to 100.

Tuesday, 5 July 2016

DB - the systemic risk to the world

Whilst the US market started the week on a moderately weak note, there was much more significant weakness in Deutsche Bank (DB), which settled lower by -3.6% @ $13.41, the lowest close... ever. DB remains a clear systemic threat to the EU... and the world.

DB, daily

DB, monthly, 20yr, linear scale

Summary

Watching 'Star Wars - the Force Awakens', the Starkiller base attack on (presumably Coruscant, and its surrounding moons), remains a profoundly disturbing scene.

The mainstream are themselves starting to awaken to the fact that DB is being priced by Mr Market as 'in serious trouble'.

Q. Will DB implode?

Mathematically.. its a given. Of course, it could be delayed (indefinately) if the ECB print trillions, and cover any/all losses.

NIRP is causing relentless problems, as DB themselves are vehemently screaming against. Ironically, financial historians will likely blame the ECB itself for the destruction of DB - and other large EU institutions.

DB as Lehman Brothers ?

Many are trying to extrapolate the DB price chart to Lehman. In theory.. it would suggest meltdown to zero, at some point between Aug-October.

Without getting lost in such bearish hysteria about the 'end of the financial world', DB is a huge problem. At some point DB will topple over.. whether that is months away... or a few more years... impossible to say.

--

*I've no position in DB, with ZERO intention to trade DB.

Something I am keeping in mind though, long BAC or even long C.... at the time of a DB implosion. Neither BAC or C look in trouble... and would be valid targets in a market crash.

-

As for 'everything else'.

We'll just have to see how the EU, and wider world capital markets react to a (seemingly probable) DB implosion. One thing is for sure, it'll be even more disturbing than watching 5 hyper-light energy beams obliterate a fictional planetary system.

|

| Systemic horror |

DB, daily

DB, monthly, 20yr, linear scale

Summary

Watching 'Star Wars - the Force Awakens', the Starkiller base attack on (presumably Coruscant, and its surrounding moons), remains a profoundly disturbing scene.

The mainstream are themselves starting to awaken to the fact that DB is being priced by Mr Market as 'in serious trouble'.

Q. Will DB implode?

Mathematically.. its a given. Of course, it could be delayed (indefinately) if the ECB print trillions, and cover any/all losses.

NIRP is causing relentless problems, as DB themselves are vehemently screaming against. Ironically, financial historians will likely blame the ECB itself for the destruction of DB - and other large EU institutions.

DB as Lehman Brothers ?

Many are trying to extrapolate the DB price chart to Lehman. In theory.. it would suggest meltdown to zero, at some point between Aug-October.

Without getting lost in such bearish hysteria about the 'end of the financial world', DB is a huge problem. At some point DB will topple over.. whether that is months away... or a few more years... impossible to say.

--

*I've no position in DB, with ZERO intention to trade DB.

Something I am keeping in mind though, long BAC or even long C.... at the time of a DB implosion. Neither BAC or C look in trouble... and would be valid targets in a market crash.

-

As for 'everything else'.

We'll just have to see how the EU, and wider world capital markets react to a (seemingly probable) DB implosion. One thing is for sure, it'll be even more disturbing than watching 5 hyper-light energy beams obliterate a fictional planetary system.

Friday, 1 July 2016

TVIX, UVXY - a weekly swing of horror

Despite equities starting the week significantly lower, the VIX failed from the start, and was indeed an early warning of a turn. With the VIX collapsing from the 26s to the 14s, the 2x lev' bullish instruments of TVIX and UVXY, saw severe net weekly declines of -38.1% and -41.0% respectively.

TVIX, daily

UVXY, daily

Summary

First, an update on the VIX, which saw a net weekly decline of -42.7%.

--

As for TVIX/UVXY, what a nightmare!

It was notable as early as pre-market on Monday, that with the VIX -1%, there was 'an issue'.

With a massive equity ramp from sp'1991 to 2108, the VIX has imploded, almost cut in half.

Naturally, we've already seen both instruments break new multi-week... and indeed, new historic lows.

--

As ever, such instruments are for short term trading only. It remains notable that as volatility itself increases, the problem of 'statistical decay' itself increases.

--

*yours truly remains long the VIX from the 17s, seeking an exit in the 19/20 zone, by next Friday.

TVIX, daily

UVXY, daily

Summary

First, an update on the VIX, which saw a net weekly decline of -42.7%.

--

As for TVIX/UVXY, what a nightmare!

It was notable as early as pre-market on Monday, that with the VIX -1%, there was 'an issue'.

With a massive equity ramp from sp'1991 to 2108, the VIX has imploded, almost cut in half.

Naturally, we've already seen both instruments break new multi-week... and indeed, new historic lows.

--

As ever, such instruments are for short term trading only. It remains notable that as volatility itself increases, the problem of 'statistical decay' itself increases.

--

*yours truly remains long the VIX from the 17s, seeking an exit in the 19/20 zone, by next Friday.

Subscribe to:

Posts (Atom)