Despite posting better than expected earnings, Seagate (STX) closed -1.7% @ $52.58 (intraday low $51.38), although had initially jumped higher to $55.23. Price structure remains a multi-week bull flag, with primary upside to the 56/57 zone.

STX, daily

STX, weekly

Summary

*I remain long STX, from the $53.50s. Right now, I don't expect an exit until later next week.

--

Relative to the main market, STX remains under valued, with a forward PE of just 9/10.

see key stats @ yahoo finance

There is little reason why this won't eventually hit the big $100 threshold in late 2015/early 2016.

Wednesday, 30 April 2014

Tuesday, 29 April 2014

DO, RIG, SDRL - drilling upward

With the main market continuing to climb up and away from the Monday low, the Oil/Gas drillers saw some notable gains. Diamond Offshore (DO), Transocean (RIG), and Seadrill (SDRL) closed higher by 0.5%, 0.4%, and 1.5% respectively. Near term outlook is very bullish.

DO, weekly

RIG, weekly

SDRL, weekly

Summary

*rather than focus on the daily charts, I wanted to highlight an even broader perspective.

--

The drillers have had a tough time since late 2013. We've seen five months or so of pretty strong declines, but that down trend was decisively broken last week.

This week began weak, but then the broader market was a little shaky. Even during the Monday afternoon sell down in the market, the underlying strength was there to be seen in stocks like DO and SDRL.

Outlook is bullish for rest of this week.

First upside targets...

DO - 56

RIG - 45

SDRL - 37

Those seem reasonable within the next 3-8 trading days. However, if the main market does see a major rollover this summer, the recent lows will eventually be taken out.

--

*I am long all three of the above stocks, but will be seeking an exit into the Friday close - not least since the positions are via option call blocks, and I prefer to have no positions across a weekend.

DO, weekly

RIG, weekly

SDRL, weekly

Summary

*rather than focus on the daily charts, I wanted to highlight an even broader perspective.

--

The drillers have had a tough time since late 2013. We've seen five months or so of pretty strong declines, but that down trend was decisively broken last week.

This week began weak, but then the broader market was a little shaky. Even during the Monday afternoon sell down in the market, the underlying strength was there to be seen in stocks like DO and SDRL.

Outlook is bullish for rest of this week.

First upside targets...

DO - 56

RIG - 45

SDRL - 37

Those seem reasonable within the next 3-8 trading days. However, if the main market does see a major rollover this summer, the recent lows will eventually be taken out.

--

*I am long all three of the above stocks, but will be seeking an exit into the Friday close - not least since the positions are via option call blocks, and I prefer to have no positions across a weekend.

Monday, 28 April 2014

OPEN - open air to the low $50s

With the broader market seeing some weakness, - especially in the momo stocks, OpenTable (OPEN) saw further very significant declines, settling -3.3% @ $64.24. Near term outlook offers opportunity of a bounce/back test to the $70 threshold, before $50 later this summer.

OPEN, daily

OPEN, weekly

Summary

*I have little interest in trading this one, but it is one I keep an eye on.

--

Suffice to say...if the broader market can rally into May, then OPEN has a fair chance of a bounce to the $68/70 zone, before a renewed wave lower.

Of course, that will largely be dependent on earnings, but..price action is suggestive OPEN is headed lower this summer.

Earnings are due this Thursday, after the close.

OPEN, daily

OPEN, weekly

Summary

*I have little interest in trading this one, but it is one I keep an eye on.

--

Suffice to say...if the broader market can rally into May, then OPEN has a fair chance of a bounce to the $68/70 zone, before a renewed wave lower.

Of course, that will largely be dependent on earnings, but..price action is suggestive OPEN is headed lower this summer.

Earnings are due this Thursday, after the close.

Friday, 25 April 2014

FB, NFLX, TWTR - momo stocks having more trouble

Whilst the broader market saw general declines into the weekend, there was particular weakness in the momo stocks. Facebook (FB), Netflix (NFLX), and Twitter (TWTR) saw very significant daily declines of -5.2%, -6.4%, and -7.2% respectively. Outlook is somewhat 'shaky'.

FB,daily

NFLX, daily

TWTR, daily

Summary

*as ever, I do NOT trade the momo stocks. I have no tolerance for any of the hysteria that surrounds them, never mind the insanely high PEs. However, they sure are entertaining to watch.

-

FB must hold the rising 200 day MA in the 51/52s, otherwise the giant gap zone will be a valid target this summer.

NFLX looks very weak, and is so far unable to claw back above the 200 dma.

TWTR is in danger of breaking the post IPO low of $38.80 from last November. If that is taken out, the door is wide open to the IPO issue price of $26.

-

Momo stocks and the broader market

In recent weeks the momo stocks have been periodically whacked lower, often on the order of 3, 5, or even 7%. Yet, the broader market has so far managed to largely cope with this 'sell the growth, buy value' rotation.

Barring a break under the recent low of sp'1814, I still see this as just another selective washout, before renewed broader market upside.

FB,daily

NFLX, daily

TWTR, daily

Summary

*as ever, I do NOT trade the momo stocks. I have no tolerance for any of the hysteria that surrounds them, never mind the insanely high PEs. However, they sure are entertaining to watch.

-

FB must hold the rising 200 day MA in the 51/52s, otherwise the giant gap zone will be a valid target this summer.

NFLX looks very weak, and is so far unable to claw back above the 200 dma.

TWTR is in danger of breaking the post IPO low of $38.80 from last November. If that is taken out, the door is wide open to the IPO issue price of $26.

-

Momo stocks and the broader market

In recent weeks the momo stocks have been periodically whacked lower, often on the order of 3, 5, or even 7%. Yet, the broader market has so far managed to largely cope with this 'sell the growth, buy value' rotation.

Barring a break under the recent low of sp'1814, I still see this as just another selective washout, before renewed broader market upside.

Thursday, 24 April 2014

CHK - multi month bull flag... confirmed

Chesapeake Energy (CHK) continued to climb today, settling higher by 0.7% @ $29.22. Recent price action over the last 6-7 months is a clear multi-month bull flag, and that has now been confirmed with the recent two weeks of price action. Primary upside target are the $34s

CHK, weekly, 4yr

Summary

*I went long CHK in the closing hour of today, from the 29.20s. Seeking a provisional exit in the 30/31 zone early next week, but will look to hold 'broadly' long until 33/34 in May.

-

Oil and Gas remains a favourite sector of mine. A 'real industry', producing an essential resource for the world economy.

Forward PE for CHK is only in the low teens, and relative to the broader market, there is little reason why CHK should not be trading in the 40/50s.

see key stats @ yahoo finance

-

Long term outlook is unquestionably sound, and this will probably be a $100 stock within 2 yrs. I'm looking for some kind of commodity mini bubble before the next economic up cycle completes..probably in late 2015/ early 2016.

CHK, weekly, 4yr

Summary

*I went long CHK in the closing hour of today, from the 29.20s. Seeking a provisional exit in the 30/31 zone early next week, but will look to hold 'broadly' long until 33/34 in May.

-

Oil and Gas remains a favourite sector of mine. A 'real industry', producing an essential resource for the world economy.

Forward PE for CHK is only in the low teens, and relative to the broader market, there is little reason why CHK should not be trading in the 40/50s.

see key stats @ yahoo finance

-

Long term outlook is unquestionably sound, and this will probably be a $100 stock within 2 yrs. I'm looking for some kind of commodity mini bubble before the next economic up cycle completes..probably in late 2015/ early 2016.

Wednesday, 23 April 2014

FCX, RIG - weekly cycles suggestive of upside

Whilst the main market churned largely sideways, there was some notable strength in Freeport McMoran (FCX) and Transocean (RIG), which settled higher by 0.6% and 0.9% respectively. Weekly cycles are suggestive of further upside into early May.

FCX weekly

RIG, weekly

Summary

*I was again not particularly in the mood to meddle in the indexes today, but two stocks that I regularly follow were again showing some strength.

As of early Wednesday, I am LONG FCX and LONG RIG,

-

First, dealing with FCX. It remains one of my favourite miners, however, they are also now involved in the Oil/Gas sector, which kinda adds some spice to their activities. Any daily close in the $34s will open a swift move to 36/37. FCX has earnings due early Thursday, April'24

As for RIG, it has had a difficult time since Icahn picked up a position in Oct/Nov. The mid 50s now look a very long way up, and RIG is going to find it tough just to re-test the big $50 threshold.

Best case upside, the upper weekly bollinger (still declining), and by early May, that will be in the 47/46 zone. RIG, next earnings are due May'4.

FCX weekly

RIG, weekly

Summary

*I was again not particularly in the mood to meddle in the indexes today, but two stocks that I regularly follow were again showing some strength.

As of early Wednesday, I am LONG FCX and LONG RIG,

-

First, dealing with FCX. It remains one of my favourite miners, however, they are also now involved in the Oil/Gas sector, which kinda adds some spice to their activities. Any daily close in the $34s will open a swift move to 36/37. FCX has earnings due early Thursday, April'24

As for RIG, it has had a difficult time since Icahn picked up a position in Oct/Nov. The mid 50s now look a very long way up, and RIG is going to find it tough just to re-test the big $50 threshold.

Best case upside, the upper weekly bollinger (still declining), and by early May, that will be in the 47/46 zone. RIG, next earnings are due May'4.

Tuesday, 22 April 2014

NFLX - jumping on reasonable earnings

With Q1 earnings coming in 'reasonable', Netflix (NFLX) jumped in Monday AH, and held most of those gains across Tuesday, settling +7.1% @ $373 (intraday peak $380). Near term outlook is bullish, although a break above the early March high looks extremely unlikely until early 2015.

NFLX, daily

Summary

*the daily candle, a black one, is somewhat bearish - not least since it is at natural resistance. Yet, considering the broader market, I'd see a daily close in the 380/390s within a matter of days.

--

NFLX is becoming something of a second tier consumer utility in the USA, and by that I mean, as something that is almost considered a basic necessity by many US/western consumers.

I see a media that has got overly fixated on what was the announcement of a minor price rise. Frankly, I think NFLX could almost double subscription prices across the next 2-3 years, and 80% of its customer base would stay.

-

*as ever, I have ZERO interest in trading any of the hysteria/momo stocks, of which NFLX is one of the top 5.

NFLX, daily

Summary

*the daily candle, a black one, is somewhat bearish - not least since it is at natural resistance. Yet, considering the broader market, I'd see a daily close in the 380/390s within a matter of days.

--

NFLX is becoming something of a second tier consumer utility in the USA, and by that I mean, as something that is almost considered a basic necessity by many US/western consumers.

I see a media that has got overly fixated on what was the announcement of a minor price rise. Frankly, I think NFLX could almost double subscription prices across the next 2-3 years, and 80% of its customer base would stay.

-

*as ever, I have ZERO interest in trading any of the hysteria/momo stocks, of which NFLX is one of the top 5.

Monday, 21 April 2014

GDX - miners on the slide

With weak precious metal prices - and a merger unravelling (Barrick/Newmont), the miners started the week on a weak note. The miner ETF of GDX, started the week with declines of -0.25% @ $23.51. Near term outlook is bearish.

GDX, daily

Summary

The near term outlook is indeed weak, and the only issue is when..not if, the 2013 low is going to be taken out.

GDX, daily

Summary

The near term outlook is indeed weak, and the only issue is when..not if, the 2013 low is going to be taken out.

Thursday, 17 April 2014

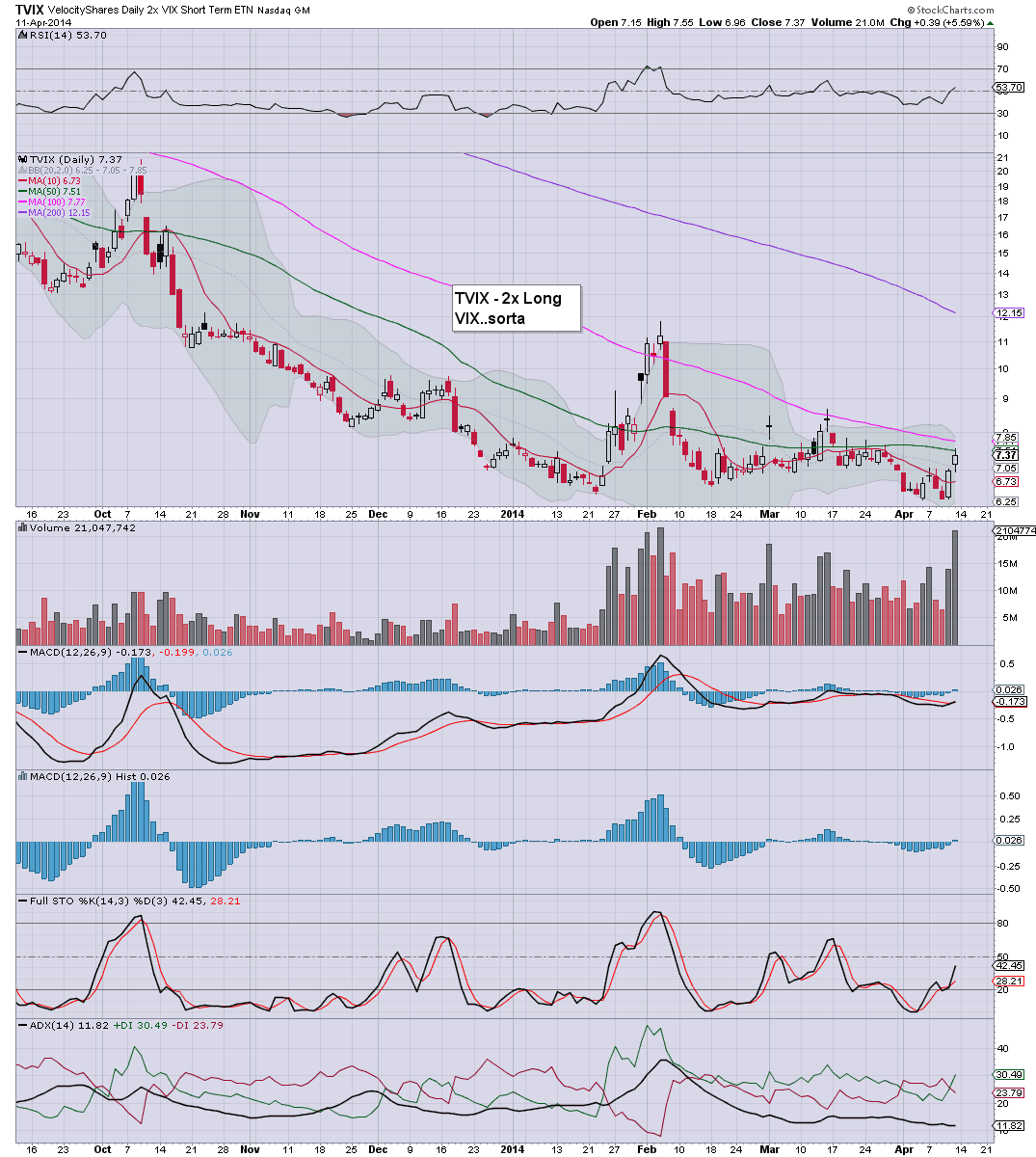

TVIX, UVXY - a failed week for the volatility bulls

The week started promising for the volatility bulls, with VIX breaking into the upper 17s. Yet, the week ended with a crushed VIX in the 13s. The 2x lev' bullish VIX instruments of TVIX and UVXY, naturally saw significant net weekly declines of -11.5% and -12.6% respectively.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which declined -21.5% across the week

--

As for the 2x bullish VIX instruments, it was a deeply disappointing end to the week. The notion of sp' under the key 1800 threshold, not looks unlikely until June, if not July/August.

At some point the VIX is going to break the big 20 threshold..and remain above - at least for a few weeks. When that point comes, the equity market is going to get smashed 15/20%.

When will it be? I still have a large hope that will be sometime this summer.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which declined -21.5% across the week

--

As for the 2x bullish VIX instruments, it was a deeply disappointing end to the week. The notion of sp' under the key 1800 threshold, not looks unlikely until June, if not July/August.

At some point the VIX is going to break the big 20 threshold..and remain above - at least for a few weeks. When that point comes, the equity market is going to get smashed 15/20%.

When will it be? I still have a large hope that will be sometime this summer.

Wednesday, 16 April 2014

AAPL - holding the 200 dma

Despite the broader market seeing some significant gains, Apple (AAPL) is still struggling, but..importantly, holding above the 200 day MA. AAPL settled the day +0.2% @ $519. Near term outlook is moderately bullish, to the 530/550 zone.

AAPL, daily

Summary

Suffice to say, we have one of the tech giants holding the 200 day MA, and with the broader market now seemingly on a new multi-week up cycle, AAPL will likely be part of it.

First upside target is the 50 day MA of $530, and a secondary target of the $550 threshold.

-

Earnings for Q1 will be interesting to see, they are due next Wednesday, April'23.

AAPL, daily

Summary

Suffice to say, we have one of the tech giants holding the 200 day MA, and with the broader market now seemingly on a new multi-week up cycle, AAPL will likely be part of it.

First upside target is the 50 day MA of $530, and a secondary target of the $550 threshold.

-

Earnings for Q1 will be interesting to see, they are due next Wednesday, April'23.

Tuesday, 15 April 2014

GDX - miners whacked, as metals fall

With Gold and Silver prices snapping sharply lower, the mining stocks saw very significant declines. The ETF of GDX settled -2.0% @ $24.02. The big 20 threshold is in danger of bring taken out this summer, not least if the metals break the 2013 lows.

GDX, daily

GDX, monthly

Summary

*like the precious metals themselves, GDX closed with a daily reversal candle. However, today's decline is unlikely to be a sporadic down day.

--

With Copper under $3, Gold -$23, and Silver -1.7%, the miners opened sharply lower, and remained weak across the day.

With metals appearing to be merely at day'1 of a new down cycle, there is very high risk of a few weeks of weakness, with GDX at serious risk of losing the 20s in late April/May.

GDX, daily

GDX, monthly

Summary

*like the precious metals themselves, GDX closed with a daily reversal candle. However, today's decline is unlikely to be a sporadic down day.

--

With Copper under $3, Gold -$23, and Silver -1.7%, the miners opened sharply lower, and remained weak across the day.

With metals appearing to be merely at day'1 of a new down cycle, there is very high risk of a few weeks of weakness, with GDX at serious risk of losing the 20s in late April/May.

Monday, 14 April 2014

KING - candy still getting crushed

Despite another vain attempt at a bounce in the broader market, King Digital Entertainment (KING) - makers of the infamous 'Candy Crush' game, saw another lousy day, closing -3.2% @ $16.96. Near term outlook remains very weak, and as many recognise..there isn't any floor to stop the declines.

KING, daily

Summary

Suffice to say, I do keep an eye on the IPO stocks, and this recent offering remains in a spiral. Certainly, it is not imploding that quickly, yet the price action has been very weak since the open, a mere 14 trading days ago.

Considering the market closed with gains, today's daily decline of another 3% is just outright dire.

Sub $10 looks likely this summer.

-

...now..back to the game.

KING, daily

Summary

Suffice to say, I do keep an eye on the IPO stocks, and this recent offering remains in a spiral. Certainly, it is not imploding that quickly, yet the price action has been very weak since the open, a mere 14 trading days ago.

Considering the market closed with gains, today's daily decline of another 3% is just outright dire.

Sub $10 looks likely this summer.

-

...now..back to the game.

Friday, 11 April 2014

TVIX, UVXY - volatility continues to rise

With equities seeing some major weakness this week, the VIX continued to rise, with net weekly gains of 22%. The 2x lev' (bullish) instruments of TVIX and UVXY saw net weekly gains of 10.2% and 13.7% respectively. If VIX can break into the low 20s next week, further gains of 15/20% seem likely.

TVIX, daily

UVXY, daily

Summary

First, an update on the VIX, weekly

--

Suffice to say, the 2x VIX instruments are set for further gains next week. Yet..as ever, even if we drop to the sp'1770s, VIX might stay in the low 20s for a just a matter of hours.

There is a 'small' possibility of a much deeper (sp'<1760) equity decline next week, but regardless, I expect the current down wave to conclude no later than next Wed/Thursday.

TVIX, daily

UVXY, daily

Summary

First, an update on the VIX, weekly

--

Suffice to say, the 2x VIX instruments are set for further gains next week. Yet..as ever, even if we drop to the sp'1770s, VIX might stay in the low 20s for a just a matter of hours.

There is a 'small' possibility of a much deeper (sp'<1760) equity decline next week, but regardless, I expect the current down wave to conclude no later than next Wed/Thursday.

Thursday, 10 April 2014

TVIX - volatility breaks higher

With the VIX closing +15% @ 15.89, the 2x lev' (bullish) VIX instrument of TVIX, saw some powerful gains, settling +9.3%. Near term outlook offers VIX in the high teens, which should equate to a further 15/20% for TVIX.

TVIX, daily

Summary

*first an update on the daily VIX....

Even though VIX did not close in the 16s, it did manage an intraday break above what used to be key resistance. There looks to be reasonable upside to 17/18s Fri/Monday. Whether the 20s will be hit...that remains difficult to say.

--

*as ever..such leveraged instruments suffer from severe statistical decay, and are for very short term holds only.

TVIX, daily

Summary

*first an update on the daily VIX....

Even though VIX did not close in the 16s, it did manage an intraday break above what used to be key resistance. There looks to be reasonable upside to 17/18s Fri/Monday. Whether the 20s will be hit...that remains difficult to say.

--

*as ever..such leveraged instruments suffer from severe statistical decay, and are for very short term holds only.

Wednesday, 9 April 2014

FB - bouncing with the broader market

With US equities continuing to bounce from the sp'1837 low, Facebook (FB) built significant daily gains, settling higher by 7.2% @ $62.41. Near term outlook is arguably unstable, and the momo stocks remain very vulnerable to another wave lower.

FB, daily

Summary

Suffice to say, today was probably just day'2 of a natural bounce. A lot of momo-shorts surely got burnt today, surprised by the latest 'fedspeak' nonsense.

First key resistance is the 50 day MA in the $65s. Right now, I find it hard to believe FB - along with any of the other momo stocks, will not see another wave lower in the near term.

FB, daily

Summary

Suffice to say, today was probably just day'2 of a natural bounce. A lot of momo-shorts surely got burnt today, surprised by the latest 'fedspeak' nonsense.

First key resistance is the 50 day MA in the $65s. Right now, I find it hard to believe FB - along with any of the other momo stocks, will not see another wave lower in the near term.

Tuesday, 8 April 2014

BTU - coal miners bounce

With the US equity market seeing some moderate gains build across the day, the coal miners were a particularly strong sector, with BTU settling +2.2% @ $17.73. Near term outlook is bullish for Wednesday, but the mid/long term trend remains dire.

BTU, daily

Summary

A significant bounce, and break of trend, but with broader downside still expected into the early summer.

--

The demise of JRCC

JRCC filed for chap'11 bankruptcy yesterday...

JRCC, monthly

A farewell to JRCC...along with even more distant demise of Patriot Coal (PCX).

I just wonder whether any of the remaining miners will also go under before the next big commodity price bubble.

BTU, daily

Summary

A significant bounce, and break of trend, but with broader downside still expected into the early summer.

--

The demise of JRCC

JRCC filed for chap'11 bankruptcy yesterday...

JRCC, monthly

A farewell to JRCC...along with even more distant demise of Patriot Coal (PCX).

I just wonder whether any of the remaining miners will also go under before the next big commodity price bubble.

Monday, 7 April 2014

DRYS - set to lose the 200 day MA

With the main market weak, and the BDI falling, the shippers are continuing to suffer, with Dry Ships (DRYS) falling another significant -2.1% @ $3.19. A failure to hold the 200 day MA of $3.06 seems likely, and that will open up the low $2s this summer.

DRYS, daily

DRYS, weekly

Summary

*first, an update on the BDI, which slipped -1.6% today...

BDI, weekly

--

The brief foray into the $5s now seems a very long way up. Indeed, DRYS is lower by around -40% since late December.

If the main market does indeed roll over this spring/summer, down to the low sp'1600s, DRYS looks set for the low $2s, which is a further 30% to the downside.

-

I would be looking to pick up DRYS in the summer..somewhere in the $1.75/2.25 zone..and hold into late 2015.

DRYS, daily

DRYS, weekly

Summary

*first, an update on the BDI, which slipped -1.6% today...

BDI, weekly

--

The brief foray into the $5s now seems a very long way up. Indeed, DRYS is lower by around -40% since late December.

If the main market does indeed roll over this spring/summer, down to the low sp'1600s, DRYS looks set for the low $2s, which is a further 30% to the downside.

-

I would be looking to pick up DRYS in the summer..somewhere in the $1.75/2.25 zone..and hold into late 2015.

Friday, 4 April 2014

AMZN, NFLX, TSLA - momo stocks trashed.. yet again

With the equity market failing to hold the opening gains, the market turned sharply lower, and the momo stocks saw yet another smack down. Amazon (AMZN), Netflix (NFLX), and Tesla (TSLA) closed significantly lower by -3.2%, -4.9%, and -5.9% respectively.

AMZN, daily

NFLX, daily

TSLA, daily

Summary

*I could add many other momo charts - such as FB & TWTR , but the above 3 are a fair spread that highlight the ongoing train wreck that used to be the 'momentum' sector.

-

We are seeing some VERY significant breaks, all are below the 50 day MA, but we're now seeing the 200 day MA violated - namely, AMZN.

--

If the main market breaks <1850 next week, momo chasing bulls will have a major problem. As it is, I don't think we'll see a major correction in the broader market until late April/early May.

AMZN, daily

NFLX, daily

TSLA, daily

Summary

*I could add many other momo charts - such as FB & TWTR , but the above 3 are a fair spread that highlight the ongoing train wreck that used to be the 'momentum' sector.

-

We are seeing some VERY significant breaks, all are below the 50 day MA, but we're now seeing the 200 day MA violated - namely, AMZN.

--

If the main market breaks <1850 next week, momo chasing bulls will have a major problem. As it is, I don't think we'll see a major correction in the broader market until late April/early May.

Thursday, 3 April 2014

FB, TWTR - momo stocks broken again

Whilst the main market broke marginal new highs, before retracing lower, there was some real carnage amongst the momo stocks. Facebook (FB) and Twitter (TWTR), closed a very significant -5.3% and -3.8% respectively. Near term outlook looks weak.

FB, daily

TWTR, daily

Summary

*yes, I'm highlighting the TWTR yet again, but then, it sure is an entertaining one to watch.

--

FB closed the day on what is pretty important rising support. A weekly close <$59 would be pretty bearish, and portend for a test of the 200 day MA...approaching the big $50 threshold.

TWTR remains especially weak, below the old $50 floor, and seemingly headed for $40/38 in the near term.

Indeed, it remains pretty interesting to see many of the momo stocks get trashed, despite the broader market making new historic highs.

An early warning of trouble for the broader market this late spring/early summer?

FB, daily

TWTR, daily

Summary

*yes, I'm highlighting the TWTR yet again, but then, it sure is an entertaining one to watch.

--

FB closed the day on what is pretty important rising support. A weekly close <$59 would be pretty bearish, and portend for a test of the 200 day MA...approaching the big $50 threshold.

TWTR remains especially weak, below the old $50 floor, and seemingly headed for $40/38 in the near term.

Indeed, it remains pretty interesting to see many of the momo stocks get trashed, despite the broader market making new historic highs.

An early warning of trouble for the broader market this late spring/early summer?

Wednesday, 2 April 2014

TWTR - the hysteria continues to slide

Whilst the main market broke new historic highs, the hysteria surrounded stock that is Twitter (TWTR) continued to weaken, settling -2.7% @ $45.70. The failure to hold the big $50 threshold remains a key bearish sign, with likely further downside to the $40/38 zone.

TWTR, daily

Summary

The hysteria of the Tweet company is indeed still on the slide. Considering we saw a late Dec' high of $74.73, the current price in the $45s is a decline of 40% across just over 3 months.

The only issue now is when TWTR will test the key low of $38.80 - Nov'25, 2013. A break under that would open up the IPO price of $26.

Frankly, considering the sickening media love affair with such 'new media' stocks, I find the whole situation very amusing.

Now... go tweet that!

TWTR, daily

Summary

The hysteria of the Tweet company is indeed still on the slide. Considering we saw a late Dec' high of $74.73, the current price in the $45s is a decline of 40% across just over 3 months.

The only issue now is when TWTR will test the key low of $38.80 - Nov'25, 2013. A break under that would open up the IPO price of $26.

Frankly, considering the sickening media love affair with such 'new media' stocks, I find the whole situation very amusing.

Now... go tweet that!

Tuesday, 1 April 2014

GDX - precious metal miners remain weak

Whilst the broader equity market continued to claw higher, there remains notable weakness in the Gold/Silver miners. The ETF of GDX closed +0.15% @ $23.64. Near term outlook remains bearish, not least with declining Gold/Silver commodity prices.

GDX, daily

GDX, monthly

Summary

The March candle for GDX was an especially bearish monthly reversal.

First downside target are the low $22s, but a break under the December 2013 low of $20.18 looks very viable this spring/summer.

Certainly, with Gold/Silver prices on the slide, the mining stocks are going to suffer - regardless of how well the broader market might be doing.

GDX, daily

GDX, monthly

Summary

The March candle for GDX was an especially bearish monthly reversal.

First downside target are the low $22s, but a break under the December 2013 low of $20.18 looks very viable this spring/summer.

Certainly, with Gold/Silver prices on the slide, the mining stocks are going to suffer - regardless of how well the broader market might be doing.

Subscribe to:

Comments (Atom)