Whilst the main equity market started the week very subdued, there was noticeable strength in the Oil/Gas drilling stocks. Transocean (RIG) and Seadrill (SDRL) settled higher by 1.1% and 1.3% respectively. Near term outlook is bullish into mid July.

RIG, daily

SDRL, daily

Summary

Suffice to say, the lows from April are now a very long way down, and there looks to be a further 5-10% upside in the relatively near term.

-

Both RIG and SDRL have sound balance sheets, with superb long term outlooks. Regardless of any weakness/upset in the main market this late summer/autumn, I'd be looking to pick up both on any pull back in Sept/October.

Monday, 30 June 2014

Friday, 27 June 2014

TVIX, UVXY - the decay continues

With the VIX still unable to even claw into the low teens, the 2x lev' bullish VIX instruments of TVIX and UVXY continue to decay. TVIX and UVXY saw net weekly declines of -3.8% and -5.0% respectively. Near term outlook is for further decay into mid July... when we might finally see a VIX floor in the 9s.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which saw net weekly gains of 3.6%

--

Suffice to say, market volatility remains very low. The leveraged instruments are simply seeing the usual problem of statistical decay.

My best guess... the VIX floors in the low 10s.. possibly 9s, in mid July, which might.....just might be reflective of a larger peak in the equity market.

In the next VIX up wave (post mid July)... first upside target will be the 15/18 zone. The 20s look unlikely in the initial move.

It will be absolutely critical for equity bears to break to the VIX 22s in Aug/Sept, if there is to be any hope of a major equity correction this year.

-

As things are, I have no interest in being long the VIX until at least mid July.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which saw net weekly gains of 3.6%

--

Suffice to say, market volatility remains very low. The leveraged instruments are simply seeing the usual problem of statistical decay.

My best guess... the VIX floors in the low 10s.. possibly 9s, in mid July, which might.....just might be reflective of a larger peak in the equity market.

In the next VIX up wave (post mid July)... first upside target will be the 15/18 zone. The 20s look unlikely in the initial move.

It will be absolutely critical for equity bears to break to the VIX 22s in Aug/Sept, if there is to be any hope of a major equity correction this year.

-

As things are, I have no interest in being long the VIX until at least mid July.

Thursday, 26 June 2014

TWTR - headed for the big $50

Whilst the main market saw some moderate swings across the day, there was noticeable strength in Twitter (TWTR), which gained an impressive 5.0%, settling @ $41.44. There looks to be high probability of a continued climb all the way to test the big $50 threshold by mid July.

TWTR, daily

Summary

Suffice to say, with the break above $40, and the main market remaining relatively strong, there is now a very likely further 20% higher to the big $50 level in July.

If TWTR earnings at least meet expectations, TWTR looks set to annihilate anyone trying to short this momo stock.

*next earnings are due approx' July 21-25.

TWTR, daily

Summary

Suffice to say, with the break above $40, and the main market remaining relatively strong, there is now a very likely further 20% higher to the big $50 level in July.

If TWTR earnings at least meet expectations, TWTR looks set to annihilate anyone trying to short this momo stock.

*next earnings are due approx' July 21-25.

Wednesday, 25 June 2014

FB - strong gains for a key momo stock

Whilst the main market saw moderate gains, there was noticeable strength in many of the momo stocks. Facebook (FB) gained a very significant 2.8%, settling @ $67.43. Near term outlook is broadly bullish, with new historic highs viable by mid July.

FB, daily

Summary

So.. a strong day for FB, and indeed, new historic highs in the $73s look viable within the relatively near term.

*I remain seeking a broader main market intermediate top this summer, and if that is the case, then FB is probably no more than a month away from completing what has been a grand multi-month ramp from Jul 2013 - when FB was in the mid 20s.

Possible 'doomer downside'.. if sp in the low 1600s?

Primary would be $45/40

Secondary.. the low 30s, where there is an absolutely giant price gap... but that of course is a huge 50% lower.

-

I don't trade the momo stocks, but as ever, they are somewhat entertaining to keep an eye, and they can be pre-cursor warnings of main market weakness - as was the case in early March.

FB, daily

Summary

So.. a strong day for FB, and indeed, new historic highs in the $73s look viable within the relatively near term.

*I remain seeking a broader main market intermediate top this summer, and if that is the case, then FB is probably no more than a month away from completing what has been a grand multi-month ramp from Jul 2013 - when FB was in the mid 20s.

Possible 'doomer downside'.. if sp in the low 1600s?

Primary would be $45/40

Secondary.. the low 30s, where there is an absolutely giant price gap... but that of course is a huge 50% lower.

-

I don't trade the momo stocks, but as ever, they are somewhat entertaining to keep an eye, and they can be pre-cursor warnings of main market weakness - as was the case in early March.

Tuesday, 24 June 2014

GDX - big bearish reversal

With the main equity market seeing a late afternoon reversal, the mining stocks were especially hard hit. The miner ETF of GDX swung from $26.53 to settle lower by -3.3% @ $25.41. There is viable downside to the $25.00/24.75 zone, before the broader up trend resumes.

GDX,daily

Summary

A rather classic bearish engulfing reversal candle on the daily charts.

Certainly, it bodes for at least a little more lower tomorrow/Thursday.

However, the recent trend/break is indeed far more important, and it looks like GDX will be making a challenge for the big $30 by mid July.

GDX,daily

Summary

A rather classic bearish engulfing reversal candle on the daily charts.

Certainly, it bodes for at least a little more lower tomorrow/Thursday.

However, the recent trend/break is indeed far more important, and it looks like GDX will be making a challenge for the big $30 by mid July.

Monday, 23 June 2014

RIG - drilling upward

Whilst the main market saw a day of churn, there was notable strength in the drillers. Transocean (RIG), settled higher by 1.4% @ $45.99. Near term outlook is bullish, with relatively easy upside to the $48/50 zone by mid July.

RIG, daily

RIG, weekly

Summary

Suffice to say, I remain a big fan of Transocean (RIG). The balance sheet is sound, and Mr Market is starting to appreciate the stock somewhat since the post earnings intraday smack down of 7%.

RIG looks good for the long term, and it would not surprise me to see RIG trade close to $100 by late 2015/early 2016.

-

*I have no position, but would look to pick up on any summer/autumnal weakness.

RIG, daily

RIG, weekly

Summary

Suffice to say, I remain a big fan of Transocean (RIG). The balance sheet is sound, and Mr Market is starting to appreciate the stock somewhat since the post earnings intraday smack down of 7%.

RIG looks good for the long term, and it would not surprise me to see RIG trade close to $100 by late 2015/early 2016.

-

*I have no position, but would look to pick up on any summer/autumnal weakness.

Friday, 20 June 2014

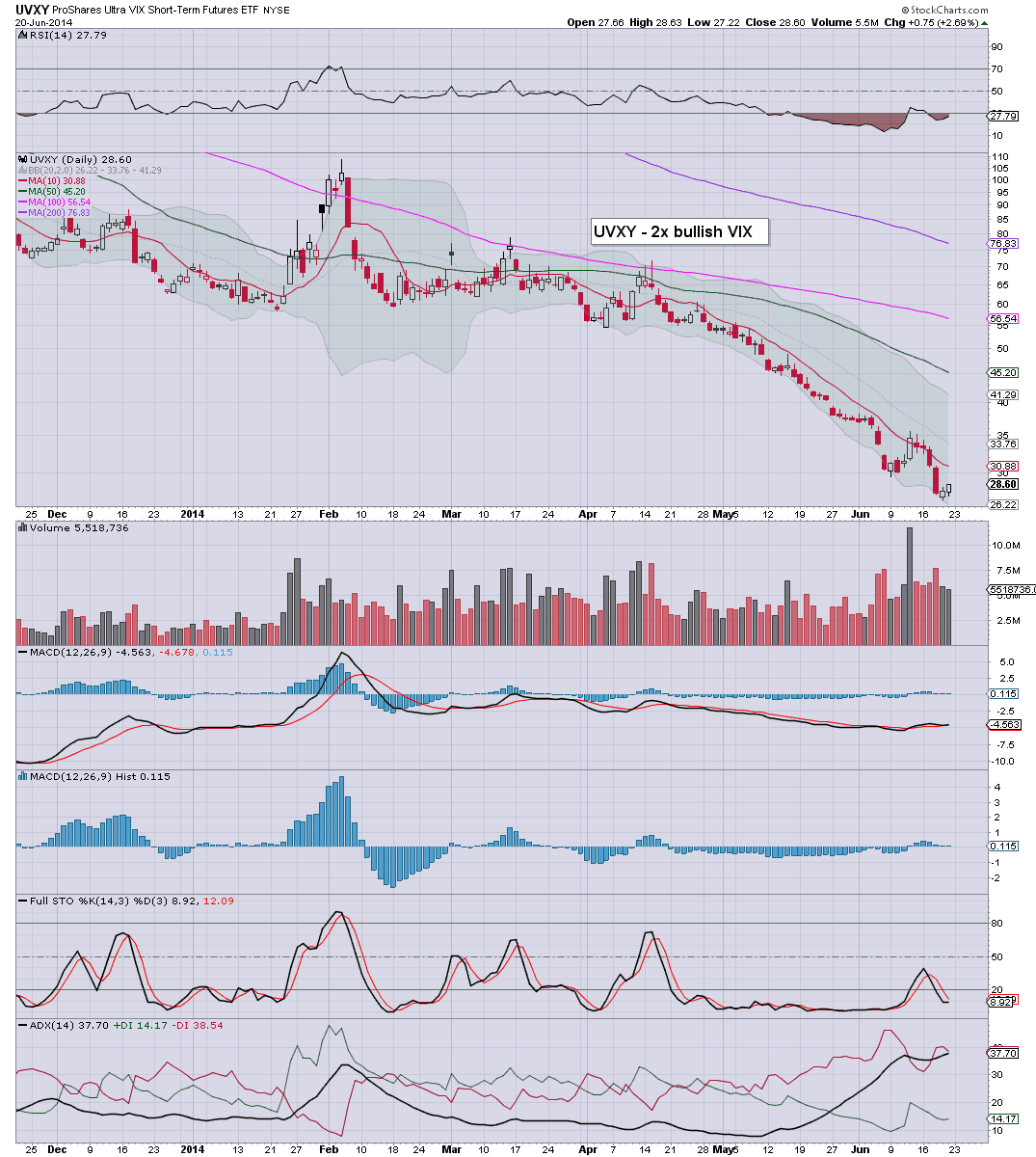

TVIX, UVXY - volatility instruments continue to decay

With the VIX slipping into the 10s, the 2x bullish VIX instruments of TVIX and UVXY had another rough week, with net weekly declines of -13.8% and -14.1% respectively. Near term outlook is for the VIX to remain subdued into mid July.

TVIX, daily

UVXY, daily

Summary

*first an update on the VIX, which declined a significant -10.9% across the week.

--

As for TVIX and UVXY, the usual problem remains one of decay. Whilst the VIX is unable to build even a moderate multi-week up trend, both TVIX/UVXY are simply decaying.

*a reverse split on TVIX seems likely within the near term, probably on the order of 1 for 15.. or even 20.

-

My longer term outlook, is for the VIX to have a 'fair chance' for the upper teens/low 20s by end July, but that is probably more of a hope right now.

As things are, I have no interest in being long the VIX - via an option Call block, until at least July'16.

TVIX, daily

UVXY, daily

Summary

*first an update on the VIX, which declined a significant -10.9% across the week.

--

As for TVIX and UVXY, the usual problem remains one of decay. Whilst the VIX is unable to build even a moderate multi-week up trend, both TVIX/UVXY are simply decaying.

*a reverse split on TVIX seems likely within the near term, probably on the order of 1 for 15.. or even 20.

-

My longer term outlook, is for the VIX to have a 'fair chance' for the upper teens/low 20s by end July, but that is probably more of a hope right now.

As things are, I have no interest in being long the VIX - via an option Call block, until at least July'16.

Thursday, 19 June 2014

GDX - accelerating to the upside

With Gold and Silver prices breaking powerfully higher, the miners are similarly on a strong climb. The miner ETF of GDX settled higher by a very significant 5.2% @ $26.06. The March high of $28.03 looks set to be challenged.. and broken.

GDX, daily

Summary

I've been very bearish on the metals and miners for a very considerable time, but we do indeed now have a rather significant move to the upside.

With the clear technical break higher in Gold and Silver, the miners look set for further gains in the near term.

I would expect the March high for GDX in the low $28s to be surpassed...with the big $30 being hit in July.

GDX, daily

Summary

I've been very bearish on the metals and miners for a very considerable time, but we do indeed now have a rather significant move to the upside.

With the clear technical break higher in Gold and Silver, the miners look set for further gains in the near term.

I would expect the March high for GDX in the low $28s to be surpassed...with the big $30 being hit in July.

Wednesday, 18 June 2014

WFM - big bull flag, set for higher levels

Whilst the main market saw churn for the first half of the day, Whole Foods Market (WFM) continued to slip, hitting a low of $41.26. There was a significant latter day recovery, with WFM settling +0.2% @ $41.82. Price structure is offering a large bull flag, with viable upside to the 48/50 zone by mid July.

WFM, 60min

WFM, daily

Summary

*I remain LONG WFM from the $41.60s...(I should have bailed recently in the 42.80s), but instead, I'm seeking my first exit in the 43/44 zone..which seems viable in the next 2-4 days.

On any exit, I would still look to re-long WFM on any subsequent intraday down cycle, and hold until 47/48. The low $50s will be... difficult.

--

Suffice to say, considering the broader market looks set to continue battling broadly higher into mid July, I see a very high chance of the high 40s within the next few weeks.

What will be extremely difficult is for WFM to retake the big 200 day MA... still in the low $50s. I do not expect that this summer..indeed...perhaps the rest of the year.

WFM, 60min

WFM, daily

Summary

*I remain LONG WFM from the $41.60s...(I should have bailed recently in the 42.80s), but instead, I'm seeking my first exit in the 43/44 zone..which seems viable in the next 2-4 days.

On any exit, I would still look to re-long WFM on any subsequent intraday down cycle, and hold until 47/48. The low $50s will be... difficult.

--

Suffice to say, considering the broader market looks set to continue battling broadly higher into mid July, I see a very high chance of the high 40s within the next few weeks.

What will be extremely difficult is for WFM to retake the big 200 day MA... still in the low $50s. I do not expect that this summer..indeed...perhaps the rest of the year.

Tuesday, 17 June 2014

SCTY - a ray of light for SolarCity

Whilst the broader market saw somewhat choppy moderate gains, there was real hyper strong action in the solar stocks. SolarCity (SCTY) gained an extreme 17.7%, settling in the $64s. There is near term easy upside to the 68/70 zone.

SCTY, daily

Summary

*I don't generally follow or chart, the solar stocks, hence the blank chart above!

--

Suffice to say.. I was made aware of this one today when it was around 10% higher. I did consider chasing it higher in the morning, but I was already content with my current long positions.

-

As for SolarCity itself...

see key stats @ yahoo finance

The obvious issue remains that the company is not currently profitable, and doesn't pay a dividend - the latter of which is something I generally want to see in a company I am considering getting involved in.

I'm pretty positive on the company in the longer term, but this is very much a momo stock that will be equally susceptible to renewed weakness later this year - not least if the broader market also rolls over.

From a pure price perspective... near term is offering a chance of the $70 threshold, but I would be surprised if we break the February high of $88, any time this summer.

SCTY, daily

Summary

*I don't generally follow or chart, the solar stocks, hence the blank chart above!

--

Suffice to say.. I was made aware of this one today when it was around 10% higher. I did consider chasing it higher in the morning, but I was already content with my current long positions.

-

As for SolarCity itself...

see key stats @ yahoo finance

The obvious issue remains that the company is not currently profitable, and doesn't pay a dividend - the latter of which is something I generally want to see in a company I am considering getting involved in.

I'm pretty positive on the company in the longer term, but this is very much a momo stock that will be equally susceptible to renewed weakness later this year - not least if the broader market also rolls over.

From a pure price perspective... near term is offering a chance of the $70 threshold, but I would be surprised if we break the February high of $88, any time this summer.

Monday, 16 June 2014

ANR, BTU - coal miners remain exceptionally weak

Whilst the broader market saw minor chop across the day, there was once again another bout of significant weakness in the coal sector. Alpha Natural Resources (ANR) and Peabody Energy (BTU) settled lower by -2.8% and -1.6% respectively.

ANR, daily

BTU, daily

Summary

Suffice to say, the broader down trend continues, and the coal sector stocks remain some of the hardest hit since commodities saw a secondary peak in early 2011.

-

I've little doubt BTU will be fine for the long term, but I have serious concerns about ANR, even though it is a relatively large company.

Worse still, ACI and WLT, both of those look set to implode within the next year or two.

ANR, daily

BTU, daily

Summary

Suffice to say, the broader down trend continues, and the coal sector stocks remain some of the hardest hit since commodities saw a secondary peak in early 2011.

-

I've little doubt BTU will be fine for the long term, but I have serious concerns about ANR, even though it is a relatively large company.

Worse still, ACI and WLT, both of those look set to implode within the next year or two.

Friday, 13 June 2014

GDX - strong weekly gains

Whilst the main equity market saw minor weakness, the mining stocks (along with the precious metals themselves) built gains across the week. The ETF of GDX closed Friday with further important gains of 0.3%, settling @ $24.11

GDX, daily

GDX, monthly

Summary

Clearly, the near term trend is to the upside - as especially reflected in Gold and Silver commodity prices.

However, I'm still highly suspicious that the metals have not yet put in a key multi-year floor. If you assume that metal prices are still set for lower levels, then you have to also look for lower levels in the miners.

Regardless of the broader market, if metal prices see a further multi-month wave lower - breaking the 2013 lows, then the mining stocks have not yet put in a key floor.

-

*for now, I have no positions in any mining stocks. I'd consider LONG Silver (via SLV).. perhaps...but I'd like to see another net weekly gain for Silver (and Gold)...after next weeks FOMC.

GDX, daily

GDX, monthly

Summary

Clearly, the near term trend is to the upside - as especially reflected in Gold and Silver commodity prices.

However, I'm still highly suspicious that the metals have not yet put in a key multi-year floor. If you assume that metal prices are still set for lower levels, then you have to also look for lower levels in the miners.

Regardless of the broader market, if metal prices see a further multi-month wave lower - breaking the 2013 lows, then the mining stocks have not yet put in a key floor.

-

*for now, I have no positions in any mining stocks. I'd consider LONG Silver (via SLV).. perhaps...but I'd like to see another net weekly gain for Silver (and Gold)...after next weeks FOMC.

Thursday, 12 June 2014

SDRL - drillers continue to climb

Seadrill (SDRL) fought hard against the weaker market, and achieved strong gains of 2.8% @ $38.80. With higher oil prices and some mainstream media attention, the oil/gas driller stocks are on a renewed push higher.

SDRL, daily

Summary

Suffice to say, with oil prices on the rise, the oil/gas stocks are managing to go against the main market, and pushed strongly higher today.

I would be similarly bullish for DO and RIG.

--

*I have no position, but will certainly keep an eye on it across the summer.

SDRL, daily

Summary

Suffice to say, with oil prices on the rise, the oil/gas stocks are managing to go against the main market, and pushed strongly higher today.

I would be similarly bullish for DO and RIG.

--

*I have no position, but will certainly keep an eye on it across the summer.

Wednesday, 11 June 2014

CHK - broadly headed higher

Whilst the main market saw moderate weakness across the day, there was noticeable strength in Chesapeake Energy (CHK), which settled higher by 2.75% @ $30.02. Near term outlook is bullish, probably into early/mid July.

CHK, daily

CHK, weekly

Summary

Little to add.

The broader trend remains to the upside, and the $34s look a viable target by mid July. From there....if the main market rolls over...then so will CHK.

CHK, daily

CHK, weekly

Summary

Little to add.

The broader trend remains to the upside, and the $34s look a viable target by mid July. From there....if the main market rolls over...then so will CHK.

Monday, 9 June 2014

WFM - a rally to gap fill ?

Whilst the main market has clawed strongly higher in the past few weeks, Whole Foods Market (WFM) has been trundling within a narrow range. Last Thursday, that concluded with a clear break, there looks to be reasonable upside to the gap zone of $48/50, which is a powerful 20% higher.

WFM, 60min

WFM, daily

Summary

*I have an interest in going LONG the stock, but would prefer an entry in zone'1 early Tuesday. Considering today's price action, the low $40s look...doubtful.

--

Recent price action, seen on the bigger daily shows WFM stabilising after the market was upset by earnings. There is a very obvious gap zone, along with the big $50 psy' level to hit, on any bounce in the near term.

-

WFM's margins are a little thin, but then, it is the retail sector, where margins are typical 5-10%..at best.

see key stats @ yahoo Finance

-

*Next earnings: late July, market will no doubt be seeking some improvement in Q2, but more importantly, the outlook for the rest of the 2014.

WFM, 60min

WFM, daily

Summary

*I have an interest in going LONG the stock, but would prefer an entry in zone'1 early Tuesday. Considering today's price action, the low $40s look...doubtful.

--

Recent price action, seen on the bigger daily shows WFM stabilising after the market was upset by earnings. There is a very obvious gap zone, along with the big $50 psy' level to hit, on any bounce in the near term.

-

WFM's margins are a little thin, but then, it is the retail sector, where margins are typical 5-10%..at best.

see key stats @ yahoo Finance

-

*Next earnings: late July, market will no doubt be seeking some improvement in Q2, but more importantly, the outlook for the rest of the 2014.

Friday, 6 June 2014

TVIX, UVXY - VIX instruments crushed

With equity indexes breaking new historic highs, the VIX broke new multi-year lows, slipping into the 10s. The 2x lev' bullish instruments of TVIX & UVXY, saw net weekly declines of -19.2% and -18.5% respectively. Near term outlook is for continued suppression of the VIX.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which declined by -5.9% across the week.

--

So, almost another 20% knocked off the 2x (bullish) VIX instruments this week. For anyone holding long across the week, it was effectively a nightmare.

Worse still, there seems little near term hope of VIX in the mid teens..never mind above the key 20 threshold.

The usual 'statistical decay' factor will further cause TVIX/UVXY to get crushed into dust.

--

*as many will recognise..the next reverse split (probably 1 for 10, or even 1 for 15) for TVIX is likely within the next month or two.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which declined by -5.9% across the week.

--

So, almost another 20% knocked off the 2x (bullish) VIX instruments this week. For anyone holding long across the week, it was effectively a nightmare.

Worse still, there seems little near term hope of VIX in the mid teens..never mind above the key 20 threshold.

The usual 'statistical decay' factor will further cause TVIX/UVXY to get crushed into dust.

--

*as many will recognise..the next reverse split (probably 1 for 10, or even 1 for 15) for TVIX is likely within the next month or two.

Thursday, 5 June 2014

AMZN - momo stock on the climb

With the main market pushing higher on the ECB announcement ,there was particular strength in some of the momo stocks, including Amazon (AMZN) which soared, closing +5.5% @ $323. With the break above the 50 day MA, AMZN is on a charge to test the 200 day MA in the $340s.

AMZN, daily

Summary

*important to note, the gains were on sig' volume, and it certainly bodes for higher levels in the near term.

--

Suffice to say, AMZN is pulling away from the recent lows, and the big issue now is whether it is merely going to back test the broken 200 day MA...or..will power right through it..pushing higher across the summer.

For the equity bears seeking a broader multi-month correction in the main market, it would be 'useful' if AMZN gets stuck at the overhead 200 day MA.

AMZN, daily

Summary

*important to note, the gains were on sig' volume, and it certainly bodes for higher levels in the near term.

--

Suffice to say, AMZN is pulling away from the recent lows, and the big issue now is whether it is merely going to back test the broken 200 day MA...or..will power right through it..pushing higher across the summer.

For the equity bears seeking a broader multi-month correction in the main market, it would be 'useful' if AMZN gets stuck at the overhead 200 day MA.

Wednesday, 4 June 2014

DO - diamonds... scratched

With Statoll cancelling a contract, Diamond Offshore (DO) was knocked significantly lower, settling -3.7% @ $47.74 - the biggest fall since early April. Near term outlook is shaky, especially with today's daily close under the 50 day MA. Next support is the 46/45 zone.

DO, daily

DO, weekly

Summary

For the statoil story..see Barrons

--

So.. Diamond has lost a contract, but still, today's decline is probably overplaying the loss of one contract. Indeed, other notable drillers - SDRL and RIG, held up relatively fine. The industry as a whole is doing reasonably okay.

-

From a pure price perspective, DO looks set for further downside to 46/45. What will be critical is the March low of $42.97. If that fails..whether this month..or later in the summer, it will be a very bearish sign for both DO..and the other drilling stocks.

A break of the $40 threshold would bode for $30/25 later this year, at which point I'd be looking to pick up DO, RIG, and SDRL.

DO, daily

DO, weekly

Summary

For the statoil story..see Barrons

--

So.. Diamond has lost a contract, but still, today's decline is probably overplaying the loss of one contract. Indeed, other notable drillers - SDRL and RIG, held up relatively fine. The industry as a whole is doing reasonably okay.

-

From a pure price perspective, DO looks set for further downside to 46/45. What will be critical is the March low of $42.97. If that fails..whether this month..or later in the summer, it will be a very bearish sign for both DO..and the other drilling stocks.

A break of the $40 threshold would bode for $30/25 later this year, at which point I'd be looking to pick up DO, RIG, and SDRL.

Tuesday, 3 June 2014

ACI, WLT - coal miners facing implosion

With relentless anti-coal policy from the US Govt. the US coal industry continues to face increasing pressure. Two of the smallest listed miners - Arch Coal (ACI), and Walter Energy (WLT), settled -6.4% and -4.4% respectively. Outlook is bearish..if not a case of which one closes down first.

*I don't chart either of these stocks, but I'll post a standard daily chart of them anyway...

ACI

WLT

Summary

First...see stats for both...

Arch Coal, @ yahoo finance

Walter Energy @ yahoo finance

-

Most obvious, both are loss making, and both have a significant debt mountain, many times their current market cap. It would seem Mr Market is starting to assume neither of these companies are going to be around in the long term.

Outlook...dire

Frankly, it does not look good for either ACI or WLT. I'd guess neither will be a listed company for much more than another year or two.

Just as PCX (Patriot Coal) and JRCC (James River) imploded, it'd seem we will see a few more of the listed coal stocks file for bankruptcy within the next year or so.

-

I still think Alpha Natural Resources (ANR) has a fair chance of surviving across the longer term, but...perhaps even they will disappear, but more likely to be merged with BTU (Peabody Energy) or CNX (Consol).

Much of this train wreck of a sector is due to the anti-coal stance of the US Govt. It would indeed seem we remain in an era where the Govt' chooses the winners...and the losers.

*I don't chart either of these stocks, but I'll post a standard daily chart of them anyway...

ACI

WLT

Summary

First...see stats for both...

Arch Coal, @ yahoo finance

Walter Energy @ yahoo finance

-

Most obvious, both are loss making, and both have a significant debt mountain, many times their current market cap. It would seem Mr Market is starting to assume neither of these companies are going to be around in the long term.

Outlook...dire

Frankly, it does not look good for either ACI or WLT. I'd guess neither will be a listed company for much more than another year or two.

Just as PCX (Patriot Coal) and JRCC (James River) imploded, it'd seem we will see a few more of the listed coal stocks file for bankruptcy within the next year or so.

-

I still think Alpha Natural Resources (ANR) has a fair chance of surviving across the longer term, but...perhaps even they will disappear, but more likely to be merged with BTU (Peabody Energy) or CNX (Consol).

Much of this train wreck of a sector is due to the anti-coal stance of the US Govt. It would indeed seem we remain in an era where the Govt' chooses the winners...and the losers.

Monday, 2 June 2014

GDX - yet another bad day for the miners

Whilst there were new historic highs in a number of equity indexes, there was once again notable weakness in the miners. The ETF of GDX settled -1.0% @ $22.27. The 2013 lows look set to be broken (as is likely the case for Gold/Silver prices), GDX looks set for the teens.

GDX, daily

Summary

There is nothing bullish for spot gold/silver prices..and that is indeed going to have an overwhelming bearish effect on the mining stocks.

-

GDX looks set to take out the $20 threshold....the only issue is does it eventually floor in the mid teens...or melts even lower across 2015/early 2016...going sub-teens.

Eventually, the surviving miners are going to be one hell of a buy....but right now, I'm very content to wait.

GDX, daily

Summary

There is nothing bullish for spot gold/silver prices..and that is indeed going to have an overwhelming bearish effect on the mining stocks.

-

GDX looks set to take out the $20 threshold....the only issue is does it eventually floor in the mid teens...or melts even lower across 2015/early 2016...going sub-teens.

Eventually, the surviving miners are going to be one hell of a buy....but right now, I'm very content to wait.

Subscribe to:

Comments (Atom)