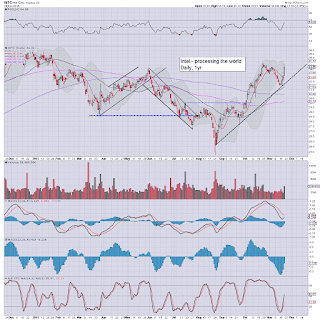

Whilst the broader market ended the month moderately weak, there was notable strength in Intel (INTC), which closed +1.0% @ $34.79. November saw the third consecutive net monthly gain of +3.5%. Next upside target are the $37s.

INTC, daily

INTC, monthly

Summary

Suffice to say, a third month higher, and INTC remains one of the leading Dow/Tech stocks out there.

It lead the way down from mid May... and it lead the way up from the Aug' low.

--

The $37s look viable by mid/late January. The big $40 threshold does not look viable until March/April.

Monday, 30 November 2015

Friday, 27 November 2015

TVIX, UVXY - naturally decaying

It was another negative week for the 2x lev' bullish VIX instruments of TVIX and UVXY, with net weekly declines of -5.0% and -6.2% respectively. The VIX is set to remain broadly subdued into end year - as some equity indexes look on track to break new historic highs.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which saw a net weekly decline of -2.3%

--

As for TVIX/UVXY... there is the usual issue of statistical decay, as equities saw a fair bit of price chop.

--

*I have ZERO interest in being long the VIX until late spring 2016... at the earliest.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which saw a net weekly decline of -2.3%

--

As for TVIX/UVXY... there is the usual issue of statistical decay, as equities saw a fair bit of price chop.

--

*I have ZERO interest in being long the VIX until late spring 2016... at the earliest.

Wednesday, 25 November 2015

DAL, UAL - airlines struggling

Whilst the broader market saw a day of nano chop, there was once again weakness in airline stocks. Delta (DAL) and United (UAL), both settled lower by -0.8% and -1.0% respectively. Near term outlook offers weakness to the 200dma, before renewed upside into early 2016.

DAL, daily

UAL, daily

Summary

Suffice to add, airlines are really struggling, relative to what are consistently low energy/fuel prices.

If Oil does break >$50 threshold in 2016... it will be interesting to see how the airline stocks are impacted.

-

*I've no position... with no intention to get involved, but I do think airlines/transports merit keeping an eye on.

DAL, daily

UAL, daily

Summary

Suffice to add, airlines are really struggling, relative to what are consistently low energy/fuel prices.

If Oil does break >$50 threshold in 2016... it will be interesting to see how the airline stocks are impacted.

-

*I've no position... with no intention to get involved, but I do think airlines/transports merit keeping an eye on.

Tuesday, 24 November 2015

APC, RIG, SDRL - exploration stocks floored?

Whilst the broader market opened sharply lower there was notable strength in energy stocks (as Oil jumped). Anadarko Petroleum (APC), Transocean (RIG), and SeaDrill (SDRL), settled higher by 2.7%, 4.4%, and 2.6% respectively. The bigger monthly charts are offering a possible multi-year floor.

APC, monthly

RIG, monthly

SDRL, monthly

Summary

*no time to list the daily charts as well.. and besides, the monthly charts are what I consider more important right now.

--

Suffice to add... look at the monthly MACD (green bar histogram) cycles... all of which are ticking upward... from the giant collapse wave that began in summer 2014.

-

Key initial targets...

APC: $78

RIG: 19/21

SDRL: 9/10

--

If those can be achieved by spring 2016... it does offer further upside across the rest of 2016.... even if Oil doesn't move much above $50.

-

*I am long RIG, the $17s look a reasonable target into January 2016... more broadly, 19/21 next spring... so long as Oil does not lose the $40 threshold.

APC, monthly

RIG, monthly

SDRL, monthly

Summary

*no time to list the daily charts as well.. and besides, the monthly charts are what I consider more important right now.

--

Suffice to add... look at the monthly MACD (green bar histogram) cycles... all of which are ticking upward... from the giant collapse wave that began in summer 2014.

-

Key initial targets...

APC: $78

RIG: 19/21

SDRL: 9/10

--

If those can be achieved by spring 2016... it does offer further upside across the rest of 2016.... even if Oil doesn't move much above $50.

-

*I am long RIG, the $17s look a reasonable target into January 2016... more broadly, 19/21 next spring... so long as Oil does not lose the $40 threshold.

Monday, 23 November 2015

CREE - lights back on?

Whilst the broader equity market saw a day of chop/moderate weakness, there was notable strength in Cree (CREE), which settled +2.3% @ $26.26 (intra high 26.56). Cree looks headed for the 200dma in the $29/30 zone. The monthly candle is offering a key multi-year floor, with first target upside to $39/40 by late spring 2016.

CREE, daily

CREE, monthly

Summary

*it is highly notable that at the current rate of incline, the monthly MACD (green bar histogram) cycle will see a bullish cross in 2-3 months.. certainly by the start of March.

--

The world of electrical lighting has changed massively across the last few decades.

Incandescents are largely now gone, and even fluorescent tech is being entirely replaced by LEDs. LED technology itself continues to evolve, and despite some problems (LEDs not lasting as long as initially expected), further progress is inevitable.

-

CREE currently lacks a PE due to recent losses. Next earnings in January will be important to show the company is prepared for the longer term.. in what is a pretty competitive industry.

--

*I am long CREE (short term hold), seeking an initial exit in the 29/30 zone. If I exit within a few weeks, I will look to pick up a longer term strategic position on any pull back, and look to hold until April/May of next year.

CREE, daily

CREE, monthly

Summary

*it is highly notable that at the current rate of incline, the monthly MACD (green bar histogram) cycle will see a bullish cross in 2-3 months.. certainly by the start of March.

--

The world of electrical lighting has changed massively across the last few decades.

Incandescents are largely now gone, and even fluorescent tech is being entirely replaced by LEDs. LED technology itself continues to evolve, and despite some problems (LEDs not lasting as long as initially expected), further progress is inevitable.

-

CREE currently lacks a PE due to recent losses. Next earnings in January will be important to show the company is prepared for the longer term.. in what is a pretty competitive industry.

--

*I am long CREE (short term hold), seeking an initial exit in the 29/30 zone. If I exit within a few weeks, I will look to pick up a longer term strategic position on any pull back, and look to hold until April/May of next year.

Friday, 20 November 2015

TVIX, UVXY - significant net weekly declines

With the US equity market flooring at the Monday open, and pushing higher across the week, the VIX cooled from 20.55 to the 15.47. The 2x lev' bullish VIX instruments of TVIX and UVXY saw net weekly declines of -22.6% and -22.7% respectively. Broad decay into year end is due.. with new historic lows.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which saw a net weekly decline of -23.0%

--

As for TVIX/UVXY, last week's gains have been almost entirely negated.

New historic lows look due before year end... and that even allows for another brief foray to VIX 20 in December.

As with almost all leveraged instruments, holding across multiple weeks usually ends very badly.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which saw a net weekly decline of -23.0%

--

As for TVIX/UVXY, last week's gains have been almost entirely negated.

New historic lows look due before year end... and that even allows for another brief foray to VIX 20 in December.

As with almost all leveraged instruments, holding across multiple weeks usually ends very badly.

Thursday, 19 November 2015

INTC - powering upward

Whilst the US market churned sideways, there was notable strength in Intel (INTC), which settled +3.5% @ $34.31, the highest level since Oct'23rd. Next key resistance is the $35 threshold, after that... a straight run to the $40s. The Aug' 2000 high of $56.61 is a valid target... on an 18/24 month outlook.

INTC, daily

INTC, weekly

INTC, monthly

Summary

Suffice to say... news of a dividend hike (24 to 26 cents a quarter)... along with a positive outlook for 2016, gave INTC a strong boost today... helping to build upon the gains already seen from the Monday morning low of $31.93.

-

*I am extremely bullish INTC... and would unquestionably deem it one of the finest companies in the world.

INTC, daily

INTC, weekly

INTC, monthly

Summary

Suffice to say... news of a dividend hike (24 to 26 cents a quarter)... along with a positive outlook for 2016, gave INTC a strong boost today... helping to build upon the gains already seen from the Monday morning low of $31.93.

-

*I am extremely bullish INTC... and would unquestionably deem it one of the finest companies in the world.

Wednesday, 18 November 2015

QCOM - implodes on negative chatter

With reports of Korean anti-trust charges, Qualcomm (QCOM) imploded from the open, settling -9.4% @ $48.01. With a decisive daily close below old support of the $52s, next support is not until the 42/40 zone.

QCOM, daily

QCOM, monthly

Summary

Seen on the bigger monthly cycle, you can see how with the loss of the 50s, there really isn't much price support until the low 40s.

Regardless of however strong the main market might be into year end.. QCOM looks set for further trouble.... not from a profitability viewpoint, but from one of tainted sentiment.

*I've no position, but do see QCOM as an interesting play ahead of Jan' earnings.... but only from the low $40s. For now... its merely one to watch.

QCOM, daily

QCOM, monthly

Summary

Seen on the bigger monthly cycle, you can see how with the loss of the 50s, there really isn't much price support until the low 40s.

Regardless of however strong the main market might be into year end.. QCOM looks set for further trouble.... not from a profitability viewpoint, but from one of tainted sentiment.

*I've no position, but do see QCOM as an interesting play ahead of Jan' earnings.... but only from the low $40s. For now... its merely one to watch.

Tuesday, 17 November 2015

GDX - miners implode as Gold breaks new lows

With Gold breaking a new multi-year low of $1064, the related mining stocks were naturally back in implosion mode. The ETF of GDX settled -4.9% @ $13.07. The 11/10s look viable before year end, not least if Gold tests the $1000 psy' level.

GDX, daily

GDX, monthly

Summary

Little to add from the many dozens of GDX/Gold posts across the last few years.

Miners will continue to follow the prices of the precious metals.. even if the broader equity market climbs.

-

If Gold $1000, GDX in the mid/low 12s.

Eventually. Gold 900/875 looks highly probable.. and that will likely equate to GDX 8s.. maybe even the 5s.. before a key multi-year low has been achieved.

GDX, daily

GDX, monthly

Summary

Little to add from the many dozens of GDX/Gold posts across the last few years.

Miners will continue to follow the prices of the precious metals.. even if the broader equity market climbs.

-

If Gold $1000, GDX in the mid/low 12s.

Eventually. Gold 900/875 looks highly probable.. and that will likely equate to GDX 8s.. maybe even the 5s.. before a key multi-year low has been achieved.

Monday, 16 November 2015

AAPL - a strong start to the week

Whilst the broader equity market closed significantly higher, there was similar strength in Apple (AAPL), which settled +1.6% @ $114.18, having swung from an opening low of $110.85. First upside target is the $120/121 zone, where the 200dma is lurking. After that... the $132.81 historic high.

AAPL, daily

AAPL, monthly

Summary

AAPL remains trading in sync with the main market.. but with stronger % swings.

--

Best guess... upside into the 120s looks an easy target by mid December.

The ultimate issue is whether AAPL can break new highs by year end.. or early 2016.

If the Fed raise rates (and inspire confidence).. AAPL could push >$132... otherwise... there is serious threat of renewed downside.

AAPL, daily

AAPL, monthly

Summary

AAPL remains trading in sync with the main market.. but with stronger % swings.

--

Best guess... upside into the 120s looks an easy target by mid December.

The ultimate issue is whether AAPL can break new highs by year end.. or early 2016.

If the Fed raise rates (and inspire confidence).. AAPL could push >$132... otherwise... there is serious threat of renewed downside.

Friday, 13 November 2015

TVIX, UVXY - powerful net weekly gains

With the VIX climbing broadly across the week to the key 20 threshold, the 2x lev' bullish VIX instruments of TVIX and UVXY saw very powerful net weekly gains of 43.0% and 44.7% respectively. Near term outlook offers renewed equity upside into the next FOMC of Dec'16th.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which saw a net weekly gain of 40.1%

--

As for TVIX/UVXY, with powerful net weekly gains of more than 40%, we're only back to the levels of 3/4 weeks ago.

Again, it is a reminder of how statistical decay remains an underlying problem for those who hold long across multiple weeks.. never mind months.

--

*I have ZERO interest in being long the VIX in the near term, not least as equities will likely rally into the next FOMC of Dec 16th.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which saw a net weekly gain of 40.1%

--

As for TVIX/UVXY, with powerful net weekly gains of more than 40%, we're only back to the levels of 3/4 weeks ago.

Again, it is a reminder of how statistical decay remains an underlying problem for those who hold long across multiple weeks.. never mind months.

--

*I have ZERO interest in being long the VIX in the near term, not least as equities will likely rally into the next FOMC of Dec 16th.

Thursday, 12 November 2015

FCX - crushed with copper

With Copper prices falling by -2.0% to $2.17, the related mining stocks were under natural downward pressure. Freeport McMoran (FCX) settled significantly lower for a seventh consecutive day, -5.5% @ $8.80. The Dec'2008 low of $6.29 is set to be taken out.

FCX, daily

FCX, monthly

Summary

*first, an update on Copper, monthly

--

Suffice to add, FCX remains in an extremely strong collapse wave from summer 2014.

Indeed, the July 2014 high of $37.42 now looks an impossibly long way up.. and is probably YEARS away from being challenged.

... and that assumes FCX won't implode to zero.

What should be increasingly clear.. there has been hardly any actual capitulation in the mining/energy sector. It is going to take some of the mid-size names to literally disappear for market forces to balance supply/demand.

-

*I have no position in FCX. I hope the company can manage to endure the continuing commodity weakness. I'll keep an eye on FCX in the months ahead.

FCX, daily

FCX, monthly

Summary

*first, an update on Copper, monthly

--

Suffice to add, FCX remains in an extremely strong collapse wave from summer 2014.

Indeed, the July 2014 high of $37.42 now looks an impossibly long way up.. and is probably YEARS away from being challenged.

... and that assumes FCX won't implode to zero.

What should be increasingly clear.. there has been hardly any actual capitulation in the mining/energy sector. It is going to take some of the mid-size names to literally disappear for market forces to balance supply/demand.

-

*I have no position in FCX. I hope the company can manage to endure the continuing commodity weakness. I'll keep an eye on FCX in the months ahead.

Wednesday, 11 November 2015

CHK, CNX, RIG - energy stocks under pressure

Whilst the broader equity market settled moderately weak, there was significant weakness in the energy sector. Chesapeake (CHK), Consol (CNX), and Transocean (RIG), settled lower by -7.4%, -7.4%, and -3.0% respectively. Near term outlook remains weak, with new multi-year lows due.

CHK, daily

CNX, daily

RIG, daily

Summary

Suffice to say... the strong dollar is not helping the commodity dependent stocks.

There is ZERO reason why the Aug/Sept' lows will be able to hold.

-

Frankly, there has been only a little capitulation within the energy sector, and it still seems a case of waiting for a few of the mid-size names to implode... and disappear.

Of CHK, CNX, and RIG, I most favour CHK... and least... CNX.

As things are.. there seems no point in getting involved (long side) for any commodity focused stock for at least some months.

CHK, daily

CNX, daily

RIG, daily

Summary

Suffice to say... the strong dollar is not helping the commodity dependent stocks.

There is ZERO reason why the Aug/Sept' lows will be able to hold.

-

Frankly, there has been only a little capitulation within the energy sector, and it still seems a case of waiting for a few of the mid-size names to implode... and disappear.

Of CHK, CNX, and RIG, I most favour CHK... and least... CNX.

As things are.. there seems no point in getting involved (long side) for any commodity focused stock for at least some months.

Tuesday, 10 November 2015

AAPL - cooling on the latest excuse

With chatter about lower component orders due to lower than originally anticipated iphone 6s demand, Apple (AAPL) opened sharply lower, settling -3.2% @ $116.71. Near term outlook offers the 114/112 zone. Sustained action under the $110 threshold looks overly difficult.

AAPL, daily

AAPL, monthly

Summary

Little to add.

It will often amuse me when the market finds another excuse to briefly knock the worlds finest tech' company lower.

Today, the market was upset at the notion of a possible 10% reduction in component orders for the iphone 6s.

--

On any 'fair value' basis, AAPL should be priced higher than the broader market. The April 2015 high of $132.81 will surely be broken above within the next few months.

AAPL, daily

AAPL, monthly

Summary

Little to add.

It will often amuse me when the market finds another excuse to briefly knock the worlds finest tech' company lower.

Today, the market was upset at the notion of a possible 10% reduction in component orders for the iphone 6s.

--

On any 'fair value' basis, AAPL should be priced higher than the broader market. The April 2015 high of $132.81 will surely be broken above within the next few months.

Monday, 9 November 2015

TSLA - stalling at the 200dma

Having jumped higher on another set of lousy earnings to the $230s, TSLA has become decisively stuck and is starting to break lower, with a net Monday decline of -3.1% @ $225.12. Near term outlook is for a retrace at least to the 215/210 zone. There is threat of broader downside to the 200/190 zone.

TSLA, daily

Summary

*as things are, TSLA will see a death cross this Thurs/Friday... and that sure won't inspire the algo-bots to be 'buy the dip'.

--

Little to add.

I remain a fan of the company.. an unquestionably good product, but its a loss maker. Every sale results in ever higher losses to the company, and there is no sign of that changing for some years.

--

As a momentum/hysteria stock, I stay well clear of TSLA... have never traded it. However, it can be useful as an indirect guide to part of the market.

TSLA, daily

Summary

*as things are, TSLA will see a death cross this Thurs/Friday... and that sure won't inspire the algo-bots to be 'buy the dip'.

--

Little to add.

I remain a fan of the company.. an unquestionably good product, but its a loss maker. Every sale results in ever higher losses to the company, and there is no sign of that changing for some years.

--

As a momentum/hysteria stock, I stay well clear of TSLA... have never traded it. However, it can be useful as an indirect guide to part of the market.

Friday, 6 November 2015

GDX - imploding with the precious metals

With Gold and Silver pressured lower by a strengthening USD, the related mining stocks continued lower for a second consecutive week. The ETF of GDX saw a severe net weekly decline of -9.8% @ $13.49. Downside into year end looks probable.. to the 12/10 zone.

GDX, weekly

GDX, monthly

Summary

The precious metals face the old problem in that a stronger USD is a strongly negative pressure.

As ever, if the precious metals are weak, the miners will be dragged lower, regardless of however strong the main equity market might be.

Outlook into year end for the metals is bearish, and by default... that will also apply to the related mining stocks.

GDX, weekly

GDX, monthly

Summary

The precious metals face the old problem in that a stronger USD is a strongly negative pressure.

As ever, if the precious metals are weak, the miners will be dragged lower, regardless of however strong the main equity market might be.

Outlook into year end for the metals is bearish, and by default... that will also apply to the related mining stocks.

Thursday, 5 November 2015

QCOM - smashed lower on fine earnings

Whilst US equities were moderately weak, there was notable extreme downside in Qualcomm (QCOM), settling -15.2% @ $51.11 (intra low $49.92. With the break under the Sept' low of $52.17, next support is 50/48. Sustained action much below 48 looks unlikely... as results were broadly 'fine'.

QCOM, daily

QCOM, monthly, 15yr

Summary

*without going over the earnings reports (as covered in a thousand other places online)...

--

Today's drop in QCOM was a truly fierce one, and took out not just the Sept' low, but even the psy' level of $50.00.

Technically, even if we see the sp'2020s within the next few weeks, QCOM should be able to hold the $48 threshold.

If not.. next support is not until the 42/40 zone. However, that seems very unlikely, as the broader US/world equity markets now look set for sustained upside into.. and across 2016.

-

*I am bullish QCOM, once the stock can build a floor.. which might become clear before end month.

QCOM, daily

QCOM, monthly, 15yr

Summary

*without going over the earnings reports (as covered in a thousand other places online)...

--

Today's drop in QCOM was a truly fierce one, and took out not just the Sept' low, but even the psy' level of $50.00.

Technically, even if we see the sp'2020s within the next few weeks, QCOM should be able to hold the $48 threshold.

If not.. next support is not until the 42/40 zone. However, that seems very unlikely, as the broader US/world equity markets now look set for sustained upside into.. and across 2016.

-

*I am bullish QCOM, once the stock can build a floor.. which might become clear before end month.

Wednesday, 4 November 2015

DIS - hyper reversal ahead of earnings

Along with the broader market, Disney (DIS) opened a little higher, with a new cycle high of $116.83, but then saw a fierce downside snap, settling -2.0% @ $113.24. The excuse for the reversal is highly arguable, but regardless, the daily MACD cycle is set to turn negative this Thursday or Friday.

DIS, daily

DIS, monthly

Summary

*there was a notable bearish option trade in DIS this morning, which might have contributed to the 10am hour snap...

Puts, Nov' 105s 10,000 @ $0.50 = $0.5 million

Puts, Nov' 100s, 10,000 @ $0.25 = $0.25 million

(all entry prices approx).

Roughly.. it seems someone spent the better part of $0.75 million on a rather significant put spread.

The fact the purchase were front month options - with just 12 days left on the detonator clock, is suggestive it was an individual trade, rather than a large institution trying to hedge.

-

Best guess... DIS to fall (at min). to 108/105 by late Friday... not least if the main market settles the week in the sp'2060/50s.

If sp'2020s, DIS could test the giant $100 psy' level.. before resuming higher into year end.

-

To be absolutely clear... I am VERY bullish DIS.. not least because of its Marvel/Star Wars movie/TV franchises.

yours.. not short via 20,000 DIS put contracts (if only)

DIS, daily

DIS, monthly

Summary

*there was a notable bearish option trade in DIS this morning, which might have contributed to the 10am hour snap...

Puts, Nov' 105s 10,000 @ $0.50 = $0.5 million

Puts, Nov' 100s, 10,000 @ $0.25 = $0.25 million

(all entry prices approx).

Roughly.. it seems someone spent the better part of $0.75 million on a rather significant put spread.

The fact the purchase were front month options - with just 12 days left on the detonator clock, is suggestive it was an individual trade, rather than a large institution trying to hedge.

-

Best guess... DIS to fall (at min). to 108/105 by late Friday... not least if the main market settles the week in the sp'2060/50s.

If sp'2020s, DIS could test the giant $100 psy' level.. before resuming higher into year end.

-

To be absolutely clear... I am VERY bullish DIS.. not least because of its Marvel/Star Wars movie/TV franchises.

yours.. not short via 20,000 DIS put contracts (if only)

Tuesday, 3 November 2015

DIS - climbing ahead of earnings

Whilst the main market closed moderately higher, Disney (DIS) was similarly on the rise, settling +0.4% @ $115.54, the highest level since the earnings collapse of Aug 5th. Indeed, there is open air to the historic high of $122.08.. although it seems far more viable in late Dec/Jan' 2016.

DIS, daily

DIS, monthly

Summary

Suffice to say, DIS has seen a massive recovery since the Aug' low of $90.00.

Regardless of any retrace/cool down after earnings (due this Thursday, AH), DIS looks set for broad upside into,, and across spring 2016.

*the increasing Star Wars hysteria will only add to some extra media/trader attention this December.

-

DIS, daily

DIS, monthly

Summary

Suffice to say, DIS has seen a massive recovery since the Aug' low of $90.00.

Regardless of any retrace/cool down after earnings (due this Thursday, AH), DIS looks set for broad upside into,, and across spring 2016.

*the increasing Star Wars hysteria will only add to some extra media/trader attention this December.

-

Monday, 2 November 2015

BAC - financials rising on hopes of higher rates

Whilst the broader market settled significantly higher in the sp'2100s, there was more pronounced upside power in financials, with Bank of America (BAC) settling +1.7% @ $17.06. A monthly close in the $18s would be extremely bullish for 2016... with subsequent targets of $20, and then $23 by late spring.

BAC, daily

BAC, monthly

Summary

First, regarding the Fed and interest rates...

It has been a VERY messy year in terms of the Fed. They had ample opportunity to raise rates.. but having repeatedly delaying, such uncertainty was a primary cause of the capital market upset in August.

-

Currently.. my best guess (although it IS also a hope).. is that the Fed raise rates at the next FOMC of Dec'16th.

A 25bps move would finally be 'lift off'.. and open the door to further periodic increases.. eventually to 2-3% or so by late 2017.

I realise some might call that 'crazy talk'.. but I am of the 'old school' economic view, and higher rates ARE bullish for financials... and the broader economy.

-

Technically. if BAC can attain an $18 monthly close.. it will open the door to a relatively straight up move to $20.. and then $23 by late spring.. which would make for a natural pre-summer cycle top.

First things first though.. lets see if BAC can attain an $18 close for Nov... or far more viable... this December.

BAC, daily

BAC, monthly

Summary

First, regarding the Fed and interest rates...

It has been a VERY messy year in terms of the Fed. They had ample opportunity to raise rates.. but having repeatedly delaying, such uncertainty was a primary cause of the capital market upset in August.

-

Currently.. my best guess (although it IS also a hope).. is that the Fed raise rates at the next FOMC of Dec'16th.

A 25bps move would finally be 'lift off'.. and open the door to further periodic increases.. eventually to 2-3% or so by late 2017.

I realise some might call that 'crazy talk'.. but I am of the 'old school' economic view, and higher rates ARE bullish for financials... and the broader economy.

-

Technically. if BAC can attain an $18 monthly close.. it will open the door to a relatively straight up move to $20.. and then $23 by late spring.. which would make for a natural pre-summer cycle top.

First things first though.. lets see if BAC can attain an $18 close for Nov... or far more viable... this December.

Subscribe to:

Comments (Atom)