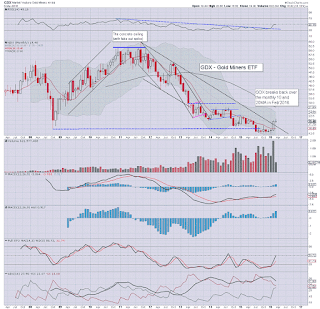

With the precious metals breaking new cycle highs, the related mining stocks continued to climb. The miner ETF of GDX saw a net monthly gain of 3.0% (intra high $21.42), settling at $19.97. Near term outlook threatens brief weakness, but the mid term outlook looks bullish, at least to the $23/24s.

GDX, monthly

GDX, daily

Summary

Suffice to add, fourth months of upside, and regardless of a near term chop/weakness, the miners look on track for at least somewhat higher levels in the months ahead.

As ever, the USD will play a major part in how the precious metals will trade - and by default.. the miners. For the moment, the USD is under pressure as the next rate hike looks unlikely until Q4.

If that is the case, then the metals.. and related miners looks set for continued broad upside.

Thursday, 31 March 2016

Wednesday, 30 March 2016

BA - a sixth consecutive daily decline

Whilst the broader market saw another day of gains, there was notable weakness in Boeing (BA), which settled lower for the sixth consecutive day, -1.8% @ $128.57. Near term outlook threatens increasing downward pressure to the 122/121 zone where the 200dma is lurking.

BA, daily

BA, monthly

Summary

*obviously depressing news for the Boeing workforce, as at least 4000 are set to be dismissed.

--

Considering the strength in the main market, BA sure is struggling, but then, since the Feb' low of $102, its seen a hyper ramp to $136.

The giant monthly chart tells the story of a Dow'30 component that looks tired.

If the broader market rolls lower again into the early summer, then the $102 low will be primary target. Secondary is the 75/74s, but clearly, that is an extremely long way down.

-

*currently no position, but will consider shorting in April.. with an outlook to hold short across May/June.

BA, daily

BA, monthly

Summary

*obviously depressing news for the Boeing workforce, as at least 4000 are set to be dismissed.

--

Considering the strength in the main market, BA sure is struggling, but then, since the Feb' low of $102, its seen a hyper ramp to $136.

The giant monthly chart tells the story of a Dow'30 component that looks tired.

If the broader market rolls lower again into the early summer, then the $102 low will be primary target. Secondary is the 75/74s, but clearly, that is an extremely long way down.

-

*currently no position, but will consider shorting in April.. with an outlook to hold short across May/June.

Tuesday, 29 March 2016

GDX - miners catch a bid as metals jump

With Yellen touting a number of conflicting messages, the metals still managed to jump higher, with the related mining stocks similarly on the rise. The ETF of GDX settled higher by a rather powerful 5.8% @ $20.54. Near term outlook is a little uncertain, but metals/miners look set to broadly climb into the summer.

GDX'daily

GDX, monthly

Summary

Suffice to add, the miners are naturally following the lead of the precious metals.

Gold looks set (at minimum) for the $1300 threshold in the next move higher.. and that will likely take GDX to the $23/24s.

Things only get interesting on a Gold monthly close >$1400.

GDX'daily

GDX, monthly

Summary

Suffice to add, the miners are naturally following the lead of the precious metals.

Gold looks set (at minimum) for the $1300 threshold in the next move higher.. and that will likely take GDX to the $23/24s.

Things only get interesting on a Gold monthly close >$1400.

Monday, 28 March 2016

GE - clearing resistance, at least for today

Whilst the broader market saw a day of moderate churn to start the week, there was notable strength in General Electric (GE), which settled +1.2% @ $ 31.34, making for a decisive close above the late Dec' 2015 high. As ever, the monthly close will be important.

GE, daily

GE, monthly

Summary

Suffice to add, GE really stood out today.

Unquestionably, a great deal of the price rise can be attributed to the monstrous stock buy back of $50bn that is well underway.

-

GE is one to watch, and equity bears should be seeking an April /May close back under $28 to confirm that the broader equity market is still set for powerful downside this summer/autumn.

GE, daily

GE, monthly

Summary

Suffice to add, GE really stood out today.

Unquestionably, a great deal of the price rise can be attributed to the monstrous stock buy back of $50bn that is well underway.

-

GE is one to watch, and equity bears should be seeking an April /May close back under $28 to confirm that the broader equity market is still set for powerful downside this summer/autumn.

Thursday, 24 March 2016

TVIX, UVXY - a sixth net weekly decline

It was another rough week for the 2x lev' bullish VIX instruments, with TVIX and UVXY seeing net weekly declines of -4.4% and -0.7% respectively. Near term outlook offers further downward pressure on Mon/Tuesday, but the VIX looks set to battle upward to the key 20 threshold by early April.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which saw a net weekly gain of 5.1%.

--

As for TVIX/UVXY, both instruments broke new historic lows this week, as the VIX equalled last Friday's floor of 13.75 on Tuesday.

*I'm looking to build up a long-VIX position across the next few weeks, seeking VIX 30/40s by late April/May.

There is serious threat of VIX 50/60s, if market turmoil in June - not least if the UK votes to exit the EU.

--

As ever, such leveraged instruments are for short term holds (almost always), due to the underlying problem of statistical decay.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which saw a net weekly gain of 5.1%.

--

As for TVIX/UVXY, both instruments broke new historic lows this week, as the VIX equalled last Friday's floor of 13.75 on Tuesday.

*I'm looking to build up a long-VIX position across the next few weeks, seeking VIX 30/40s by late April/May.

There is serious threat of VIX 50/60s, if market turmoil in June - not least if the UK votes to exit the EU.

--

As ever, such leveraged instruments are for short term holds (almost always), due to the underlying problem of statistical decay.

Wednesday, 23 March 2016

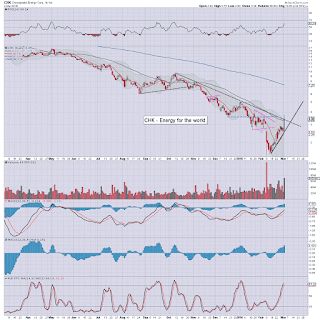

CHK, FCX, SDRL - smashed junk

Whilst the main market closed broadly weak, there was severe weakness in the usual 'junk suspects'. Chesapeake Energy (CHK), Freeport McMoran (FCX), and Seadrill (SDRL) settled lower by -14.3%, -11.4%, and -10.1% respectively. Mid term outlook is dire.

CHK, daily

FCX, daily

SDRL, daily

Summary

What should be clear to anyone, even when the main market is only moderately lower, the 'junk' stocks get effectively smashed to pieces.

--

Suffice to add... I have ALL three stocks of CHK, FCX, and SDRL on the 'disappear list'. I'd be surprised if at least one hasn't filed for bankruptcy by June.

In terms of order of vulnerability.. all three companies look in equally serious trouble.

--

*I've no position in either.. but I believe all merit keeping an eye on, as they are reflective of some serious underlying economic problems.

CHK, daily

FCX, daily

SDRL, daily

Summary

What should be clear to anyone, even when the main market is only moderately lower, the 'junk' stocks get effectively smashed to pieces.

--

Suffice to add... I have ALL three stocks of CHK, FCX, and SDRL on the 'disappear list'. I'd be surprised if at least one hasn't filed for bankruptcy by June.

In terms of order of vulnerability.. all three companies look in equally serious trouble.

--

*I've no position in either.. but I believe all merit keeping an eye on, as they are reflective of some serious underlying economic problems.

Tuesday, 22 March 2016

INFN - swinging from resistance to support

Whilst the broader equity market closed moderately mixed, there was notable weakness in Infinera (INFN), which settled -7.4% @ $15.57. INFN has swung from natural resistance around the $17 threshold, to rising support in the low $15s. Broadly, the stock looks vulnerable to the psy' level of $10 this year.

INFN, daily

Summary

Infinera is a tech', involved in networking.

I happen to like the company, but if the broader market rolls lower again this spring, and into the summer, INFN will probably cool to the $10 threshold.

At that level, I'd be interested in it. For now, I've no interest in short individual companies, not least anything that is not part of the Dow'30.

INFN, daily

Summary

Infinera is a tech', involved in networking.

I happen to like the company, but if the broader market rolls lower again this spring, and into the summer, INFN will probably cool to the $10 threshold.

At that level, I'd be interested in it. For now, I've no interest in short individual companies, not least anything that is not part of the Dow'30.

Monday, 21 March 2016

TVIX, UVXY - another week starts badly

Despite equity indexes only leaning 'marginally' higher, the 2x lev' bullish VIX instruments of TVIX and UVXY started the week with net declines of a very significant -8.6% and -6.0% respectively. Near term outlook threatens a further 8-12% lower before a key floor.

TVIX, daily

UVXY, daily

Summary

Suffice to add (from the weekend post), it was a particularly rough week for the VIX instruments.

For the moment, equity price action remains broadly bullish, probably to the sp'2070/80 zone, and that will likely equate to VIX 12s... if briefly.

--

'Rogue print' for TVIX.

Earlier in the morning I noticed a kooky 'rogue print' on TVIX. The print did occur.. although not all trading screens or charting software captured it.

TVIX 5min

It is somewhat interesting how we have a print in the $4.50s.

*AAPL had a similar spike print in early trading, but to the upside - in the $110.50s.

--

TVIX, daily

UVXY, daily

Summary

Suffice to add (from the weekend post), it was a particularly rough week for the VIX instruments.

For the moment, equity price action remains broadly bullish, probably to the sp'2070/80 zone, and that will likely equate to VIX 12s... if briefly.

--

'Rogue print' for TVIX.

Earlier in the morning I noticed a kooky 'rogue print' on TVIX. The print did occur.. although not all trading screens or charting software captured it.

TVIX 5min

It is somewhat interesting how we have a print in the $4.50s.

*AAPL had a similar spike print in early trading, but to the upside - in the $110.50s.

--

Friday, 18 March 2016

TVIX, UVXY - a fifth week of horror

With equities continuing to broadly climb, the VIX naturally cooled for a fifth week. The 2x lev' bullish VIX instruments of TVIX and UVXY saw net weekly declines of -12.8% and -14.3% respectively. Next week offers further weakness, before a viable turn once WTIC oil maxes out around $44/45.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which saw a net weekly decline of -15.0%

--

As for TVIX and UVXY, indeed.. a fifth week of horror.

Since the Feb'11th equity low...

TVIX has declined from $13.58 to $5.44, a net decline of -59.9%.

UVXY has fallen from $61.92 to $23.66, a net decline of -61.5%.

-

*I am seeking to be long VIX - via TVIX, once Oil has maxed out. Oil is a clear threat to the equity bears, as most recognise its been a key factor in pushing the market back upward.

Once Oil maxes out, I'd imagine equities will be able to cool into end month.. and more broadly.. across the spring ,and into the summer.

--

As ever, such leveraged instruments are (almost always) for very short term holds only, primarily due to the inherent problem of statistical decay.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which saw a net weekly decline of -15.0%

--

As for TVIX and UVXY, indeed.. a fifth week of horror.

Since the Feb'11th equity low...

TVIX has declined from $13.58 to $5.44, a net decline of -59.9%.

UVXY has fallen from $61.92 to $23.66, a net decline of -61.5%.

-

*I am seeking to be long VIX - via TVIX, once Oil has maxed out. Oil is a clear threat to the equity bears, as most recognise its been a key factor in pushing the market back upward.

Once Oil maxes out, I'd imagine equities will be able to cool into end month.. and more broadly.. across the spring ,and into the summer.

--

As ever, such leveraged instruments are (almost always) for very short term holds only, primarily due to the inherent problem of statistical decay.

Thursday, 17 March 2016

BA - continuing to climb with the main market

Whilst the broader market broke a new cycle high of sp'2046, there was more notable strength in Boeing (BA), which settled higher by a rather significant 2.4% @ $130.69. Next resistance is the 200dma, currently in the $134s.

BA, daily

BA, monthly

Summary

Boeing has effectively ramped around 30% since the low of $102 in February.

On any basis, this is one crazy ramp, and it is notable that during this time Oil has climbed from $26 to the $40 threshold. Unquestionably, higher aviation fuel prices are NOT bullish for the airlines, although I recognise most will have contracts that protect against such price volatility in the short/mid term.

-

If the broader market rolls over into the spring, Boeing looks highly vulnerable to breaking below the Feb' low. Any price action <$100, would be suggestive of $75/74, but with the ongoing rally, that is almost 50% lower!

BA, daily

BA, monthly

Summary

Boeing has effectively ramped around 30% since the low of $102 in February.

On any basis, this is one crazy ramp, and it is notable that during this time Oil has climbed from $26 to the $40 threshold. Unquestionably, higher aviation fuel prices are NOT bullish for the airlines, although I recognise most will have contracts that protect against such price volatility in the short/mid term.

-

If the broader market rolls over into the spring, Boeing looks highly vulnerable to breaking below the Feb' low. Any price action <$100, would be suggestive of $75/74, but with the ongoing rally, that is almost 50% lower!

Wednesday, 16 March 2016

TVIX, UVXY - further weakness as VIX crushed

With equities breaking a new cycle high to sp'2032, the VIX was crushed to the 14s. The 2x lev' bullish VIX instruments of TVIX and UVXY settled lower by -5.8% and -7.3% respectively. Near term outlook threatens early Thursday weakness, but then a viable key turn.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX... currently net lower for a fifth consecutive week.

--

Suffice to add.. with the VIX having been cut in half, the down cycle from Feb'11th is about complete.

-

*I am seeking to be short equities and long the VIX (via TVIX) by 11am Thursday.

On any fair basis.. we're at the very low end of the cycle... and in theory, the equity market should cool into end month.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX... currently net lower for a fifth consecutive week.

--

Suffice to add.. with the VIX having been cut in half, the down cycle from Feb'11th is about complete.

-

*I am seeking to be short equities and long the VIX (via TVIX) by 11am Thursday.

On any fair basis.. we're at the very low end of the cycle... and in theory, the equity market should cool into end month.

Tuesday, 15 March 2016

CHK, FCX, SDRL - junk under pressure

Whilst the broader market saw moderate weakness across the day, there were far more notable declines in the usual (junk) suspects. Chesapeake Energy (CHK), Freeport McMoran (FCX), and Seadrill (SDRL) settled lower by -4.1%, -7.1%, and -7.9% respectively.

CHK,daily

FCX, daily

SDRL, daily

Summary

It is notable that whenever the main market is just a little lower, the junk gets smashed very fast.

If you are also of the mindset that we'll see the sp'1600s this year, it is not exactly difficult to come to the realisation that many of the junk stock are going to be hugely lower from current levels.

-

*I would expect at least one to file for bankruptcy within the next 2-4 months (probably CHK), with one of the other two by year end.

The balance sheets should be clear to anyone... yet no doubt, the mainstream will be 'ohh so surprised' when the implosions occur.

CHK,daily

FCX, daily

SDRL, daily

Summary

It is notable that whenever the main market is just a little lower, the junk gets smashed very fast.

If you are also of the mindset that we'll see the sp'1600s this year, it is not exactly difficult to come to the realisation that many of the junk stock are going to be hugely lower from current levels.

-

*I would expect at least one to file for bankruptcy within the next 2-4 months (probably CHK), with one of the other two by year end.

The balance sheets should be clear to anyone... yet no doubt, the mainstream will be 'ohh so surprised' when the implosions occur.

Monday, 14 March 2016

GDX - miners retracing with the metals

With the precious metals closing lower for a second consecutive day, the related mining stocks were naturally following. The ETF of GDX settled lower by a very significant -4.3% @ $19.11. Near term outlook offers further weakness to the fib' retrace zone in the mid $17s.

GDX, daily2

GDX, monthly

Summary

The precious metals appear in a long overdue retrace, and that is naturally seeing the related mining stocks being dragged lower.

The only issue is whether the metals/miners will floor around the next FOMC, or need a bigger retrace.. not so much in terms of price, but time.

Having rallied from mid December to early March, that is almost 3 months. A time retrace could be argued should last around a month.. which would be suggestive of early April.

-

In any case... broader upside targets remain unchanged..

Primary $24/25

Secondary $30/32 zone

The best case upside target for Gold is around $1500. If that occurred by late summer, GDX would likely be trading around $40 ... effectively double the current level.

-

*no current position, will strongly consider GDX in the 18.50/17.50 zone.. with GLD 115/114.

GDX, daily2

GDX, monthly

Summary

The precious metals appear in a long overdue retrace, and that is naturally seeing the related mining stocks being dragged lower.

The only issue is whether the metals/miners will floor around the next FOMC, or need a bigger retrace.. not so much in terms of price, but time.

Having rallied from mid December to early March, that is almost 3 months. A time retrace could be argued should last around a month.. which would be suggestive of early April.

-

In any case... broader upside targets remain unchanged..

Primary $24/25

Secondary $30/32 zone

The best case upside target for Gold is around $1500. If that occurred by late summer, GDX would likely be trading around $40 ... effectively double the current level.

-

*no current position, will strongly consider GDX in the 18.50/17.50 zone.. with GLD 115/114.

Friday, 11 March 2016

TVIX, UVXY - a fourth net weekly decline

With VIX continuing to cool, the 2x lev' bullish instruments of TVIX and UVXY, saw net weekly declines for a fourth consecutive week, declining by -7.5% and -8.3% respectively. Near term outlook threatens further cooling in volatility into the FOMC of March 16th.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which saw a net decline of -2.1%.

--

As for TVIX/UVXY... the pain continues.

TVIX has now declined by -54.0% since the high of Feb'11th high of $13.58

UVXY -55.2%, from the Feb'11th high of $61.92

It has been a brutal month for the VIX instruments, as the VIX has cooled from a Feb'11th peak of 30.90 (with sp'1810) to the mid 16s.. with sp'2022.

If sp'2030/40s next week, TVIX/UVXY will likely see a further 5/10% decline, before beginning a new multi-week up cycle.

--

*I will be looking to be long the VIX, once the next FOMC is out of the way. First upside target will be a monthly VIX close >20.

If VIX 40/50s - with sp'1700/1600s, by early summer, I would certainly want to be broadly long VIX.

--

As ever, such instruments are (almost always) for very short term holds only, due to the underlying problem of statistical decay.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which saw a net decline of -2.1%.

--

As for TVIX/UVXY... the pain continues.

TVIX has now declined by -54.0% since the high of Feb'11th high of $13.58

UVXY -55.2%, from the Feb'11th high of $61.92

It has been a brutal month for the VIX instruments, as the VIX has cooled from a Feb'11th peak of 30.90 (with sp'1810) to the mid 16s.. with sp'2022.

If sp'2030/40s next week, TVIX/UVXY will likely see a further 5/10% decline, before beginning a new multi-week up cycle.

--

*I will be looking to be long the VIX, once the next FOMC is out of the way. First upside target will be a monthly VIX close >20.

If VIX 40/50s - with sp'1700/1600s, by early summer, I would certainly want to be broadly long VIX.

--

As ever, such instruments are (almost always) for very short term holds only, due to the underlying problem of statistical decay.

Thursday, 10 March 2016

SDRL - cooling from recent bullish hysteria

Last Friday saw 'hyper bullish' hysteria in Seadrill (SDRL), yet since Friday afternoon, SDRL has been systematically re-destroyed, cooling from $7.49 to a third consecutive net daily decline of -9.9% @ $3.56. Long term outlook is dire.. and SDRL remains on the 'disappear list'.

SDRL, daily

SDLR, monthly

Summary

Suffice to add, all those who got lost in the 'ohh, everything is fine now' hysteria, chasing SDLR higher into the $5s, 6s.. or even 7s last Friday are now massively underwater.

The underlying issue that SDRL looks liable to eventual implode this year remains utterly unchanged.

-

*no position, not least at what is an already smashed down stock. I'd prefer to short energy via one of the bigger names - such as APC, APA, or even CVX, or merely trade short via a generic index such as SPY or DIA.

SDRL, daily

SDLR, monthly

Summary

Suffice to add, all those who got lost in the 'ohh, everything is fine now' hysteria, chasing SDLR higher into the $5s, 6s.. or even 7s last Friday are now massively underwater.

The underlying issue that SDRL looks liable to eventual implode this year remains utterly unchanged.

-

*no position, not least at what is an already smashed down stock. I'd prefer to short energy via one of the bigger names - such as APC, APA, or even CVX, or merely trade short via a generic index such as SPY or DIA.

Wednesday, 9 March 2016

FCX - short term upside, broadly vulnerable

Whilst the main market closed moderately higher, there was notable strength in Freeport McMoran (FCX) which settled higher by a very significant 5.6% @ $9.15. The 200dma remains core resistance in the $10s. A break under the Jan'20th low of $3.52 still looks probable by late spring/early summer.

FCX, daily

FCX, monthly

Summary

Suffice to add... FCX has seen a powerful ramp since the January low, but then.. it saw an equally strong ramp last August-October.

The company still looks seriously vulnerable, being involved in not just the mining sector, but the equally battered oil/gas service sector.

FCX remains on my disappear list.

FCX, daily

FCX, monthly

Summary

Suffice to add... FCX has seen a powerful ramp since the January low, but then.. it saw an equally strong ramp last August-October.

The company still looks seriously vulnerable, being involved in not just the mining sector, but the equally battered oil/gas service sector.

FCX remains on my disappear list.

Tuesday, 8 March 2016

GDX - rough day for the miners

With the precious metals not able to break a new high, and closing broadly lower, the related Gold/Silver mining stocks were on the slide. The ETF of GDX settled lower by a very significant -4.9% @ $19.40. Further downside to the $18.00/17.50 zone looks probable by the next FOMC of March 16th.

GDX, daily2

GDX, weekly

GDX, monthly

Summary

Suffice to add... the precious metals and related mining stocks, appear to finally be seeing a long overdue retrace.

--

Downside to $18.00/17.50... then UP to at least 24/25

If Gold $1500s, then GDX will be around $40... and that is one trade I'd sure like to be involved in.

GDX, daily2

GDX, weekly

GDX, monthly

Summary

Suffice to add... the precious metals and related mining stocks, appear to finally be seeing a long overdue retrace.

--

Downside to $18.00/17.50... then UP to at least 24/25

If Gold $1500s, then GDX will be around $40... and that is one trade I'd sure like to be involved in.

Monday, 7 March 2016

BA - still climbing with the main market

With US equities remaining within the broad upward trend from the Feb'11th low, Boeing (BA) saw notable strength, settling +1.5% @ $122.90. There is clear gap zone resistance of 122/127. Sustained action >127 looks very difficult. On renewed weakness into the spring... first core target is the $102/100 zone.

BA, daily

BA, monthly

Summary

BA is indeed merely trading with the broader market, but is seeing stronger percentage moves, having climbed a powerful 20% in barely 4 weeks.

If the sp'1600s this late spring/summer, BA should at least cool lower to around $100.

Seen on the bigger monthly chart, the 75/74 zone looks a valid target, but that is indeed a long way down.

BA, daily

BA, monthly

Summary

BA is indeed merely trading with the broader market, but is seeing stronger percentage moves, having climbed a powerful 20% in barely 4 weeks.

If the sp'1600s this late spring/summer, BA should at least cool lower to around $100.

Seen on the bigger monthly chart, the 75/74 zone looks a valid target, but that is indeed a long way down.

Friday, 4 March 2016

TVIX, UVXY - a third week of significant declines

With equities rising, and the VIX continuing to melt lower, the 2x lev' bullish VIX instruments of TVIX and UVXY saw net weekly declines of -20.8% and -21.6% respectively. Near term outlook offers threat of another 10/15%, via decay and continued equity upside into the FOMC of March 16th.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which saw a net weekly decline of -14.9% @ 16.86.

--

As for TVIX and UVXY...

TVIX has now declined by -50.4% since the high of $13.58 (Feb 11'th).

UVXY is -51.1% since the high of $61.92

-

My broader outlook remains unchanged. Market to max out in the sp'2020/40 zone, by mid March. Considering the VIX has already cooled to the 16s. If sp'2030/40s, then VIX might briefly spike-floor in the 14/13s.

Broadly, the VIX 25/30 zone looks probable by mid April. The 40/50s look more viable in late April/early May.

--

As ever, TVIX/UVXY are for short term holds only, due to the underlying problem of statistical decay.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which saw a net weekly decline of -14.9% @ 16.86.

--

As for TVIX and UVXY...

TVIX has now declined by -50.4% since the high of $13.58 (Feb 11'th).

UVXY is -51.1% since the high of $61.92

-

My broader outlook remains unchanged. Market to max out in the sp'2020/40 zone, by mid March. Considering the VIX has already cooled to the 16s. If sp'2030/40s, then VIX might briefly spike-floor in the 14/13s.

Broadly, the VIX 25/30 zone looks probable by mid April. The 40/50s look more viable in late April/early May.

--

As ever, TVIX/UVXY are for short term holds only, due to the underlying problem of statistical decay.

Thursday, 3 March 2016

CHK, CNX, SDRL - rising junk

Whilst the broader market saw a third consecutive day of gains, there was notable hyper strength in many of the energy/resource stocks. Chesapeake Energy (CHK), Consol Energy (CNX), and Seadrill (SDRL) settled powerfully higher by 26.2%, 9.0%, and 14.5% respectively.

CHK, daily

CNX, daily

SDRL, daily

Summary

Suffice to add, powerful gains for many of those stocks which have been smashed lower since summer 2014.

--

Broadly, the three listed companies of CHK, CNX, and SDRL continue to look in dire trouble, and I'd expect at least 1 of them to have filed for bankruptcy by June.

--

*no position, and I'm leaving such stocks well alone. Instead, I'll merely hold to shorting the main indexes from mid March onward.

CHK, daily

CNX, daily

SDRL, daily

Summary

Suffice to add, powerful gains for many of those stocks which have been smashed lower since summer 2014.

--

Broadly, the three listed companies of CHK, CNX, and SDRL continue to look in dire trouble, and I'd expect at least 1 of them to have filed for bankruptcy by June.

--

*no position, and I'm leaving such stocks well alone. Instead, I'll merely hold to shorting the main indexes from mid March onward.

Wednesday, 2 March 2016

CHK - a truly crazy day

Whilst the broader equity market saw a day of moderate chop, there was notable hyper strength in Chesapeake Energy (CHK), which settled +22.8% @ $3.39 (intra high 3.75). The news of the death of the ex CEO McClendon only adds to the uncertainty for what remains a company that looks set to disappear.

CHK, daily

CHK, monthly

Summary

CHK had naturally battled higher - with the rest of the market, since the Feb'8'th low of $1.50, to the $3s.

This afternoon's news that the recently indicted (just yesterday) of the ex CEO Audbrey McClendon only adds to the tangled web that the company is now wrapped in.

--

Outlook - set to disappear

Regardless of the death of McClendon, the company remains in dire trouble... not least as Nat' gas prices look set to remain low across 2016.

Having imploded from $29.37 (July 2014), CHK looks set to disappear.... with the market already pricing it effectively as 'on the edge of bankruptcy'.

The only issue is how many months can the seemingly inevitable be delayed?

CHK, daily

CHK, monthly

Summary

CHK had naturally battled higher - with the rest of the market, since the Feb'8'th low of $1.50, to the $3s.

This afternoon's news that the recently indicted (just yesterday) of the ex CEO Audbrey McClendon only adds to the tangled web that the company is now wrapped in.

--

Outlook - set to disappear

Regardless of the death of McClendon, the company remains in dire trouble... not least as Nat' gas prices look set to remain low across 2016.

Having imploded from $29.37 (July 2014), CHK looks set to disappear.... with the market already pricing it effectively as 'on the edge of bankruptcy'.

The only issue is how many months can the seemingly inevitable be delayed?

Subscribe to:

Comments (Atom)