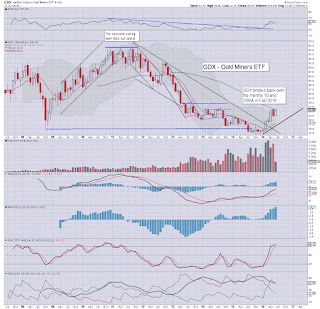

With the precious metals soaring across June, the related mining stocks saw similar gains. The ETF of GDX gained a very powerful 22.5% to settle @ $27.67, the best monthly close since April 2013. Mid term outlook remains very bullish... so long as equities don't breakout >sp'2134.

GDX, monthly

GDX, daily

Summary

So, with Thursday gains of 1.9%, the miners ended the month at multi-year highs.

Considering Gold is still only in the mid/low $1300s, GDX has already excelled beyond any almost Gold bugs dreams.

If Gold $1500... GDX to the $35/40 zone.

As ever, a stronger USD would be a downward pressure, that is one key variable, but it certainly is not the only one.

Thursday, 30 June 2016

Wednesday, 29 June 2016

GDX - climbing with the metals

With the precious metals back on the rise, the related mining stocks were similarly higher. The ETF of GDX settled higher by a rather significant 2.4% @ $27.25. Capital markets remain highly vulnerable, and Gold/Silver look due for much higher levels... and that will continue to benefit the miners.

GDX, daily

GDX, monthly

Summary

Little to add.

Clearly, the weaker USD today helped give the metals/miners an extra kick higher today. Yet, the broader trend is outright bullish anyway.

GDX looks set for the $35/40 zone if Gold $1500s, which really isn't that bold a target given a few months.

GDX, daily

GDX, monthly

Summary

Little to add.

Clearly, the weaker USD today helped give the metals/miners an extra kick higher today. Yet, the broader trend is outright bullish anyway.

GDX looks set for the $35/40 zone if Gold $1500s, which really isn't that bold a target given a few months.

Tuesday, 28 June 2016

TVIX, UVXY - increasingly volatile

With the VIX settling lower for a second consecutive day, the 2x lev' bullish instruments of TVIX and UVXY were naturally on the slide, settling lower by a very significant -21.3% and -23.8% respectively. Near term outlook offers a Wednesday reversal.. with renewed upside into early July.

TVIX, daily

UVXY, daily

Summary

Having imploded from February to early June, the VIX instruments continue to attract a lot of attention.

TVIX looks vulnerable to the 2.30/2.20s, but with subsequent upside to the 4s, possibly 5s on a very brief spike - which would likely require VIX 30s.

UVXY looks vulnerable to the mid/low $11s... with viable upside to the 18/21 zone.

--

As ever, long term holds in such leveraged instruments never ends well.

Also.. one tragically ironic aspect of higher volatility... the 'statistical decay' problem is worse.

--

Yours truly is more focused on shorting equities and long-Gold, and I'll likely refrain from meddling in the VIX for the next few weeks.

TVIX, daily

UVXY, daily

Summary

Having imploded from February to early June, the VIX instruments continue to attract a lot of attention.

TVIX looks vulnerable to the 2.30/2.20s, but with subsequent upside to the 4s, possibly 5s on a very brief spike - which would likely require VIX 30s.

UVXY looks vulnerable to the mid/low $11s... with viable upside to the 18/21 zone.

--

As ever, long term holds in such leveraged instruments never ends well.

Also.. one tragically ironic aspect of higher volatility... the 'statistical decay' problem is worse.

--

Yours truly is more focused on shorting equities and long-Gold, and I'll likely refrain from meddling in the VIX for the next few weeks.

Monday, 27 June 2016

BAC, DB - financials smashed

With world capital markets still upset from the BREXIT, financial stocks remained under severe downward pressure. Bank of America (BAC) and Deutsche Bank (DB), settled lower by -6.3% and -5.5% respectively. Near term outlook threatens a brief bounce, but mid/long term outlook is dire.. due to low/negative rates.

BAC, daily

DB, daily

Summary

Suffice to add... real ugly, not least for DB that is an obvious systemic risk to the EU.

--

BAC looks set for $10/9s. If DB implodes (literally).. then BAC to $5.

As central banks keep rates low/negative, the financials are going to remain under broad downward pressure. The recent geo-political upset is only adding to the problems.

BAC, daily

DB, daily

Summary

Suffice to add... real ugly, not least for DB that is an obvious systemic risk to the EU.

--

BAC looks set for $10/9s. If DB implodes (literally).. then BAC to $5.

As central banks keep rates low/negative, the financials are going to remain under broad downward pressure. The recent geo-political upset is only adding to the problems.

Saturday, 25 June 2016

TVIX, UVXY - a third week of gains

With the BREXIT shocking world capital markets, equities saw severe weakness, with the VIX soaring into the weekend. The 2x lev' bullish instruments of TVIX and UVXY managed a third consecutive net weekly gain, higher by 6.8% and 7.4% respectively. Near term outlook threatens VIX 30s.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which saw a powerful net weekly gain of 32.7%

In the near term, the VIX 28/32 zone looks a relatively easy target. If sp'1950/25, then VIX 35/45.

--

As for TVIX and UVXY, the net weekly gains are not exactly inspiring, relative to the gain in the VIX.

However, Friday did show that TVIX/UVXY do have their moments of glory. If would seem another 50/60% upside is viable next week... if the main market declines by at least a further 4%.

--

*I am long VIX, via option calls, and hold across the weekend, seeking my next exit in the 30s.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which saw a powerful net weekly gain of 32.7%

In the near term, the VIX 28/32 zone looks a relatively easy target. If sp'1950/25, then VIX 35/45.

--

As for TVIX and UVXY, the net weekly gains are not exactly inspiring, relative to the gain in the VIX.

However, Friday did show that TVIX/UVXY do have their moments of glory. If would seem another 50/60% upside is viable next week... if the main market declines by at least a further 4%.

--

*I am long VIX, via option calls, and hold across the weekend, seeking my next exit in the 30s.

Thursday, 23 June 2016

BAC - bizarrely strong

Whilst the main market closed broadly higher - ahead of the UK vote, there was notable strength in financials, with Bank of America (BAC), settling +3.2% @ $14.04. Considering the Fed appear increasingly concerned about the growth/jobs outlook, a rate hike in the near term looks extremely unlikely, and that will surely keep BAC pinned lower.

BAC, daily

BAC, monthly

Summary

BAC is my most favoured of financial stocks.. at least from a 'safety' perspective.

In terms of price, BAC is a real mess, having been broadly stuck under the resistance of the $17/18s since spring 2014. Indeed, it has been a full TWO years, and with a Feb' low of $10.91, BAC remains unable to break up and away, as the Fed - along with other central banks, refuse to raise rates.

The financials are going to suffer for as long as rates remain low... or as is the case in the EU/Japan... actual negative rates.

Even Deutsche Bank (DB) has been loudly proclaiming NIRP as threatening the very social fabric of the EU.

-

Until BAC can clear the 200dma - currently in the $15s, I can't take the current rally seriously.

From a grander perspective, the bull maniacs need to see BAC attain a monthly close in the $18s to have real confidence that 'everything is going to be fine' in the long term.

... and frankly... that looks almost impossible to see any time within the next few years, as the Fed aren't even going to raise rates above 1%... as market consensus would agree with.

BAC, daily

BAC, monthly

Summary

BAC is my most favoured of financial stocks.. at least from a 'safety' perspective.

In terms of price, BAC is a real mess, having been broadly stuck under the resistance of the $17/18s since spring 2014. Indeed, it has been a full TWO years, and with a Feb' low of $10.91, BAC remains unable to break up and away, as the Fed - along with other central banks, refuse to raise rates.

The financials are going to suffer for as long as rates remain low... or as is the case in the EU/Japan... actual negative rates.

Even Deutsche Bank (DB) has been loudly proclaiming NIRP as threatening the very social fabric of the EU.

-

Until BAC can clear the 200dma - currently in the $15s, I can't take the current rally seriously.

From a grander perspective, the bull maniacs need to see BAC attain a monthly close in the $18s to have real confidence that 'everything is going to be fine' in the long term.

... and frankly... that looks almost impossible to see any time within the next few years, as the Fed aren't even going to raise rates above 1%... as market consensus would agree with.

Wednesday, 22 June 2016

TSLA - the market is not pleased

Whilst the main market closed moderately weak, there was very severe downside in Tesla Motors (TSLA), which settled -10.4% @ $196.66. The takeover bid for Solarcity (SCTY) has resulted in almost all analysts turning their backs on the once greatly favoured CEO of Musk.

TSLA, daily

Summary

A rough day for TSLA stock holders, as the big $200 threshold failed to hold. There were some clear 'bargain hunters' appearing at the open, but with renewed latter day weakness.

Just one of many analysts...

Oppenheimer have finally awoken to the fact that $385 is a rather nonsensical upside target.

--

To be clear, I like TSLA as an innovative company, but the underlying (if not obvious) issue is that TSLA does NOT make money.

The fact Musk now wants TSLA to take on the debts and cash-hungry company of SCTY seems borderline madness, and its somewhat a relief to see even the mainstream recognise it.

I'd not consider buying TSLA even at the Feb' low of $141.05. Maybe the 50/40s would be tempting, but even then, until TSLA makes it clear that it intends to turn a profit, there seems zero point in getting involved.

TSLA, daily

Summary

A rough day for TSLA stock holders, as the big $200 threshold failed to hold. There were some clear 'bargain hunters' appearing at the open, but with renewed latter day weakness.

Just one of many analysts...

Oppenheimer have finally awoken to the fact that $385 is a rather nonsensical upside target.

--

To be clear, I like TSLA as an innovative company, but the underlying (if not obvious) issue is that TSLA does NOT make money.

The fact Musk now wants TSLA to take on the debts and cash-hungry company of SCTY seems borderline madness, and its somewhat a relief to see even the mainstream recognise it.

I'd not consider buying TSLA even at the Feb' low of $141.05. Maybe the 50/40s would be tempting, but even then, until TSLA makes it clear that it intends to turn a profit, there seems zero point in getting involved.

Tuesday, 21 June 2016

NFLX - broadly struggling

Whilst the main market closed moderately higher, there was notable weakness in Netflix (NFLX), which settled lower by a rather significant -3.0% @ $90.97. If the main market can't break to the upside, and instead implodes, NFLX will decline to at least $70, with a secondary target of 50/45.

NFLX, daily

NFLX, monthly

Summary

Suffice to add... great shows.. some of the finest TV ever produced.

NFLX is set to increase fees for some of its services, and that is a good thing, even if some of the customers leave.

However, market valuation remains insane, and even Mr Market is no longer tolerant of this once beloved momo stock.

--

*I would consider picking up in the $50s later this year, as I'm a fan of anything Marvel related.

Bullish the Defenders !

NFLX, daily

NFLX, monthly

Summary

Suffice to add... great shows.. some of the finest TV ever produced.

NFLX is set to increase fees for some of its services, and that is a good thing, even if some of the customers leave.

However, market valuation remains insane, and even Mr Market is no longer tolerant of this once beloved momo stock.

--

*I would consider picking up in the $50s later this year, as I'm a fan of anything Marvel related.

Bullish the Defenders !

Monday, 20 June 2016

RIG - stuck under key resistance

Despite the main market settling broadly higher, there was relative weakness in the oil/gas driller of Transocean (RIG), which cooled from an early high of $11.73, settling -1.2% @ $11.18. Broader trend remains weak, stuck under the 200dma, and that is with WTIC oil having ramped from the $26s to the low $50s.

RIG, daily

RIG, monthly

Summary

RIG is one of the main energy stocks I regularly follow.

RIG has been under broad downward pressure since Oil began cooling in summer 2014, falling from the $38s to the $7s. Considering Oil has effectively doubled since February, RIG is lagging.

--

*if the main market sees an upside bullish breakout, I'd actually consider RIG - or KMI, as short/mid term upside trades in the weeks ahead... but such a market move seems unlikely.

So long as the main market does not break new historic highs, RIG shall remain on the 'disappear list'.

RIG, daily

RIG, monthly

Summary

RIG is one of the main energy stocks I regularly follow.

RIG has been under broad downward pressure since Oil began cooling in summer 2014, falling from the $38s to the $7s. Considering Oil has effectively doubled since February, RIG is lagging.

--

*if the main market sees an upside bullish breakout, I'd actually consider RIG - or KMI, as short/mid term upside trades in the weeks ahead... but such a market move seems unlikely.

So long as the main market does not break new historic highs, RIG shall remain on the 'disappear list'.

Friday, 17 June 2016

TVIX, UVXY - a second week of gains

With the VIX breaking into the 20s for the first time since March 1st, the 2x lev' bullish VIX instruments continued to climb. Despite some slight cooling into the weekend, TVIX and UXVY saw net weekly gains of 14.8% and 15.1% respectively. Near term outlook offers considerably higher volatility, with the BREXIT vote, and a wide array of other threatening issues.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which saw a net weekly gain of 14.0%

--

As for TVIX/UVXY, a second week of gains, and as volatility itself increases, the day to day.. and intraday swings are also increasing.

Price structure on the daily charts could be argued is a bull flag.

For TVIX, the $4s look a pretty easy target... 5s are within range. If the sp' breaks under the critical low of 2025, a decline to 1950/00 would likely see 6/7s.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which saw a net weekly gain of 14.0%

--

As for TVIX/UVXY, a second week of gains, and as volatility itself increases, the day to day.. and intraday swings are also increasing.

Price structure on the daily charts could be argued is a bull flag.

For TVIX, the $4s look a pretty easy target... 5s are within range. If the sp' breaks under the critical low of 2025, a decline to 1950/00 would likely see 6/7s.

Thursday, 16 June 2016

BAC - low rates remain the problem

With the Fed too afraid to raise rates, the financials remain under broad downward pressure. Bank of America (BAC) settled -0.3% @ $13.30. Unless the market can break up and away to new historic highs.. with the Fed raising... BAC looks set for much lower levels as the summer proceeds.

BAC, daily

BAC, monthly

Summary

Relative to Deutsche Bank (DB), BAC is holding together pretty well.

Seen on a giant monthly chart, BAC remains broadly weak, stuck under the 10MA. Next support is the Feb' low of $10.91, and then the psy' level of $10.00 itself.

If the main market implodes to the sp'1600s or lower, BAC will be trading around $5.00.

... eyes on the EU systemic risk that is DB... as if that implodes... the rest of the financials will be rocked... much like 2008.

--

*I like BAC for the long term... but only if US growth starts ticking upward... along with interest rates. In the short/mid term... that simply doesn't look likely.

BAC, daily

BAC, monthly

Summary

Relative to Deutsche Bank (DB), BAC is holding together pretty well.

Seen on a giant monthly chart, BAC remains broadly weak, stuck under the 10MA. Next support is the Feb' low of $10.91, and then the psy' level of $10.00 itself.

If the main market implodes to the sp'1600s or lower, BAC will be trading around $5.00.

... eyes on the EU systemic risk that is DB... as if that implodes... the rest of the financials will be rocked... much like 2008.

--

*I like BAC for the long term... but only if US growth starts ticking upward... along with interest rates. In the short/mid term... that simply doesn't look likely.

Wednesday, 15 June 2016

GDX - underlying strength

With the Fed not raising rates, Gold swung back upward, with the related mining stocks seeing a rather powerful wave of renewed buying interests. The ETF of GDX settled +3.5% @ $26.23. A break into the $30s looks due this summer... and eventually to 35/40.. if Gold 1400/1500s.

GDX, daily

GDX, monthly

Summary

Little to add.

With the Fed showing outright weakness - by refraining to raise rates, the precious metals caught a bid, with miners the sector highlight of the day.

GDX, daily

GDX, monthly

Summary

Little to add.

With the Fed showing outright weakness - by refraining to raise rates, the precious metals caught a bid, with miners the sector highlight of the day.

Tuesday, 14 June 2016

TVIX, UVXY - a day of swings

With some moderate market swings (especially in the morning), it was a mixed day for the 2x lev' bullish VIX instruments of TVIX and UVXY, settling lower by -5.2% and -4.4% respectively. Near term outlook threatens some sig' cooling of around 15/20%... before viable hyper upside into end month/early July.

TVIX, daily

UVXY, daily

Summary

Pre-market saw TVIX in the $3.70s, but then a rapid cool down to $3.20.. only for another rebound, as the main equity market cooled to a new cycle low of sp'2064.

Yet... there was a clear divergence, as TVIX did not make a new high.

*same applies to UVXY.

--

Broadly, the VIX is warning of underlying market tremors. It remains VERY notable that we didn't even need to come close to the sp'2025 low to break back above the key 20 threshold.

VIX looks set for a move into the 30s... and if correct, that will likely result in TVIX/UVXY doubling up from whatever level they cool to in the next few days.

TVIX, daily

UVXY, daily

Summary

Pre-market saw TVIX in the $3.70s, but then a rapid cool down to $3.20.. only for another rebound, as the main equity market cooled to a new cycle low of sp'2064.

Yet... there was a clear divergence, as TVIX did not make a new high.

*same applies to UVXY.

--

Broadly, the VIX is warning of underlying market tremors. It remains VERY notable that we didn't even need to come close to the sp'2025 low to break back above the key 20 threshold.

VIX looks set for a move into the 30s... and if correct, that will likely result in TVIX/UVXY doubling up from whatever level they cool to in the next few days.

Monday, 13 June 2016

GDX - short term weakness

With Gold opening higher, the related mining stocks opened higher, but there was some cooling into late afteroon. The ETF of GDX swung from an early high of $26.65, to settle -0.1% @ $25.94. There is viable near term downside to the 24/23s, but that will do nothing to negate the broader bullish trend.

GDX, daily

GDX, monthly

Summary

Little to add.

Short term weakness.. ahead of the FOMC, but broadly.. the precious metals.. and related mining stocks, are holding a broadly bullish trend.

It is highly notable the metals/miners are a broadly inverse trade to equities.

GDX, daily

GDX, monthly

Summary

Little to add.

Short term weakness.. ahead of the FOMC, but broadly.. the precious metals.. and related mining stocks, are holding a broadly bullish trend.

It is highly notable the metals/miners are a broadly inverse trade to equities.

Friday, 10 June 2016

TVIX, UVXY - climbing into the weekend

With equities cooling, and the VIX significantly higher, the 2x lev' bullish instruments of TVIX and UVXY ended the week on a strongly positive note, resulting in net weekly gains of 20.5% and 21.0% respectively. Market volatility looks set to broadly climb across June, as equities will likely at least test the key low of sp'2025.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which saw a sig' net weekly gain of 26.4%

VIX looks set for the upper teens next week. If the sp'2025 low is broken - viable in BREXIT week, then equities will accelerate lower, and that would result in VIX spiking into the 28/35 zone.

--

As for TVIX and UVXY... as I noted last weekend, the declines since the Feb' highs have been relentless.

Even if the VIX battles into the mid/upper 20s.. that will only see TVIX/UVXY claw back a portion (30/40%) of the declines.

TVIX in the $4/5s looks viable this June, but anything much above 6/7 will be very difficult, even if the market breaks under sp'2K.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which saw a sig' net weekly gain of 26.4%

VIX looks set for the upper teens next week. If the sp'2025 low is broken - viable in BREXIT week, then equities will accelerate lower, and that would result in VIX spiking into the 28/35 zone.

--

As for TVIX and UVXY... as I noted last weekend, the declines since the Feb' highs have been relentless.

Even if the VIX battles into the mid/upper 20s.. that will only see TVIX/UVXY claw back a portion (30/40%) of the declines.

TVIX in the $4/5s looks viable this June, but anything much above 6/7 will be very difficult, even if the market breaks under sp'2K.

Thursday, 9 June 2016

BAC, DB - no rate hike is bearish

The market is increasingly coming around to the realisation that the US fed won't be raising rates this June 15th, nor probably at the July meeting. The financials are thus seeing particular weakness, with Bank of America (BAC), and Deutsche Bank (DB) settling -1.7% and -2.0% respectively.

BAC, daily

DB, daily

Summary

Suffice to add.... low rates are unquestionably bearish for the financials.

DB continues to sound alarms that the policies of the ECB - especially NIRP, are a direct threat to the long term viability of the EU itself.

BAC, daily

DB, daily

Summary

Suffice to add.... low rates are unquestionably bearish for the financials.

DB continues to sound alarms that the policies of the ECB - especially NIRP, are a direct threat to the long term viability of the EU itself.

Wednesday, 8 June 2016

NFLX - the once beloved momo stock

Whilst the main market closed a little higher, there was notable weakness in Netflix (NFLX), which settled lower by a significant -2.1% @ $97.83. Price action since the Dec'7th high of $133.27, has been broadly bearish, with the recent low of May 26th marking yet another key lower high.

NFLX, daily

NFLX, monthly

Summary

I like NFLX, which continues to produce some of the finest TV ever made.. yet from a pure valuation perspective, its still over-valued - with a 'generous' forward PE in the 90s.

Relative to the main market, it is seriously struggling, with the 200dma now strong resistance just above the psy' level of $100.

If the main market fails to see a major bullish breakout (>sp'2134), and instead implodes this summer/autumn, then downside targets are...

Primary $70

Secondary $50/45.

.. I'd be interested in the $50s.. if sp'1600/1500s. Until then, I'll merely enjoy the show... and leave the stock well alone.

NFLX, daily

NFLX, monthly

Summary

I like NFLX, which continues to produce some of the finest TV ever made.. yet from a pure valuation perspective, its still over-valued - with a 'generous' forward PE in the 90s.

Relative to the main market, it is seriously struggling, with the 200dma now strong resistance just above the psy' level of $100.

If the main market fails to see a major bullish breakout (>sp'2134), and instead implodes this summer/autumn, then downside targets are...

Primary $70

Secondary $50/45.

.. I'd be interested in the $50s.. if sp'1600/1500s. Until then, I'll merely enjoy the show... and leave the stock well alone.

Tuesday, 7 June 2016

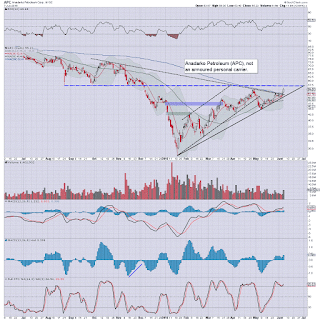

APA, APC - energy stocks broadly strong

With WTIC oil at $50, energy stocks continue their broad climb since the January lows. Apache (APA), and Anadarko Petroleum (APC), settled significantly higher by 4.7% and 3.6% respectively. If oil prices hold up, and sp >2134, both look set for the $70/80s before end 2016.

APA, daily

APC, daily

Summary

*normally, I would only highlight the daily charts.. but lets also take a look at the bigger picture.. via the monthly charts...

APA, monthly

APC, monthly

--

Key levels...

APA, $60... if taken.. then 70/80s

APC, $58... if taken.. then 70/80s.

Of the two companies, I favour APA, due to its lower debt load of around $8bn, vs. $20bn for APC.

--

*no position, but would strongly consider chasing APA, if sp >2134... with a bullish June close.

APA, daily

APC, daily

Summary

*normally, I would only highlight the daily charts.. but lets also take a look at the bigger picture.. via the monthly charts...

APA, monthly

APC, monthly

--

Key levels...

APA, $60... if taken.. then 70/80s

APC, $58... if taken.. then 70/80s.

Of the two companies, I favour APA, due to its lower debt load of around $8bn, vs. $20bn for APC.

--

*no position, but would strongly consider chasing APA, if sp >2134... with a bullish June close.

Monday, 6 June 2016

GDX - a fifth day higher

Relative to the very powerful Friday gains, the gold/silver mining stocks held up very well today. The ETF of GDX was moderately lower for much of the day, but settled net higher by 0.4% @ $24.32. Broadly, new multi-month highs look due. That bullish outlook only gets negated on a monthly close under $19.

GDX, daily

GDX, monthly

Summary

*I didn't cover the miners on Friday, and I thought I should at least highlight them today, even though the actual Monday change wasn't anything particularly noteworthy.

--

Suffice to add, the miners remain hugely above their Jan' low, with GDX having climbed from $12.40 to $26.17. Even recent cooling to the $22/21s, has done very little to negate the massive bullish breakout achieved.

--

Special note...

If US equities break >sp'2134, that would bode against the precious metals.. and by default.. the related mining stocks.

It is highly arguable that those seeking much higher levels in the mining stocks in the latter half of this year, should be seeking renewed weakness in the broader equity market.

-

There is also the secondary issue of the USD. A weaker USD almost always gives the metals/miners an extra kick upward - as we saw last Friday. However, its not always necessary, and its very possible we could see global capital market upset... with a 'flight to safety' to the USD, but with an increased 'fear bid' in Gold/Silver.

How those variables will balance out is very difficult to say, but on any basis, having declined from the $1900s, Gold remains relatively low.

GDX, daily

GDX, monthly

Summary

*I didn't cover the miners on Friday, and I thought I should at least highlight them today, even though the actual Monday change wasn't anything particularly noteworthy.

--

Suffice to add, the miners remain hugely above their Jan' low, with GDX having climbed from $12.40 to $26.17. Even recent cooling to the $22/21s, has done very little to negate the massive bullish breakout achieved.

--

Special note...

If US equities break >sp'2134, that would bode against the precious metals.. and by default.. the related mining stocks.

It is highly arguable that those seeking much higher levels in the mining stocks in the latter half of this year, should be seeking renewed weakness in the broader equity market.

-

There is also the secondary issue of the USD. A weaker USD almost always gives the metals/miners an extra kick upward - as we saw last Friday. However, its not always necessary, and its very possible we could see global capital market upset... with a 'flight to safety' to the USD, but with an increased 'fear bid' in Gold/Silver.

How those variables will balance out is very difficult to say, but on any basis, having declined from the $1900s, Gold remains relatively low.

Friday, 3 June 2016

TVIX, UVXY - another week lower

With equities holding close to historic highs, the VIX remained broadly subdued. The 2x lev' bullish instruments of TVIX and UVXY declined for a fifth consecutive week, by -8.2% and -7.9% respectively. A jump in the VIX to the key 20 threshold remains probable, but that sure won't negate much of the horror story since the Feb' high.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which saw a net weekly gain of 2.7%.

--

Outlook on the VIX...

A test of the key 20 threshold seems extremely probable, but will that be it for the summer?

If US equities can achieve the unthinkable, with sp >2134, then VIX will remain broadly subdued <20 for the remainder of the year.

Best guess... VIX 25/30 zone (if briefly), but that outlook is dropped on any move much above sp'2111/16.

--

As for TVIX and UVXY, a fifth consecutive week of horror, and the 14'th weekly decline of the past 17.

Since the Feb'11th high....

TVIX $13.58 > $2.24, a net decline of -83.5%

UVXY $61.92 > $9.99, a net decline of -83.9%

--

As ever.. long term holds (as in 1-2 months or greater) rarely end well.

Even for those who bought TVIX in the $5s or $4s in March/April, will likely require the VIX to spike to the 20/25 zone to have any chance of a breakeven exit.

Those who bought in the 6s or higher, are going to almost certainly exit for a loss in June, or will merely see further decay.

It is inevitable that TVIX/UVXY will see periodic reverse splits, as a result of the statistical decay issue, inherent fees, and the costs involved within the instrument as VIX futures are regularly rolled across to the next month.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which saw a net weekly gain of 2.7%.

--

Outlook on the VIX...

A test of the key 20 threshold seems extremely probable, but will that be it for the summer?

If US equities can achieve the unthinkable, with sp >2134, then VIX will remain broadly subdued <20 for the remainder of the year.

Best guess... VIX 25/30 zone (if briefly), but that outlook is dropped on any move much above sp'2111/16.

--

As for TVIX and UVXY, a fifth consecutive week of horror, and the 14'th weekly decline of the past 17.

Since the Feb'11th high....

TVIX $13.58 > $2.24, a net decline of -83.5%

UVXY $61.92 > $9.99, a net decline of -83.9%

--

As ever.. long term holds (as in 1-2 months or greater) rarely end well.

Even for those who bought TVIX in the $5s or $4s in March/April, will likely require the VIX to spike to the 20/25 zone to have any chance of a breakeven exit.

Those who bought in the 6s or higher, are going to almost certainly exit for a loss in June, or will merely see further decay.

It is inevitable that TVIX/UVXY will see periodic reverse splits, as a result of the statistical decay issue, inherent fees, and the costs involved within the instrument as VIX futures are regularly rolled across to the next month.

Thursday, 2 June 2016

AAPL - bearish against consensus

Whilst the main market remained broadly stuck close to the sp'2100 threshold, there was once again notable weakness in Apple (AAPL), which settled -0.8% @ $97.69. If the broader market unravels this summer/autumn, AAPL remains highly vulnerable.

AAPL, daily

Winer - guest (CNBC)

Summary

There is an awful lot of chatter about the tech behemoth that is AAPL. From the issue that the product cycle for the iPhone7 is likely to span 3 years - rather than two, to very spurious comments from TSLA CEO Musk, about a possible iCar by 2020.

AAPL will certainly remain a key tech player for the long term, but market sentiment has become quite sour since the April high of $131.29.

During the lunch time show on CNBC, one guest/analyst - Winer, was one of the few who are seeking renewed downside. Ironically though, his $85 target is a mere $4 below the recent May 12'th low of $89.47.

--

The bigger monthly view...

The 10MA ($103s) is currently one particularly important aspect of upside resistance, and unless AAPL can settle June >$105, broader price action is still leaning bearish.

Having recently seen the $89s, if the main market implodes to the sp'1600s, the next natural fibonacci target would be around $70.

AAPL, daily

Winer - guest (CNBC)

Summary

There is an awful lot of chatter about the tech behemoth that is AAPL. From the issue that the product cycle for the iPhone7 is likely to span 3 years - rather than two, to very spurious comments from TSLA CEO Musk, about a possible iCar by 2020.

AAPL will certainly remain a key tech player for the long term, but market sentiment has become quite sour since the April high of $131.29.

During the lunch time show on CNBC, one guest/analyst - Winer, was one of the few who are seeking renewed downside. Ironically though, his $85 target is a mere $4 below the recent May 12'th low of $89.47.

--

The bigger monthly view...

The 10MA ($103s) is currently one particularly important aspect of upside resistance, and unless AAPL can settle June >$105, broader price action is still leaning bearish.

Having recently seen the $89s, if the main market implodes to the sp'1600s, the next natural fibonacci target would be around $70.

Wednesday, 1 June 2016

F, GM, TSLA - broadly struggling

Whilst the main market closed moderately mixed, there was notable weakness in motor vehicle manufacturers. Ford (F), General Motors (GM), and Tesla (TSLA) settled significantly lower by -2.9%, -3.4% and -1.7% respectively. Broadly, the trio look highly vulnerable across the summer.

F, daily

GM, daily

TSLA, daily

Summary

*I don't chart/follow GM, but it merits an inclusion, after today's lousy May sales data

--

Suffice to add, of the three, I favour Ford, as it notably never required a bailout from the US taxpayer.

TSLA is an industry leader in terms of innovation, but it remains a loss making venture. Further capital injections will be necessary to have any hope of meeting the touted 500k annual production target, and many analysts seem resigned TSLA will struggle just to achieve half that number.

--

In terms of price... if the main market rolls lower again this June/July, first targets will be..

F - the low $11s

GM - $26s

TSLA - $150/140s.

F, daily

GM, daily

TSLA, daily

Summary

*I don't chart/follow GM, but it merits an inclusion, after today's lousy May sales data

--

Suffice to add, of the three, I favour Ford, as it notably never required a bailout from the US taxpayer.

TSLA is an industry leader in terms of innovation, but it remains a loss making venture. Further capital injections will be necessary to have any hope of meeting the touted 500k annual production target, and many analysts seem resigned TSLA will struggle just to achieve half that number.

--

In terms of price... if the main market rolls lower again this June/July, first targets will be..

F - the low $11s

GM - $26s

TSLA - $150/140s.

Subscribe to:

Comments (Atom)