With the precious metals of Gold and Silver seeing rather severe net monthly declines, the related mining stocks were naturally dragged massively lower. The ETF of GDX settled the day -1.9% @ $20.83, which made for a net monthly decline of -15.1%. Near/mid term outlook remains outright bearish.

GDX, daily

GDX, monthly

Summary

Its pretty straight forward...

Higher USD - as interest rate expectations are really starting to ramp.

The higher USD is putting natural downward pressure on the precious metals.

With economic/market sentiment at the best levels since 2007, the precious metals are losing more of their inherent 'fear bid'.

With the precious metals lower, the Gold/Silver miners have duly repriced to the downside. The only issue now is whether GDX puts in a higher low, or breaks below the Jan'2016 low of $12.40.

The one indirectly bullish aspect for Gold/Silver is Copper

Copper, with Gold/Silver, monthly, 20yr.

Its difficult to see Copper continue to climb across much of 2017, without Gold/Silver not eventually catching up.

Wednesday, 30 November 2016

Tuesday, 29 November 2016

CNX - rising as the war on coal is ending

Whilst the main market settled moderately higher, there was notable strength in Consol Energy (CNX), which settled +2.6% @ $20.25. November is set to close very bullish, with the $26-28 zone probable by late spring/early summer 2017.

CNX, daily

CNX, monthly

Summary

It has been a very long time since I highlighted any of the coal miners. Since I started posting here in spring 2012, all but one of the old familiar names has imploded, and been effectively delisted to the pink/junk sheets.

Consol is the last surviving properly-listed US coal miner. It imploded from the $47s in summer 2014 to a low of $4.53 this past January.

Effectively, CNX has since hyper-ramped 300% across the year, back to levels last seen in July 2015. From a pure price perspective, there really isn't anything but empty air to the 26/28 zone.

In terms of profitability, CNX is still struggling... see: http://finance.yahoo.com/quote/CNX/key-statistics?p=CNX

The war on coal ending

For those who watched the many Trump rallies, one particularly regular issue was the notion of ending the 'War on coal'. A Trump administration will no doubt help the coal industry to some extent, not least in terms of levelling the playing field against solar.

Further, most fail to realise that besides energy production, coal has many industrial uses.

It will be interesting to see how CNX trades into next spring, and how much President Trump highlights the coal mining industry.

CNX, daily

CNX, monthly

Summary

It has been a very long time since I highlighted any of the coal miners. Since I started posting here in spring 2012, all but one of the old familiar names has imploded, and been effectively delisted to the pink/junk sheets.

Consol is the last surviving properly-listed US coal miner. It imploded from the $47s in summer 2014 to a low of $4.53 this past January.

Effectively, CNX has since hyper-ramped 300% across the year, back to levels last seen in July 2015. From a pure price perspective, there really isn't anything but empty air to the 26/28 zone.

In terms of profitability, CNX is still struggling... see: http://finance.yahoo.com/quote/CNX/key-statistics?p=CNX

The war on coal ending

For those who watched the many Trump rallies, one particularly regular issue was the notion of ending the 'War on coal'. A Trump administration will no doubt help the coal industry to some extent, not least in terms of levelling the playing field against solar.

Further, most fail to realise that besides energy production, coal has many industrial uses.

It will be interesting to see how CNX trades into next spring, and how much President Trump highlights the coal mining industry.

Monday, 28 November 2016

GDX - miners bounce with the metals

With the precious metals starting the week on a broadly positive note (Gold +$11, Silver +0.9%), the related miners similarly built gains. The ETF of GDX settled +3.8% @ $21.40. There remains powerful resistance from $25-26, and mid term outlook remains bearish until a daily close >$26.00.

GDX, daily

GDX, monthly

Summary

Even if the metals can claw a little higher across the remaining two days of the month, November is still on track to settle extremely bearish for gold/silver, and the related miners.

Indeed, the monthly candles are highly suggestive that December will break new multi-month lows.

The real issue is whether GDX will eventually retrace fully back to the Jan'2016 low of $12.40, but that is a very considerable 40% or so lower.

yours... eyes on GG, ABX, KGC, AUY, and a fair few others.

GDX, daily

GDX, monthly

Summary

Even if the metals can claw a little higher across the remaining two days of the month, November is still on track to settle extremely bearish for gold/silver, and the related miners.

Indeed, the monthly candles are highly suggestive that December will break new multi-month lows.

The real issue is whether GDX will eventually retrace fully back to the Jan'2016 low of $12.40, but that is a very considerable 40% or so lower.

yours... eyes on GG, ABX, KGC, AUY, and a fair few others.

Friday, 25 November 2016

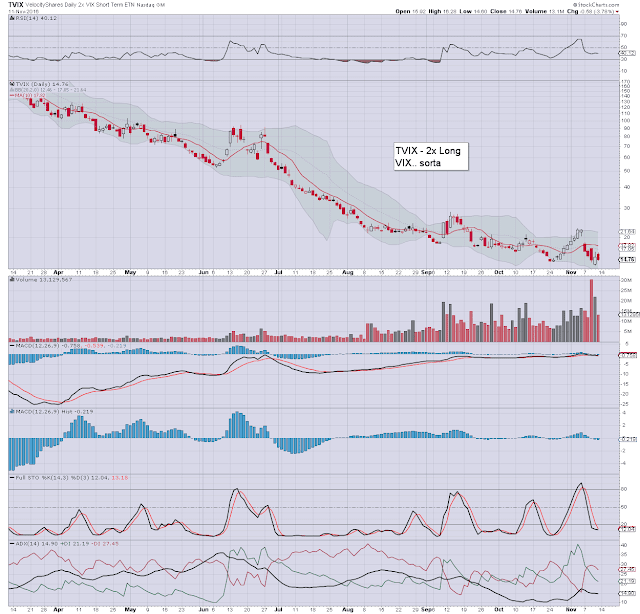

TVIX, UVXY - a third week lower

With equities breaking new historic highs, the VIX continued to cool, with the 2x lev' bullish instruments of TVIX and UVXY both settling lower by -8.2%. Near term outlook offers little realistic hope of any significant climb in the VIX, with TVIX/UVXY set to broadly decay into early 2017.

TVIX, daily

UVXY, daily

Summary

First, an update on the VIX, which saw a net weekly decline of -3.7%.

--

As for TVIX and UVXY, it was merely a week of further decay, as the VIX remains subdued in the 13/12s.

At best, the most realistic retrace for the equity bears is a test of the 50dma, which by mid December will be around sp'2165/70. That might briefly equate to VIX 16/17s. Anything >20 looks highly difficult, as the equity market is regularly breaking new historic highs.

-

*As ever, such leveraged instruments suffer from near relentless decay. Holding overnight, across the weekend, or a few weeks, rarely ends well.

**yours truly has ZERO interest in being long-VIX, as the equity market looks set for broad upside into early spring 2017.

TVIX, daily

UVXY, daily

Summary

First, an update on the VIX, which saw a net weekly decline of -3.7%.

--

As for TVIX and UVXY, it was merely a week of further decay, as the VIX remains subdued in the 13/12s.

At best, the most realistic retrace for the equity bears is a test of the 50dma, which by mid December will be around sp'2165/70. That might briefly equate to VIX 16/17s. Anything >20 looks highly difficult, as the equity market is regularly breaking new historic highs.

-

*As ever, such leveraged instruments suffer from near relentless decay. Holding overnight, across the weekend, or a few weeks, rarely ends well.

**yours truly has ZERO interest in being long-VIX, as the equity market looks set for broad upside into early spring 2017.

Wednesday, 23 November 2016

GDX - miners buried as metals trashed

With the USD continuing to climb, the precious metals saw another significant wave lower. The miner ETF of GDX duly imploded (intra low 20.14), settling -4.8% @ $20.52. Near term outlook threatens a bounce, but mid term outlook remains bearish, unless GDX >$26.

GDX, daily

GDX, monthly

Summary

Suffice to add, with Gold <$1200, and Silver in the low $16s, it was no surprise to see the related mining stocks very significantly lower.

With the USD comfortably holding above the giant psy' level of DXY 100, its difficult to see how the metals and related miners, are going to be able to break out of the downward trend that began this summer.

As ever... one day a time, but for now, those gold bugs whose portfolios are filled with gold/silver mining stocks don't have much realistic hope of things reversing any time soon.

--

*the next post on this page will appear Friday.

GDX, daily

GDX, monthly

Summary

Suffice to add, with Gold <$1200, and Silver in the low $16s, it was no surprise to see the related mining stocks very significantly lower.

With the USD comfortably holding above the giant psy' level of DXY 100, its difficult to see how the metals and related miners, are going to be able to break out of the downward trend that began this summer.

As ever... one day a time, but for now, those gold bugs whose portfolios are filled with gold/silver mining stocks don't have much realistic hope of things reversing any time soon.

--

*the next post on this page will appear Friday.

Tuesday, 22 November 2016

DAL, UAL - airlines cruising broadly higher

Along with the main transportation index, it was another bullish day for airline stocks, with Delta (DAL) and United (UAL) settling higher by 0.6% and 0.8% respectively. Near term outlook offers some chop, but with further broad upside into early 2017.

DAL, daily

UAL, daily

Summary

Suffice to add... the gains since June lows have been rather monstrous, with DAL climbing from $32.27, to the $49s, and UAL from $37.41 to the $70s.

On any basis, short term... arguably overbought, but mid/long term outlook is bullish.

--

*Of the two, yours truly prefers DAL, as the stock itself is generally more stable than the more volatile UAL.

--

Airline chatter from Pete Najarian

--

DAL, daily

UAL, daily

Summary

Suffice to add... the gains since June lows have been rather monstrous, with DAL climbing from $32.27, to the $49s, and UAL from $37.41 to the $70s.

On any basis, short term... arguably overbought, but mid/long term outlook is bullish.

--

*Of the two, yours truly prefers DAL, as the stock itself is generally more stable than the more volatile UAL.

--

Airline chatter from Pete Najarian

--

Monday, 21 November 2016

FCX - pushing broadly higher

Whilst there were a quartet of historic highs in the main indexes, there was notable strength in Freeport McMoran (FCX), which settled +5.6% @ $14.51, the best level since July 2015. Near/mid term outlook offers a run to old support - now resistance, in the $17s. More broadly, if Copper >$3, then FCX $20.

FCX, daily

FCX, monthly

Summary

Seen on the giant monthly cycle, there is a clear multi-month bull flag.. already provisionally confirmed.

Further strength seems probable, at least to around $17.

Will FCX require $4.00 copper prices, to see $20.00 ? Difficult to say. What is clear, the downward trend in copper - that stretched across FIVE years has concluded. Similarly, the powerful downward run in FCX from July 2014 ($37.52), concluded in Jan'2016 @ $3.52.

Indeed, as things are, FCX has effectively doubled from the 2015 close.

FCX, daily

FCX, monthly

Summary

Seen on the giant monthly cycle, there is a clear multi-month bull flag.. already provisionally confirmed.

Further strength seems probable, at least to around $17.

Will FCX require $4.00 copper prices, to see $20.00 ? Difficult to say. What is clear, the downward trend in copper - that stretched across FIVE years has concluded. Similarly, the powerful downward run in FCX from July 2014 ($37.52), concluded in Jan'2016 @ $3.52.

Indeed, as things are, FCX has effectively doubled from the 2015 close.

Friday, 18 November 2016

TVIX, UVXY - a second week lower

With equities continuing to climb, and the VIX still cooling, the 2x lev' bullish instruments of TVIX and UVXY saw a second week of sig' declines, settling lower by -14.8% and -14.9% respectively. Near term outlook threatens VIX 16/17s, but at best.. that might only translate to 10/15% for TVIX/UVXY.

TVIX, daily

UVXY, daily

Summary

First, an update on the VIX, which saw a net weekly decline of -9.3%

--

As for TVIX and UVXY, with the equity market still battling upward, the bullish VIX instruments were ground lower across the week.

At best.. if VIX 17s - with sp'2150s, TVIX/UVXY will merely pop back to levels from the start of this week.

--

As ever, holding such leveraged instruments across multiple days.. or worse.. weeks, very rarely ends well.

*yours truly sees broader upside in US equities into 2017, and has ZERO interest in being long the VIX for some months. That view only is only re-considered if sp <2100, which does not look likely for the remainder of the year.

TVIX, daily

UVXY, daily

Summary

First, an update on the VIX, which saw a net weekly decline of -9.3%

--

As for TVIX and UVXY, with the equity market still battling upward, the bullish VIX instruments were ground lower across the week.

At best.. if VIX 17s - with sp'2150s, TVIX/UVXY will merely pop back to levels from the start of this week.

--

As ever, holding such leveraged instruments across multiple days.. or worse.. weeks, very rarely ends well.

*yours truly sees broader upside in US equities into 2017, and has ZERO interest in being long the VIX for some months. That view only is only re-considered if sp <2100, which does not look likely for the remainder of the year.

Thursday, 17 November 2016

GDX - miners still broadly struggling

With the USD continuing to climb, the precious metals were unable to hold early moderate gains, with Gold settling -$7, and Silver -1.5%. The related mining stocks were naturally under pressure, with the ETF of GDX -2.4% @ $21.31. Near/mid term outlook is bearish.

GDX, daily

GDX, monthly

Summary

Strong USD > weak metals > weak miners.

Its really that simple.

Considering the USD is now sustainably trading above the giant DXY 100 threshold, the mid/long term outlook for Gold/Silver - and by default.. the related miners, is increasingly bearish.

GDX, daily

GDX, monthly

Summary

Strong USD > weak metals > weak miners.

Its really that simple.

Considering the USD is now sustainably trading above the giant DXY 100 threshold, the mid/long term outlook for Gold/Silver - and by default.. the related miners, is increasingly bearish.

Wednesday, 16 November 2016

DIS - Lord Vader is on his way

Whilst the broader equity market saw a day of minor chop, there was notable significant strength in Disney (DIS), which settled higher by 1.5% @ $99.13, the highest close since mid July. Near term outlook offers the giant psy' level of $100, with the 102/106 zone before year end.

DIS,daily

DIS, monthly

Summary

Suffice to add... DIS has climbed around 10% since the mid October low. Clearly, broader upside in the main market has helped.

Clearing above the gap zone of 102/106 won't be easy, but it'll be easier than the recent task of trying to clear the 200dma in the $96s.

Seen on the giant monthly cycle, DIS is set for a rather grand up wave into 2017. An eventual break above the Aug'2015 high of $120.43 looks probable.

--

Meanwhile... even Kylo Ren is looking forward to Rogue One.

:)

DIS,daily

DIS, monthly

Summary

Suffice to add... DIS has climbed around 10% since the mid October low. Clearly, broader upside in the main market has helped.

Clearing above the gap zone of 102/106 won't be easy, but it'll be easier than the recent task of trying to clear the 200dma in the $96s.

Seen on the giant monthly cycle, DIS is set for a rather grand up wave into 2017. An eventual break above the Aug'2015 high of $120.43 looks probable.

--

Meanwhile... even Kylo Ren is looking forward to Rogue One.

:)

Tuesday, 15 November 2016

GDX - a second day for the miners

Whilst the main equity market settled broadly higher, there was notable strength in the gold/silver mining stocks, with the ETF of GDX settling +4.3% @ $22.03. Near term outlook is bullish, but there remains huge upside resistance within the $24/26 zone.

GDX, daily

GDX, monthly

Summary

Relative to the precious metals - which saw moderate gains, the mining stocks actually had a rather strong day.

Yet the two day decline last Thurs/Friday was so severe that despite two sig' daily gains, GDX is still below the Thursday close. Seen on the giant monthly cycle, we're currently -10.1% on the month. It can be argued price structure is offering a giant multi-month bull flag, but we'll only have provisional confirmation of that with some daily closes >$26.

Cyclically, short-term, the miners are clearly vulnerable to further upside, but the broader mid term bearish trend remains intact. Only negated on a break >$26.

--

*its notable that a death cross is due within a few days, as the 50dma is set to cross under the 200dma. There will indeed be a great deal of resistance in the $24s.

GDX, daily

GDX, monthly

Summary

Relative to the precious metals - which saw moderate gains, the mining stocks actually had a rather strong day.

Yet the two day decline last Thurs/Friday was so severe that despite two sig' daily gains, GDX is still below the Thursday close. Seen on the giant monthly cycle, we're currently -10.1% on the month. It can be argued price structure is offering a giant multi-month bull flag, but we'll only have provisional confirmation of that with some daily closes >$26.

Cyclically, short-term, the miners are clearly vulnerable to further upside, but the broader mid term bearish trend remains intact. Only negated on a break >$26.

--

*its notable that a death cross is due within a few days, as the 50dma is set to cross under the 200dma. There will indeed be a great deal of resistance in the $24s.

Monday, 14 November 2016

BAC - already in the $20s

Whilst the broader market closed rather mixed, there was continued super strength in Bank of America (BAC) settling higher for a fourth consecutive day, +5.6% @ $20.09 (intra high 20.20). Today was the highest level since Nov' 2008. Mid/long term outlook is bullish to 25/26.

BAC, daily

BAC, monthly

Summary

Last week's break above the $18 threshold was very significant, and it bode for a run to the $20 threshold before year end.

Frankly, even I'm surprised to see BAC already hit $20... and its still only mid November.

Regardless of near term cooling - which is a serious threat after a ramp from the low $17s, the broadly outlook is strongly bullish, as US int' rates are set to increase. Higher rates ARE bullish for the financials, and indeed the broader economy/market.

BAC, daily

BAC, monthly

Summary

Last week's break above the $18 threshold was very significant, and it bode for a run to the $20 threshold before year end.

Frankly, even I'm surprised to see BAC already hit $20... and its still only mid November.

Regardless of near term cooling - which is a serious threat after a ramp from the low $17s, the broadly outlook is strongly bullish, as US int' rates are set to increase. Higher rates ARE bullish for the financials, and indeed the broader economy/market.

Friday, 11 November 2016

TVIX, UVXY - post election implosion

With the uncertainty of the election out of the way, equities soared, and the VIX collapsed. The 2x lev' bullish instruments of TVIX and UVXY duly imploded, with net weekly declines of -33.5% and -33.6% respectively. Near term outlook offers moderate upside next Mon/Tue, but decaying across the mid/long term.... as.... ever.

TVIX, daily

UVXY, daily

Summary

First, an update on the VIX, which saw a net weekly decline of -37.0%

Note the underlying (blue bar histogram) cycle, which is on the high side, and has ticked lower this week. In theory, the VIX can broadly cool all the way into Jan' 2017.

--

As for TVIX and UVXY... it was looking rather good overnight Tuesday. With the futures showing the equiv' of sp' -107 handles, and the VIX +40% to around 23.

Despite equities opening significantly lower on Wednesday, the VIX still gaped significantly lower.

The sp' will probably cool a little early next week to at least test the 50dma around 2145, but that will likely only inspire the VIX to the 16/17s. Broadly, the market looks strong into end month, and indeed, into early 2017.

--

As ever... holding such instruments overnight, across the weekend, or worse.. multiple weeks.. almost always ends badly.. due to a number of issues... not least.. statistical decay.

TVIX, daily

UVXY, daily

Summary

First, an update on the VIX, which saw a net weekly decline of -37.0%

Note the underlying (blue bar histogram) cycle, which is on the high side, and has ticked lower this week. In theory, the VIX can broadly cool all the way into Jan' 2017.

--

As for TVIX and UVXY... it was looking rather good overnight Tuesday. With the futures showing the equiv' of sp' -107 handles, and the VIX +40% to around 23.

Despite equities opening significantly lower on Wednesday, the VIX still gaped significantly lower.

The sp' will probably cool a little early next week to at least test the 50dma around 2145, but that will likely only inspire the VIX to the 16/17s. Broadly, the market looks strong into end month, and indeed, into early 2017.

--

As ever... holding such instruments overnight, across the weekend, or worse.. multiple weeks.. almost always ends badly.. due to a number of issues... not least.. statistical decay.

Thursday, 10 November 2016

BAC - higher rates are bullish

Whilst the main equity indexes settled pretty mixed, there was notably powerful strength in financials, with Bank of America (BAC) settling +4.3% @ $18.75. The break above the $18 threshold is hugely significant. First stop is the psy' level of $20, and then 25/26... whether late 2017 or early 2018.

BAC, daily

BAC, monthly

Summary

Yesterday saw the algo-bots briefly test the $18 threshold. Today's close was extremely bullish. Now its merely a case of whether Nov' will settle >$18.

I've been waiting for this bullish break in BAC for a few years... and its finally occurred.

BAC >$18 has massively bullish implications for the broader equity market into 2017.. and probably at least part of 2018.

... as a number of other traders agree.

BAC, daily

BAC, monthly

Summary

Yesterday saw the algo-bots briefly test the $18 threshold. Today's close was extremely bullish. Now its merely a case of whether Nov' will settle >$18.

I've been waiting for this bullish break in BAC for a few years... and its finally occurred.

BAC >$18 has massively bullish implications for the broader equity market into 2017.. and probably at least part of 2018.

... as a number of other traders agree.

Wednesday, 9 November 2016

F - reversing with the main market

Ford (F) had a similar day to the broader equity market, opening significantly lower, but settling +0.9% @ $11.58. Near term outlook threatens a little cooling, but broadly, it would seem we have a key mid term low of $11.00. Things turn broadly bullish on a move above the $14 threshold.

F, daily

F, monthly

Summary

Suffice to say... a short term low of $11.00, and even if the market cools 1-2% across the next few days, it'd seem highly probable that the broad weakness that began in late July has concluded.

Seen on the giant monthly cycle, underlying MACD (green bar histogram) cycle remains on the low end, and will be highly vulnerable to turning positive in early 2017.

For now.. things only turn provisionally bullish with a move back above the 200dma - currently in the $12.40s.

F, daily

F, monthly

Summary

Suffice to say... a short term low of $11.00, and even if the market cools 1-2% across the next few days, it'd seem highly probable that the broad weakness that began in late July has concluded.

Seen on the giant monthly cycle, underlying MACD (green bar histogram) cycle remains on the low end, and will be highly vulnerable to turning positive in early 2017.

For now.. things only turn provisionally bullish with a move back above the 200dma - currently in the $12.40s.

Tuesday, 8 November 2016

FCX - surging with Copper

Whilst the main market closed higher for a second consecutive day, there was very significant strength in the copper miners, with Freeport McMoran settling +7.2% @ $12.10, the best close since late August. Near term outlook remains mixed, and things only turn outright bullish with a break above the $14 threshold.

FCX, daily

FCX, monthly

Summary

With copper prices in the $2.30s - the highest level since Nov'2015, the copper miners - such as FCX and TCK, had a very bullish day.

--

Broader price action since April has been very choppy.

FCX has a strong short term floor of around $9.50, with huge resistance at the $14 threshold. Things turn VERY bullish on any daily closes in the 14s. By definition, from there... $20.. by late spring/early summer 2017.

FCX, daily

FCX, monthly

Summary

With copper prices in the $2.30s - the highest level since Nov'2015, the copper miners - such as FCX and TCK, had a very bullish day.

--

Broader price action since April has been very choppy.

FCX has a strong short term floor of around $9.50, with huge resistance at the $14 threshold. Things turn VERY bullish on any daily closes in the 14s. By definition, from there... $20.. by late spring/early summer 2017.

Monday, 7 November 2016

GDX - miners dig deep

Whilst the broader equity market saw very powerful pre-election gains, the gold/silver miners were under massive downward pressure, as gold/silver prices plunged. The ETF of GDX settled -4.0% @ $24.07. There is clear resistance around $26... and until that is broken above, the mid term outlook remains bearish.

GDX, daily

GDX, monthly

Summary

Suffice to add, the stronger USD (+0.7% in the DXY 97.70s) sure didn't help today, with gold/silver prices opening significantly lower, and broadly cooling across the day.

Naturally, the mining stocks followed.... despite strong gains in the main market.

The result of this week's election does offer HIGH threat of a whipsaw back upward in the metals/miners... but as noted... the mid term outlook is still bearish unless upside resistance is broken AND held above.

GDX, daily

GDX, monthly

Summary

Suffice to add, the stronger USD (+0.7% in the DXY 97.70s) sure didn't help today, with gold/silver prices opening significantly lower, and broadly cooling across the day.

Naturally, the mining stocks followed.... despite strong gains in the main market.

The result of this week's election does offer HIGH threat of a whipsaw back upward in the metals/miners... but as noted... the mid term outlook is still bearish unless upside resistance is broken AND held above.

Friday, 4 November 2016

TVIX, UVXY - powerful net weekly gains

With equities sliding for a second week, the VIX continued to climb, and that resulted in the 2x lev' bullish instruments of TVIX and UVXY seeing powerful net weekly gains of 28.4% and 28.3% respectively. Near term outlook offers further VIX upside to 25/30, before cooling into end month.

TVIX, daily

UVXY, daily

Summary

First, an update on the VIX, which saw a net weekly gain of 39.0%

--

As for TVIX and UVXY, it was indeed a rather strong week, with both pushing up against first resistance of their upper daily bollingers.

Clearly, the mainstream and market are NOT expecting a Trump victory. Considering current equity downward momentum, there is HIGH potential for a major equity washout/capitulation next Wednesday.

With the VIX already having seen the 23s, next target of 25/26 looks easy. The 30s now look rather probable.. whether into the Tuesday close.. or at the Wed' open.

--

Special note...

It should be clear that once the election result is absorbed by the mainstream/market, that volatility - whether VIX 25, 30.. or even far higher, will be extremely prone to cool for the remainder of the month.

Unless equities completely implode (<sp'1900), the VIX is not going to be able to sustain above the key 20 threshold.

TVIX and UVXY would thus lose not just all of their gains, but break new historic lows before year end. The very nature of such instruments means the higher the volatility, the more severe the problem of 'statistical decay' becomes!.

TVIX, daily

UVXY, daily

Summary

First, an update on the VIX, which saw a net weekly gain of 39.0%

--

As for TVIX and UVXY, it was indeed a rather strong week, with both pushing up against first resistance of their upper daily bollingers.

Clearly, the mainstream and market are NOT expecting a Trump victory. Considering current equity downward momentum, there is HIGH potential for a major equity washout/capitulation next Wednesday.

With the VIX already having seen the 23s, next target of 25/26 looks easy. The 30s now look rather probable.. whether into the Tuesday close.. or at the Wed' open.

--

Special note...

It should be clear that once the election result is absorbed by the mainstream/market, that volatility - whether VIX 25, 30.. or even far higher, will be extremely prone to cool for the remainder of the month.

Unless equities completely implode (<sp'1900), the VIX is not going to be able to sustain above the key 20 threshold.

TVIX and UVXY would thus lose not just all of their gains, but break new historic lows before year end. The very nature of such instruments means the higher the volatility, the more severe the problem of 'statistical decay' becomes!.

Thursday, 3 November 2016

DIS - another day closer to Rogue One

Whilst the broader market saw a day of moderate swings, there was notable strength in Disney (DIS), settling +1.6% @ $93.37. Even if sp'2070/60s, DIS should be able to hold the recent low of $90.31. More broadly, further upside above the 200dma looks viable within the near term.

DIS, daily

DIS, monthly

Summary

Suffice to add, relative to the market, Disney had a particularly strong day.

First support is at the recent low of $90.31.

More broadly, if the broader market can rally once the election is out of the way, first big target for DIS is the 200dma in the $96s, and then the price gap zone of 102/106. Certainly, the latter still seems within range before year end, not least if the market can break new historic highs into the sp'2200s.

*Q3 earnings are due Nov'10th, AH.

--

yours... still bullish X-wings

DIS, daily

DIS, monthly

Summary

Suffice to add, relative to the market, Disney had a particularly strong day.

First support is at the recent low of $90.31.

More broadly, if the broader market can rally once the election is out of the way, first big target for DIS is the 200dma in the $96s, and then the price gap zone of 102/106. Certainly, the latter still seems within range before year end, not least if the market can break new historic highs into the sp'2200s.

*Q3 earnings are due Nov'10th, AH.

--

yours... still bullish X-wings

Wednesday, 2 November 2016

F - headed toward the February low

Whilst the main market closed moderately mixed, there was further significant weakness in Ford (F), which settled -1.8% @ $11.40, the lowest level since late February. There is little support until price cluster of $11.20/00, and then the Feb'3rd low of $10.65.

F, daily

F, monthly

Summary

Suffice to add... Ford remains one of the market's most unloved corporate giants.

Forward PE - if extrapolating from Q3 earnings, is no higher than 11/10. Based on mainstream estimates, the PE is arguably in the 6s.

The current yield is 5.1%... and there seems no reason to believe the dividend will be cut.

--

Seen on the giant monthly cycle, the $16 threshold remains massively powerful resistance. For the more 'conservatively bullish' out there, it remains a case of waiting for a monthly close in the $16s before getting involved. With the current price in the mid $11s though, that is a clear 40% higher.

F, daily

F, monthly

Summary

Suffice to add... Ford remains one of the market's most unloved corporate giants.

Forward PE - if extrapolating from Q3 earnings, is no higher than 11/10. Based on mainstream estimates, the PE is arguably in the 6s.

The current yield is 5.1%... and there seems no reason to believe the dividend will be cut.

--

Seen on the giant monthly cycle, the $16 threshold remains massively powerful resistance. For the more 'conservatively bullish' out there, it remains a case of waiting for a monthly close in the $16s before getting involved. With the current price in the mid $11s though, that is a clear 40% higher.

Tuesday, 1 November 2016

GDX - miners rising as the metals climb

With USD starting to cool ahead of the US election, the precious metals saw some significant gains, with the related mining stocks similarly pushing upward. The ETF of GDX settled higher for a third consecutive day, +2.6% @ $25.15, and is now approaching key resistance.

GDX, daily

GDX, monthly

Summary

Suffice to add... USD weak... > metals higher.. and despite the broader equity market, the mining stocks saw very significant gains.

Further upside into the $26s would bode provisionally bullish for the mid/long term.

To have clarity the wave from August-October was merely a correction, mining bulls should be seeking a weekly close >$28 before year end.

GDX, daily

GDX, monthly

Summary

Suffice to add... USD weak... > metals higher.. and despite the broader equity market, the mining stocks saw very significant gains.

Further upside into the $26s would bode provisionally bullish for the mid/long term.

To have clarity the wave from August-October was merely a correction, mining bulls should be seeking a weekly close >$28 before year end.

Subscribe to:

Comments (Atom)