Barrick Gold (ABX) ended the month on a rather negative note, settling the day -1.7% at $18.58, but that still made for a net February gain of 0.9%. Near term outlook is bullish, as the precious metals have a basic 2-3% of upside - to around the Gold $1300 threshold, with Silver in the $19s.

ABX, daily

ABX, monthly

Summary

Tuesday afternoon saw the gold miners implode (for no apparent reason, other than the algo-bots trying to wash out a set of long-stops). The same pattern was seen today, as morning gains were negated with some distinct afternoon weakness. Today saw a seventh consecutive net daily decline (the most bearish run since July 2015 - 10 days down). The closing daily candle was a clear spike reaction from a test of the 200dma.

As things are, a golden cross (50dma above the 200dma) still looks due in the first half of March.

Broadly, the Gold Miners are all leaning upward, as the precious metals are rising month over month.

--

I cover ABX in depth.. along with GDX, and 12 other individual Gold mining stocks in my first report...

For details: http://permabeardoomster.blogspot.com/p/research-reports.html

yours...

bullish GDX, ABX.. and a fair few other things

Tuesday, 28 February 2017

Monday, 27 February 2017

GDX - short term weakness

The precious metals and miners saw some significant gains by late morning, but the short term trend from early February resumed, with the ETF of GDX settling lower by a very significant -5.6% at $22.78. The 50dma is now being tested. Any daily closes <$22.00 would threaten an unravelling back to the Dec'2016 low, but that looks unlikely.

GDX, daily

GDX, monthly

Summary

It was a day of two halves for the Gold miners. The morning saw some gains by late morning, as Gold/Silver had built moderate gains.

Yet, the afternoon saw a very sharp reversal.. as Gold swung moderately lower.. with GDX rapidly imploding by the biggest amount since the Dec'2016 low of $18.58.

Notably, with just one trading day left of the month, the current candle is set to close net lower. The candle has something of a topping spike, which is inherently bearish.

For the moment, there is no need for alarm bells, as we're still well above rising trend.. which would only get broken (in March) with price action <$20.00.

Lets see how Tuesday/February settles.

--

I've just recently published my first Gold Miners report. Its the first of many (I hope), and as well as an update on the precious metals, I cover GDX, along with 13 of the individual miners.

For details: http://permabeardoomster.blogspot.co.uk/p/research-reports.html

yours...

trying

GDX, daily

GDX, monthly

Summary

It was a day of two halves for the Gold miners. The morning saw some gains by late morning, as Gold/Silver had built moderate gains.

Yet, the afternoon saw a very sharp reversal.. as Gold swung moderately lower.. with GDX rapidly imploding by the biggest amount since the Dec'2016 low of $18.58.

Notably, with just one trading day left of the month, the current candle is set to close net lower. The candle has something of a topping spike, which is inherently bearish.

For the moment, there is no need for alarm bells, as we're still well above rising trend.. which would only get broken (in March) with price action <$20.00.

Lets see how Tuesday/February settles.

--

I've just recently published my first Gold Miners report. Its the first of many (I hope), and as well as an update on the precious metals, I cover GDX, along with 13 of the individual miners.

For details: http://permabeardoomster.blogspot.co.uk/p/research-reports.html

yours...

trying

Saturday, 25 February 2017

GDX - a second weekly decline

It was a second net weekly decline for the gold mining stocks, with the ETF of GDX net lower by a rather significant -2.7% at $24.13. However, recent cooling does nothing to dent the mid term bullish trend, which began with the key low of $12.36 in Jan'2016

GDX, weekly

--

Gold miners report

For those of you with an interest in the Gold mining stocks and related precious metals, I have something new to offer you.

For details: http://permabeardoomster.blogspot.co.uk/p/research-reports.html

GDX, weekly

--

Gold miners report

For those of you with an interest in the Gold mining stocks and related precious metals, I have something new to offer you.

For details: http://permabeardoomster.blogspot.co.uk/p/research-reports.html

Friday, 24 February 2017

TVIX, UVXY - first net weekly gain of 2017

Whilst most equity indexes broke new historic highs, the VIX saw a fractional net weekly decline, it was notable that the 2x lev' bullish VIX instruments of TVIX and UVXY saw net weekly gains of 6.1% and 5.9% respectively. However, one positive week does little to offer any realistic hope of near term VIX even in the mid teens.

TVIX, daily

UVXY, daily

Summary

First, an update on the VIX, which saw a net weekly decline of -0.2%.

--

As for TVIX and UVXY...

It was indeed the first net weekly gain of the year. Ironically, that only brings TVIX and UVXY back to levels from two weeks ago.

There is increasing interest in 'VIX protection' - especially for April, and thus whilst front month VIX still closed net lower for the week, the second and further out months are actually a little higher. The underlying problems of futures rollover, and statistical decay make holding such instruments a perpetual nightmare.

The outlook for equities remains outright bullish, and VIX could easily slip back to the 10s... even 9s next week.

--

*for the record, I have ZERO interest in being long the VIX in the near term.. and that has been the case since last summer.

TVIX, daily

UVXY, daily

Summary

First, an update on the VIX, which saw a net weekly decline of -0.2%.

--

As for TVIX and UVXY...

It was indeed the first net weekly gain of the year. Ironically, that only brings TVIX and UVXY back to levels from two weeks ago.

There is increasing interest in 'VIX protection' - especially for April, and thus whilst front month VIX still closed net lower for the week, the second and further out months are actually a little higher. The underlying problems of futures rollover, and statistical decay make holding such instruments a perpetual nightmare.

The outlook for equities remains outright bullish, and VIX could easily slip back to the 10s... even 9s next week.

--

*for the record, I have ZERO interest in being long the VIX in the near term.. and that has been the case since last summer.

Thursday, 23 February 2017

X - chop within a broader bullish trend

It was a rough day for US Steel (X) which saw some significant weakness, settling -7.8% at $37.31. With talk that President Trump's infrastructure bill might be delayed until 2018, the HFT algo-bots took an axe to many of the manufacturing/industrial stocks. For now, mid/long term trend remains bullish, with a monthly close >$40 due.

X, daily

X, monthly

Summary

Its very notable that despite today's smackdown, US Steel is still net higher for the month by a very powerful 14%.

Recent price structure was a giant bull flag.That was decisively confirmed with a move into the $41s. It would seem to be just a matter of when we'll see a monthly close above the key $40 thresold. Whether that is this month... March.. or not until the early summer, it shouldn't much matter to those long.

Technically, a monthly close >$40 will offer grander upside to $60.. whether by year end.. or early 2018.

--

The CEO Longhi met the President today... and boldly equated Trump with Eisenhower.

Trump will present the State of the Union next Tuesday, and that will likely highlight an intended 1 trillion dollar infrastructure bill.

X, daily

X, monthly

Summary

Its very notable that despite today's smackdown, US Steel is still net higher for the month by a very powerful 14%.

Recent price structure was a giant bull flag.That was decisively confirmed with a move into the $41s. It would seem to be just a matter of when we'll see a monthly close above the key $40 thresold. Whether that is this month... March.. or not until the early summer, it shouldn't much matter to those long.

Technically, a monthly close >$40 will offer grander upside to $60.. whether by year end.. or early 2018.

--

The CEO Longhi met the President today... and boldly equated Trump with Eisenhower.

Trump will present the State of the Union next Tuesday, and that will likely highlight an intended 1 trillion dollar infrastructure bill.

Wednesday, 22 February 2017

GE - the slow moving corporate monster

Whilst the main equity market saw a day of minor chop, there was a touch more weakness in General Electric (GE), which settled -0.7% @ $30.32. Mid/long term trend is bullish, and by end 2017, the $35/36s would be the natural 'bullish case' target.

GE, daily

GE, monthly

Summary

GE rarely gets much attention. Certainly, the momo chasers have zero interest in such a slow moving stock.

Things only turn bearish with a break <$28.. where rising trend is.

Best guess.... the 34/35s by end year. The $36s will be just about possible... on a stretch.

GE, daily

GE, monthly

Summary

GE rarely gets much attention. Certainly, the momo chasers have zero interest in such a slow moving stock.

Things only turn bearish with a break <$28.. where rising trend is.

Best guess.... the 34/35s by end year. The $36s will be just about possible... on a stretch.

Tuesday, 21 February 2017

FCX - the bad news continues

Whilst the broader market saw another bullish day, there was notable weakness in Freeport McMoran (FCX), which settled lower for a fifth consecutive day, -5.2% @ $14.13. Next support is the recent low in the $13s. If that fails to hold, then a test of the 200dma in the mid $12s... where the 200dma is lurking.

FCX, daily

FCX, monthly

Summary

So.. another rough day for Freeport, as its in the midst of a dispute with the Indonesian govt' who are still refusing an export license... to terms that FCX (so far) can't accept. Further, this past weekend, Chappy Hakim, the chief executive of Freeport's Indonesian unit resigned. That sure isn't inspiring confidence in the company.

Short term price structure is ugly.. as the low $13s seem viable.

Seen on the giant monthly cycle though, things only turn bearish in April if FCX is sustainably trading under the mid $12s.. which would be a break of the 200dma, the monthly 10MA.. and rising trend, that stretches back to the core low of $3.52 from Jan'2016.

--

Najarian, CNBC

Dr J' highlighting the DB downgrade of FCX from hold to sell, with a target of $12.50.

-

Yours truly is bullish the Gold, Silver, and especially Copper miners for the mid/long term, as I continue to see the inflationary scenario panning out into 2018... something the central banks will be very pleased about.

FCX, daily

FCX, monthly

Summary

So.. another rough day for Freeport, as its in the midst of a dispute with the Indonesian govt' who are still refusing an export license... to terms that FCX (so far) can't accept. Further, this past weekend, Chappy Hakim, the chief executive of Freeport's Indonesian unit resigned. That sure isn't inspiring confidence in the company.

Short term price structure is ugly.. as the low $13s seem viable.

Seen on the giant monthly cycle though, things only turn bearish in April if FCX is sustainably trading under the mid $12s.. which would be a break of the 200dma, the monthly 10MA.. and rising trend, that stretches back to the core low of $3.52 from Jan'2016.

--

Najarian, CNBC

Dr J' highlighting the DB downgrade of FCX from hold to sell, with a target of $12.50.

-

Yours truly is bullish the Gold, Silver, and especially Copper miners for the mid/long term, as I continue to see the inflationary scenario panning out into 2018... something the central banks will be very pleased about.

Friday, 17 February 2017

GDX - gold miners cool a little

The gold miners have seen the first net weekly decline of the year. The ETF of GDX settled the week on a significantly negative note, -1.6% at $24.79, which made for a net weekly decline of -2.0%. Near term outlook threatens further cooling, but broadly, the miners look super strong.

GDX, daily

GDX, weekly

Summary

We're seeing some distinct resistance at the 200 day MA, around the $25.00 threshold.

Even if the metals - and related miners, cool for another 2-3 weeks, it won't negate the broader bullish trend. A serious attempt to break above last summer's high in the GDX $31s seems a given within 3-6 months.

Any monthly close >32 will offer a grander run to around $50... with a timeframe of no later than late spring 2018.

GDX, daily

GDX, weekly

Summary

We're seeing some distinct resistance at the 200 day MA, around the $25.00 threshold.

Even if the metals - and related miners, cool for another 2-3 weeks, it won't negate the broader bullish trend. A serious attempt to break above last summer's high in the GDX $31s seems a given within 3-6 months.

Any monthly close >32 will offer a grander run to around $50... with a timeframe of no later than late spring 2018.

Thursday, 16 February 2017

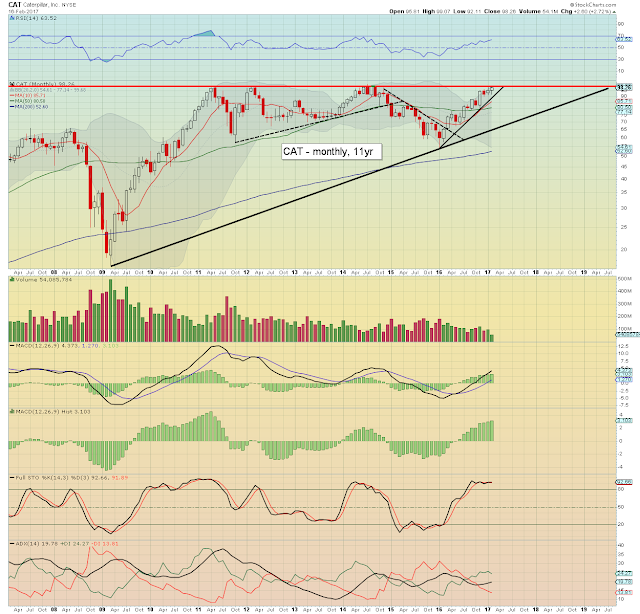

CAT - battling to clear $100

It was a day of moderate chop for Caterpillar (CAT), which settled -0.8% @ $98.26. Broadly though, CAT has seen a massive climb from the Jan'2016 low of $54.35. There is massive resistance at the psy' threshold of $100, but CAT does look on track for a hyper-bullish breakout.

CAT, daily

CAT, monthly

Summary

For the hyper bullish out there, CAT is one of those key stocks that will need to breakout above massive resistance, for the multi-year main market rally to continue.

Its certainly not critical for CAT to break $100 by end month, March.. or even April. However, if CAT isn't above $100 by the early summer, that'd be a major problem.

Any monthly close >$100 will offer basic upside to $110. Its reasonable to assume 120/125 within 6 months of any such break >$100.

yours... bullish D10Ns

--

(see: https://en.wikipedia.org/wiki/Caterpillar_D10 )

CAT, daily

CAT, monthly

Summary

For the hyper bullish out there, CAT is one of those key stocks that will need to breakout above massive resistance, for the multi-year main market rally to continue.

Its certainly not critical for CAT to break $100 by end month, March.. or even April. However, if CAT isn't above $100 by the early summer, that'd be a major problem.

Any monthly close >$100 will offer basic upside to $110. Its reasonable to assume 120/125 within 6 months of any such break >$100.

yours... bullish D10Ns

--

(see: https://en.wikipedia.org/wiki/Caterpillar_D10 )

Wednesday, 15 February 2017

DAL, UAL - airline stocks breaking up and away

Whilst the main market saw another day of moderate gains, there was particular strength in the airlines. Delta (DAL) and United (UAL), settled higher by a significant 2.6% and 2.7% respectively. Near term outlook is bullish into early March.. with broader upside due across the year.

DAL,daily

UAL, daily

Summary

*Transports index has followed the other indexes, with a new historic high in the 9500s.

--

As for DAL and UAL, suffice to add.... the airlines have seen a massive bullish run since last summer, but there is simply no sign of the current upward trend ending.

I personally prefer DAL to UAL.. as its a far more stable stock, with an arguably superior balance sheet.

DAL,daily

UAL, daily

Summary

*Transports index has followed the other indexes, with a new historic high in the 9500s.

--

As for DAL and UAL, suffice to add.... the airlines have seen a massive bullish run since last summer, but there is simply no sign of the current upward trend ending.

I personally prefer DAL to UAL.. as its a far more stable stock, with an arguably superior balance sheet.

Tuesday, 14 February 2017

BAC - headed into the 30s

With increased chatter about another rate hike, the financials are catching renewed interest. Bank of America (BAC) settled significantly higher for a second day, +2.8% @ $24.06, the best level since Oct'2008. Next big target remains the 25/26s.. with the low $30s now viable by year end.

BAC, daily

BAC, monthly

Summary

Seen on the giant monthly cycle, we can see just how critically important last November was for BAC, and most other financial stocks. An absolutely decisive breakout of a trading range that extended back to late 2008.

Considering we've now seen the $24s.. and its only Feb', the 25/26s are clearly viable this spring.

If you believe - as I do, that we'll see three rate hikes this year, then the financials are going to lead the charge higher across the year. BAC to the $30 threshold by year end is a VERY valid target.

BAC, daily

BAC, monthly

Summary

Seen on the giant monthly cycle, we can see just how critically important last November was for BAC, and most other financial stocks. An absolutely decisive breakout of a trading range that extended back to late 2008.

Considering we've now seen the $24s.. and its only Feb', the 25/26s are clearly viable this spring.

If you believe - as I do, that we'll see three rate hikes this year, then the financials are going to lead the charge higher across the year. BAC to the $30 threshold by year end is a VERY valid target.

Monday, 13 February 2017

X - reflective of the R2K

Whilst US equities started the week on a very bullish note, there was particular strength in US Steel (X), which saw another powerful push upward, settling +5.6% at $39.71. The bigger issue is whether a monthly close >$40 occurs in Feb, March, April, or not until May. Which ever it turns out to be... grander upside to $60 now looks due.

X, daily

X, monthly

Summary

Suffice to add... yours truly still likes US Steel.

Price action/structure is arguably similar to the R2K index. After around two months of chop, with the move above the Dec'2016 high, we have FULL confirmation of the giant bull flag.

If you believe X has a high chance of reaching $60 - whether late 2017 or not until 2018... what should occur to you, are the bullish implications for the broader equity market.

X, daily

X, monthly

Summary

Suffice to add... yours truly still likes US Steel.

Price action/structure is arguably similar to the R2K index. After around two months of chop, with the move above the Dec'2016 high, we have FULL confirmation of the giant bull flag.

If you believe X has a high chance of reaching $60 - whether late 2017 or not until 2018... what should occur to you, are the bullish implications for the broader equity market.

Friday, 10 February 2017

GDX - an eighth consecutive weekly gain

It was yet another bullish week for the gold/silver miners, attaining a very notable eighth consecutive net weekly gain. The ETF of GDX settled Friday +1.6% @ $25.30, and that made for a net weekly gain of 3.3%. Near term outlook is a little uncertain - as a retrace is overdue, but mid term outlook is bullish unless price action <$23.00

GDX, weekly

GDX, daily

Summary

*Thursday was pretty bearish, but the week did end on a positive note, back above the key 200dma.

--

Eight consecutive net weekly gains is the best run since March 2016, and that sure can't be termed as 'just a bounce'. Its a VERY bullish sign for the mid/long term.

The precious metals of Gold and Silver themselves are still not particularly bullish though. However, copper is offering a strong indirect indicator that Gold and Silver will eventually play catchup across the spring/summer.

Things turn EXTREMELY bullish for the miners with Gold $1400s, and Silver $22s.

--

Any monthly close in the $32s should give full clarity that GDX will hit first big target of around $50... no later than spring 2018.

GDX, weekly

GDX, daily

Summary

*Thursday was pretty bearish, but the week did end on a positive note, back above the key 200dma.

--

Eight consecutive net weekly gains is the best run since March 2016, and that sure can't be termed as 'just a bounce'. Its a VERY bullish sign for the mid/long term.

The precious metals of Gold and Silver themselves are still not particularly bullish though. However, copper is offering a strong indirect indicator that Gold and Silver will eventually play catchup across the spring/summer.

Things turn EXTREMELY bullish for the miners with Gold $1400s, and Silver $22s.

--

Any monthly close in the $32s should give full clarity that GDX will hit first big target of around $50... no later than spring 2018.

Thursday, 9 February 2017

X - breaks up and away

Whilst the main market was broadly higher, there was very powerful upside in US Steel (X), which settled +8.4% @ $37.42. Price structure was a big bull flag, which has now been provisionally confirmed. First soft target is the Dec' high of $39.08. The low/mid $40s are a viable target in early March.

X, daily

X, monthly

Summary

Suffice to add... near/mid term bullish.

Long term bullish, with any monthly close >$40... which would offer grander upside to $60 within 9-15 months.

yours... still lovesAnacott, I mean US Steel

X, daily

X, monthly

Summary

Suffice to add... near/mid term bullish.

Long term bullish, with any monthly close >$40... which would offer grander upside to $60 within 9-15 months.

yours... still loves

Wednesday, 8 February 2017

DIS - minor quakes in Disneyland

There was rather dynamic action in Disney (DIS), after Q4 earnings were rather mixed. From a Tue' AH flash-print low of $105.50, DIS gained in early morning to a high of $111.42, and settling u/c @ $109.00. Near term outlook offers cyclical upside to around $115.

DIS, daily

DIS, monthly

Summary

Earnings: EPS $1.55 adj'.. whilst revenue missed by almost half a billion.

There is still mainstream concern about ESPN, but that is just one component of what is a giant multi-national entertainment business. Disney owns the largest two movie franchises of Marvel and Star Wars. Those two gems alone would merit being part of the infinity gauntlet.

Seen on the bigger monthly chart, upper bollinger continues to offer the $115s before getting stuck in late Feb/early March.

Broadly... if sp'2500/600s later this year, DIS should be at least in the $130s.

yours.. I am Groot.

DIS, daily

DIS, monthly

Summary

Earnings: EPS $1.55 adj'.. whilst revenue missed by almost half a billion.

There is still mainstream concern about ESPN, but that is just one component of what is a giant multi-national entertainment business. Disney owns the largest two movie franchises of Marvel and Star Wars. Those two gems alone would merit being part of the infinity gauntlet.

Seen on the bigger monthly chart, upper bollinger continues to offer the $115s before getting stuck in late Feb/early March.

Broadly... if sp'2500/600s later this year, DIS should be at least in the $130s.

yours.. I am Groot.

Tuesday, 7 February 2017

AAPL - new historic highs

Whilst the main market saw a day of minor chop, there was notable strength in Apple (AAPL), which broke a new historic high of $132.09, and settling +0.9% @ $131.53. Near term outlook offers the $134/36s.. within the next few weeks, before a threat of retracing back to the price gap zone of 125/22.

AAPL, daily

AAPL, monthly

Summary

Many have long touted 'the best days for AAPL are in the past'.

Well, Mr Market doesn't think so, as today AAPL broke the April 2015 high.

Broader upside to the next soft psy' level of $150 looks due this summer.

It is just a matter of time before mainstream talk resumes of the $200s.

AAPL, daily

AAPL, monthly

Summary

Many have long touted 'the best days for AAPL are in the past'.

Well, Mr Market doesn't think so, as today AAPL broke the April 2015 high.

Broader upside to the next soft psy' level of $150 looks due this summer.

It is just a matter of time before mainstream talk resumes of the $200s.

Monday, 6 February 2017

RIG - drillers under pressure

With energy prices starting the week on a bearish note, the oil/gas drillers were on the slide. Transocean (RIG) settled lower by a rather significant -3.1% @ $13.54. Further weakness to first big support around $12.75 looks a given. Any main market retrace in late Feb/March would threaten RIG to the $11s.

RIG, daily

RIG, monthly

Summary

re: WTIC oil. Price action in oil has been broadly choppy since early Jan'.. if not early Dec'.. depending on how you look at things. First support is the $50 threshold, and should hold across the spring. An eventual move to the $60 threshold looks a given by early summer.

Keep in mind an inverse H/S scenario - that was first noted last autumn/late summer... suggestive of 70/75. That is clearly a long way up, and will likely not be seen until very late in the year.

--

As for RIG... short term weakness, not least if the main market sees a 5% correction by late March. Broadly though, first big target is the $20 threshold.

If Oil in the $70s... RIG to $30... which is a very long way up.

RIG, daily

RIG, monthly

Summary

re: WTIC oil. Price action in oil has been broadly choppy since early Jan'.. if not early Dec'.. depending on how you look at things. First support is the $50 threshold, and should hold across the spring. An eventual move to the $60 threshold looks a given by early summer.

Keep in mind an inverse H/S scenario - that was first noted last autumn/late summer... suggestive of 70/75. That is clearly a long way up, and will likely not be seen until very late in the year.

--

As for RIG... short term weakness, not least if the main market sees a 5% correction by late March. Broadly though, first big target is the $20 threshold.

If Oil in the $70s... RIG to $30... which is a very long way up.

Friday, 3 February 2017

GDX - miners climb for a seventh week

With the precious metals seeing rather sig' net weekly gains, the related miners were similarly on the rise. The ETF of GDX climbed for a seventh consecutive week - the best run since March 2016, settling net higher by 5.5% @ $24.50. Mid term outlook is bullish to $50.

GDX, weekly

GDX, monthly

Summary

Suffice to add... the miners really are showing some mid term strength.

We have a core multi-year low in Jan'2016.. and then a higher low in Dec'2016. The Jan' net monthly gain was very important, and unless the Dec' low is broken back under... mid term outlook is very bullish indeed.

I recognise $50 is a long way up, but it does look due. The only issue is whether that is late 2017.. or spring 2018.

GDX, weekly

GDX, monthly

Summary

Suffice to add... the miners really are showing some mid term strength.

We have a core multi-year low in Jan'2016.. and then a higher low in Dec'2016. The Jan' net monthly gain was very important, and unless the Dec' low is broken back under... mid term outlook is very bullish indeed.

I recognise $50 is a long way up, but it does look due. The only issue is whether that is late 2017.. or spring 2018.

Thursday, 2 February 2017

X - Permabear loves US Steel

Whilst the main market saw a day of minor chop, there was a powerful rebound in US Steel (X), which settled +11.2% @ $34.85. With the daily close above the $34.00 resistance and the 50dma, near term outlook is bullish. Price structure itself remains a big bull flag, confirmed with any price action >$35.50.

X, daily

X, monthly

Summary

I'll note first... this is one stomach churning stock to be meddling in (as I currently am). The intraday action is wild, with the stock typically twitching 1-2% every few hours.

Today's upgrade by BoA/Merrill Lync really helped to re-inspire sentiment after a rather bizarre post earnings washout.

see: https://www.fool.com/investing/2017/02/02/us-steel-stock-upgraded-what-you-need-to-know.aspx

--

The post election rally saw X hyper-ramp... effectively doubling from the $17s to 39s. Since then, price action has been choppy downside... whilst price structure is a clear bull flag.

Any monthly close >$40... would offer broader upside to $60 by late 2017/spring 2018. If correct, the implications for the broader market are rather profound.

--

Yours... made the call recently.

X, daily

X, monthly

Summary

I'll note first... this is one stomach churning stock to be meddling in (as I currently am). The intraday action is wild, with the stock typically twitching 1-2% every few hours.

Today's upgrade by BoA/Merrill Lync really helped to re-inspire sentiment after a rather bizarre post earnings washout.

see: https://www.fool.com/investing/2017/02/02/us-steel-stock-upgraded-what-you-need-to-know.aspx

--

The post election rally saw X hyper-ramp... effectively doubling from the $17s to 39s. Since then, price action has been choppy downside... whilst price structure is a clear bull flag.

Any monthly close >$40... would offer broader upside to $60 by late 2017/spring 2018. If correct, the implications for the broader market are rather profound.

--

Yours... made the call recently.

Wednesday, 1 February 2017

AAPL - strength with good earnings

Q4 earnings for Apple (AAPL) were unquestionally good, and the stock has justifiably powered upward, settling +6.3% @ $129.00, the best level in almost two years. There will clearly be some resistance around the 130/131 zone, but new historic highs look due, with $150 a realistic target by year end..

AAPL , daily

AAPL, monthly

Summary

It has been rather amusing to see how twitchy the mainstream have been about AAPL lately. What exactly are they worried about? Is $35/40bn a quarter in earnings not enough? Is a PE of around 10 too pricey, relative to the main market of 18/20 ?

These are crazy times, and its bizarre to see how many have lost almost all perspective of what is 'fair value'

In terms of price - short term, the stock is clearly on the high side. On the giant monthly cycle, we're now a little beyond the upper bollinger, and a straight run to new highs won't be easy.

Regardless of any near term chop/retrace, AAPL looks set to break new historic highs, and to keep on pushing across the year. Frankly, the psy' level of $150 is a valid target as early as the summer.

yours... never bought an AAPL product

AAPL , daily

AAPL, monthly

Summary

It has been rather amusing to see how twitchy the mainstream have been about AAPL lately. What exactly are they worried about? Is $35/40bn a quarter in earnings not enough? Is a PE of around 10 too pricey, relative to the main market of 18/20 ?

These are crazy times, and its bizarre to see how many have lost almost all perspective of what is 'fair value'

In terms of price - short term, the stock is clearly on the high side. On the giant monthly cycle, we're now a little beyond the upper bollinger, and a straight run to new highs won't be easy.

Regardless of any near term chop/retrace, AAPL looks set to break new historic highs, and to keep on pushing across the year. Frankly, the psy' level of $150 is a valid target as early as the summer.

yours... never bought an AAPL product

Subscribe to:

Comments (Atom)