With gold and silver seeing significant net monthly gains, the miners followed. The ETF of GDX ended the month on a positive note, +2.3% at $24.72, which made for a net monthly gain of a powerful 8.1%. Near/mid term outlook is bullish, with copper offering an indirect strongly bullish signal, having closed >$3.00.

GDX daily

GDX monthly

Summary

Suffice to add.. a second consecutive net monthly gain for GDX.

GDX is still 4.0% below the Feb' high of $25.71, but it looks very prone to being broken above in September. Any price action in the $26s would offer a straight run to the summer 2016 high of $31.70.

The 'hyper bulls' should be seeking a push to the $32s, which would then offer a grander run to 45/50 some time in 2018.

Thursday, 31 August 2017

Wednesday, 30 August 2017

AMD - holding the 200dma

Whilst the main market settled moderately higher, there was significant strength in Advanced Micro Devices (AMD), which settled +4.3% at $12.67. The 50dma is a basic target within the near term. If the main market cools 4-5% in Sept/Oct, the 200dma will be very vulnerable to breaking.

AMD daily

AMD monthly

Summary

Suffice to add, near term bullish, for a company that has a rapidly growing line of high quality products that are increasingly respected within the tech/gaming/mining community.

A main market wave lower of 4-5% - to the sp'2350s, seems due this Sept/Oct. If correct, AMD is going to struggle to hold the 200dma.

More broadly though, the stock looks exceptionally bullish. That view only changes if the main market sees a bearish monthly close.

--

notable call buying today...

Traders were rolling from the Oct' calls to the Nov'13s. Any break of the 200dma in Sept' or Oct' though, and AMD would implode to at least $10, in which case those Nov'13s will become worthless.

Yours... prefers NVDA graphics cards

AMD daily

AMD monthly

Summary

Suffice to add, near term bullish, for a company that has a rapidly growing line of high quality products that are increasingly respected within the tech/gaming/mining community.

A main market wave lower of 4-5% - to the sp'2350s, seems due this Sept/Oct. If correct, AMD is going to struggle to hold the 200dma.

More broadly though, the stock looks exceptionally bullish. That view only changes if the main market sees a bearish monthly close.

--

notable call buying today...

Traders were rolling from the Oct' calls to the Nov'13s. Any break of the 200dma in Sept' or Oct' though, and AMD would implode to at least $10, in which case those Nov'13s will become worthless.

Yours... prefers NVDA graphics cards

Tuesday, 29 August 2017

AAPL - a new historic high

Apple (AAPL) broke a new historic high of $163.12, settling +0.9% at $162.91. Near term outlook offers further upside to the 164/65s. Once the Sept'12th product announcement is out of the way, the stock will be highly vulnerable into early Oct'. Core monthly support from early Oct' onward will be around 145/40.

AAPL daily

AAPL monthly

Summary

The main market's swing from an early low of sp'2428 to '49 was pretty incredible - relative to the most recent news about NK. Yet, AAPL still managed to break a new historic high. The near/mid/long term trend is clearly outright bullish.

Things would only turn bearish with a monthly close under the key 10MA, which as of end Oct', will be around 145/40.

On balance... there will no bearish monthy closes for AAPL this autumn. Once we're into November, the bulls would have clear air all the way into late spring 2018, at which point the $200s aren't even that much of a stretch.

--

Traders were notably buying the weekly (Sept'1st exp') $160 calls this morning...

--

AAPL daily

AAPL monthly

Summary

The main market's swing from an early low of sp'2428 to '49 was pretty incredible - relative to the most recent news about NK. Yet, AAPL still managed to break a new historic high. The near/mid/long term trend is clearly outright bullish.

Things would only turn bearish with a monthly close under the key 10MA, which as of end Oct', will be around 145/40.

On balance... there will no bearish monthy closes for AAPL this autumn. Once we're into November, the bulls would have clear air all the way into late spring 2018, at which point the $200s aren't even that much of a stretch.

--

Traders were notably buying the weekly (Sept'1st exp') $160 calls this morning...

--

Monday, 28 August 2017

GDX - starting on a very positive note

With the precious metals starting the week on a very positive note, the related miners followed. The sector ETF of GDX settled +3.6% at $24.26, the highest level since mid April. Near term outlook is bullish, mid term is still borderline, as the gold bugs should seeking a monthly gold close >$1300 to have some confidence.

GDX daily

GDX monthly

Summary

Suffice to add, it was a rather bullish day indeed, not least with Gold settling higher by $17.40 (1.3%) to $1315.30, the highest close since Nov'2016.

With gold and silver on the rise, the miners are naturally following. As things are, GDX is set for a second consecutive net monthly gain, currently +6.1% in the $24s.

Things are starting to turn rather bullish... with copper leading the way.

GDX daily

GDX monthly

Summary

Suffice to add, it was a rather bullish day indeed, not least with Gold settling higher by $17.40 (1.3%) to $1315.30, the highest close since Nov'2016.

With gold and silver on the rise, the miners are naturally following. As things are, GDX is set for a second consecutive net monthly gain, currently +6.1% in the $24s.

Things are starting to turn rather bullish... with copper leading the way.

Friday, 25 August 2017

GDX - net weekly gains

With the precious metals closing the week moderately higher, the mining ETF of GDX ended the week on a positive note, settling +0.3% at $23.42, making for a net weekly gain of 2.1%. Near term outlook is bullish, with a powerful bullish indirect signal via copper.

GDX daily

GDX weekly

Summary

The trend for the gold miners since early July has been leaning rather bullish, but we're still well under the Feb' high of $25.71. Arguably, things only turn outright bearish with a break <$20.99, and that looks any time soon, not least as copper continues to push strongly higher.

--

Indeed, more important than anything right now, even more than price action in the USD, is what is happening within copper. Copper has attained the first weekly close >$3.00, since late 2014.

If copper can manage an August (or somewhat beyond) monthly close >$3.00, it would bode indirectly bullish for gold, silver, and the related mining stocks. It should be seen as an absolutely important issue for the gold bugs.

GDX daily

GDX weekly

Summary

The trend for the gold miners since early July has been leaning rather bullish, but we're still well under the Feb' high of $25.71. Arguably, things only turn outright bearish with a break <$20.99, and that looks any time soon, not least as copper continues to push strongly higher.

--

Indeed, more important than anything right now, even more than price action in the USD, is what is happening within copper. Copper has attained the first weekly close >$3.00, since late 2014.

If copper can manage an August (or somewhat beyond) monthly close >$3.00, it would bode indirectly bullish for gold, silver, and the related mining stocks. It should be seen as an absolutely important issue for the gold bugs.

Thursday, 24 August 2017

FCX - climbing with copper

Whilst the main equity market settled on the weaker side, there was continued strength within the copper miners. Freeport McMoRan (FCX) settled higher for a fourth consecutive day, +1.3% at $15.49. With copper achieving the first daily close >$3.00 since late 2014, the near term outlook is especially bullish.

FCX, daily

FCX, monthly

Summary

*special update on copper, weekly

If copper can manage another net weekly gain, it'll be the best run since Aug'2009. Cyclically, copper is on the high side, but any weekly/monthly close >$3.00 would lean for continued upside. Technically, its arguably 'empty air' to the next psy' level of $4.00.

--

Naturally, the related miners, such as FCX, SCCO, and TECK are all powering upward, as copper is set for a SEVENTH consecutive net weekly gain. The only issue now is whether copper can hold above the $3.00 threshold into end month.

There are huge implications for Gold/Silver - and the related miners, if copper can attain a monthly close (whether August, Sept', or beyond).

FCX, daily

FCX, monthly

Summary

*special update on copper, weekly

If copper can manage another net weekly gain, it'll be the best run since Aug'2009. Cyclically, copper is on the high side, but any weekly/monthly close >$3.00 would lean for continued upside. Technically, its arguably 'empty air' to the next psy' level of $4.00.

--

Naturally, the related miners, such as FCX, SCCO, and TECK are all powering upward, as copper is set for a SEVENTH consecutive net weekly gain. The only issue now is whether copper can hold above the $3.00 threshold into end month.

There are huge implications for Gold/Silver - and the related miners, if copper can attain a monthly close (whether August, Sept', or beyond).

Wednesday, 23 August 2017

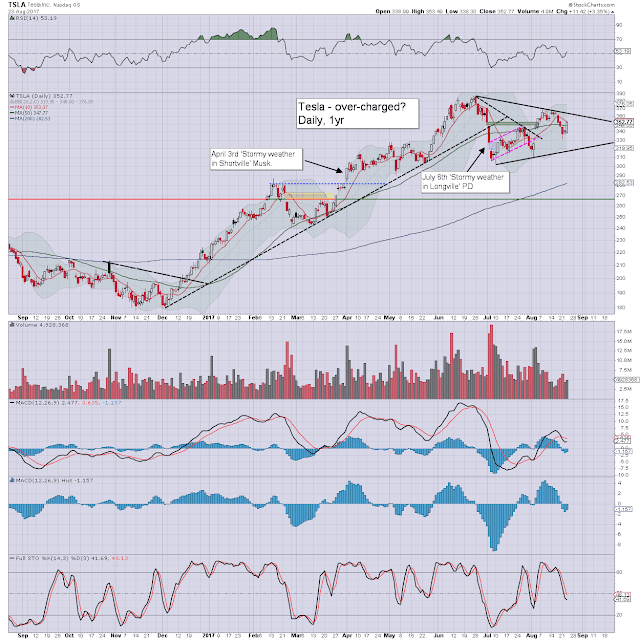

TSLA - broadly scary strong

Whilst the main market saw a day of weak chop, there was notable strength in Tesla (TSLA), settling +3.3% at $352.77. Near term outlook offers further upside into the $360s. Things will turn exceptionally bullish with sp'2490 and/or TSLA >370. The bears have nothing to tout unless a bearish break <320.

TSLA daily

TSLA monthly

Summary

Suffice to add, TSLA remains a stock that is bizarrely valued, but protected by a titanium 'free pass' that the capital market continues to provide the CEO Elon Musk.

To be clear, I really like the product, and the CEO is genuinely inspirational, but on a pure valuation basis, the stock is ludicrously priced.

Due to its nature of being a momo stock, it is arguably one that simply can't be shorted, even if the main market has stalled or leaning weak.

--

yours... would like to order a fully self driving Tesla by 2025.

TSLA daily

TSLA monthly

Summary

Suffice to add, TSLA remains a stock that is bizarrely valued, but protected by a titanium 'free pass' that the capital market continues to provide the CEO Elon Musk.

To be clear, I really like the product, and the CEO is genuinely inspirational, but on a pure valuation basis, the stock is ludicrously priced.

Due to its nature of being a momo stock, it is arguably one that simply can't be shorted, even if the main market has stalled or leaning weak.

--

yours... would like to order a fully self driving Tesla by 2025.

Tuesday, 22 August 2017

MU - a key stock to at least track

Whilst the main market closed significantly higher, there was particular strength in Micron Technology (MU), settling +3.0% at $30.35. Near term offers a little higher to the $31s. Things will turn hyper bullish with any daily closes >$33.00.

MU daily

MU monthly

Summary

Even if you never trade it, Micron is arguably one of the key stocks that will help give clarity to the mid term main market outlook into 2018.

Any price action in MU >$33 would give VERY high confidence that the main market will see a Sept/Oct' retrace of only a moderate amount - around 4-5%, before resuming strongly upward into spring 2018.

I understand some would disagree, but I've been following MU for a considerable time, and its a pretty good representation of the tech sector, and the broader market.

--

*On a pure valuation perspective, MU is ludicrously priced, with a forward PE in the 5s. Just dwell on that for a while.

MU daily

MU monthly

Summary

Even if you never trade it, Micron is arguably one of the key stocks that will help give clarity to the mid term main market outlook into 2018.

Any price action in MU >$33 would give VERY high confidence that the main market will see a Sept/Oct' retrace of only a moderate amount - around 4-5%, before resuming strongly upward into spring 2018.

I understand some would disagree, but I've been following MU for a considerable time, and its a pretty good representation of the tech sector, and the broader market.

--

*On a pure valuation perspective, MU is ludicrously priced, with a forward PE in the 5s. Just dwell on that for a while.

Monday, 21 August 2017

TSLA - struggling with higher bond yields

Whilst the main market saw a day of moderate swings, there was significant weakness in Tesla (TSLA), which settled lower for a third consecutive day, -2.8% at $337.86. The stock was under pressure as the new $1.8bn block of bonds saw yields jump.

TSLA daily

TSLA monthly

Summary

See: http://www.zerohedge.com/news/2017-08-21/tesla-stock-slumps-after-terrible-bond-new-issue-tanks

--

As for Tesla stock, from a pure technical perspective, despite recent weakness, its still holding the post earnings bullish breakout.

From a pure valuation perspective, the stock is ludicriously valued, but for the moment, the US capital market is showing no sign of taking away the 'free pass' given to Elon Musk.

To be clear, I am bullish the product and the CEO, but the stock is insanely priced, not that such a momo stock deserves to be shorted.

--

*Only bearish if the main market breaks key supports (<200dma, <10MA), with TSLA under the old ceiling... around $285.

TSLA daily

TSLA monthly

Summary

See: http://www.zerohedge.com/news/2017-08-21/tesla-stock-slumps-after-terrible-bond-new-issue-tanks

--

As for Tesla stock, from a pure technical perspective, despite recent weakness, its still holding the post earnings bullish breakout.

From a pure valuation perspective, the stock is ludicriously valued, but for the moment, the US capital market is showing no sign of taking away the 'free pass' given to Elon Musk.

To be clear, I am bullish the product and the CEO, but the stock is insanely priced, not that such a momo stock deserves to be shorted.

--

*Only bearish if the main market breaks key supports (<200dma, <10MA), with TSLA under the old ceiling... around $285.

Friday, 18 August 2017

GDX - settling on a weak note

With the precious metals ending the week on a somewhat weak note, the related mining stocks followed, with the ETF of GDX settling lower for a second day, -0.4% at $22.93, making for a net weekly decline of -0.9%. Near term outlook is bearish, not least if the USD can claw into the DXY 94s.

GDX daily

GDX weekly

Summary

GDX settled the week with a bearish engulfing candle on the daily chart, as Gold was unable to break AND hold the big $1300 threshold. It is notable that GDX is trading above the 50 and 200 day MAs, but still... price structure isn't so bullish.

Seen on a bigger weekly cycle, the picture is messy, as GDX is trying to break upward, but it could be argued is just back testing the old (broken) core support/trend - from Jan'2016.

The more cautious will leave GDX alone until a break >24.00, or a break under the July low of $20.99.

--

*Copper remains an important indirect bullish signal, as its close to breaking the key $3.00 threshold. Any monthly close >3.00 would bode very bullish for gold/silver and the related miners.

GDX daily

GDX weekly

Summary

GDX settled the week with a bearish engulfing candle on the daily chart, as Gold was unable to break AND hold the big $1300 threshold. It is notable that GDX is trading above the 50 and 200 day MAs, but still... price structure isn't so bullish.

Seen on a bigger weekly cycle, the picture is messy, as GDX is trying to break upward, but it could be argued is just back testing the old (broken) core support/trend - from Jan'2016.

The more cautious will leave GDX alone until a break >24.00, or a break under the July low of $20.99.

--

*Copper remains an important indirect bullish signal, as its close to breaking the key $3.00 threshold. Any monthly close >3.00 would bode very bullish for gold/silver and the related miners.

Thursday, 17 August 2017

CSCO - knocked lower on good earnings

Despite posting good earnings, Cisco Systems (CSCO) was knocked significantly lower by a market that is frustrated about lack of future growth prospects, settling -4.0% at $31.04. First soft support is the psy' level of $30.00, then the core $27s, and rising support (from 2011) in the $25s.

CSCO daily

CSCO monthly

Summary

Investor relations home: https://investor.cisco.com/investor-relations/overview/default.aspx

Earnings slideshow: https://s2.q4cdn.com/230918913/files/doc_presentations/2017/Q4FY17-Earnings-Slides-FINAL.PDF

--

With Q2 EPS of 61cents, this is a company that is generating around $2.40 pa... something that Tesla (and many other famous companies) could only dream about.

The current valuation offers a forward PE in the 13s, with a yield of around 3.6%.

On any basis, that is on the very low side. Of course.. the current 'twisted' mindset of the mainstream places more value on revenue growth than actual earnings.

In any case, if you believe the 'bullish train will remain on the tracks' into 2018, then Cisco should rise, at least to some extent.

CSCO daily

CSCO monthly

Summary

Investor relations home: https://investor.cisco.com/investor-relations/overview/default.aspx

Earnings slideshow: https://s2.q4cdn.com/230918913/files/doc_presentations/2017/Q4FY17-Earnings-Slides-FINAL.PDF

--

With Q2 EPS of 61cents, this is a company that is generating around $2.40 pa... something that Tesla (and many other famous companies) could only dream about.

The current valuation offers a forward PE in the 13s, with a yield of around 3.6%.

On any basis, that is on the very low side. Of course.. the current 'twisted' mindset of the mainstream places more value on revenue growth than actual earnings.

In any case, if you believe the 'bullish train will remain on the tracks' into 2018, then Cisco should rise, at least to some extent.

Wednesday, 16 August 2017

MU - mid term super strong

Whilst the main market settled fractionally mixed, there was notable significant strength in Micron Technology (MU), settling +3.4% at $30.69. A break above the key $33.00 threshold will offer a fast run to the $36s. Any price action >37 will offer grander upside to 45/50 in 2018.

MU, daily

MU, monthly

Summary

Suffice to add, I really like Micron. The most recent earnings were superb, and the current valuation, offers a forward PE around 5. On any basis, that is ludicrously low, and frankly, the stock 'should' be priced at least double.

A mid term outlook to $45/50 doesn't seem overly bold, but it'll clearly require the main market to 'stay on the tracks' into spring 2018. On balance.. that seems probable.

--

There was notable option call buying today...

Traders were buying the Sept'33s and 36s. Those are pretty bullish upside trades, with barely a full month left on the detonator clock. Regardless of that short term trade though, the mid term outlook for MU looks very bullish indeed.

MU, daily

MU, monthly

Summary

Suffice to add, I really like Micron. The most recent earnings were superb, and the current valuation, offers a forward PE around 5. On any basis, that is ludicrously low, and frankly, the stock 'should' be priced at least double.

A mid term outlook to $45/50 doesn't seem overly bold, but it'll clearly require the main market to 'stay on the tracks' into spring 2018. On balance.. that seems probable.

--

There was notable option call buying today...

|

| Jon Najarian, regular guest on the CNBC lunch hour show. |

Traders were buying the Sept'33s and 36s. Those are pretty bullish upside trades, with barely a full month left on the detonator clock. Regardless of that short term trade though, the mid term outlook for MU looks very bullish indeed.

Tuesday, 15 August 2017

RIG - back to 1995

Whilst the main market saw a great deal of minor chop, there was very significant weakness in Transocean (RIG), which broke below the Jan'2016 low of $7.66, seeing an intra low of $7.55 - the lowest level since 1995, and settling -5.7% at $7.91. Near/mid term outlook is bearish, as WTIC and Nat' gas remain mid term weak.

RIG, monthly, 27yr

RIG, daily

Summary

Suffice to add, near, mid, and long term trends are unquestionably bearish.

The cautious will leave this stock, and the entire sector, well alone unless a break above declining trend, which for RIG is currently around $17.00... and that is a very long way up.

--

As an aside... for those with an interest in the bigger picture, the following is highly recommended...

yours.. no car.

RIG, monthly, 27yr

RIG, daily

Summary

Suffice to add, near, mid, and long term trends are unquestionably bearish.

The cautious will leave this stock, and the entire sector, well alone unless a break above declining trend, which for RIG is currently around $17.00... and that is a very long way up.

--

As an aside... for those with an interest in the bigger picture, the following is highly recommended...

yours.. no car.

Monday, 14 August 2017

NVDA - a powerful bounce

Whilst the main equity market settled broadly higher, there was a powerful bounce within Nvidia (NVDA), which settled +8.0% at $168.40. Last week's break of rising trend/support is still a problem though, and there remains high threat of another swing lower, at least to test last week's low of $152.91.

NVDA daily

NVDA monthly

Summary

Despite today's very powerful gain, the outlook is short term bearish, not least after last week's break of rising trend that stretches back to the mid April low of $95.39.

Seen on a monthly chart, NVDA looks frigtheningly bullish. First core support is around $120, which is currently 28% lower.

Unless the main market is close to a key top (the only sign of that is via the R2K), there is little reason to be mid term bearish NVDA. Recent earnings were certainly somewhat better than reasonable.

NVDA daily

NVDA monthly

Summary

Despite today's very powerful gain, the outlook is short term bearish, not least after last week's break of rising trend that stretches back to the mid April low of $95.39.

Seen on a monthly chart, NVDA looks frigtheningly bullish. First core support is around $120, which is currently 28% lower.

Unless the main market is close to a key top (the only sign of that is via the R2K), there is little reason to be mid term bearish NVDA. Recent earnings were certainly somewhat better than reasonable.

Friday, 11 August 2017

GDX - a significant weekly gain

With the precious metals catching a 'fear bid' this week on the 'Korean situation', the related miners followed. The ETF of GDX settled the day +0.3% at $23.15, which made for a very significant net weekly gain of 3.7%. Near term outlook is leaning bullish. Mid term is turning bullish with a fractional break of declining trend/resistance.

GDX daily

GDX weekly

Summary

It was a somewhat mixed week, starting weak, but then pushing upward as the equity/capital market became increasingly upset.

With the precious metals of gold and silver building an outright 'fear bid', the related miners followed. The weekly close is fractionally above declining trend/resistance, that extends back to the Feb' high of $25.71.

--

To have confidence, mining bulls need to see Gold >$1300, Silver >$19, and Copper >$3.00.

Those with a hyper bullish mining outlook require Gold >$1400, Silver >$22, and Copper >$3.00.

--

Arguably, the 'cautious bears' will only chase/short GDX lower on a break of the July low of $20.99.

GDX daily

GDX weekly

Summary

It was a somewhat mixed week, starting weak, but then pushing upward as the equity/capital market became increasingly upset.

With the precious metals of gold and silver building an outright 'fear bid', the related miners followed. The weekly close is fractionally above declining trend/resistance, that extends back to the Feb' high of $25.71.

--

To have confidence, mining bulls need to see Gold >$1300, Silver >$19, and Copper >$3.00.

Those with a hyper bullish mining outlook require Gold >$1400, Silver >$22, and Copper >$3.00.

--

Arguably, the 'cautious bears' will only chase/short GDX lower on a break of the July low of $20.99.

Thursday, 10 August 2017

TVIX, UVXY - a powerful day higher

With equities closing significantly lower, there was powerful upside in volatility. The 2x lev' bullish VIX instruments of TVIX and UVXY settled higher by 26.8% and 26.9% respectively. Near term outlook offers sp'2435, which should equate to VIX at least another 1-2pts higher in the 17/18s. The key 20 threshold is a serious (if brief) threat.

TVIX daily

UVXY daily

Summary

Special update on the VIX, currently net higher for the week by a hyper powerful 59.9%

--

I have generally refrained from highlighting any of the VIX instruments since summer 2016, not least as the VIX-long trade has been frankly... dead.

With the sp' swinging from 2490 to 2437, things are getting a little interesting, and we've seen the VIX surge from the 9s to the 16s.

A three day series of gains have clawed TVIX and UVXY back to levels from early July. The mid May highs look out of range, unless next Monday sees a mini-crash to sp'2350/25 zone... which on balance, is extremely unlikely.

--

As ever, holding across multiple days or certainly - weeks, is extremely problematic for any leveraged instrument.

--

TVIX daily

UVXY daily

Summary

Special update on the VIX, currently net higher for the week by a hyper powerful 59.9%

--

I have generally refrained from highlighting any of the VIX instruments since summer 2016, not least as the VIX-long trade has been frankly... dead.

With the sp' swinging from 2490 to 2437, things are getting a little interesting, and we've seen the VIX surge from the 9s to the 16s.

A three day series of gains have clawed TVIX and UVXY back to levels from early July. The mid May highs look out of range, unless next Monday sees a mini-crash to sp'2350/25 zone... which on balance, is extremely unlikely.

--

As ever, holding across multiple days or certainly - weeks, is extremely problematic for any leveraged instrument.

--

Wednesday, 9 August 2017

DIS, NFLX - begun the streaming war has

Disney earnings were fine, but the withdrawal of movies from Netflix, is effectively a declaration of war against what will now be its prime rival. DIS and NFLX settled lower by a significant -3.9% and -1.4% respectively. Despite settling reversal candles, near term outlook offers further weakness.

DIS daily

NFLX daily

Summary

*Withdrawal of the DIS movies from NFLX is scheduled for 2019. No doubt, a number of TV shows (such as Defenders) will also be eventually pulled.

--

DIS: EPS of $1.58, with rev' $14.24bn, the latter being a marginal miss under consensus. Regardless, the company is doing very well. It remains somewhat odd how the mainstream are overly focused on ESPN, which is a decreasingly important part of its business.

Today's early low of $100.50 was the lowest level since Dec'6th 2016. The break under the 50/200dma's is a serious matter - at least in the short term.Things would turn bearish for the mid term with a monthly close <$99, and to be clear.. that seems unlikely.

NFLX: clearly spooked by the news that DIS is going to start breaking away from its previously 'cosy relationship'. The daily settling candle is a reversal, but further weakness to the 50dma - currently $165, seems extremely likely.

--

For the record, I really like both companies for the long term. Of the two, I favour DIS, not least due to the valuation (forward PE 15/16s), and a yield of around 1.5%.

--

Indeed, begun war has, between two corporate giants.

--

ps. .. and no, I'm not suggesting Iger is Palpatine. :)

DIS daily

NFLX daily

Summary

*Withdrawal of the DIS movies from NFLX is scheduled for 2019. No doubt, a number of TV shows (such as Defenders) will also be eventually pulled.

--

DIS: EPS of $1.58, with rev' $14.24bn, the latter being a marginal miss under consensus. Regardless, the company is doing very well. It remains somewhat odd how the mainstream are overly focused on ESPN, which is a decreasingly important part of its business.

Today's early low of $100.50 was the lowest level since Dec'6th 2016. The break under the 50/200dma's is a serious matter - at least in the short term.Things would turn bearish for the mid term with a monthly close <$99, and to be clear.. that seems unlikely.

NFLX: clearly spooked by the news that DIS is going to start breaking away from its previously 'cosy relationship'. The daily settling candle is a reversal, but further weakness to the 50dma - currently $165, seems extremely likely.

--

For the record, I really like both companies for the long term. Of the two, I favour DIS, not least due to the valuation (forward PE 15/16s), and a yield of around 1.5%.

--

Indeed, begun war has, between two corporate giants.

--

ps. .. and no, I'm not suggesting Iger is Palpatine. :)

Tuesday, 8 August 2017

ABX - continuing to struggle

Like most Gold miners, Barrick Gold (ABX) is struggling, settling lower for a fifth consecutive day, -0.4% at $16.50. Near term outlook is bearish to the 50dma at $16.20. Mid term outlook only turns bullish with price action >$19.00.

ABX, daily

ABX, monthly

Summary

Barrick Gold is unquestionably one of, if not, the best gold miner out there. Yet.. gold and silver prices remain broadly weak, and that is keeping the stock subdued.

The cautious will wait to chase ABX until a sig' break higher. Seen on the daily chart, the $19.00 threshold... or via the monthly chart, a monthly close >$20.00. The latter looks out of range within the near term, as Gold and Silver remain choppy, and well below the summer 2016 highs.

The infamous 'gold bugs' can only get confident of hyper upside, if Gold >$1400, Silver >$22s, Copper >$3.00, and ABX >$23.33.

Right now, only the copper target/threshold looks viable within the near term.

ABX, daily

ABX, monthly

Summary

Barrick Gold is unquestionably one of, if not, the best gold miner out there. Yet.. gold and silver prices remain broadly weak, and that is keeping the stock subdued.

The cautious will wait to chase ABX until a sig' break higher. Seen on the daily chart, the $19.00 threshold... or via the monthly chart, a monthly close >$20.00. The latter looks out of range within the near term, as Gold and Silver remain choppy, and well below the summer 2016 highs.

The infamous 'gold bugs' can only get confident of hyper upside, if Gold >$1400, Silver >$22s, Copper >$3.00, and ABX >$23.33.

Right now, only the copper target/threshold looks viable within the near term.

Monday, 7 August 2017

DIS - leaning weak ahead of earnings

Whilst the main market saw yet another day of micro chop, there was notable weakness in Disney (DIS), which settled net lower for the third day of the past four, -1.2% at $106.35. The 50/200dma will offer big support in the upper $105s.

DIS daily

DIS monthly

Summary

Suffice to add, short term, from a pure technical/cyclical perspective, the setup favours the bears across the next few days, as we saw a bearish MACD cross on the daily cycle today. Price momentum on the bigger monthly cycle is fractionally negative, having cooled since April ($115.24).

However, unless you think the main market is close to a mid/long term top, there is little reason to see DIS under the most recent key low of $102.41, or the core psy' level of $100 any time soon.

--

*earnings are due Tuesday Aug'8th in AH.

DIS daily

DIS monthly

Summary

Suffice to add, short term, from a pure technical/cyclical perspective, the setup favours the bears across the next few days, as we saw a bearish MACD cross on the daily cycle today. Price momentum on the bigger monthly cycle is fractionally negative, having cooled since April ($115.24).

However, unless you think the main market is close to a mid/long term top, there is little reason to see DIS under the most recent key low of $102.41, or the core psy' level of $100 any time soon.

--

*earnings are due Tuesday Aug'8th in AH.

Friday, 4 August 2017

GDX - stuck at a key intersection

The gold miner ETF of GDX ended the week on a bearish note, settling -1.7% at $22.32, making for a net weekly decline of -2.6%. Near term outlook is bearish, not least as the USD is in the early phase of a multi-week bounce. Mid term outlook is extremely borderline, with indirect 'hope' via copper near $3.00.

GDX daily

GDX weekly

Summary

With the USD ending the week with a moderate bounce, the precious metals were pressured lower, and that dragged the related miners lower.

Seen on the bigger weekly chart, you can see how GDX has seen a clear rejection as what is an interesting intersection of two key trend lines.

The cautious mining bulls will leave the miners alone unless a break >$23.09... or a more decisive $24.00. Things would turn exceptionally bearish if the July low of $20.99 is taken out, with Gold <$1170.

--

The one indirect bullish aspect for Gold/Silver, and the related miners is copper...

Copper, weekly

Based on decades of price action, the three metals do broadly trade together. If copper can attain a monthly close >$3.00, it will be highly suggestive that Gold and Silver will eventually catch up. For the gold bugs out there... copper really is something to keep an eye on for the rest of the summer.

GDX daily

GDX weekly

Summary

With the USD ending the week with a moderate bounce, the precious metals were pressured lower, and that dragged the related miners lower.

Seen on the bigger weekly chart, you can see how GDX has seen a clear rejection as what is an interesting intersection of two key trend lines.

The cautious mining bulls will leave the miners alone unless a break >$23.09... or a more decisive $24.00. Things would turn exceptionally bearish if the July low of $20.99 is taken out, with Gold <$1170.

--

The one indirect bullish aspect for Gold/Silver, and the related miners is copper...

Copper, weekly

Based on decades of price action, the three metals do broadly trade together. If copper can attain a monthly close >$3.00, it will be highly suggestive that Gold and Silver will eventually catch up. For the gold bugs out there... copper really is something to keep an eye on for the rest of the summer.

Thursday, 3 August 2017

TSLA - Q2 much like Q1

Whilst the main market closed moderately mixed, there was significant strength in Tesla, which settled +6.5% at $347.09. Near term outlook does threaten some cooling, but no lower than $330. With the US capital market still giving Musk a 'free pass', mid term outlook is bullish.

TSLA daily

TSLA monthly

Summary

Suffice to add, Q2 EPS of -$1.33 was identical to Q1, although the cash burn is accelerating, as the company is trying to ramp production.

The stock valuation is utterly insane, but as is often the case, so long as earnings are better than expectations - even if its nominally bad, the stock will at least initially rally.

Fundamentally, this is one messed up company. Higher sales will merely see Tesla lose even more money, and that is despite huge govt' subsidies for each vehicle.

Technically, Tesla is super strong. Many recognise the $500s seem viable in 2018, and I can't much disagree.

TSLA daily

TSLA monthly

Summary

Suffice to add, Q2 EPS of -$1.33 was identical to Q1, although the cash burn is accelerating, as the company is trying to ramp production.

The stock valuation is utterly insane, but as is often the case, so long as earnings are better than expectations - even if its nominally bad, the stock will at least initially rally.

Fundamentally, this is one messed up company. Higher sales will merely see Tesla lose even more money, and that is despite huge govt' subsidies for each vehicle.

Technically, Tesla is super strong. Many recognise the $500s seem viable in 2018, and I can't much disagree.

Wednesday, 2 August 2017

AAPL - earnings remain good

Earnings for Apple (AAPL) remain good, with the stock breaking a new historic high of $159.75, settling +4.7% at $157.14. Near term outlook offers a touch of cooling to at least $154. Mid term, the $200s seem a given, as the US/global economy continues to tick along.

AAPL daily

AAPL monthly

Summary

Suffice to add, earnings were unquestionably good, and the stock justifiably broke a new historic high.

The daily settling black-fail candle is a subtle warning of short term exhaustion, and some cooling to 154, perhaps $150 would be very natural within 1-3 days. However, mid term.. the trend is super strong, but fully justified on good earnings.

Most now recognise that the $200s are on track, certainly by late spring 2018.

AAPL daily

AAPL monthly

Summary

Suffice to add, earnings were unquestionably good, and the stock justifiably broke a new historic high.

The daily settling black-fail candle is a subtle warning of short term exhaustion, and some cooling to 154, perhaps $150 would be very natural within 1-3 days. However, mid term.. the trend is super strong, but fully justified on good earnings.

Most now recognise that the $200s are on track, certainly by late spring 2018.

Subscribe to:

Comments (Atom)