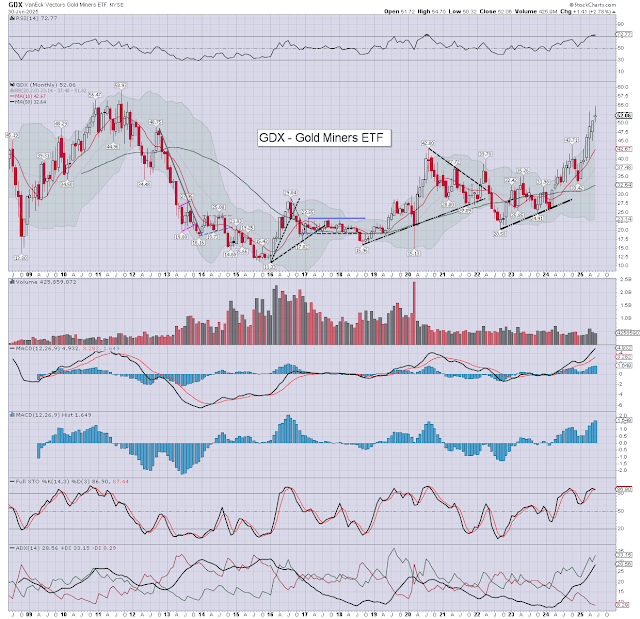

The gold miner ETF of GDX saw a net November gain of +$10.90 (15.1%) to

$82.96.

GDX, monthly

Summary

The collective of miners printed a low of $68.20, if recovering to the highest ever monthly settlement. November's candle is bullish engulfing, and bodes distinctly positive into early 2026. Monthly momentum accelerated upward, and is on the very high side. Monthly RSI 81s remains overbought.

-

Four of the key miners...

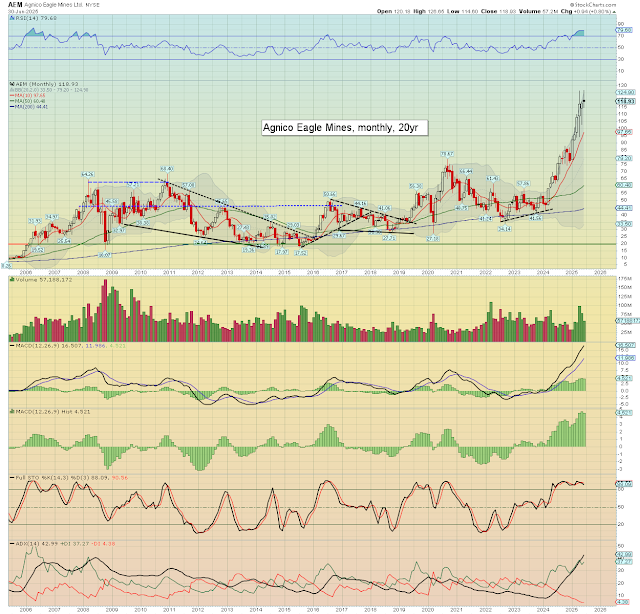

Agnico Eagle Mines (AEM)

Agnico saw a net November gain of +$13.32 (8.2%) to $174.13. Monthly

momentum ticked a touch higher, and is on the very high side. Vol' was considerably lower at 40.4M.

--

Newmont (NEM)

Newmont saw a net November gain of +$10.34 (12.8%) to $91.08. I

would note the monthly 10MA at $64.38, which was settled above. Monthly

momentum ticked a little higher, and is on the extremely high side. Vol' was considerably lower at 175M

--

Barrick Mining (B)

Barrick saw a net November gain of +$8.86 (27.1%) to $41.52, the highest monthly settlement since September 2012. Momentum is on the very high side. Vol' declined to 352M

--

Pan American Silver (PAAS)

Pan American Silver broke a new historic high of $45.97, with a net November gain of +$10.37 (29.6%) to

$45.44. Volume was significantly less at 102M.

--

Of the four, yours truly favours Agnico Eagle Mines, which has been the sector leader for over a year.

For more of the same...

Subscription details >>> https://www.tradingsunset.com