With Gold and Silver prices slipping across September, the mining stocks were again destroyed. The miner ETF of GDX saw a net monthly decline of an extreme -20.1% @ $21.33. The mid teens look likely, when Gold eventually trades to $1000/900s.

GDX, daily

GDX, monthly

Summary

Little to add from the endless posts of recent weeks..months.. even years.

--

GDX looks set to continue falling along with the metals... at the current rate... a key multi-year floor looks likely in late 2015/early 2016.

*On any basis, I have zero interest in picking up physical metals, or going long GLD/SLV, or ANY of the mining stocks.

Tuesday, 30 September 2014

Monday, 29 September 2014

TSLA - sliding with the broader market

With the main market moderately lower, Tesla (TSLA) was similarly weak, settling -0.6% @ $245. Near term outlook is for continued weakness, with the giant 200 day MA a rather obvious target, which will be in the $220/215 zone across October.

TSLA, daily

Summary

Suffice to say...TSLA remains a somewhat weak momo stock... and will probably remain weak ahead of Q3 earnings. If the numbers come in okay... TSLA will surely rebound back.. and break new highs.

-

*as ever, I have no interest in trading the momo stocks, but they remain rather entertaining to watch, and can be good pre-cursor warnings of weakness in the broader market.

TSLA, daily

Summary

Suffice to say...TSLA remains a somewhat weak momo stock... and will probably remain weak ahead of Q3 earnings. If the numbers come in okay... TSLA will surely rebound back.. and break new highs.

-

*as ever, I have no interest in trading the momo stocks, but they remain rather entertaining to watch, and can be good pre-cursor warnings of weakness in the broader market.

Friday, 26 September 2014

TVIX, UVXY - strong net weekly gains

Despite the VIX slipping a little lower into the weekend, the bullish 2x lev' VIX instruments of TVIX and UVXY saw net weekly gains of 14.1% and 14.6% respectively. There looks to be further upside of another 15/25% next week.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which saw a net weekly gain of 22.6%

VIX looks set to test the important weekly 10MA next week, currently in the mid 17s. A possible spike into the 18/19s looks possible if sp'1940/30s. The 20s.. as has been the case for a few years, look difficult to break and hold over.

--

As for TVIX and UVXY, interesting net weekly gains... and if my outlook on the VIX is correct, then both look set for another positive week.

As ever.. due to the usual statistical decay issue, such instruments are best for short term holds only, even when the trend is going 'the right way'.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which saw a net weekly gain of 22.6%

VIX looks set to test the important weekly 10MA next week, currently in the mid 17s. A possible spike into the 18/19s looks possible if sp'1940/30s. The 20s.. as has been the case for a few years, look difficult to break and hold over.

--

As for TVIX and UVXY, interesting net weekly gains... and if my outlook on the VIX is correct, then both look set for another positive week.

As ever.. due to the usual statistical decay issue, such instruments are best for short term holds only, even when the trend is going 'the right way'.

Thursday, 25 September 2014

AAPL - following the broader market

With the broader market seeing some very serious technical breaks to the downside, Apple (AAPL) was similarly weak, settling -3.8% @ $97.89. Near term outlook offers further weakness, down to $90/88 or so.. where the 200 day MA is fast approaching.

AAPL, daily

Summary

Suffice to say... a break of the 50 day MA, and with the technical breaks in the broader market, AAPL looks set for further downside.

The low $90s now look pretty likely.. with a viable bounce off the 200 dma in early October.

*those seeking an intermediate market top - from sp'2019, would arguably look for AAPL to fall to the giant gap zone.. with a primary downside target of $80/75 before end year.

AAPL, daily

Summary

Suffice to say... a break of the 50 day MA, and with the technical breaks in the broader market, AAPL looks set for further downside.

The low $90s now look pretty likely.. with a viable bounce off the 200 dma in early October.

*those seeking an intermediate market top - from sp'2019, would arguably look for AAPL to fall to the giant gap zone.. with a primary downside target of $80/75 before end year.

Wednesday, 24 September 2014

RIG, SDRL - the broader down trend continues

Whilst the major US equity indexes managed to break the recent down trend, there was continued weakness in the Oil/Gas drillers. Transocean (RIG) and Seadrill (SDRL) settled lower by -1.2% and -1.6% respectively.

RIG, weekly

SDRL, weekly

Summary

*I'll omit the daily charts, and just focus on the bigger weekly cycles

--

Suffice to say, the last 3 months have been a pretty horrific time for the driller stocks. As thing are, there is no sign of the down trend ending.

Considering the main market has continued to broadly rally into the late summer, the performance of the drilling stocks is even more dire.

-

At some point this sector destruction is going to end.. .but for now, I have zero interest in being long any of them, which includes, DO, RIG, and SDRL.

RIG, weekly

SDRL, weekly

Summary

*I'll omit the daily charts, and just focus on the bigger weekly cycles

--

Suffice to say, the last 3 months have been a pretty horrific time for the driller stocks. As thing are, there is no sign of the down trend ending.

Considering the main market has continued to broadly rally into the late summer, the performance of the drilling stocks is even more dire.

-

At some point this sector destruction is going to end.. .but for now, I have zero interest in being long any of them, which includes, DO, RIG, and SDRL.

Tuesday, 23 September 2014

BABA - day three

With the broader equity market seeing moderate weakness across the day, Alibaba (BABA) continued to cool from its issuance day high of $99.70. A few more days of weakness would be natural, but the offer price of $68 looks unlikely to be hit this year.

BABA,15min

Summary

*since we've only had three days of trading, I thought I'd merely highlight a micro 15min cycle chart.

--

Suffice to say, my only significant concern is that those hitting the buy button for BABA aren't actually directly buying BABA stock.. they are merely buying part of some investment/holding fund based in the Cayman islands.

The word... shady.... comes to mind.

-

Regardless, given a few more days, BABA will likely start to resume higher... the $100 threshold would remain an obvious target.

How long until we start seeing analysts with long term targets of $125/150 start appearing? In my view.. probably before year end.

--

*those who believe the broader US/world equity markets will likely continue to rise for another 12-18 months (not exactly that bold an outlook), could be looking for BABA to double up to around $150 by late 2015.

Considering the crazy price valuations of some LOSS making companies - notably AMZN, BABA could be argued to be trading in the $200s.

-

BABA is certainly one to watch for the rest of the year.

BABA,15min

Summary

*since we've only had three days of trading, I thought I'd merely highlight a micro 15min cycle chart.

--

Suffice to say, my only significant concern is that those hitting the buy button for BABA aren't actually directly buying BABA stock.. they are merely buying part of some investment/holding fund based in the Cayman islands.

The word... shady.... comes to mind.

-

Regardless, given a few more days, BABA will likely start to resume higher... the $100 threshold would remain an obvious target.

How long until we start seeing analysts with long term targets of $125/150 start appearing? In my view.. probably before year end.

--

*those who believe the broader US/world equity markets will likely continue to rise for another 12-18 months (not exactly that bold an outlook), could be looking for BABA to double up to around $150 by late 2015.

Considering the crazy price valuations of some LOSS making companies - notably AMZN, BABA could be argued to be trading in the $200s.

-

BABA is certainly one to watch for the rest of the year.

Monday, 22 September 2014

GDX - the destruction continues

Whilst the metals were broadly flat, with the US markets in a somewhat bad mood, the mining stocks were dragged lower. The ETF of GDX slipped by another -2.2% @ $22.16. The 2013 low in the $20s is set to be lost, outlook is for considerable downside into 2015.

GDX, daily

Summary

Suffice to say, the mining stocks continue to suffer.. whether as a result of a rising USD, falling metal prices, or in todays case, merely via the weaker broader equity market.

There is ZERO reason why GDX won't break below last years low.

An eventual multi-year floor in the mid/low teens now looks very likely.

GDX, daily

Summary

Suffice to say, the mining stocks continue to suffer.. whether as a result of a rising USD, falling metal prices, or in todays case, merely via the weaker broader equity market.

There is ZERO reason why GDX won't break below last years low.

An eventual multi-year floor in the mid/low teens now looks very likely.

Friday, 19 September 2014

GDX - another bad week for the miners

Whilst the broader equity market built gains, there was once again notable weakness in the mining stocks. The ETF of GDX saw a net weekly decline of -5.3%. For September so far, GDX has been smashed lower by -15.3%. Outlook remains.... absolutely dire.

GDX,daily

GDX, monthly

Summary

*the third consecutive net weekly decline for GDX

---

Little to add from the many posts across the last few weeks.

So long as the precious metals continue to fall.. the miner stocks will also decline, regardless of however strong the main equity market might be.

GDX,daily

GDX, monthly

Summary

*the third consecutive net weekly decline for GDX

---

Little to add from the many posts across the last few weeks.

So long as the precious metals continue to fall.. the miner stocks will also decline, regardless of however strong the main equity market might be.

Thursday, 18 September 2014

ANR, BTU - coal miners horror show

Whilst the broader equity market broke new historic highs, the coal miners were once again barred from the party. Alpha Natural Resources (ANR) and Peabody Energy (BTU) settled sharply lower, -7.1% and -4.9% respectively. Mid term outlook remains... dire.

ANR, daily

BTU, daily

Summary

The daily charts look horrific... but just consider the following...

ANR, monthly

BTU, monthly

-

With the US Govt' maintaining an effective 'war on coal'... the sector remains under constant downward pressure. There is ZERO sign of this sector destruction coming to an end any time soon.

Other notable weakness today

Arch Coal (ACI) -5.4%

Walter Energy (WLT) -14.4%.

Both of the above look vulnerable to ending up on the pink sheets...if not worse.

ANR, daily

BTU, daily

Summary

The daily charts look horrific... but just consider the following...

ANR, monthly

BTU, monthly

-

With the US Govt' maintaining an effective 'war on coal'... the sector remains under constant downward pressure. There is ZERO sign of this sector destruction coming to an end any time soon.

Other notable weakness today

Arch Coal (ACI) -5.4%

Walter Energy (WLT) -14.4%.

Both of the above look vulnerable to ending up on the pink sheets...if not worse.

Wednesday, 17 September 2014

GDX - the slide resumes

Whilst equities closed with moderate gains, with the FOMC announcement out of the way, the metals resumed the downside trend, which naturally pressured the miners. The ETF of GDX settled lower by a rather significant -2.2% @ $23.47.

GDX, daily

Summary

Suffice to say... weak metal prices are going to keep the downward pressure on the miners, regardless of however strong the broader equity market might be.

GDX looks set to lose the $20 threshold.. at some point in the remainder of this year.

GDX, daily

Summary

Suffice to say... weak metal prices are going to keep the downward pressure on the miners, regardless of however strong the broader equity market might be.

GDX looks set to lose the $20 threshold.. at some point in the remainder of this year.

Tuesday, 16 September 2014

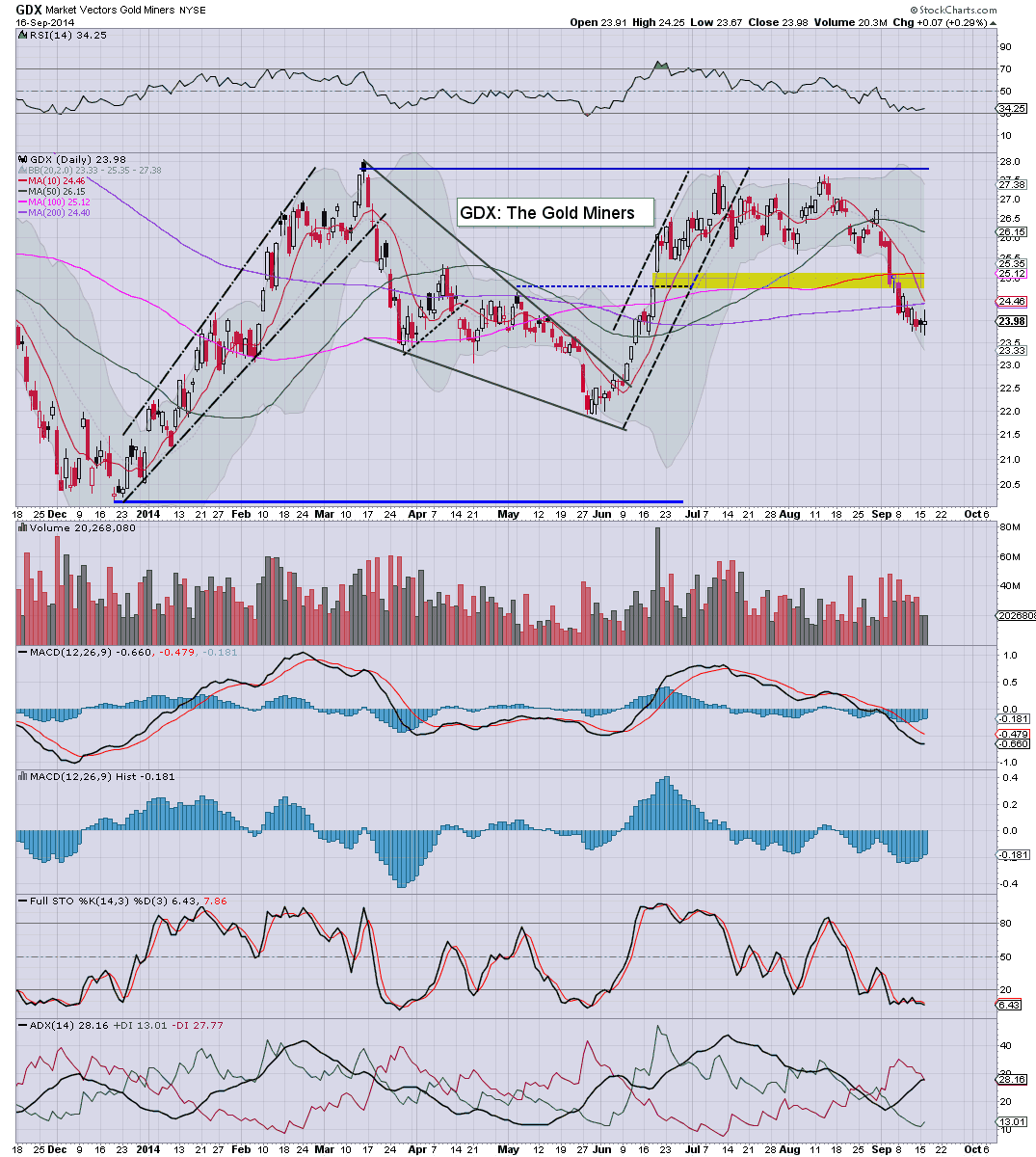

GDX - relatively minor bounce

With the broader market climbing back into the sp'2000s, and precious metal prices also rising, the miners gained. The ETF of GDX settled +0.3% @ $23.98. Near term outlook offers a continued bounce, but the $20 threshold looks set to be lost.. within 2-3 months.

GDX, daily

Summary

*I was queried my view on the ETF of DUST...(3x short miners). Naturally, that has done particularly well lately, as the mining stocks have been pressured by lower metal prices.- which themselves were pressured by a rising USD.

--

Suffice to say... a minor 2-3 week bounce in the metals seems likely... which will likely be reflected in moderate upside of 2-4% for GDX.

However, with the broader trends as they are, much lower levels for the mining stocks seem likely into year end.

Right now, Gold and Silver will likely take out the 2013 lows.. and if that is the case, then GDX will be sub $20. A grander multi-year floor target for GDX is likely in the mid/low teens...no later than later 2015.

*In terms of the ETF of DUST, that does bode for upside, but being a 3x leveraged ETF, there will be some severe decay issues (as ever). Multi-month holds... even when the trend is in favour... still often results in net losses.

GDX, daily

Summary

*I was queried my view on the ETF of DUST...(3x short miners). Naturally, that has done particularly well lately, as the mining stocks have been pressured by lower metal prices.- which themselves were pressured by a rising USD.

--

Suffice to say... a minor 2-3 week bounce in the metals seems likely... which will likely be reflected in moderate upside of 2-4% for GDX.

However, with the broader trends as they are, much lower levels for the mining stocks seem likely into year end.

Right now, Gold and Silver will likely take out the 2013 lows.. and if that is the case, then GDX will be sub $20. A grander multi-year floor target for GDX is likely in the mid/low teens...no later than later 2015.

*In terms of the ETF of DUST, that does bode for upside, but being a 3x leveraged ETF, there will be some severe decay issues (as ever). Multi-month holds... even when the trend is in favour... still often results in net losses.

Monday, 15 September 2014

FB, TSLA, TWTR - momo stocks slammed

Whilst the main market saw continued minor weak chop, there was rather severe downside in most of the momo stocks. Facebook (FB), Tesla (TSLA), and Twitter (TWTR) closed lower by -3.8%, -9.1%, and -5.2% respectively.

FB, daily

TSLA, daily

TWTR, daily

Summary

Suffice to say, the only notable significant weakness today was in the momo stocks.

What does it mean for the broader market? Probably.. very little. We've seen these kind of periodic smack downs a number of times this year, and overall.. it probably means nothing for the main market.

Regardless, for those who were short any of the momo stocks.. today was a great day... and a great opportunity to close out.. ahead of the next FOMC announcement.

FB, daily

TSLA, daily

TWTR, daily

Summary

Suffice to say, the only notable significant weakness today was in the momo stocks.

What does it mean for the broader market? Probably.. very little. We've seen these kind of periodic smack downs a number of times this year, and overall.. it probably means nothing for the main market.

Regardless, for those who were short any of the momo stocks.. today was a great day... and a great opportunity to close out.. ahead of the next FOMC announcement.

Friday, 12 September 2014

GDX - another lousy week for the miners

With precious metal prices seeing very significant declines across the week, the miners were seriously impacted. The miner ETF of GDX saw a net weekly decline of -4.75% @ $23.88. With the 200 day MA decisively broken, GDX looks set to lose the $20s this autumn.

GDX, daily

GDX, monthly

Summary

As ever, I approach the mining stocks from how the precious metals are performing. So long as metal prices remain weak, the miners are going to remain pressured lower.

This weeks significant declines in Gold and Silver - pressured lower by a rising USD, are driving many mining stocks to multi-year lows.

--

My broad target for the metals remains Gold $1000/900, and if that is the case, then most miners are still set to lose a further 30% or so. Some will no doubt be cut in half..or even more worse.

As for GDX, the $20 threshold - from last year, looks set to be broken, and the mid/low teens look a very viable target sometime in 2015.

GDX, daily

GDX, monthly

Summary

As ever, I approach the mining stocks from how the precious metals are performing. So long as metal prices remain weak, the miners are going to remain pressured lower.

This weeks significant declines in Gold and Silver - pressured lower by a rising USD, are driving many mining stocks to multi-year lows.

--

My broad target for the metals remains Gold $1000/900, and if that is the case, then most miners are still set to lose a further 30% or so. Some will no doubt be cut in half..or even more worse.

As for GDX, the $20 threshold - from last year, looks set to be broken, and the mid/low teens look a very viable target sometime in 2015.

Thursday, 11 September 2014

SDRL - the post earnings slide continues

Since earnings came out in late August, Seadrill (SDRL) has been on the slide, falling from the $36s, settling today -1.9% @ $32.82. Next support is around 31/30, if that fails, then the $26/24 zone is likely within a few months.

SDRL, daily

SDRL, weekly

Summary

I remain a major fan of the oil/gas driller stocks - unquestionably a key sector for the long term, but Mr Market has no such interest, with the entire sector suffering since June.

The current multi-week down cycle is a rather severe one, and SDRL looks set to have lost a quarter of its value by Oct/November.

SDRL has a sound balance sheet, and is within a sector that I am very bullish about.

Another key problem right now remains weak Oil/Nat' gas prices, that sure is not inspiring the mainstream to take an interest in the sector. That level of disdain though... won't last forever.

--

*I was long SDRL just ahead of earnings, but bailed in the $35s... and currently have no interest to re-enter until a major market correction... or if Nat' gas falls from $3.80 to the $3.30/20s.

SDRL, daily

SDRL, weekly

Summary

I remain a major fan of the oil/gas driller stocks - unquestionably a key sector for the long term, but Mr Market has no such interest, with the entire sector suffering since June.

The current multi-week down cycle is a rather severe one, and SDRL looks set to have lost a quarter of its value by Oct/November.

SDRL has a sound balance sheet, and is within a sector that I am very bullish about.

Another key problem right now remains weak Oil/Nat' gas prices, that sure is not inspiring the mainstream to take an interest in the sector. That level of disdain though... won't last forever.

--

*I was long SDRL just ahead of earnings, but bailed in the $35s... and currently have no interest to re-enter until a major market correction... or if Nat' gas falls from $3.80 to the $3.30/20s.

Wednesday, 10 September 2014

GDX - the down trend of destruction continues

Whilst the broader equity market saw minor chop, there was again notable weakness in the precious metals, and that naturally had a negative effect on the miners. The miner ETF of GDX slipped -1.9% @ $24.10. Near term outlook is bearish.

GDX, daily

Summary

Suffice to say, it was just another lousy day for the precious metals, and as usual, the mining stocks were naturally badly hit.

--

*my broader outlook is for Gold $1000/900s.. and if that is the case, then miners are going to lose another 25/30% on average. GDX will probably fall into the mid/low teens by mid 2015.

GDX, daily

Summary

Suffice to say, it was just another lousy day for the precious metals, and as usual, the mining stocks were naturally badly hit.

--

*my broader outlook is for Gold $1000/900s.. and if that is the case, then miners are going to lose another 25/30% on average. GDX will probably fall into the mid/low teens by mid 2015.

Tuesday, 9 September 2014

AAPL - new products & services

Whilst the main market saw another day of minor chop, there was significant strength (at least initially) in Apple (APPL) +3% in the $103s, but settling -0.5% @ $97.90. Near term outlook is bullish, with viable upside to $105/07 in the immediate term.

AAPL, daily

Summary

With yet another iPhone issued, along with a watch, and some 'apple pay' service, the market was more than pleased with today's announcement.

Even though AAPL closed a little lower, the huge drop that some equity bears were seeking simply didn't occur.

--

If the main market does not unravel into year end, then AAPL looks set for the $120s.

AAPL, daily

Summary

With yet another iPhone issued, along with a watch, and some 'apple pay' service, the market was more than pleased with today's announcement.

Even though AAPL closed a little lower, the huge drop that some equity bears were seeking simply didn't occur.

--

If the main market does not unravel into year end, then AAPL looks set for the $120s.

Monday, 8 September 2014

GDX - miners lose the 200 day MA

With the precious metals being pressured lower by a rising USD, the miners started the week on an especially negative note. The miner ETF of GDX settled -3.3% @ $24.23. The break under the 200dma is very significant, and bodes for much lower levels.

GDX, daily

Summary

Little to add from recent posts.

-

So long as the metals keep falling.. the miners are going to slide - regardless of however strong the main equity market is.

GDX, daily

Summary

Little to add from recent posts.

-

So long as the metals keep falling.. the miners are going to slide - regardless of however strong the main equity market is.

Friday, 5 September 2014

GDX - a bad week for the miners

With the precious metals continuing to slide (the rising USD sure did not help), mining stocks had a very bad start to the month. The ETF of GDX saw net weekly declines of -6.1%. Outlook is bearish.

GDX, daily

GDX, monthly

Summary

In the immediate term, there is certainly a high possibility of a minor bounce - having filled the price gap from mid June. Yet, we now have a concrete wall of resistance in the $27s. I do not expect that level to be broken above in the remainder of the year.

The gold bugs are again starting to be reminded of what happens to commodities (most.. but not necessarily all), when the US dollar increases in value.

Despite a great deal of 'dollar doom' talk out there, we are clearly seeing the USD in a new multi-month up wave. This will no doubt keep very strong downward pressure on both the metals and the mining stocks, probably for at least another 3-6 months.

--

*with my grander target of Gold $1000/900s, I am resigned to seeing much lower levels in the miners, and that would most likely see GDX under the big $20 threshold. It would not surprise me if GDX eventually floors in the mid/low teens next year.

GDX, daily

GDX, monthly

Summary

In the immediate term, there is certainly a high possibility of a minor bounce - having filled the price gap from mid June. Yet, we now have a concrete wall of resistance in the $27s. I do not expect that level to be broken above in the remainder of the year.

The gold bugs are again starting to be reminded of what happens to commodities (most.. but not necessarily all), when the US dollar increases in value.

Despite a great deal of 'dollar doom' talk out there, we are clearly seeing the USD in a new multi-month up wave. This will no doubt keep very strong downward pressure on both the metals and the mining stocks, probably for at least another 3-6 months.

--

*with my grander target of Gold $1000/900s, I am resigned to seeing much lower levels in the miners, and that would most likely see GDX under the big $20 threshold. It would not surprise me if GDX eventually floors in the mid/low teens next year.

Wednesday, 3 September 2014

AAPL - back under the big $100 threshold

Whilst the main market saw minor weak chop, there was more significant weakness in the tech sector. Apple (AAPL) saw a sharp sell down on major volume, settling -4.2% @ $98.94. Near term outlook is... borderline.

AAPL, daily

Summary

First...my broader market targets remain unchanged, with sp'2030/50 zone by opex week.

AAPL is of course a major component of the market, and today's drop was the largest since late January.

In terms of price, we have a clear daily close just above the lower rising channel. Any break to the 97s tomorrow, will open up a test of the 50 day MA in the $95s. A break under $90 looks unlikely this month.

There is the announcement of new products for the Christmas season.. next Tuesday. A super Tuesday for AAPL?

Regardless, AAPL is an interesting and important stock to keep an eye on.

-

A glimpse of the new HQ...

Likely to be completed in 2016.

--

AAPL, daily

Summary

First...my broader market targets remain unchanged, with sp'2030/50 zone by opex week.

AAPL is of course a major component of the market, and today's drop was the largest since late January.

In terms of price, we have a clear daily close just above the lower rising channel. Any break to the 97s tomorrow, will open up a test of the 50 day MA in the $95s. A break under $90 looks unlikely this month.

There is the announcement of new products for the Christmas season.. next Tuesday. A super Tuesday for AAPL?

Regardless, AAPL is an interesting and important stock to keep an eye on.

-

A glimpse of the new HQ...

Likely to be completed in 2016.

--

Tuesday, 2 September 2014

GDX - miners indirectly hit by rising dollar

With the precious metals being slammed - pressured by a rising US dollar, the mining stocks started the shortened week badly. The ETF of GDX fell a significant -3.4% @ $25.77. Next key support remains the mid $25s... and is likely going to fail.

GDX, daily

Summary

A failure to hold the mid $25s will open the door to a straight forward price gap fill in the low $25s.

Considering the broader trend in the precious metals... and with a US dollar that is continuing on a multi-month climb... the miners look set to further slip.

First major downside target are the low $20s from last December. I do not expect the 2013 lows to hold...in either the metals...or the precious metals.

GDX, daily

Summary

A failure to hold the mid $25s will open the door to a straight forward price gap fill in the low $25s.

Considering the broader trend in the precious metals... and with a US dollar that is continuing on a multi-month climb... the miners look set to further slip.

First major downside target are the low $20s from last December. I do not expect the 2013 lows to hold...in either the metals...or the precious metals.

Subscribe to:

Comments (Atom)