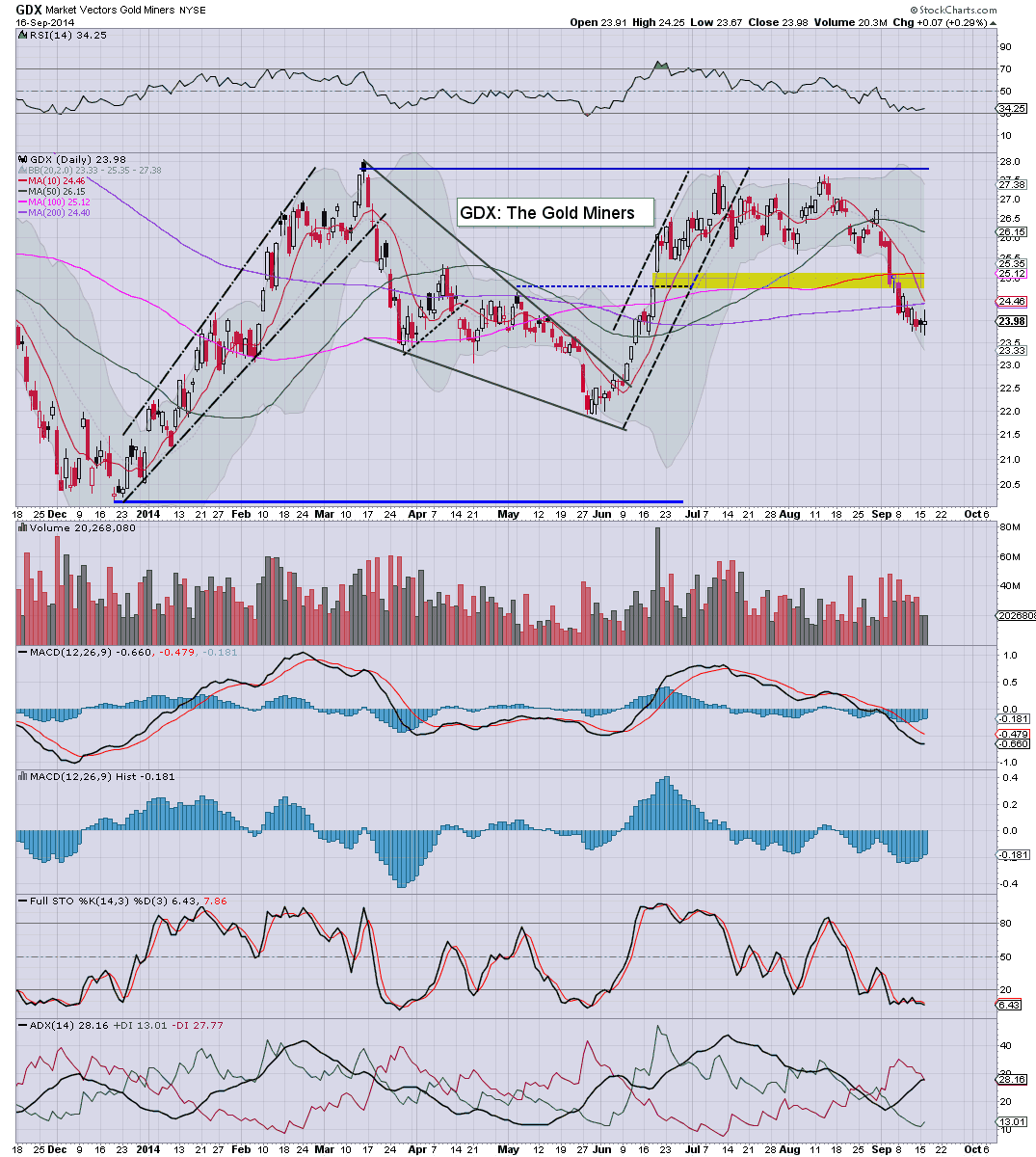

With the broader market climbing back into the sp'2000s, and precious metal prices also rising, the miners gained. The ETF of GDX settled +0.3% @ $23.98. Near term outlook offers a continued bounce, but the $20 threshold looks set to be lost.. within 2-3 months.

GDX, daily

Summary

*I was queried my view on the ETF of DUST...(3x short miners). Naturally, that has done particularly well lately, as the mining stocks have been pressured by lower metal prices.- which themselves were pressured by a rising USD.

--

Suffice to say... a minor 2-3 week bounce in the metals seems likely... which will likely be reflected in moderate upside of 2-4% for GDX.

However, with the broader trends as they are, much lower levels for the mining stocks seem likely into year end.

Right now, Gold and Silver will likely take out the 2013 lows.. and if that is the case, then GDX will be sub $20. A grander multi-year floor target for GDX is likely in the mid/low teens...no later than later 2015.

*In terms of the ETF of DUST, that does bode for upside, but being a 3x leveraged ETF, there will be some severe decay issues (as ever). Multi-month holds... even when the trend is in favour... still often results in net losses.