With precious metals seeing further weakness across March, the Gold/Silver miners were on the slide. The ETF of GDX settled lower by -1.2% @ $18.24. Across the month, GDX fell a rather extreme -14.3%. Near/mid term outlook is bearish, with viable downside to the 12/10 level by late summer.

GDX, daily

GDX, monthly

Summary

Suffice to say.. a second consecutive monthly decline for the miners. There is little reason not to expect further downside across the spring/summer

I hold to a broader downside target of $1000 for Gold, and if that is the case.. then most mining stocks will be lower by between 30/50% within the next 3-6 months.

-

Further, I am seeking a key mult-year floor in the miners.. and the precious metals by the autumn.

Tuesday, 31 March 2015

Monday, 30 March 2015

MCD - I want breakfast

With the main market seeing significant gains, McDonalds (MCD) settled higher by 0.95% @ $97.88. Near term outlook is moderately bullish... with next resistance at the giant $100 threshold. Across the last two years, MCD has remained broadly stuck within the 86/101 range.

MCD, daily

Summary

The chatter today was that McD' was considering doing breakfast 24/7.. at least in some places.

In the scheme of things though.. such changes are all minor of course.

As many recognise... the peak era for McD' has probably come and gone. With fierce competitors like CMG, market share for McD' looks set to gradually decline for many years to come.

*in terms of price, it remains a real mess. Equity bulls need a monthly close above the giant $100 threshold. Until that is achieved, it remains effectively stuck in the same range as it has done since early 2013.

--

... it remains a classic...

- Falling Down,1993... with Michael Douglas.. at perhaps his finest.

MCD, daily

Summary

The chatter today was that McD' was considering doing breakfast 24/7.. at least in some places.

In the scheme of things though.. such changes are all minor of course.

As many recognise... the peak era for McD' has probably come and gone. With fierce competitors like CMG, market share for McD' looks set to gradually decline for many years to come.

*in terms of price, it remains a real mess. Equity bulls need a monthly close above the giant $100 threshold. Until that is achieved, it remains effectively stuck in the same range as it has done since early 2013.

--

... it remains a classic...

- Falling Down,1993... with Michael Douglas.. at perhaps his finest.

Friday, 27 March 2015

INTC, ALTR - soaring into the weekend

Whilst the main market saw very subdued chop into the weekend, there was some closing hour drama in tech land. Intel (INTC) is rumoured to be buying Altera (ALTR) which settled the day higher by 6.5% and 27.6% respectively.

INTC, daily

ALTR, daily

Summary

*a good example of some closing hour drama...

INTC, 5min

--

As for the likely deal... INTC looks like it is now very eager to grow. The market was delighted with the news.. and the net daily gains in INTC were pretty unusual for the company that is set to launch an official bid next week.

-

INTC, monthly

Broadly.. I am seeking the $50s... eventually. On no reasonable outlook can I see INTC falling back under the breakout zone of $25.

INTC, daily

ALTR, daily

Summary

*a good example of some closing hour drama...

INTC, 5min

--

As for the likely deal... INTC looks like it is now very eager to grow. The market was delighted with the news.. and the net daily gains in INTC were pretty unusual for the company that is set to launch an official bid next week.

-

INTC, monthly

Broadly.. I am seeking the $50s... eventually. On no reasonable outlook can I see INTC falling back under the breakout zone of $25.

Thursday, 26 March 2015

GDX - fails to rally with Gold

Despite Gold rallying around $9, the precious metal miners failed to follow. The ETF of GDX settled lower by a rather significant -1.5% @ $19.07. Near term outlook is mixed, as the miners look vulnerable with the broader market, but have failed to break/hold above the 2013 floor at the $20 threshold.

GDX, daily

GDX, monthly

Summary

Little to add.

It has been a rough month for the precious metals.. and even though much of the Gold/Silver declines have been negated (as the USD weakens), the mining stocks are still massively lower by -10.4% on the month.

-

Best guess remains, a key multi-year floor for the precious metals (and by default.. the miners) in late summer/autumn.

GDX, daily

GDX, monthly

Summary

Little to add.

It has been a rough month for the precious metals.. and even though much of the Gold/Silver declines have been negated (as the USD weakens), the mining stocks are still massively lower by -10.4% on the month.

-

Best guess remains, a key multi-year floor for the precious metals (and by default.. the miners) in late summer/autumn.

Wednesday, 25 March 2015

DIS - break of trend in Disneyland

With increasing weakness in the broader equity market, Disney (DIS) was similarly under significant pressure, settling -2.0% @ $105.00. Next support is around 103/02.. where the 50dma will be lurking in the days ahead. There remains a very obvious price gap zone of 98/94.

DIS, daily

DIS, monthly

Summary

Disney has seen a clear break of the rising trend that stretches back to Feb 1st'.

There remain a huge truck load of reasons why the stock should continue to outperform the broader market, not least of which is Avengers'2 due for release in May.

-

*I remain very bullish DIS across the longer term... and will consider going long around 103/102 this Friday, not least if sp' looks floored in the 2040/20 zone.

DIS, daily

DIS, monthly

Summary

Disney has seen a clear break of the rising trend that stretches back to Feb 1st'.

There remain a huge truck load of reasons why the stock should continue to outperform the broader market, not least of which is Avengers'2 due for release in May.

-

*I remain very bullish DIS across the longer term... and will consider going long around 103/102 this Friday, not least if sp' looks floored in the 2040/20 zone.

Tuesday, 24 March 2015

FB, NFLX, TWTR - momo stocks catch a bid

Whilst the broader US equity market saw moderate declines, there was distinct strength in many of the momo stocks. Facebook (FB), Netflix (NFLX), and Twitter (TWTR) settled higher by a significant 1.0%, 3.1%, and 6.2% respectively. Near term outlook into April earnings is bullish for all three.

FB, daily

NFLX, daily

TWTR, daily

Summary

Suffice to say, all three look bullish into next earning season.

Of the three listed, TWTR looks the most bullish, with a decisive close above the $50 threshold. Next upside target is around $55, but the $60s look viable if Mr Market is inspired by Q1 earnings.

-

*I very rarely meddle in the momo stocks (my last trade in them was last earnings for TWTR... on the long side).. generally though.. they are merely useful to keep an eye on.. to help in determining the broader market sentiment.

FB, daily

NFLX, daily

TWTR, daily

Summary

Suffice to say, all three look bullish into next earning season.

Of the three listed, TWTR looks the most bullish, with a decisive close above the $50 threshold. Next upside target is around $55, but the $60s look viable if Mr Market is inspired by Q1 earnings.

-

*I very rarely meddle in the momo stocks (my last trade in them was last earnings for TWTR... on the long side).. generally though.. they are merely useful to keep an eye on.. to help in determining the broader market sentiment.

Monday, 23 March 2015

AAPL - post opex gains

Whilst the broader market started the week somewhat mixed, there was notable strength in Apple (AAPL), which settled higher by 1.1% @ $127.24. There is viable near term upside to around $130, with key resistance at the Feb'24th high of $133.60.

AAPL, daily

Summary

*first.. a reminder on last Friday afternoons closing minutes 'quadruple opex' nonsense...

AAPL, 5min

--

Suffice to add ... AAPL - along with the broader market should be able to claw higher in the next earnings season. No doubt, AAPL earnings will be reasonable... and the $140/45 zone remains a viable target if sp'2150/75 into May.

AAPL, daily

Summary

*first.. a reminder on last Friday afternoons closing minutes 'quadruple opex' nonsense...

AAPL, 5min

--

Suffice to add ... AAPL - along with the broader market should be able to claw higher in the next earnings season. No doubt, AAPL earnings will be reasonable... and the $140/45 zone remains a viable target if sp'2150/75 into May.

Friday, 20 March 2015

TVIX, UVXY - new lows with perpetual decay

With equities seeing strong net weekly gains, it was a rough week for the 2x lev' bullish VIX instruments. TVIX and UVXY saw net weekly declines of -16.4% and -16.7% respectively. The problem of statistical decay remains a serious issue, and the latest new lows are not surprising.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which saw a net weekly decline of -18.6%.

VIX looks set to remain subdued for some weeks as the sp'500 battles into the 2120/30s. There is viable 'algo bot slow grind' all the way into June... when there remains the first real threat of a Fed rate rise.

--

As for TVIX and UVXY.. they remain train wrecks for anyone holding longer than a few weeks.

There was a notable UVXY option trade today... see the following Friday update from Mr T.

A huge trade (120,000 x $510 per contract = $61.2 million), and considering the perpetual decay issue, it should be very profitable by mid 2016.

-

In terms of TVIX/UVXY in the near term... further declines seem likely as the broader US/world equity markets continue to break new highs. Seasonally, there is a chance for the Volatility bulls across May-June.

TVIX, daily

UVXY, daily

Summary

*first, an update on the VIX, which saw a net weekly decline of -18.6%.

VIX looks set to remain subdued for some weeks as the sp'500 battles into the 2120/30s. There is viable 'algo bot slow grind' all the way into June... when there remains the first real threat of a Fed rate rise.

--

As for TVIX and UVXY.. they remain train wrecks for anyone holding longer than a few weeks.

There was a notable UVXY option trade today... see the following Friday update from Mr T.

A huge trade (120,000 x $510 per contract = $61.2 million), and considering the perpetual decay issue, it should be very profitable by mid 2016.

-

In terms of TVIX/UVXY in the near term... further declines seem likely as the broader US/world equity markets continue to break new highs. Seasonally, there is a chance for the Volatility bulls across May-June.

Thursday, 19 March 2015

TSLA - broadly weak

With the main market seeing a moderate retrace of the Wed' gains, there was notable weakness in Tesla (TSLA), which settled -2.6% @ $195.51 . Near term outlook is bearish, next support is the Jan' low of $185.

TSLA, daily

Summary

Suffice to say, Tesla remains broadly weak from last September.

The company is unquestionably innovative, with an impressive product line, but.... fails to make any significant money on sales.

-

*TSLA is one of the infamous momo stocks, and I merely keep an eye on it for 'entertainment' reasons.

TSLA, daily

Summary

Suffice to say, Tesla remains broadly weak from last September.

The company is unquestionably innovative, with an impressive product line, but.... fails to make any significant money on sales.

-

*TSLA is one of the infamous momo stocks, and I merely keep an eye on it for 'entertainment' reasons.

Wednesday, 18 March 2015

RIG, SDRL - soaring on an oil swing

With Oil seeing an extreme swing from -2% to +5% - along with broader equity strength, the oil/gas drillers ramped. Transocean (RIG) and Seadrill (SDRL) settled powerfully higher by 8.8% and 7.5% respectively. Near term outlook is now bullish, but within a broader bearish trend.

RIG, daily

SDRL, daily

Summary

Unquestionably... with the FOMC statement.. along with the Yellen Q/A inspiring the market, energy stocks soared, particularly so.. the drillers.

However.. the broader trend remains weak.... and if Oil continues to slide - as I expect, then energy stocks will remain vulnerable.

RIG, daily

SDRL, daily

Summary

Unquestionably... with the FOMC statement.. along with the Yellen Q/A inspiring the market, energy stocks soared, particularly so.. the drillers.

However.. the broader trend remains weak.... and if Oil continues to slide - as I expect, then energy stocks will remain vulnerable.

Tuesday, 17 March 2015

AAPL - vulnerable.. with the main market

Whilst the main market saw moderate weakness for much of the day, there was notable strength in Apple (AAPL), which settled higher by 1.7% @ $127.06. Broad trend remains powerfully bullish, however if main market slips to sp'2k, then AAPL will fall to $115.

AAPL, daily

Summary

Little to add.

AAPL remains under-valued relative to main market.. but if the main market does rollover tomorrow/Thursday, then AAPL has a very high opportunity to slip to the lower rising trend/channel, within the next 2-3 weeks.

AAPL, daily

Summary

Little to add.

AAPL remains under-valued relative to main market.. but if the main market does rollover tomorrow/Thursday, then AAPL has a very high opportunity to slip to the lower rising trend/channel, within the next 2-3 weeks.

Monday, 16 March 2015

NFLX - rough start to the week

Whilst the broader market built significant gains across the day, Netflix (NFLX) was under pressure due to an institutional downgrade, settling -3.7% @ $422.10. Next support is $390.. and then $350.

NFLX, daily

Summary

*the momo stocks can be interesting to keep an eye on... but I generally leave them well alone.

--

Netflix remains broadly weak from the late Feb' high of $486.50... there looks to be 'reasonable' downside to the 390s.. or 350s within the near term.

-

NFLX, daily

Summary

*the momo stocks can be interesting to keep an eye on... but I generally leave them well alone.

--

Netflix remains broadly weak from the late Feb' high of $486.50... there looks to be 'reasonable' downside to the 390s.. or 350s within the near term.

-

Friday, 13 March 2015

RIG, SDRL - drillers breaking new lows

With WTIC Oil seeing major net weekly declines of -9.9%, energy stocks were again weak. Transocean (RIG), and Seadrill (SDRL) closed significantly lower by -4.7% and -6.2% respectively. Outlook into the spring/summer is exceptionally bearish... both stocks could fall a further 50%.

RIG, daily

SDRL, daily

Summary

*the daily charts are interesting.. but just reflect on the giant monthly cycles..

RIG, monthly

SDRL, monthly

--

*Best guess... Oil breaks the January low of $43, and if so.. next downside target zone is $35/30 into the spring.

If correct, then all energy stocks are going to get trashed into the spring. Even though RIG and SDRL are already lower by around 75% from last summer, both stocks could still get cut in half from current levels.

**I have confidence in both companies across the longer term... but for now... I am more than content to merely watch them in what is freefall mode.

RIG, daily

SDRL, daily

Summary

*the daily charts are interesting.. but just reflect on the giant monthly cycles..

RIG, monthly

SDRL, monthly

--

*Best guess... Oil breaks the January low of $43, and if so.. next downside target zone is $35/30 into the spring.

If correct, then all energy stocks are going to get trashed into the spring. Even though RIG and SDRL are already lower by around 75% from last summer, both stocks could still get cut in half from current levels.

**I have confidence in both companies across the longer term... but for now... I am more than content to merely watch them in what is freefall mode.

Thursday, 12 March 2015

ACI, ANR, WLT - three coal miners in real trouble

Whilst the broader market built strong gains across the day, there was notable weakness in energy. Arch coal (ACI), Alpha Natural Resources (ANR), and Walter Energy (WLT), settled lower by -4.0%, -7.0%, and -19.3% respectively. Near, mid, and long term outlook is bearish... to zero.

ACI, daily

ANR, daily

WLT, daily

Summary

*I don't chart ACI or WLT - hence blank charts, but I wanted to highlight them anyway.

-

Unlike Peabody Energy (BTU) or Consol (CNX), the above three little coal miners continue on their way to the pink sheets.. and probably bankruptcy.

Frankly.. there is little to add... the US Govt' 'war on coal' is clearly succeeding. We've lost PCX and JRCC (amongst others) in recent years, I'll be surprised if we don't lose one of two of the above trio by end year.

ACI, daily

ANR, daily

WLT, daily

Summary

*I don't chart ACI or WLT - hence blank charts, but I wanted to highlight them anyway.

-

Unlike Peabody Energy (BTU) or Consol (CNX), the above three little coal miners continue on their way to the pink sheets.. and probably bankruptcy.

Frankly.. there is little to add... the US Govt' 'war on coal' is clearly succeeding. We've lost PCX and JRCC (amongst others) in recent years, I'll be surprised if we don't lose one of two of the above trio by end year.

Wednesday, 11 March 2015

BAC - set for the $17s

Whilst the broader market saw minor chop, there was notable strength in the financials - ahead of the latest Fed stress test. Bank of America (BAC) settled higher by 2.1% @ $16.12. A key break above resistance in 16.70s look viable within the near term.. offering a key monthly close in the $18s by early summer.

BAC, daily

BAC, monthly

Summary

Suffice to say.. BAC remains my favourite financial stock across the longer term. In terms of price action, it has been struggling since the start of the year, but now looks set for renewed upside.

*A BAC monthly close in the $18s (unlikely until at least April/May) would bode for much higher levels in the broader market for the rest of the year.

BAC, daily

BAC, monthly

Summary

Suffice to say.. BAC remains my favourite financial stock across the longer term. In terms of price action, it has been struggling since the start of the year, but now looks set for renewed upside.

*A BAC monthly close in the $18s (unlikely until at least April/May) would bode for much higher levels in the broader market for the rest of the year.

Tuesday, 10 March 2015

INTC - falling with the main market

With the main equity market seeing a second significant decline in three trading days, Intel (INTC) settled lower by a rather strong -3.1% @ $31.71. Despite the declines, the broader trend remains powerfully bullish, after a key upside break last summer. First key upside target is $40... then the giant $50.

INTC, monthly

INTC, daily

Summary

Little to add.

Intel remains one of my top three tech stocks... unquestionably sound across the longer term... and headed broadly higher.

If you agree that a monthly Nasdaq Comp' close in the 5200s is likely at some point this spring/summer... then it is not overly bold to be seeking INTC in the $40s... which is some 35% or so higher.

-

INTC, monthly

INTC, daily

Summary

Little to add.

Intel remains one of my top three tech stocks... unquestionably sound across the longer term... and headed broadly higher.

If you agree that a monthly Nasdaq Comp' close in the 5200s is likely at some point this spring/summer... then it is not overly bold to be seeking INTC in the $40s... which is some 35% or so higher.

-

Monday, 9 March 2015

AA - the October floor fails to hold

Whilst the main market saw moderate gains, there was very significant weakness in Alcoa (AA), settling -5.4% @ $13.70. Near term outlook is especially bearish, with the key Oct' low of $13.66 now having been taken out. Broader downside to $10/9 by late summer.

AA, daily

AA, monthly

Summary

Alcoa is now a completely broken stock... seemingly headed for the $10/9 zone into the summer... regardless of however strong the broader market might be.

AA, daily

AA, monthly

Summary

Alcoa is now a completely broken stock... seemingly headed for the $10/9 zone into the summer... regardless of however strong the broader market might be.

Friday, 6 March 2015

GDX - miners cave in... as metals implode

With the precious metals seeing very sharp falls into the weekend, the mining stocks were naturally smashed. The ETF of GDX settled lower by a rather extreme -7.2% @ $18.63. If Gold slips to $1000, then GDX looks set to be in the 14/12 zone by early summer, with a grander target floor of 12/10.

GDX, weekly'3, 'best guess' outlook

GDX, monthly

Summary

Frankly, today was absolute carnage for the miners, with some of the smaller mining stocks seeing double digit declines.

However.. the declines in metals were expected... and as ever.. if the metals are lower... the miners will (almost always) be similarly lower.

-

GDX looks set to continue broadly lower across the spring.. and into the summer. There seems very viable downside to the 14/12 zone... if Gold $1000. However, if Gold can slip to the fib' retrace of 61%... in the 900/875 zone.. .then GDX will be trading around 12/10.

At that price level.... and time... it will arguably be a generational buy.

GDX, weekly'3, 'best guess' outlook

GDX, monthly

Summary

Frankly, today was absolute carnage for the miners, with some of the smaller mining stocks seeing double digit declines.

However.. the declines in metals were expected... and as ever.. if the metals are lower... the miners will (almost always) be similarly lower.

-

GDX looks set to continue broadly lower across the spring.. and into the summer. There seems very viable downside to the 14/12 zone... if Gold $1000. However, if Gold can slip to the fib' retrace of 61%... in the 900/875 zone.. .then GDX will be trading around 12/10.

At that price level.... and time... it will arguably be a generational buy.

Thursday, 5 March 2015

AAPL - continuing to retrace

Whilst the broader saw moderate price chop, there was notable weakness in Apple (AAPL), settling -1.7% @ $126.39. There looks to be further near term weakness to the 120/118 zone. Broader upside into the summer to the $140s looks highly probable.

AAPL, daily

Summary

Suffice to say... near term downside is $120/118 zone.. where the 50dma is lurking.

-

In next wave, AAPL has a fair chance at 140/45... perhaps the psy' level of $150 in June.

AAPL, daily

Summary

Suffice to say... near term downside is $120/118 zone.. where the 50dma is lurking.

-

In next wave, AAPL has a fair chance at 140/45... perhaps the psy' level of $150 in June.

Wednesday, 4 March 2015

BTU, CHK, SDRL - energy stocks under pressure

With the broader market continuing to see some weakness, it was a particularly bad day for most energy related stocks. Peabody Energy (BTU), Chesapeake Energy (CHK), and Seadrill (SDRL), settled lower by -6.4%, -4.5%, and -2.9% respectively. Near/mid term outlook remains bearish.

BTU, daily

CHK, daily

SDRL, daily

Summary

Suffice to say.... a bad day for most energy stocks... near term outlook is bearish.... and mid term outlook into the summer doesn't look great!

--

*I would like to clarify that I have long term confidence in the viability of all three companies (even the stinky coal miner of BTU!).. but for now.. the prices are wrong... and time.. is still not right.

Three to watch... into the summer.

BTU, daily

CHK, daily

SDRL, daily

Summary

Suffice to say.... a bad day for most energy stocks... near term outlook is bearish.... and mid term outlook into the summer doesn't look great!

--

*I would like to clarify that I have long term confidence in the viability of all three companies (even the stinky coal miner of BTU!).. but for now.. the prices are wrong... and time.. is still not right.

Three to watch... into the summer.

Tuesday, 3 March 2015

BABA - broken floor

With the main market a little lower, BABA was again on the slide, settling -2.9% @ $81.53. More importantly, the Nov' floor ($82.81) has been taken out, with viable downside to the IPO price of $68.

BABA, daily

Summary

Suffice to say... the floor has been taken out.. and there is nothing but empty air until the $70/68 zone.

--

BABA chatter from Mr H.

As ever... make of that... what you will.

BABA, daily

Summary

Suffice to say... the floor has been taken out.. and there is nothing but empty air until the $70/68 zone.

--

BABA chatter from Mr H.

As ever... make of that... what you will.

Monday, 2 March 2015

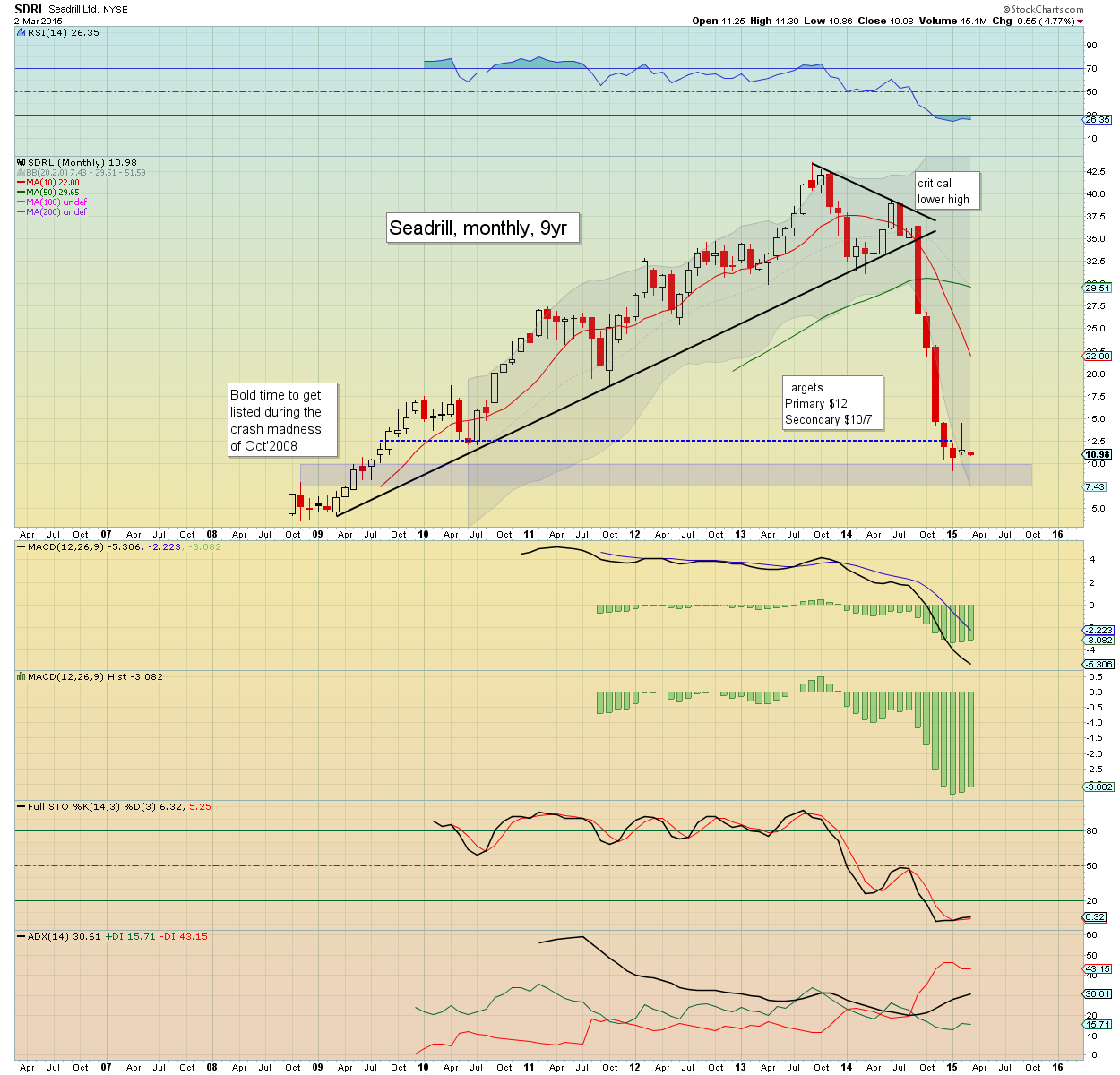

SDRL - still broadly weak

Despite a notable bounce from the low $9s to the $14s, Seadrill (SDRL) remains broadly weak. Whilst the broader market continues to make new historic highs, SDRL is not invited to the party, settling -4.8% @ $10.98. Near/mid term outlook remains bearish.

SDRL, monthly

Summary

*as noted repeatedly in recent months, I like the oil/gas drillers, but not at these prices... and more importantly... not at this time.

--

SDRL... along with RIG (Transocean) and DO (Diamond Offshore), remain broadly weak... and there is little reason to believe new multi-year lows are not going to happen into the summer.

I am still highly suspicious that WTIC Oil will not hold the recent $43 low... and if Oil is in the $35/30 zone later this year... SDRL will be at least somewhat lower than current levels.

SDRL, monthly

Summary

*as noted repeatedly in recent months, I like the oil/gas drillers, but not at these prices... and more importantly... not at this time.

--

SDRL... along with RIG (Transocean) and DO (Diamond Offshore), remain broadly weak... and there is little reason to believe new multi-year lows are not going to happen into the summer.

I am still highly suspicious that WTIC Oil will not hold the recent $43 low... and if Oil is in the $35/30 zone later this year... SDRL will be at least somewhat lower than current levels.

Subscribe to:

Comments (Atom)