Whilst the broader market saw a day of minor chop, the gold/silver miners ended the month on a very positive note, with the ETF of GDX settling +3.0% @ $24.52. However, that still made for a very significant net monthly decline of -7.2%. Whilst mid term price action remains bearish, price structure is threatening a bull flag.

GDX, daily

GDX, monthly

Summary

Suffice to add, even a couple of net daily gains doesn#t negate what has been the second big net monthly decline of the past three.

Wave counters could justifiably count everything since the Aug' peak of $31.79 as an ABC corrective wave, after the giant ramp from the Jan' low of $12.40.

Overall, its a messy situation. Arguably, things only turn provisionally bullish with a break >26, and 'strongly bullish, with any price action >28.

yours.. bullish 'Gold Rush'.

Monday, 31 October 2016

Friday, 28 October 2016

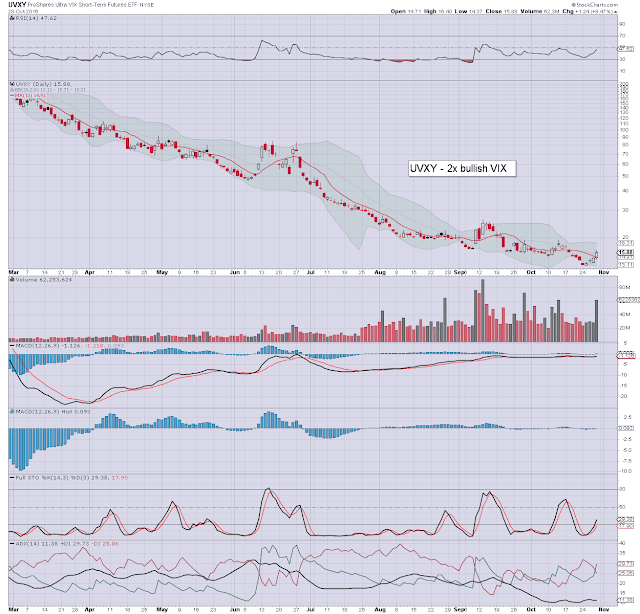

TVIX, UVXY - climbing into the weekend

With the 'FBI Clinton emails' news rattling the equity market, the VIX climbed into the weekend. The 2x lev' bullish instruments of TVIX and UVXY saw net weekly gains of 11.0% and 11.6% respectively. Near term outlook threatens a touch of cooling, but with a probable significant increase in volatility into the US election of Nov'8th.

TVIX, daily

UVXY, daily

Summary

First, an update on the VIX, which saw a net weekly gain of 21.4%

Seen on the bigger weekly cycle, there is viable near term upside to the key 20 threshold. Anything above the BREXIT high of 26.72 looks a stretch, unless the market fails to hold the 200dma (sp'2070s), with some resulting closes in the sp'2050s or lower. Right now, that looks unlikely, as based on broadly bullish price action in other world equity markets.

--

As for TVIX/UVXY...

The week started on a down note, indeed, with new historic lows. Yet, the rest of the week saw a four day run of net gains.

A little cooling in TVIX/UVXY is a threat next Mon/Tuesday, as equities will be vulnerable to a brief (and unsustainable) bounce.

If the sp'2080/70 zone is hit, that will likely equate to VIX around the key 20 threshold, which should see TVIX/UVXY at least another 10/15% higher.

--

As ever... holding overnight, and more so - across multiple weeks, almost never ends well, as such leveraged instruments suffer from (amongst various things) the problem of statistical decay.

TVIX, daily

UVXY, daily

Summary

First, an update on the VIX, which saw a net weekly gain of 21.4%

Seen on the bigger weekly cycle, there is viable near term upside to the key 20 threshold. Anything above the BREXIT high of 26.72 looks a stretch, unless the market fails to hold the 200dma (sp'2070s), with some resulting closes in the sp'2050s or lower. Right now, that looks unlikely, as based on broadly bullish price action in other world equity markets.

--

As for TVIX/UVXY...

The week started on a down note, indeed, with new historic lows. Yet, the rest of the week saw a four day run of net gains.

A little cooling in TVIX/UVXY is a threat next Mon/Tuesday, as equities will be vulnerable to a brief (and unsustainable) bounce.

If the sp'2080/70 zone is hit, that will likely equate to VIX around the key 20 threshold, which should see TVIX/UVXY at least another 10/15% higher.

--

As ever... holding overnight, and more so - across multiple weeks, almost never ends well, as such leveraged instruments suffer from (amongst various things) the problem of statistical decay.

Thursday, 27 October 2016

F - falling on uninspiring earnings

Q3 earnings for Ford (F) were above market expectations, but that wasn't enough to inspired any upside, with the stock settling -1.3% @ $11.73. Considering the broader market looks set to weaken into early November, Ford will be inclined for the $11.20/10.80 zone.

F, daily

F, monthly

Summary

Suffice to add... EPS of 26 cents was far better than consensus of 21, but that was notably below last years equivalent of 45 cents.

At the current price, Ford has a PE of around 10/11, and is offering a yield of around 5%... almost 3 times the US 10yr bond.

Relative to the main market, Ford has been struggling since hitting the brick wall of the $16s in summer 2014.

For the conservative 'bullish chasers', its one to merely watch until a monthly close >$16.

F, daily

F, monthly

Summary

Suffice to add... EPS of 26 cents was far better than consensus of 21, but that was notably below last years equivalent of 45 cents.

At the current price, Ford has a PE of around 10/11, and is offering a yield of around 5%... almost 3 times the US 10yr bond.

Relative to the main market, Ford has been struggling since hitting the brick wall of the $16s in summer 2014.

For the conservative 'bullish chasers', its one to merely watch until a monthly close >$16.

Wednesday, 26 October 2016

GDX - a very clear bear flag

With the precious metals seeing some moderate cooling, the related mining stocks were naturally on the slide. The ETF of GDX settled lower by a rather significant -2.1% @ $24.12. Price structure since the Oct'11th low of $22.50 is a very clear bear flag. The 21/19 zone looks extremely viable.

GDX, daily

GDX, monthly

Summary

With just 3 trading days left of the month, the miners are set for a very significant net monthly decline.

I would imagine some of the wave counters would count August as 'A', a September 'B' bounce, with current price action part of a final C - as part of a corrective wave, after the hyper ramp from the Jan' low of $12.40.

Confidence is high than further short term downside is due. Yet.. the mid term outlook is very uncertain. It will be largely dependent on whether the USD stops climbing.. and starts to cool back away from the very important DXY 100 threshold.

GDX, daily

GDX, monthly

Summary

With just 3 trading days left of the month, the miners are set for a very significant net monthly decline.

I would imagine some of the wave counters would count August as 'A', a September 'B' bounce, with current price action part of a final C - as part of a corrective wave, after the hyper ramp from the Jan' low of $12.40.

Confidence is high than further short term downside is due. Yet.. the mid term outlook is very uncertain. It will be largely dependent on whether the USD stops climbing.. and starts to cool back away from the very important DXY 100 threshold.

Tuesday, 25 October 2016

FCX - post earnings swings

Whilst the broader market closed moderately weak, there was some notable price action in Freeport McMoran (FCX), which settled +3.6% @ $10.55. The daily close was 1 cent below first key resistance of the 50dma. Things only turn 'conservatively bullish', on a break above the $14 threshold.

FCX, daily

FCX, monthly

Summary

*the closing daily candle was a touch bearish... having cooled from the $11 threshold, and settling a touch under the 50dma.

--

Earnings were very mixed. It could be argued that FCX has tried - to some success, to stabilise itself after a rough couple of years.

Freeport still has almost $19bn of debt, which is clearly a problem for a company with a market cap of $14bn.

*For further details.. see: http://finance.yahoo.com/news/freeport-mcmoran-reports-third-quarter-120000897.html

--

Seen on the giant monthly cycle, price structure is threatening a large bull flag. First upside would be around $17, which is around 60% higher. That will clearly require a decisive breakout in copper prices.. well above $2.40, and probably to around the $3.00 threshold.

FCX, daily

FCX, monthly

Summary

*the closing daily candle was a touch bearish... having cooled from the $11 threshold, and settling a touch under the 50dma.

--

Earnings were very mixed. It could be argued that FCX has tried - to some success, to stabilise itself after a rough couple of years.

Freeport still has almost $19bn of debt, which is clearly a problem for a company with a market cap of $14bn.

*For further details.. see: http://finance.yahoo.com/news/freeport-mcmoran-reports-third-quarter-120000897.html

--

Seen on the giant monthly cycle, price structure is threatening a large bull flag. First upside would be around $17, which is around 60% higher. That will clearly require a decisive breakout in copper prices.. well above $2.40, and probably to around the $3.00 threshold.

Monday, 24 October 2016

Miners digging deeper

Whilst the broader market closed moderately higher, there was notable weakness in the gold/silver mining stocks. The ETF of GDX settled lower for a third consecutive day, -2.0% @ $24.12. First soft support is the recent low of $22.50. Broader weakness to the 21/19 zone looks probable.

GDX, daily

GDX, monthly

Summary

With just six trading days left of the month, the miners are clearly struggling. August was a train wreck month, September saw a failing bounce, and we're currently set for a sig' net monthly decline.

The mining bulls can argue broad price structure is a multi-month bull flag. Any price action in the $17s or lower, would negate such a scenario.

--

Underlying MACD (blue bar histogram) cycle on the giant monthly cycle continues to tick lower. Even at the current rate though, a bearish cross is at least 3-4 months away.

GDX, daily

GDX, monthly

Summary

With just six trading days left of the month, the miners are clearly struggling. August was a train wreck month, September saw a failing bounce, and we're currently set for a sig' net monthly decline.

The mining bulls can argue broad price structure is a multi-month bull flag. Any price action in the $17s or lower, would negate such a scenario.

--

Underlying MACD (blue bar histogram) cycle on the giant monthly cycle continues to tick lower. Even at the current rate though, a bearish cross is at least 3-4 months away.

Friday, 21 October 2016

TVIX, UVXY - a rough week with new historic lows

Whilst equities saw a great deal of chop this week, the VIX broadly cooled to the low teens. The 2x lev' bullish instruments of TVIX and UVXY saw net weekly declines of -18.6% and -19.1% respectively. Near term outlook offers a strong rebound, as VIX is set to challenge the key 20 threshold.

TVIX, daily

UVXY, daily

Summary

First, an update on the VIX, which saw a net weekly decline of -17.2%

--

As for TVIX and UVXY.... the net weekly declines are especially harsh, as equities saw a broad failure to continue pushing upward from last week's low of sp'2114.

Considering the looming election, the VIX remains bizarrely subdued. Some degree of rebound looks due next week.

It is hard to see the VIX not making at least one or two attempts to reach the key 20 threshold into early November. The weekly VIX chart is offering the 20/22 zone, which would likely equate to sp'2080/70.

--

As ever, the issue of statistical decay makes holding such leveraged instruments across multiple days... or weeks... increasingly problematic.

TVIX, daily

UVXY, daily

Summary

First, an update on the VIX, which saw a net weekly decline of -17.2%

--

As for TVIX and UVXY.... the net weekly declines are especially harsh, as equities saw a broad failure to continue pushing upward from last week's low of sp'2114.

Considering the looming election, the VIX remains bizarrely subdued. Some degree of rebound looks due next week.

It is hard to see the VIX not making at least one or two attempts to reach the key 20 threshold into early November. The weekly VIX chart is offering the 20/22 zone, which would likely equate to sp'2080/70.

--

As ever, the issue of statistical decay makes holding such leveraged instruments across multiple days... or weeks... increasingly problematic.

Thursday, 20 October 2016

GDX - miners starting to cool

After three days of rather significant gains, the mining stocks are back under some pressure - notably via the strong USD. The ETF of GDX settled -0.3% @ $24.80. There remains a serious threat of renewed downside all the way to the $21/19s.

GDX, daily

GDX, monthly

Summary

Suffice to add.. things only turn bullish on a break above declining trend... where the 50dma is lurking in the mid $26s. Otherwise... we have an arguable gap fill, and are now set to break new multi-month lows.

The bigger monthly chart is threatening a large multi-month bull flag. That will only be provisionally confirmed though with a monthly close in the mid/upper $26s.

As ever... the USD will be a key variable. The metals would be under severe downward pressure if DXY >100. For now.. its an increasingly borderline situation.

GDX, daily

GDX, monthly

Summary

Suffice to add.. things only turn bullish on a break above declining trend... where the 50dma is lurking in the mid $26s. Otherwise... we have an arguable gap fill, and are now set to break new multi-month lows.

The bigger monthly chart is threatening a large multi-month bull flag. That will only be provisionally confirmed though with a monthly close in the mid/upper $26s.

As ever... the USD will be a key variable. The metals would be under severe downward pressure if DXY >100. For now.. its an increasingly borderline situation.

Wednesday, 19 October 2016

INTC - big break lower

Whilst the broader market managed moderate gains, there was severe weakness in Intel (INTC), which snapped lower on earnings in Tuesday AH, and settling Wednesday lower by -5.8% @ $35.56 - the lowest level since early September.

INTC, daily

INTC, monthly

Summary

*its notable that today's big drop was after yesterday's closing black-fail candle. Those are never to be dismissed lightly.

--

Unadjusted EPS was 80 cents - well above market consensus of 73... but that was not enough to satisfy the mainstream. With a slightly lowered forecast for Q4, the market duly whacked INTC stock.

There is a clear break of first support of 50dma in the $36.40s. Next big price-cluster support is in the $34.40s.

--

Those equity bears seeking massively lower levels in the broader US equity market, are going to need to see stocks like INTC, break below core rising trend. In Intel's case.. that is in the low $33s.

So... it can be safely said things only turn 'decisively bearish', if INTC is trading in the $32s in November.. or any time after.

INTC, daily

INTC, monthly

Summary

*its notable that today's big drop was after yesterday's closing black-fail candle. Those are never to be dismissed lightly.

--

Unadjusted EPS was 80 cents - well above market consensus of 73... but that was not enough to satisfy the mainstream. With a slightly lowered forecast for Q4, the market duly whacked INTC stock.

There is a clear break of first support of 50dma in the $36.40s. Next big price-cluster support is in the $34.40s.

--

Those equity bears seeking massively lower levels in the broader US equity market, are going to need to see stocks like INTC, break below core rising trend. In Intel's case.. that is in the low $33s.

So... it can be safely said things only turn 'decisively bearish', if INTC is trading in the $32s in November.. or any time after.

Tuesday, 18 October 2016

NFLX - the upside down

Whilst the broader market closed moderately higher, there was extremely powerful strength in Netflix (NFLX), which settled +19.1% @ $118.87, the best daily close since late Dec'2015. Next term outlook is bearish, as the broader market looks highly vulnerable to a brief foray <sp'2100.

NFLX, monthly (inv), 16yr, rainbow

*if you have never seen 'Stranger Things', you're missing out, and you probably will not get the reference via the above kooky chart.

--

NFLX, daily

NFLX, monthly

Summary

Earnings certainly impressed the market, as subscriber growth was good in both the US and elsewhere.

The problem - as many recognise, is that NFLX is a cash burner. Its kinda ironic that despite such great numbers, NFLX noted it will still need to raise new funds - via debt, in the near term, to keep funding the production of original content.

The recent move back above the $100 threshold was significant. Today's move wasn't exactly a surprise.

In the mid/long term, NFLX will be highly vulnerable to competition. Further, what happens when the next recession hits? Such subscriptions will be the first to get cancelled by the recently unemployed.

An expensive stock

With quarterly earnings of 12 cents, if you round that up to 50 cents a year, that gives a PE of around 240. Such a ludicrous valuation belongs in the upside down.

As I'll keep saying, I personally think Netflix is now producing some of the most innovative and best shows ever made. Whether its the Marvel universe of Daredevil, Jessica Jones, or the recent Luke Cage, or the ground breaking Sense8 or nostalgia of Stranger Things, its pretty incredible how bold Netflix has been.

NFLX just need to keep building their customer base and raising those subscription prices for long term survivability. That is easier said than done of course.

yours truly...

in London.. which after sundown, can feel like living in the upside down.

NFLX, monthly (inv), 16yr, rainbow

*if you have never seen 'Stranger Things', you're missing out, and you probably will not get the reference via the above kooky chart.

--

NFLX, daily

NFLX, monthly

Summary

Earnings certainly impressed the market, as subscriber growth was good in both the US and elsewhere.

The problem - as many recognise, is that NFLX is a cash burner. Its kinda ironic that despite such great numbers, NFLX noted it will still need to raise new funds - via debt, in the near term, to keep funding the production of original content.

The recent move back above the $100 threshold was significant. Today's move wasn't exactly a surprise.

In the mid/long term, NFLX will be highly vulnerable to competition. Further, what happens when the next recession hits? Such subscriptions will be the first to get cancelled by the recently unemployed.

An expensive stock

With quarterly earnings of 12 cents, if you round that up to 50 cents a year, that gives a PE of around 240. Such a ludicrous valuation belongs in the upside down.

As I'll keep saying, I personally think Netflix is now producing some of the most innovative and best shows ever made. Whether its the Marvel universe of Daredevil, Jessica Jones, or the recent Luke Cage, or the ground breaking Sense8 or nostalgia of Stranger Things, its pretty incredible how bold Netflix has been.

NFLX just need to keep building their customer base and raising those subscription prices for long term survivability. That is easier said than done of course.

yours truly...

in London.. which after sundown, can feel like living in the upside down.

Monday, 17 October 2016

BAC - earnings were... reasonable

Whilst the broader market closed moderately weak, Bank of America saw a day of swings, settling +0.4% @ $16.06. Near term outlook offers the mid $16s, but if the main market weakens <sp'2100, BAC will cool to the 15.50/00 zone. Broadly, the $18 threshold remains powerful multi-year resistance.

BAC, daily

BAC, monthly

Summary

Suffice to add... earnings were reasonable, in what remains one of the better US financials.

Higher rates would really help the financials. A Fed rate rise at the Dec' FOMC remains on the menu.

However, it should be clear that 'data dependency' at the Federal Reserve is primarily based on equity prices. If the broader market ends October on a bad note, that'd bode for a rough November.

Any break to even the low sp'1900s would effectively take a rate hike off the menu, and that would wreck the remainder of the year for BAC, and almost all other financials.

--

Seen on the giant monthly cycle, the $18 threshold remains massively important. The more conservative 'bullish chasers' will remain waiting until a monthly close >18.

BAC, daily

BAC, monthly

Summary

Suffice to add... earnings were reasonable, in what remains one of the better US financials.

Higher rates would really help the financials. A Fed rate rise at the Dec' FOMC remains on the menu.

However, it should be clear that 'data dependency' at the Federal Reserve is primarily based on equity prices. If the broader market ends October on a bad note, that'd bode for a rough November.

Any break to even the low sp'1900s would effectively take a rate hike off the menu, and that would wreck the remainder of the year for BAC, and almost all other financials.

--

Seen on the giant monthly cycle, the $18 threshold remains massively important. The more conservative 'bullish chasers' will remain waiting until a monthly close >18.

Friday, 14 October 2016

TVIX, UVXY - a mixed week in volatility land

With key lows of sp'2119 and Dow 18k failing to hold, the VIX climbed to the upper 17s this week. The 2x lev' bullish instruments of TVIX and UVXY saw net weekly gains of 10.4% and 10.6% respectively. With equities unable to hold support, the door is open to a further 3% of downside, which would equate to VIX in the low 20s.

TVIX, daily

UVXY, daily

Summary

First, an update on the VIX, which saw a very significant net weekly gain of 19.6%

--

As for TVIX and UVXY, it is notable that despite settling the week net higher, both instruments did break new historic lows.

The underlying issue of statistical decay will always be a problem, especially for those holding across multiple weeks.. or even just overnight.

-

*things only get hyper-bullish for volatility, if we see a daily close in the sp'2050s. Until then... TVIX/UVXY will remain broadly vulnerable to the usual decay.

TVIX, daily

UVXY, daily

Summary

First, an update on the VIX, which saw a very significant net weekly gain of 19.6%

--

As for TVIX and UVXY, it is notable that despite settling the week net higher, both instruments did break new historic lows.

The underlying issue of statistical decay will always be a problem, especially for those holding across multiple weeks.. or even just overnight.

-

*things only get hyper-bullish for volatility, if we see a daily close in the sp'2050s. Until then... TVIX/UVXY will remain broadly vulnerable to the usual decay.

Thursday, 13 October 2016

DAL, UAL - climbing against the broader market

Whilst the broader market was struggling for much of the day, there was notable strength in the airlines, with Delta (DAL) and United (UAL) settling net higher by 2.0% and 1.5% respectively. Near term outlook is a little shaky, as the main market has broken recent key lows.

DAL, daily

UAL, daily

Summary

*very strong reversals were seen in the airline stocks today. DAL held support and reversed, whilst UAL broke support, but then battled strongly upward.

--

Suffice to add... DAL earnings were a touch mixed, with EPS coming in at $1.47, but revenue a touch under expectations at $10.45bn.

Broadly, I favour DAL over UAL, which is arguably a far more stable company, as also reflected in its stock price action.

--

*UAL, earnings due, Mon' Oct 17th, AH.

DAL, daily

UAL, daily

Summary

*very strong reversals were seen in the airline stocks today. DAL held support and reversed, whilst UAL broke support, but then battled strongly upward.

--

Suffice to add... DAL earnings were a touch mixed, with EPS coming in at $1.47, but revenue a touch under expectations at $10.45bn.

Broadly, I favour DAL over UAL, which is arguably a far more stable company, as also reflected in its stock price action.

--

*UAL, earnings due, Mon' Oct 17th, AH.

Wednesday, 12 October 2016

F - battling to hold support

Whilst the broader market closed moderately mixed, there was notable relative weakness in Ford (F), which settled -0.2% @ $11.96. Any daily closes <11.90 would be provisionally bearish, and open the door to the Feb' low of $10.78.

F, daily

F, monthly

Summary

Suffice to add... its an extremely borderline situation.

--

I like Ford across mid/long term, but until it can close back above the $14 threshold, its somewhat suspect. More broadly, the hyper-bulls need to see a monthly close >$16 to really be confident.

F, daily

F, monthly

Summary

Suffice to add... its an extremely borderline situation.

--

I like Ford across mid/long term, but until it can close back above the $14 threshold, its somewhat suspect. More broadly, the hyper-bulls need to see a monthly close >$16 to really be confident.

Tuesday, 11 October 2016

AA - post earnings depression

With the main market having a somewhat difficult day, Alcoa (AA) dropped in pre-market, and was unable to rally on earnings, settling -11.4% @ $27.92. A test of the $27.00 threshold looks probable within the next few days... even if the broader market can rally.

AA, daily

AA, monthly

Summary

Alcoa is in the middle of splitting into two distinct companies. In many ways, things are going to remain somewhat confusing for another few quarters.

There was a split in the stock last week of 3 for 1.. hence the price jump from around $10 to $30.

--

So long as AA can hold the 27s... the threat remains of renewed upside. Price structure on the giant monthly cycle is threatening a somewhat stretched bullish pennant.

Any move above the April high of $34.40 would be suggestive of another multi-month climb to challenge multi-year resistance around $50.

AA, daily

AA, monthly

Summary

Alcoa is in the middle of splitting into two distinct companies. In many ways, things are going to remain somewhat confusing for another few quarters.

There was a split in the stock last week of 3 for 1.. hence the price jump from around $10 to $30.

--

So long as AA can hold the 27s... the threat remains of renewed upside. Price structure on the giant monthly cycle is threatening a somewhat stretched bullish pennant.

Any move above the April high of $34.40 would be suggestive of another multi-month climb to challenge multi-year resistance around $50.

Monday, 10 October 2016

TWTR - no interested buyers

Whilst the main market started the week on a broadly positive note, there was outright carnage in Twitter (TWTR), which imploded at the open, and settling -11.1% @ $17.68. As any realistic hope of a near term bid has evapourated, so have most of the gains built since mid June.

TWTR, daily

TWTR, weekly, 3.5yr

Summary

Thursday saw the initial shock as it became clear neither Disney, Salesforce, or Google, had any near term intention to issue a takeover bid.

Friday was a classic churn day, as some 'bargain buyers' appeared.

The week has begun with an increased mainstream realistion that Twitter is likely to remain public for at least some months.

The company is clearly struggling, unable to grow, with management that seem entirely devoid of ideas.

Keep in mind the IPO price was $26, and it seems absolutely no one in corporate land is willing to pay that much.

If TWTR does break new historic lows, a bidder or two will probably appear. Yet.. if TWTR if trading at around $10.. such a bid won't likely be >$20.

--

Here is a thought....

Its 2016.. and we have a twitter website, where most uses want such simple things as an edit button. Yet management are either not listening... or just don't care.

TWTR, daily

TWTR, weekly, 3.5yr

Summary

Thursday saw the initial shock as it became clear neither Disney, Salesforce, or Google, had any near term intention to issue a takeover bid.

Friday was a classic churn day, as some 'bargain buyers' appeared.

The week has begun with an increased mainstream realistion that Twitter is likely to remain public for at least some months.

The company is clearly struggling, unable to grow, with management that seem entirely devoid of ideas.

Keep in mind the IPO price was $26, and it seems absolutely no one in corporate land is willing to pay that much.

If TWTR does break new historic lows, a bidder or two will probably appear. Yet.. if TWTR if trading at around $10.. such a bid won't likely be >$20.

--

Here is a thought....

Its 2016.. and we have a twitter website, where most uses want such simple things as an edit button. Yet management are either not listening... or just don't care.

Friday, 7 October 2016

TVIX, UVXY - the usual decay

With equities seeing a lot of moderate chop, the VIX remained broadly subdued. That has resulted in the 2x lev' bullish VIX instruments of TVIX and UVXY seeing net weekly declines of -4.4% and -4.6% respectively. Near term outlook offers very little hope that market volatility will pick up.. despite the looming earnings and election.

TVIX, daily

UVXY, daily

Summary

First, an update on the VIX, which saw a net weekly gain of 1.4%.

--

As for TVIX and UVXY.. its merely the same old problem....

If equities are choppy... that isn't enough to inspire a sustainably higher VIX. Indeed, such trading conditions are only marginally less bad than a soaring market.. as the statistical decay is a near relentless problem.

--

Yours truly has ZERO interest in being long the VIX. That view would only change if a monthly close in the sp'2050s or lower.... and that sure doesn't look likely for the remainder of this year.

TVIX, daily

UVXY, daily

Summary

First, an update on the VIX, which saw a net weekly gain of 1.4%.

--

As for TVIX and UVXY.. its merely the same old problem....

If equities are choppy... that isn't enough to inspire a sustainably higher VIX. Indeed, such trading conditions are only marginally less bad than a soaring market.. as the statistical decay is a near relentless problem.

--

Yours truly has ZERO interest in being long the VIX. That view would only change if a monthly close in the sp'2050s or lower.... and that sure doesn't look likely for the remainder of this year.

Thursday, 6 October 2016

Miners still digging deeper

With precious metals seeing another significant wave lower, the related mining stocks were naturally on the slide. The ETF of GDX settled -3.0% @ $22.86, the lowest level since late May. Any daily closes <22, would be a serious warning that all of the gains since the Jan' low of $12.40 are vulnerable.

GDX, daily

GDX, monthly

Summary

Suffice to add... another really rough day for the mining stocks.

Many are now trading under their respective 200dmas, and the early summer lows are being broken under. Its an ugly picture, as Gold/Silver have both broken the rising trend that stretches back to the Dec'2015 lows.

There is threat of a short term bounce, but the mid term outlook is currently bearish.

GDX, daily

GDX, monthly

Summary

Suffice to add... another really rough day for the mining stocks.

Many are now trading under their respective 200dmas, and the early summer lows are being broken under. Its an ugly picture, as Gold/Silver have both broken the rising trend that stretches back to the Dec'2015 lows.

There is threat of a short term bounce, but the mid term outlook is currently bearish.

Wednesday, 5 October 2016

CHK, RIG - energy stocks rising with oil

With oil/gas prices climbing, the related energy sector stocks were naturally following. Chesapeake Energy (CHK), and Transocean (RIG), settled higher by a very significant 6.7% and 5.9% respectively. Price action remains pretty volatile, but if WTIC can break/hold $50, it will bode for broader upside for months to come.

CHK, daily

RIG, daily

Summary

Suffice to add... with oil/gas prices on the rise, most energy stocks are naturally continuing their broad climb from their Jan/Feb lows.

Many of the mid/small tier stocks have already doubled up... yet there is viable upside of another 25/50% in most cases... assuming Oil to the $70s by late spring/early summer 2017.

--

As ever, the USD will be a key variable that shapes broader price action. I'm still leaning on a weaker USD into 2017... which would help give oil.. .and the related energy stocks an extra boost.

CHK, daily

RIG, daily

Summary

Suffice to add... with oil/gas prices on the rise, most energy stocks are naturally continuing their broad climb from their Jan/Feb lows.

Many of the mid/small tier stocks have already doubled up... yet there is viable upside of another 25/50% in most cases... assuming Oil to the $70s by late spring/early summer 2017.

--

As ever, the USD will be a key variable that shapes broader price action. I'm still leaning on a weaker USD into 2017... which would help give oil.. .and the related energy stocks an extra boost.

Tuesday, 4 October 2016

GDX - Tuesday mining massacre

With Gold and Silver smashed lower across the day, the related mining stocks were similarly obliterated. The ETF of GDX settled lower by an outright horrific -9.8% @ $23.42. Near/mid term outlook is bearish, as a great many aspects of support have been broken... as now also reflected in Gold prices.

GDX, daily

GDX, monthly

Summary

Gold was borderline breaking rising trend last week... a trend that has held since the Dec'2015 low.

Yesterday, Gold broke outside of that trend. Today's massive decline gives absolute clarity that the upward wave from Dec'2015 has concluded.

In many ways, this week can be counted as 'week'1 down' for Gold. Considering the rally spanned a full 9 months. It is VERY conservative to say Gold will now broadly cool for at least another 2 months... probably 3.

If that does turn out to be the case.. the related mining stocks are in for a world of hurt.

Many of the miners have multiplied many times from the lows... yet... there is now a high threat they'll retrace everything gained.

--

*its notable there never was any 'industry capitulation' within the mining sector, as the metals broadly declined across 2011-2015.

GDX, daily

GDX, monthly

Summary

Gold was borderline breaking rising trend last week... a trend that has held since the Dec'2015 low.

Yesterday, Gold broke outside of that trend. Today's massive decline gives absolute clarity that the upward wave from Dec'2015 has concluded.

In many ways, this week can be counted as 'week'1 down' for Gold. Considering the rally spanned a full 9 months. It is VERY conservative to say Gold will now broadly cool for at least another 2 months... probably 3.

If that does turn out to be the case.. the related mining stocks are in for a world of hurt.

Many of the miners have multiplied many times from the lows... yet... there is now a high threat they'll retrace everything gained.

--

*its notable there never was any 'industry capitulation' within the mining sector, as the metals broadly declined across 2011-2015.

Monday, 3 October 2016

NFLX - the strength of Luke Cage

Whilst the broader market closed moderately mixed, there was notable strength in Netflix (NFLX), settling +4.1% @ $102.63, the best level since late May. With the break >$100, near/mid term outlook is bullish. If the main market rallies into spring 2017, NFLX will be at least in the 120/130s.

NFLX, daily

NFLX, monthly

Summary

Today's gain really did break a wheel barrow of aspects of resistance. The daily close above the psy' level of $100 is very significant.

Next big level is the April high of $111.85, with viable upside to at least challenge the Dec'2015 high of $133.27 in spring 2017.

--

Netflix is increasingly churning out some of the best shows (at considerable costs). From a valuation perspective, today's gains merely make NFLX even less attractive. The current forward PE is around 115/120... which is clearly ludicrous.

Yours truly shall merely enjoy the shows.

-

NFLX, daily

NFLX, monthly

Summary

Today's gain really did break a wheel barrow of aspects of resistance. The daily close above the psy' level of $100 is very significant.

Next big level is the April high of $111.85, with viable upside to at least challenge the Dec'2015 high of $133.27 in spring 2017.

--

Netflix is increasingly churning out some of the best shows (at considerable costs). From a valuation perspective, today's gains merely make NFLX even less attractive. The current forward PE is around 115/120... which is clearly ludicrous.

Yours truly shall merely enjoy the shows.

-

Subscribe to:

Comments (Atom)