With the 'FBI Clinton emails' news rattling the equity market, the VIX climbed into the weekend. The 2x lev' bullish instruments of TVIX and UVXY saw net weekly gains of 11.0% and 11.6% respectively. Near term outlook threatens a touch of cooling, but with a probable significant increase in volatility into the US election of Nov'8th.

TVIX, daily

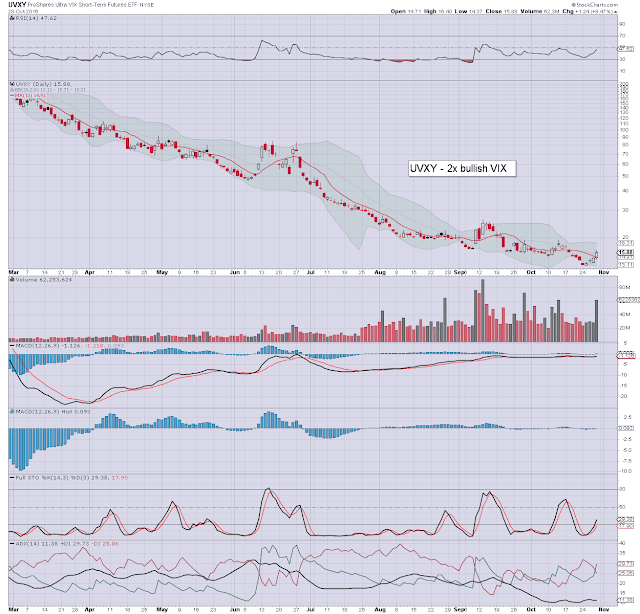

UVXY, daily

Summary

First, an update on the VIX, which saw a net weekly gain of 21.4%

Seen on the bigger weekly cycle, there is viable near term upside to the key 20 threshold. Anything above the BREXIT high of 26.72 looks a stretch, unless the market fails to hold the 200dma (sp'2070s), with some resulting closes in the sp'2050s or lower. Right now, that looks unlikely, as based on broadly bullish price action in other world equity markets.

--

As for TVIX/UVXY...

The week started on a down note, indeed, with new historic lows. Yet, the rest of the week saw a four day run of net gains.

A little cooling in TVIX/UVXY is a threat next Mon/Tuesday, as equities will be vulnerable to a brief (and unsustainable) bounce.

If the sp'2080/70 zone is hit, that will likely equate to VIX around the key 20 threshold, which should see TVIX/UVXY at least another 10/15% higher.

--

As ever... holding overnight, and more so - across multiple weeks, almost never ends well, as such leveraged instruments suffer from (amongst various things) the problem of statistical decay.