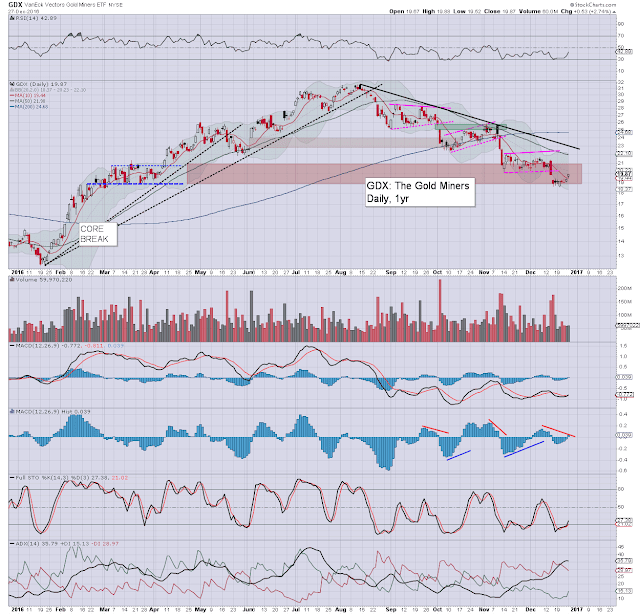

Whilst the main market held moderate gains across the day, there was more significant strength in the gold/silver miners, with the ETF of GDX settling higher for a second consecutive day, +2.7% @ $19.87. Near term outlook is bullish, but mid term price action remains bearish unless GDX >$25.

GDX, daily

GDX, monthly

Summary

With just three trading days left of the year, its notable that GDX is still set for a third consecutive net monthly decline... and is some 35% (or so) lower from the August high of $31.70.

For now, the mid term trend remains outright bearish.

For the less cautious, first 'conservative' level to start chasing higher would be on a break above the monthly 10MA in the mid $24s.

Personally, I'd like to see GDX $25s before seriously believing a key 'higher low' is in.