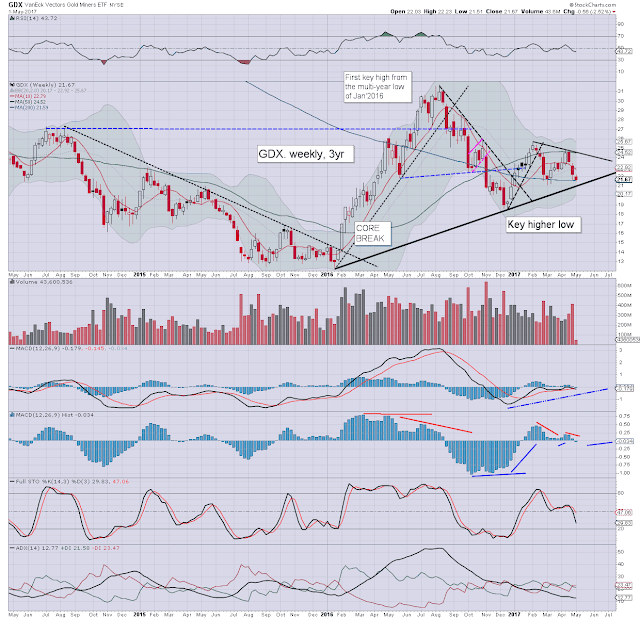

The mining sector ETF of GDX settled the day +0.5% at $22.70, which made for a net monthly gain of 2.1%. Price action since February has been choppy, leaning on the weak side. May saw a marginal break of core rising trend, but it was a transient event, and the positive monthly close keeps open the door to far higher levels this summer.

GDX monthly

GDX daily

Summary

Suffice to add, its been a choppy few months for the Gold miners, not least as the precious metals have themselves been seeing some swings, also leaning on the weaker side.

A key issue is the USD, which recently saw a break of mid term rising trend. By definition, a weaker USD is inherently bullish for Gold and Silver, and the related miners.

--

Yours truly is still leaning bullish. Lets be clear though, if the May low (GDX $20.89) is taken out in June (or any time after), it would bode badly for mining stocks and the precious metals.

Wednesday, 31 May 2017

Tuesday, 30 May 2017

MU - breaking up and away

Whilst the main market saw a day of subdued weak chop, there was notable strength in Micron Technology (MU), which settled +3.2% at $30.71. There is a clear break out of the consolidation range, with the $35/36s due as early as July.

MU, daily

MU, monthly

Summary

Suffice to add... recent earnings were superb.

Further upside to $35/36 looks a given. Any closes in the $37s would be hyper-bullish, and offer 45/50 by spring 2018.

I am extremely bullish MU. Alternatives... INTC, QCOM, NVDA, and AMD.

MU, daily

MU, monthly

Summary

Suffice to add... recent earnings were superb.

Further upside to $35/36 looks a given. Any closes in the $37s would be hyper-bullish, and offer 45/50 by spring 2018.

I am extremely bullish MU. Alternatives... INTC, QCOM, NVDA, and AMD.

Friday, 26 May 2017

GDX - a third week for the miners

With precious metals on the rise, the gold miners ended the week on a positive note, with the sector ETF of GDX settling +1.0% at $22.94, which made for a net weekly gain of 0.3%. Near term outlook is mixed, as there is significant overhead resistance.

GDX, daily

GDX,weekly

Summary

So, a third net weekly gain for the gold miners. Recent price action has been choppy, and its notable the weekly candle was of the black-fail type... just like last week. That does bode on the weaker side in the near term.

The weak USD - stuck under the DXY 100 threshold, continues to help prop up Gold and Silver, and that is certainly helping the related miners.

Outlook: near term is mixed, but mid term is bullish.

Key levels: Gold $1400, Silver $22s, Copper >$3.00, with GDX $32s. Indeed, any price action for GDX in the $32s would open the window to a grander run to $50, as early as spring 2018.

--

For extra charts (usually after 7pm EST each day), see https://twitter.com/permabear_uk

GDX, daily

GDX,weekly

Summary

So, a third net weekly gain for the gold miners. Recent price action has been choppy, and its notable the weekly candle was of the black-fail type... just like last week. That does bode on the weaker side in the near term.

The weak USD - stuck under the DXY 100 threshold, continues to help prop up Gold and Silver, and that is certainly helping the related miners.

Outlook: near term is mixed, but mid term is bullish.

Key levels: Gold $1400, Silver $22s, Copper >$3.00, with GDX $32s. Indeed, any price action for GDX in the $32s would open the window to a grander run to $50, as early as spring 2018.

--

For extra charts (usually after 7pm EST each day), see https://twitter.com/permabear_uk

Thursday, 25 May 2017

CHK, RIG - whacked lower with oil

With WTIC oil significantly lower after the OPEC meeting, the related energy stocks had a rough day. Chesapeake Energy (CHK) and Transocean (RIG) settled lower by -6.3% and -7.6% respectively. Near term outlook is bearish, but the mid term outlook will turn bullish if some aspects of overhead resistance can be broken.

CHK, daily

RIG, daily

Summary

Energy stocks have been broadly weak since Dec'2016. Relative to WTIC oil and Nat' gas prices, energy stocks are actually lagging rather badly.

Key levels...

CHK: declining trend, currently at $5.80, and the 200dma in the $6.20s. The cautious will wait to meddle in CHK until some weekly closes >$6.30.

RIG: declining trend, currently around $11.40, and the 200dma in the $11.90s. The cautious will wait for the $12s.

Of the two, I favour CHK, especially as I see better upside in Nat' gas, than in WTIC oil.

CHK, daily

RIG, daily

Summary

Energy stocks have been broadly weak since Dec'2016. Relative to WTIC oil and Nat' gas prices, energy stocks are actually lagging rather badly.

Key levels...

CHK: declining trend, currently at $5.80, and the 200dma in the $6.20s. The cautious will wait to meddle in CHK until some weekly closes >$6.30.

RIG: declining trend, currently around $11.40, and the 200dma in the $11.90s. The cautious will wait for the $12s.

Of the two, I favour CHK, especially as I see better upside in Nat' gas, than in WTIC oil.

Wednesday, 24 May 2017

TIF - no breakfast for Tiffany

Whilst the main market closed a little higher, there was very significant downside in Tiffany (TIF), which settled -8.7% at $85.03. Near term outlook is bearish, with next support at the 200dma in the $80s. The March high of $97.29 likely marks a mid term high, and was itself notably below the Nov'2014 high.

TIF, daily

TIF, monthly

Summary

First, see: http://investor.tiffany.com/releases.cfm

--

Earnings were actually better than a year ago, but market expectations have been leaning on the rather bullish side, and today's numbers were simply not met.

Technically, today's big drop is merely part of a downward trend that began in late March, when Tiffany fell short of the giant $100 threshold.

Things will turn very bearish on any monthly close under the key 10MA, which is currently in the $81s... interestingly just above the 200dma.

Unquestionably, high end retail is a better type of retail to be in than the low end - such as SHLD, M, or JCP. Yet.. its important to keep in mind than when the next recession hits.. high end will also greatly suffer.

For now.... there is ZERO sign of a US recession.

--

Breakfast at Tiffany's, 1961. A distant time, when more women knew how to dress.

TIF, daily

TIF, monthly

Summary

First, see: http://investor.tiffany.com/releases.cfm

--

Earnings were actually better than a year ago, but market expectations have been leaning on the rather bullish side, and today's numbers were simply not met.

Technically, today's big drop is merely part of a downward trend that began in late March, when Tiffany fell short of the giant $100 threshold.

Things will turn very bearish on any monthly close under the key 10MA, which is currently in the $81s... interestingly just above the 200dma.

Unquestionably, high end retail is a better type of retail to be in than the low end - such as SHLD, M, or JCP. Yet.. its important to keep in mind than when the next recession hits.. high end will also greatly suffer.

For now.... there is ZERO sign of a US recession.

--

Breakfast at Tiffany's, 1961. A distant time, when more women knew how to dress.

Tuesday, 23 May 2017

FCX, TECK - choppy copper miners

With copper prices remaining broadly stuck within a range of $2.70-2.45, the related copper miners remain broadly choppy. Freeport McMoran (FCX) and Teck Resources (TECK) settled +0.4% and -2.7% respectively. Near term outlook is for further choppy, leaning on the weaker side.

FCX, daily

TECK, daily

Summary

Suffice to add, it was a bit of a mixed day for the copper miners. Both FCX and TECK have really struggled since January. Even if copper can break >$2.70, it will take at 6-8 weeks for both stocks to have any hope of breaking a new multi-year high.

Of the the two, I personally favour TECK.

For those who prefer ETFs, there is COPX.

FCX, daily

TECK, daily

Summary

Suffice to add, it was a bit of a mixed day for the copper miners. Both FCX and TECK have really struggled since January. Even if copper can break >$2.70, it will take at 6-8 weeks for both stocks to have any hope of breaking a new multi-year high.

Of the the two, I personally favour TECK.

For those who prefer ETFs, there is COPX.

Monday, 22 May 2017

F - Fields gets the kick

Whilst the main market closed moderately higher, there was notable strength in Ford Motors (F), which settled +2.1% at $11.10. Things will turn bullish with a break above declining trend/resistance, which in August will be around $12.00. Any price action >$12 will offer the $15s before year end.

F, daily

F, monthly

Summary

The rumbles were apparent last Friday, with a report that the Ford family were increasingly frustrated at the mid term stock price performance.

I said to a fellow trader at the time 'Firing fields would be a start'.... I didn't realise we would see it just a few days later.

What now for Ford?

Ford remains a hugely profitable and successful company. I'd refer anyone to go dig in their recent earnings report. Things are ticking along fine. The equity market though has little else than contempt for the company. Why? Well, the 'new normal' is one where growth is everything, even if it doesn't mean any profits (such as AMZN, NFLX, or TSLA).

The technicals

Declining trend/resistance from summer 2014 is currently around $12.50, and that is ticking lower by around 15/20 cents per month. A break above declining trend still seems an inevitable outcome.

I'm bullish Ford for the long term. The kick of Fields is a start, but the company now needs to focus on self-driving car technology, as that is where we're headed. If Ford can just tap 10% of the media attention that Tesla garners, Ford will eventually be in the $20s. If the latter, the implications for the broader market would be hugely bullish.

yours.. awaiting a 100% self driving car... probably due by 2020.

F, daily

F, monthly

Summary

The rumbles were apparent last Friday, with a report that the Ford family were increasingly frustrated at the mid term stock price performance.

I said to a fellow trader at the time 'Firing fields would be a start'.... I didn't realise we would see it just a few days later.

|

| Jim Hackett.. the new guy |

What now for Ford?

Ford remains a hugely profitable and successful company. I'd refer anyone to go dig in their recent earnings report. Things are ticking along fine. The equity market though has little else than contempt for the company. Why? Well, the 'new normal' is one where growth is everything, even if it doesn't mean any profits (such as AMZN, NFLX, or TSLA).

The technicals

Declining trend/resistance from summer 2014 is currently around $12.50, and that is ticking lower by around 15/20 cents per month. A break above declining trend still seems an inevitable outcome.

I'm bullish Ford for the long term. The kick of Fields is a start, but the company now needs to focus on self-driving car technology, as that is where we're headed. If Ford can just tap 10% of the media attention that Tesla garners, Ford will eventually be in the $20s. If the latter, the implications for the broader market would be hugely bullish.

yours.. awaiting a 100% self driving car... probably due by 2020.

Friday, 19 May 2017

GDX - a choppy week for the miners

It was a choppy week for the Gold miners, with the sector ETF of GDX settling the week on a positive note, +0.9% at $22.86, which made for a net weekly gain of 0.6%. Near term outlook threatens further choppy price action, but May does look set to close with a net gain.

GDX, daily

GDX, weekly

Summary

Suffice to add, a week of chop. Relative to the gains in the precious metals, the mining stocks are still lagging. The situation is actually very similar to oil and the related energy stocks.

Another big push higher seems due this coming summer. Things will turn rather bullish for GDX with a break above the Feb' high of $25.71. If that is seen, it will open to the door to a straight challenge of the summer 2016 high of $31.70, and that is a very considerable 38.7% to the upside.

The key thresholds to keep in mind: Gold $1400s, Silver $22s, Copper >$3.00, and GDX >$32.

I remain leaning bullish... as I believe 'Mr inflation is out there'.

GDX, daily

GDX, weekly

Summary

Suffice to add, a week of chop. Relative to the gains in the precious metals, the mining stocks are still lagging. The situation is actually very similar to oil and the related energy stocks.

Another big push higher seems due this coming summer. Things will turn rather bullish for GDX with a break above the Feb' high of $25.71. If that is seen, it will open to the door to a straight challenge of the summer 2016 high of $31.70, and that is a very considerable 38.7% to the upside.

The key thresholds to keep in mind: Gold $1400s, Silver $22s, Copper >$3.00, and GDX >$32.

I remain leaning bullish... as I believe 'Mr inflation is out there'.

Thursday, 18 May 2017

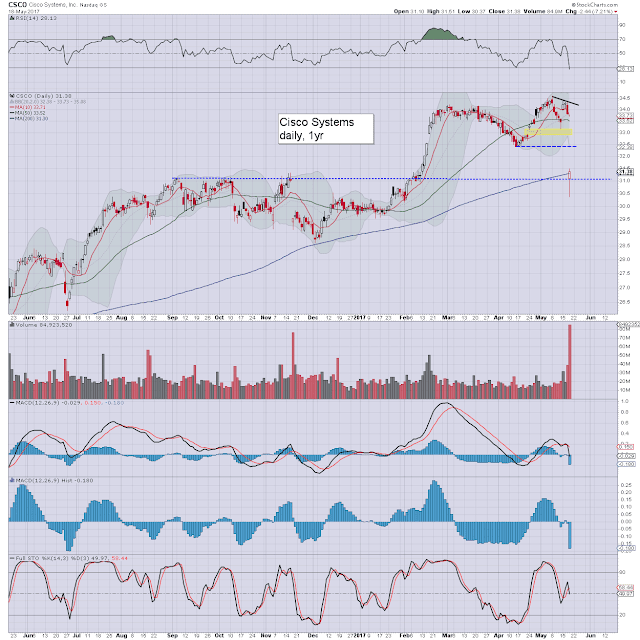

CSCO - whacked on weak guidance

Headline EPS/rev' for Cisco Systems (CSCO) was better than market consensus, but the algo-bots whacked the stock lower on weak guidance, settling -7.2% at $31.38. Near term outlook offers some weeks of chop, before the mid term bullish trend can securely resume.

CSCO, daily

CSCO, monthly

Summary

First, see: http://investor.cisco.com/investor-relations/news-and-events/events-and-presentations/events-and-presentations-details/2017/Ciscos-Q3FY17-Earnings-Results/

--

Q1 earnings were unquestionably better than 'reasonable', but it has been the case for many stocks lately that any mention of 'weak/lowered guidance', and the stock is duly whacked.

Today saw CSCO open sharply lower, with a break under the key 200dma. The daily close was notably above the 200dma though, and this does highlight that this is indeed a level where the stock will start to build a floor.

Seen on the giant monthly cycle, there are a number of key aspects of support. First, the breakout level of the $28s. Rising trend/support is currently in the $24s.

Frankly, the $28s should comfortably hold. Mid term upside to the $40/45 zone remains a realistic target, but is clearly far more viable in the first half of 2018.

Underlying bid.

Something to keep in mind is that CSCO has a large stock buy back program. In the accounts they note they are currently authorised to buy back another $12bn of stock. That will help to keep a bid under the stock for another few years, unless they decide the program needs to cease - such as for cash flow issues, if a US/global recession occurred.

Bullish CSCO into spring 2018.

--

CSCO, daily

CSCO, monthly

Summary

First, see: http://investor.cisco.com/investor-relations/news-and-events/events-and-presentations/events-and-presentations-details/2017/Ciscos-Q3FY17-Earnings-Results/

--

Q1 earnings were unquestionably better than 'reasonable', but it has been the case for many stocks lately that any mention of 'weak/lowered guidance', and the stock is duly whacked.

Today saw CSCO open sharply lower, with a break under the key 200dma. The daily close was notably above the 200dma though, and this does highlight that this is indeed a level where the stock will start to build a floor.

Seen on the giant monthly cycle, there are a number of key aspects of support. First, the breakout level of the $28s. Rising trend/support is currently in the $24s.

Frankly, the $28s should comfortably hold. Mid term upside to the $40/45 zone remains a realistic target, but is clearly far more viable in the first half of 2018.

Underlying bid.

Something to keep in mind is that CSCO has a large stock buy back program. In the accounts they note they are currently authorised to buy back another $12bn of stock. That will help to keep a bid under the stock for another few years, unless they decide the program needs to cease - such as for cash flow issues, if a US/global recession occurred.

Bullish CSCO into spring 2018.

--

Wednesday, 17 May 2017

GDX - miners following strong Gold

With some concern in the US capital market, the precious metals caught a fear bid in the early morning, with Gold higher by around 1.5%. The related miners naturally followed, with the sector ETF of GDX higher for a sixth consecutive day, settling +1.8% at $23.37. The mid term outlook is increasingly bullish.

GDX daily

GDX, monthly

Summary

First, note the giant monthly chart, which saw a marginal break of core rising trend just two weeks ago. Underlying MACD (blue bar histogram) has seen price momentum cool from summer 2016. However, rather than turn negative cycle, momentum has levelled out above the zero threshold, and is now threatening another up cycle. In theory, its possible that we're in the first month of a giant hyper-ramp that will continue into spring 2018.

--

Indeed, its not even about how the metals and mining stocks trade across the remainder of this week, but far more important is how the month settles.

Whilst Gold has remained comfortably above core support, Silver and the miners saw key breaks of core rising trend/support. Last week saw something of a turnaround, and this week is seeing some rather significant follow through.

Right now, GDX looks set for a net monthly gain, anything around current levels would suffice to help negate the technical damage from two weeks ago.

Things turn hyper-bullish with Gold $1400s, Silver $22s, Copper >$3.00, and GDX $32s.

GDX daily

GDX, monthly

Summary

First, note the giant monthly chart, which saw a marginal break of core rising trend just two weeks ago. Underlying MACD (blue bar histogram) has seen price momentum cool from summer 2016. However, rather than turn negative cycle, momentum has levelled out above the zero threshold, and is now threatening another up cycle. In theory, its possible that we're in the first month of a giant hyper-ramp that will continue into spring 2018.

--

Indeed, its not even about how the metals and mining stocks trade across the remainder of this week, but far more important is how the month settles.

Whilst Gold has remained comfortably above core support, Silver and the miners saw key breaks of core rising trend/support. Last week saw something of a turnaround, and this week is seeing some rather significant follow through.

Right now, GDX looks set for a net monthly gain, anything around current levels would suffice to help negate the technical damage from two weeks ago.

Things turn hyper-bullish with Gold $1400s, Silver $22s, Copper >$3.00, and GDX $32s.

Tuesday, 16 May 2017

DIS - pirates holding at ransom

Whilst the main market saw a day of moderate swings, there was notable weakness in Disney (DIS), which settled -1.0% at $107.98. Next support is around $105, where the 200dma will be lurking by mid/late June. Recent earnings were unquestionably good, and a break to new historic highs remains due.

DIS, daily

DIS, monthly

Summary

Pirates 5' is due in just ten days (for Memorial day), but (rather ironically) a group of pirates have seized themselves a digital copy of the movie, and are requesting ransom, or they will release the movie in pieces prior to release. Disney is naturally refusing to pay, so I'd imagine the various p2p networks - and even youtube, will start seeing 5-10min pieces of the movie within a few days.

Frankly though, I don't see it harming box office sales, the setup is good, and the movie will probably pull in $1bn worldwide.

Recent earnings were fine, but the stock continues to see some cooling from a recent high of $116.10. Old resistance of the $105s is now first big support. Its notable that the 200dma will be around that level in June.

I am broadly bullish Disney, an eventual break above the Aug'2015 high of $119.51 seems a given. A year end close in the $130s (as Star Wars 8 is due) looks just about within range.

--

yours... prefers the solidity of land.

DIS, daily

DIS, monthly

Summary

Pirates 5' is due in just ten days (for Memorial day), but (rather ironically) a group of pirates have seized themselves a digital copy of the movie, and are requesting ransom, or they will release the movie in pieces prior to release. Disney is naturally refusing to pay, so I'd imagine the various p2p networks - and even youtube, will start seeing 5-10min pieces of the movie within a few days.

Frankly though, I don't see it harming box office sales, the setup is good, and the movie will probably pull in $1bn worldwide.

Recent earnings were fine, but the stock continues to see some cooling from a recent high of $116.10. Old resistance of the $105s is now first big support. Its notable that the 200dma will be around that level in June.

I am broadly bullish Disney, an eventual break above the Aug'2015 high of $119.51 seems a given. A year end close in the $130s (as Star Wars 8 is due) looks just about within range.

--

yours... prefers the solidity of land.

Monday, 15 May 2017

RIG - strength in energy

Whilst the main market saw moderate gains, there was significant strength within some of the energy stocks. Transocean (RIG) settled +1.7% at $10.80, although was well below the intra high of $11.14. There are multiple aspects of resistance in the $11s,and things only turn bullish with some closes >$12.00.

RIG, daily

RIG, monthly

Summary

Broadly, Transocean is still very weak. Since WTIC oil saw a major turn lower in summer 2014, the stock has struggled, imploding from the $41s to the $7s.

The recent low of $10.03 was the lowest level since Nov'11th 2016. Indeed, all of the 'Trump/election' gains have been fully negated.

Any daily closes >$12, will offer a challenge of the Dec'2016 high of $16.66. If you believe WTIC oil will eventually hit the $60 threshold within 7-12mths, then an upside target for RIG of $20.00 would be valid.

*unquestionably speculative in nature, and without question, the cautious 'bull chasers' will wait for some daily closes >$12.00.

RIG, daily

RIG, monthly

Summary

Broadly, Transocean is still very weak. Since WTIC oil saw a major turn lower in summer 2014, the stock has struggled, imploding from the $41s to the $7s.

The recent low of $10.03 was the lowest level since Nov'11th 2016. Indeed, all of the 'Trump/election' gains have been fully negated.

Any daily closes >$12, will offer a challenge of the Dec'2016 high of $16.66. If you believe WTIC oil will eventually hit the $60 threshold within 7-12mths, then an upside target for RIG of $20.00 would be valid.

*unquestionably speculative in nature, and without question, the cautious 'bull chasers' will wait for some daily closes >$12.00.

Friday, 12 May 2017

GDX - an important net weekly gain

Whilst the precious metals broke new multi-week lows, the related mining stocks displayed some resilience. The sector ETF of GDX settled the week on a rather positive note, +1.6% at $22.73, which made for a net weekly gain of a powerful 5.4%. Near term outlook remains somewhat shaky.

GDX, daily

GDX, weekly

Summary

Last week saw a marginal break of core rising trend in the Gold miners, that extended back to the Jan'2016 lows. It was a surprise to be sure, but not a welcome one!

This week saw Gold and Silver break new multi-week lows, but the miners held up very well. The fact GDX settled powerfully higher for the week is a pretty bullish sign for the Gold miners.

However, last week's break of trend can't be glossed over lightly. I'd like to see a net monthly gain in GDX (>$22.23) to have some confidence that the break was indeed just a transient one. This week's net gain is important, but the May close will be infinitely more so.

--

Yours truly will probably be publishing another Gold miners report in early June, to cover the settling May monthly candles.

GDX, daily

GDX, weekly

Summary

Last week saw a marginal break of core rising trend in the Gold miners, that extended back to the Jan'2016 lows. It was a surprise to be sure, but not a welcome one!

This week saw Gold and Silver break new multi-week lows, but the miners held up very well. The fact GDX settled powerfully higher for the week is a pretty bullish sign for the Gold miners.

However, last week's break of trend can't be glossed over lightly. I'd like to see a net monthly gain in GDX (>$22.23) to have some confidence that the break was indeed just a transient one. This week's net gain is important, but the May close will be infinitely more so.

--

Yours truly will probably be publishing another Gold miners report in early June, to cover the settling May monthly candles.

Thursday, 11 May 2017

SNAP - the hysteria bubble pops

Whilst the main market saw a day of moderate weakness, there was severe downside in SNAP, which settled -21.7% at $18.00. Near term outlook offers some wild swings, as there are a lot of buyers around the IPO price of $17.00. However, that looks set to be broken at some point, and single digits is a realistic bearish target.

SNAP, daily5

Summary

Yesterday afternoon, the mainstream acknowledged that SNAP was likely to see a swing of 13%. The only issue was whether that would be to the upside or downward. My guess was for a drop of around -15%.

In the event, in AH yesterday, SNAP imploded by around 25%, with low of around $17.06 (approx), but holding above the IPO price of $17.00.

--

Pivotal research: seeking the $9s

The issues are all valid, especially the one of competition.

There is a finite number of viewable hours from a given user, with Twitter and Facebook offering powerful competition.

A valid question is, are we App saturated? I'd argue we're close. Sure, more parts of the world are yet to fully become part of the online community, but most other non-western countries will tend to have their own domestic apps.

Where next for SNAP?

Technically, there is indeed a lot of buying interest around the $17.00 threshold - as especially seen yesterday in AH. On balance, that level will likely fail to hold this summer, and then a slow decline to around $10. I'd guess single digits are valid before a serious possibility of a mid term upward trend beginning.

It will somewhat entertaining to see how the CEO responds to increasing media/corp' pressure, if such a price decline occurs.

SNAP, daily5

Summary

Yesterday afternoon, the mainstream acknowledged that SNAP was likely to see a swing of 13%. The only issue was whether that would be to the upside or downward. My guess was for a drop of around -15%.

In the event, in AH yesterday, SNAP imploded by around 25%, with low of around $17.06 (approx), but holding above the IPO price of $17.00.

--

Pivotal research: seeking the $9s

The issues are all valid, especially the one of competition.

There is a finite number of viewable hours from a given user, with Twitter and Facebook offering powerful competition.

A valid question is, are we App saturated? I'd argue we're close. Sure, more parts of the world are yet to fully become part of the online community, but most other non-western countries will tend to have their own domestic apps.

Where next for SNAP?

Technically, there is indeed a lot of buying interest around the $17.00 threshold - as especially seen yesterday in AH. On balance, that level will likely fail to hold this summer, and then a slow decline to around $10. I'd guess single digits are valid before a serious possibility of a mid term upward trend beginning.

It will somewhat entertaining to see how the CEO responds to increasing media/corp' pressure, if such a price decline occurs.

Wednesday, 10 May 2017

DIS - earnings were good

Whilst the main market saw a day of minor chop, there was notable sig' weakness in Disney (DIS), which settled -2.3% at $109.53. Near term outlook is somewhat bearish, as there is 'magnet' support around $105. Mid term outlook remains very bullish. A break above the 2015 high remains due.

DIS, daily

DIS, monthly

Summary

I strongly suggest you see: https://thewaltdisneycompany.com/investor-relations-news

Q1/H2 report: https://thewaltdisneycompany.com/walt-disney-company-reports-second-quarter-six-months-earnings-fiscal-2017

--

Frankly, 'good' is probably under-stating the results. When you dig into the accounts, everything looks excellent in Disneyland. Q1 EPS was $1.50, a sig' increase from Q4 $1.30.

--

Many are still bearish Disney, such as this analyst from Bernstein...

There is a focus on ESPN, and yes, its a struggling business. Yet Disney has many parts to it, not least the world's best movie/TV franchises of Star Wars and Marvel.

-

With an extrapolated annual EPS of $6, that offers a PE of around 18. Disney certainly isn't cheap, but neither is it expensive. Indeed, its valuation is broadly inline with the main market.

Disney pays two dividends a year, the latest to April 2017 was $0.78, with the prev' half year of $0.71.

I remain very bullish Disney. A break above the summer 2015 of $119.51 seems a given, not least within a broadly 'scary strong' US equity market. Any price action >119 will offer the 125/130s before year end.

DIS, daily

DIS, monthly

Summary

I strongly suggest you see: https://thewaltdisneycompany.com/investor-relations-news

Q1/H2 report: https://thewaltdisneycompany.com/walt-disney-company-reports-second-quarter-six-months-earnings-fiscal-2017

--

Frankly, 'good' is probably under-stating the results. When you dig into the accounts, everything looks excellent in Disneyland. Q1 EPS was $1.50, a sig' increase from Q4 $1.30.

--

Many are still bearish Disney, such as this analyst from Bernstein...

There is a focus on ESPN, and yes, its a struggling business. Yet Disney has many parts to it, not least the world's best movie/TV franchises of Star Wars and Marvel.

-

With an extrapolated annual EPS of $6, that offers a PE of around 18. Disney certainly isn't cheap, but neither is it expensive. Indeed, its valuation is broadly inline with the main market.

Disney pays two dividends a year, the latest to April 2017 was $0.78, with the prev' half year of $0.71.

I remain very bullish Disney. A break above the summer 2015 of $119.51 seems a given, not least within a broadly 'scary strong' US equity market. Any price action >119 will offer the 125/130s before year end.

Tuesday, 9 May 2017

UAL - do they show Jeopardy inflight?

Whilst the main market saw a day of minor chop, there was notable strength in United Continental (UAL) which settled +4.8% at $78.55. This was a massively bullish technical breakout to new historic highs, and offers much higher levels into 2018.

UAL, daily

Summary

The company/stock is clearly still massively tainted after the recent 'incident', which was politely settled out of a court room.

Today's push upward was a massively important bullish breakout, with the 76/75s now first short term support. Arguably, the mid term outlook is bullish unless a break <70.

It can be expected that mainstream chatter of '$100' will soon begin, and some will understandably be surprised considering the very negative publicity.

--

Meanwhile... the CEO for Qantas...

... which leads to...

Does UAL or any airline have Jeopardy as inflight entertainment, especially in late afternoon?

yours... prefers... trains.

UAL, daily

Summary

The company/stock is clearly still massively tainted after the recent 'incident', which was politely settled out of a court room.

Today's push upward was a massively important bullish breakout, with the 76/75s now first short term support. Arguably, the mid term outlook is bullish unless a break <70.

It can be expected that mainstream chatter of '$100' will soon begin, and some will understandably be surprised considering the very negative publicity.

--

Meanwhile... the CEO for Qantas...

... which leads to...

Does UAL or any airline have Jeopardy as inflight entertainment, especially in late afternoon?

yours... prefers... trains.

Monday, 8 May 2017

AAPL - powering upward

Whilst the main market saw a day of minor chop, there was significant strength in the tech behemoth that is Apple (AAPL), which settled +2.7% at $152.96. The stock is clearly over-stretched in the short term, but underlying price momentum remains 'scary strong'.

AAPL, daily

AAPL, monthly

Summary

There is frankly nothing to add, for what remains one of the better companies out there.

--

Ohh, I almost forgot to note...

The mainstream chatter is now starting to seek the $200s... which seems a given if you believe in sp'3K in 2018.

AAPL, daily

AAPL, monthly

Summary

There is frankly nothing to add, for what remains one of the better companies out there.

--

Ohh, I almost forgot to note...

The mainstream chatter is now starting to seek the $200s... which seems a given if you believe in sp'3K in 2018.

Friday, 5 May 2017

GDX - a third bearish week for the miners

With the precious metals continuing to slide, the related mining stocks had an especially bearish week. Despite a Friday gain of 2.1%, the sector ETF of GDX still settled net lower for a third consecutive week, -3.1% at $21.55. Notably, there was a break of mid term rising trend that extends back to the Jan'2016 low.

GDX, weekly

GDX, daily

Summary

Suffice to add, with Gold and Silver (along with WTIC oil) smacked lower across the week, the miners saw rather significant net weekly declines.

The break of rising trend is a serious matter.

Mid term outlook is now uncertain, as whilst Gold is still well above core support, Silver has broken its mid term trend.

Either the miners whipsaw back upward, with a flat or net monthly gain, or the mid term outlook will turn outright bearish.

GDX, weekly

GDX, daily

Summary

Suffice to add, with Gold and Silver (along with WTIC oil) smacked lower across the week, the miners saw rather significant net weekly declines.

The break of rising trend is a serious matter.

Mid term outlook is now uncertain, as whilst Gold is still well above core support, Silver has broken its mid term trend.

Either the miners whipsaw back upward, with a flat or net monthly gain, or the mid term outlook will turn outright bearish.

Thursday, 4 May 2017

CHK - earnings were surprisingly good

Whilst the main market saw another day of minor chop, there was significant weakness in Chesapeake Energy (CHK) which settled -7.4% at $5.13. Q1 earnings were better than expected though, and the mid term outlook is unquestionably brighter. The first grand target remain the $12s... which is a long ways higher.

CHK, daily

CHK, monthly

Summary

First, see: http://www.chk.com/media/news/press-releases/Chesapeake+Energy+Corporation+Reports+2017+First+Quarter+Financial+And+Operational+Results+5+4+2017+

Also: https://finance.yahoo.com/news/chesapeake-energy-chk-beats-q1-130801836.html

--

EPS of 23 cents was notably above expectations of 19 cents. Arguably, the increase in rev' to $1.4bn was the most impressive, and that was despite commodity prices seeing distinct weakness across Jan-Feb.

Technically, the stock is still a mess, and that is largely a result of ongoing weakness in the energy sector, that extends back to Dec'2016.

Speculative, but seemingly 'sound'.

Without question, Chesapeake is a particularly speculative stock. Its future as a listed company was in serious doubt in early 2016, but those dark days are now a faded memory.

CHK looks to have stabilised fundamentally, and so long as the economy just 'ticks along reasonably', another big push upward looks due. First soft target are the low $8s, and from there... the $12s, which have been a key level since late 2008.

CHK, daily

CHK, monthly

Summary

First, see: http://www.chk.com/media/news/press-releases/Chesapeake+Energy+Corporation+Reports+2017+First+Quarter+Financial+And+Operational+Results+5+4+2017+

Also: https://finance.yahoo.com/news/chesapeake-energy-chk-beats-q1-130801836.html

--

EPS of 23 cents was notably above expectations of 19 cents. Arguably, the increase in rev' to $1.4bn was the most impressive, and that was despite commodity prices seeing distinct weakness across Jan-Feb.

Technically, the stock is still a mess, and that is largely a result of ongoing weakness in the energy sector, that extends back to Dec'2016.

Speculative, but seemingly 'sound'.

Without question, Chesapeake is a particularly speculative stock. Its future as a listed company was in serious doubt in early 2016, but those dark days are now a faded memory.

CHK looks to have stabilised fundamentally, and so long as the economy just 'ticks along reasonably', another big push upward looks due. First soft target are the low $8s, and from there... the $12s, which have been a key level since late 2008.

Wednesday, 3 May 2017

FCX, TECK - miners pressured by copper

Whilst the main market settled a little weak, there was significant weakness in the copper miners. Freeport McMoRan (FCX) and Teck Resources (TECK) settled lower by -5.5% and -5.7% respectively. Near term outlook is a little shaky, as copper is still firmly stuck within the $2.70/2.40s. Mid term outlook resumes bullish with copper >$2.70.

FCX, daily

TECK, daily

Summary

*first, an update on copper, weekly

Suffice to add... copper saw $2.69 on Monday, and since then... its been a full reversal. Arguably, things only turn bearish if <$2.45. In theory, commodity/copper bulls could tolerate the $2.30s - above the Nov'2016 breakout.

--

As for FCX and TECK...

Freeport is especially struggling, as it has yet to fully reach an agreement with the Indonesian govt. That has been a dark cloud over the stock since late last year. Things only turn bullish with a break into the low $13s... back above the 50/200dma's. The grander target is $20.00, but that will require a secondary bullish breakout in copper >$3.00.

Teck Resources is fairing much better, and is still trading close to a very extended consolidation phase. Keep in mind, TECK hyper ramped from a Jan'2016 low of $2.55 to a Nov'2016 high of $26.56. Seen on a bigger weekly/monthly chart, price structure could be argued is a bull flag/pennant. First upside target would be the $34/35 zone.

On balance, TECK is the stronger stock, although I'd imagine FCX would rapidly catchup once the Indonesian situation is conclusively resolved.

FCX, daily

TECK, daily

Summary

*first, an update on copper, weekly

Suffice to add... copper saw $2.69 on Monday, and since then... its been a full reversal. Arguably, things only turn bearish if <$2.45. In theory, commodity/copper bulls could tolerate the $2.30s - above the Nov'2016 breakout.

--

As for FCX and TECK...

Freeport is especially struggling, as it has yet to fully reach an agreement with the Indonesian govt. That has been a dark cloud over the stock since late last year. Things only turn bullish with a break into the low $13s... back above the 50/200dma's. The grander target is $20.00, but that will require a secondary bullish breakout in copper >$3.00.

Teck Resources is fairing much better, and is still trading close to a very extended consolidation phase. Keep in mind, TECK hyper ramped from a Jan'2016 low of $2.55 to a Nov'2016 high of $26.56. Seen on a bigger weekly/monthly chart, price structure could be argued is a bull flag/pennant. First upside target would be the $34/35 zone.

On balance, TECK is the stronger stock, although I'd imagine FCX would rapidly catchup once the Indonesian situation is conclusively resolved.

Tuesday, 2 May 2017

AMD - smashed on mixed earnings

Earnings for Advanced Micro Devices (AMD) were 'mixed', but it was enough to result in Mr Market smashing the stock lower, settling -24.4% at $10.30. Near term outlook offers little to the tech bulls, as the stock will likely take some weeks to stabilise. A test of the 200dma in the low $10s is already well within range.

AMD, daily

AMD, monthly

Summary

Earnings were indeed mixed...

Corporate: http://ir.amd.com/phoenix.zhtml?c=74093&p=irol-newsArticle&ID=2268417

Also: http://finance.yahoo.com/news/amd-stock-slumps-line-q1-214109070.html

--

So... EPS was inline, but rev'/sales were a clear miss.

Near term outlook? The failure to break back above resistance of $13.60/14.60 is a major failure, and the stock has duly imploded, and is already very close to the 200dma.

The mid term outlook still looks promising though, but it will likely take some weeks to build a floor in the $10s. A challenge of the Feb' high of $15.55 now looks at least 4-5 months away.

The scary thing - and it should be seen as such, this is the growth phase of the economy, and AMD is still not making a profit. A recession is inevitable as some point, and then AMD really will be under massive pressure.

AMD, daily

AMD, monthly

Summary

Earnings were indeed mixed...

Corporate: http://ir.amd.com/phoenix.zhtml?c=74093&p=irol-newsArticle&ID=2268417

Also: http://finance.yahoo.com/news/amd-stock-slumps-line-q1-214109070.html

--

So... EPS was inline, but rev'/sales were a clear miss.

Near term outlook? The failure to break back above resistance of $13.60/14.60 is a major failure, and the stock has duly imploded, and is already very close to the 200dma.

The mid term outlook still looks promising though, but it will likely take some weeks to build a floor in the $10s. A challenge of the Feb' high of $15.55 now looks at least 4-5 months away.

The scary thing - and it should be seen as such, this is the growth phase of the economy, and AMD is still not making a profit. A recession is inevitable as some point, and then AMD really will be under massive pressure.

Monday, 1 May 2017

GDX - miners start the month badly

With the precious metals starting the month on a pretty bearish note, the related mining stocks followed. The ETF of GDX settled -2.5% at $21.67. Mid term rising support is currently around the $21.00 threshold. Any break of it would be an indirect threat to the bullish commodity, and even equity case.

GDX, daily

GDX, weekly

Summary

Q. Why are the metals still falling?

Part of it was cyclical, but we're clearly seeing a particularly large retrace, especially within Silver. For now though, ALL are holding the mid term trend.

There is also an aspect of the 'fear bid' being eroded, as the US capital market has quickly shrugged off things like a cruise missile strike on Syria, North Korean nuclear threats, and the French election.

--

The 'bold' will be buying the miners at these levels.

The simple long-stop is either at rising trend.. or the Dec'2016 lows.

GDX, daily

GDX, weekly

Summary

Q. Why are the metals still falling?

Part of it was cyclical, but we're clearly seeing a particularly large retrace, especially within Silver. For now though, ALL are holding the mid term trend.

There is also an aspect of the 'fear bid' being eroded, as the US capital market has quickly shrugged off things like a cruise missile strike on Syria, North Korean nuclear threats, and the French election.

--

The 'bold' will be buying the miners at these levels.

The simple long-stop is either at rising trend.. or the Dec'2016 lows.

Subscribe to:

Comments (Atom)