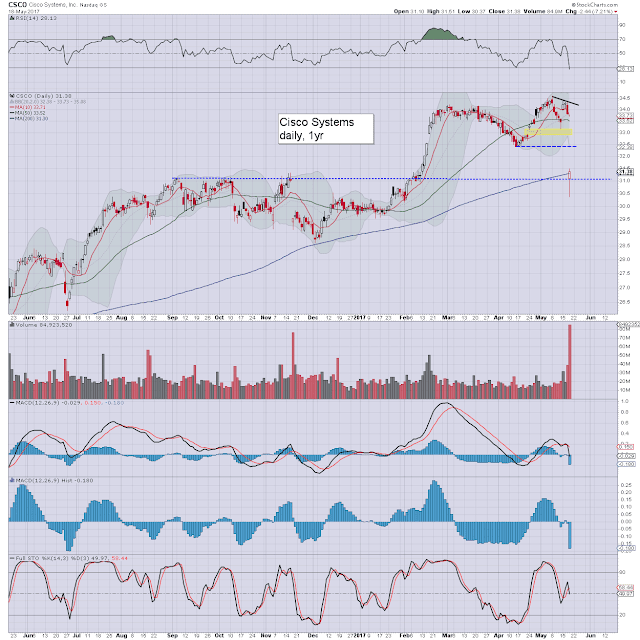

Headline EPS/rev' for Cisco Systems (CSCO) was better than market consensus, but the algo-bots whacked the stock lower on weak guidance, settling -7.2% at $31.38. Near term outlook offers some weeks of chop, before the mid term bullish trend can securely resume.

CSCO, daily

CSCO, monthly

Summary

First, see: http://investor.cisco.com/investor-relations/news-and-events/events-and-presentations/events-and-presentations-details/2017/Ciscos-Q3FY17-Earnings-Results/

--

Q1 earnings were unquestionably better than 'reasonable', but it has been the case for many stocks lately that any mention of 'weak/lowered guidance', and the stock is duly whacked.

Today saw CSCO open sharply lower, with a break under the key 200dma. The daily close was notably above the 200dma though, and this does highlight that this is indeed a level where the stock will start to build a floor.

Seen on the giant monthly cycle, there are a number of key aspects of support. First, the breakout level of the $28s. Rising trend/support is currently in the $24s.

Frankly, the $28s should comfortably hold. Mid term upside to the $40/45 zone remains a realistic target, but is clearly far more viable in the first half of 2018.

Underlying bid.

Something to keep in mind is that CSCO has a large stock buy back program. In the accounts they note they are currently authorised to buy back another $12bn of stock. That will help to keep a bid under the stock for another few years, unless they decide the program needs to cease - such as for cash flow issues, if a US/global recession occurred.

Bullish CSCO into spring 2018.

--