The gold miner ETF of GDX saw a

net September gain of +$0.32 (1.3%) to $24.12, the sector was impacted by

further downside in gold, and a m/t bearish equity market.

GDX, monthly

Summary

Whilst the miners managed a net monthly gain, the m/t trend remains bearish. I

would note the 10MA at $30.33, which was once again settled below. Monthly momentum is increasingly negative, with zero

sign of a short/mid term floor.

--

Three of the key miners...

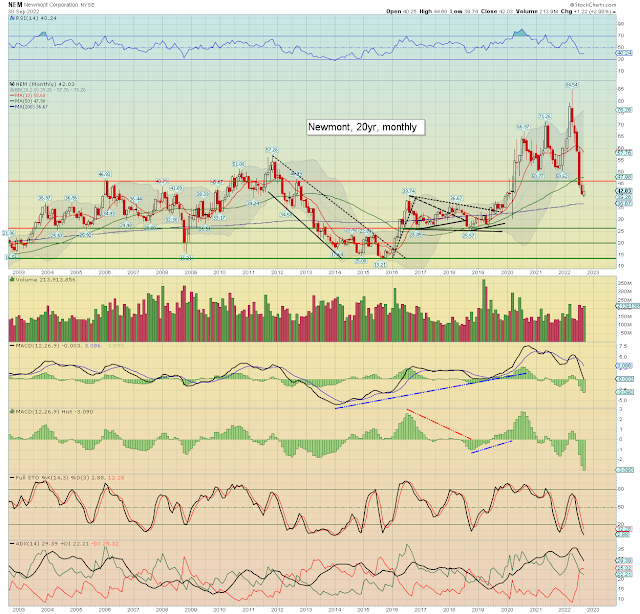

Newmont (NEM), monthly

Newmont saw a net September gain of +$1.22 (3.0%) to $42.03. Despite the net monthly gain, I'd note we're still putting in lower highs and lower lows. I

would note the monthly 10MA at $58.60, which was settled far below. Monthly

momentum continues to spiral lower, settling deeply negative.

Barrick Gold (GOLD), monthly

Barrick Gold settled +$0.65 (4.4%)

to $15.50. Momentum continues to weaken, and is moderately negative.

--

First Majestic Silver (AG), monthly

First Majestic saw a net September gain of $0.34 (4.7%) to $7.62. In the scheme of things, its a minor gain.

*Further main market downside, or dollar strength aren't going to help any of the gold and silver miners.

-

For more of the same...

For the latest offers > https://www.tradingsunset.com