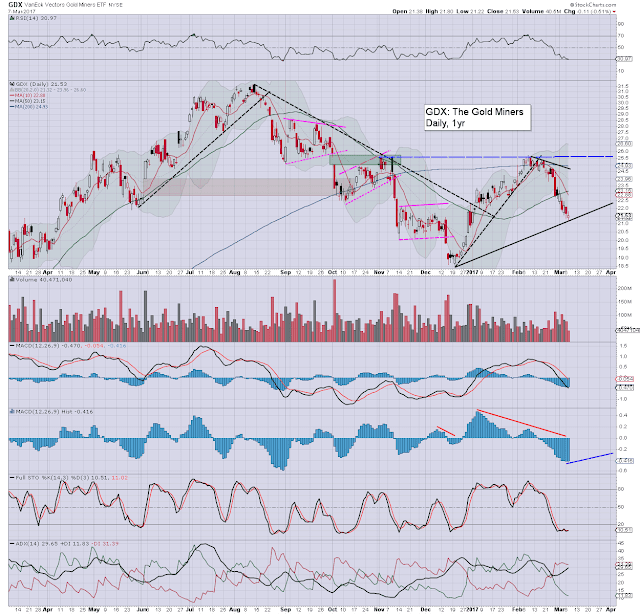

The precious metals - and by default... the related miners, appear to be pinned lower, ahead of the March 15th FOMC. The ETF of GDX settled -0.5% at $21.53. Despite ongoing weakness, the mid term rising trend remains comfortably intact around the $20.00 threshold.

GDX, daily

GDX, weekly

Summary

We have short term weakness from the Feb'8th high of $25.71, to today's low of $21.22. Even a foray into the $20s still won't break the mid term rising trend, that links the Dec'2015 and Dec'2016 lows.

Whether the fed raise rates next Wednesday, or not until May 3rd doesn't much matter. What does matter is that whilst it is true that higher rates aren't bullish for the metals/miners, we're still talking about rates that are still around emergency levels.

Clearly, it will be very important to see GDX break last summer's high of $31.70. Once that is achieved, the grander target is around $50.00.

--

For those with an interest in the precious metals and the related Gold Miners...

For details: http://permabeardoomster.blogspot.com/p/research-reports.html

yours.. still watching Bering Sea Gold and Gold Rush (I guess that also makes me somewhat bullish DISCA)