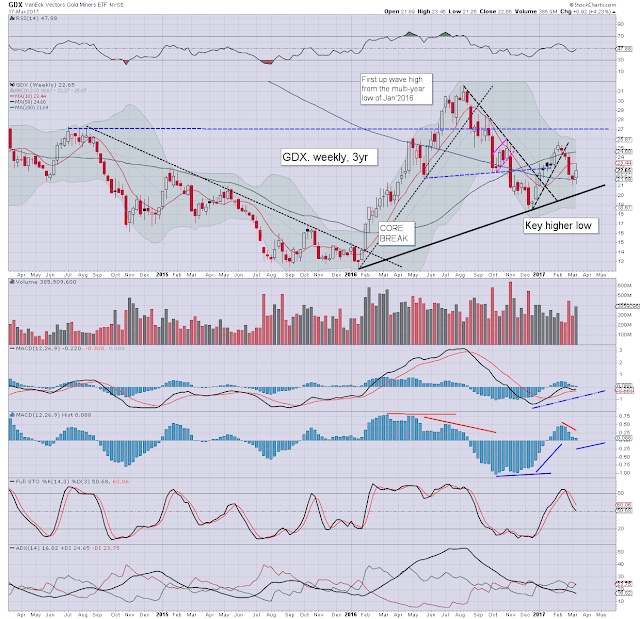

The downward trend from mid February came to an end this week. The Gold miner ETF of GDX settled Friday -0.4% at $22.67, but that still made for a significant net weekly gain of 4.2%. With the fed out of the way, the mid term bullish trend is likely in the early phase of resuming.

GDX, daily

GDX, weekly

Summary

As noted last weekend, it had seem that the precious metals - and related mining stocks, were merely being pinned lower, until the fed was out of the way. Indeed, once the FOMC announcement was made, there was a powerful jump in the metals, with the miners exploding higher.

So, we've had four weeks of cooling, and now a sig' net weekly gain, what now?

In theory, the metals/miners, should be able to battle upward. That sure doesn't mean every week has to result in a net weekly gain, but those who are bullish, should be seeking some sig' gains across the next 2-4 months.

A challenge of the summer 2016 highs won't be easy, but is a valid target, even if the USD remains broadly strong around the DXY 100 threshold.

--

For those of you with a serious interest in the Gold Miners, I'm still offering issue'1 of my Gold Miners report.

see: http://permabeardoomster.blogspot.com/p/research-reports.html