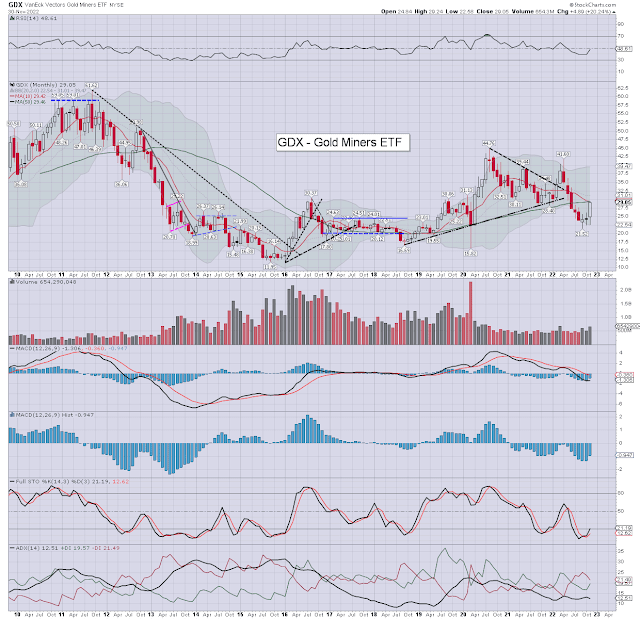

The gold miner ETF of GDX saw a

net November gain of +$4.89 (20.2%) to $29.05, the sector was helped by

a weaker dollar and a positive equity market.

GDX, monthly

Summary

The miners managed a third consecutive net monthly gain. I would note the 10MA at $29.42, which was once again settled below, as the m/t trend remains bearish. Monthly momentum ticked upward, and remains on the low side. The weaker dollar and the positive equity market certainly helped.

Miner bulls need to see a decisive push >psy' $30 for confidence, with Gold >$1824 and Silver sustainably >$22.00

--

Three of the key miners...

Newmont (NEM), monthly

Newmont saw a net November gain of +$5.15 (12.2%) to $47.47. The monthly candle is bullish engulfing, and leans distinctly s/t bullish into year end. I

would note the monthly 10MA at $55.60, which is a natural target.

Monthly

momentum is offering a provisional floor/turn.

--

Barrick Gold (GOLD), monthly

Barrick Gold settled +$1.44 (9.6%) to $16.32. The monthly candle is bullish engulfing, and leans s/t bullish. Momentum ticked upward, as we have a provisional cyclical floor/turn. Soft target is the 10MA in the $18s, and then psy' $20.

--

First Majestic Silver (AG), monthly

First Majestic saw a net November gain of $0.87 (10.3%) to $9.29. Momentum will be prone to turning positive in January. Soft target are the $11s, which would likely require a positive main equity market, and some degree of upside in silver.

-

Of the three, I would favour Barrick Gold, although I'd note it has some distinct exposure (around 30%) to Copper, which itself remains m/t bearish.

-

For more of the same...

For details > https://www.tradingsunset.com