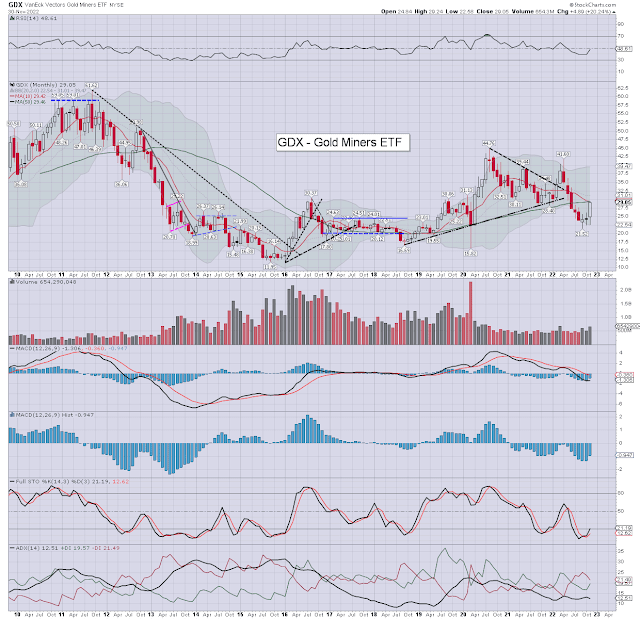

The gold miner ETF of GDX saw a

net December gain of +$0.09 (3.0%) to $28.66, which made for a net 2022 decline -$2.84 (9.0%).

GDX, monthly

Summary

The collective of miners climbed for a fourth consecutive month. The December candle is black, and is suggestive of s/t bullish exhaustion. I would note the 10MA at $28.42, which was marginally settled above. Things only turn decisive with a monthly settlement above $30, which looks difficult considering the outlook for the broader market.

Unless you believe the main market has a key m/t floor from early Oct' 2020, any renewed downside will be a pressure on the miners. It doesn't necessarily mean they will be net lower, but it does mean they would be restrained to a considerable degree.

--

Three of the key miners...

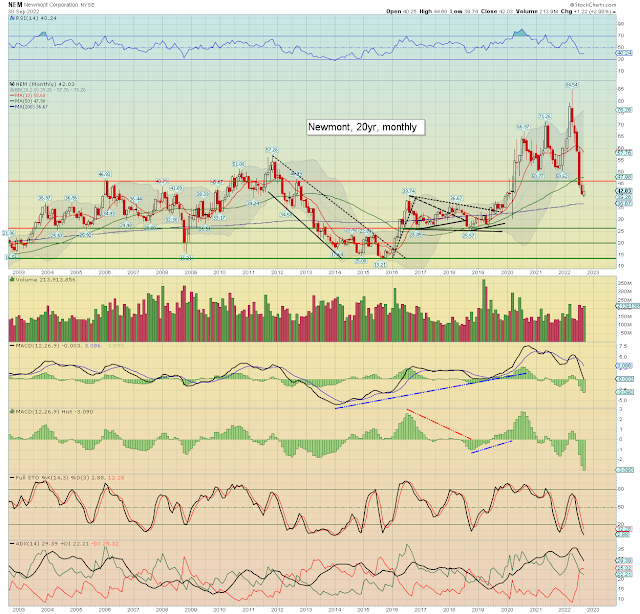

Newmont (NEM), monthly

Newmont saw a net December gain of +$0.28 (0.6%) to $47.20. The

December candle is black, and leans s/t bearish. I

would note the monthly 10MA in the $53s, which was settled below for a seventh consecutive month. Net yearly decline of -$12.37 (20.8%). Monthly

momentum remains deeply negative, and I'd note the March 2020 spike low of $30.11.

--

Barrick Gold (GOLD), monthly

A net December gain of +$0.86 (5.3%) to $17.18. A

net yearly decline of -$1.13 (6.2%). The December candle is rather spiky from around the monthly 10MA. The problem will likely be further downside in the main market.

--

First Majestic Silver (AG), monthly

A net December decline of -$0.95 (10.2%) to $8.34. I would note the December settlement is below the 10MA. A net yearly decline of -$2.74 (24.7%), as the silver miners are (as is usually the case) fairing worse than the gold miners, with a m/t bearish main market.

--Of the three, yours truly favours GOLD.

As of end 2022... I hold no miner stocks/options.

For more of the same...

For details and the latest offers > https://www.tradingsunset.com